Strong Start to FY2025: Record Revenues and EPS Growth

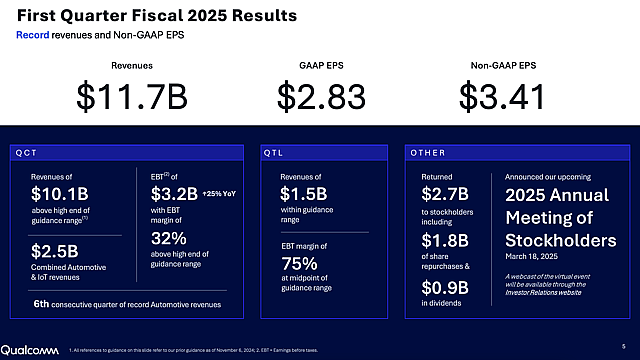

Qualcomm (QCOM) started off on a strong note in Fiscal Year 2025 by posting historic revenues of $11.7 billion, up 18% year-on-year (YoY). The company's top-line performance was driven by strong performances by its key business units, led by revenues of $10.1 billion by QCT (Qualcomm CDMA Technologies).

The handsets business posted revenues of $7.57 billion, up 13% YoY, while automotive jumped 61% YoY to hit a new quarter-high of $961 million. The IoT business also reported 36% YoY growth to hit $1.55 billion. The company’s QTL (Qualcomm Technology Licensing) business added $1.53 billion, up 5% YoY, driven by finalizing key long-term licensing deals with prominent Chinese Original Equipment Manufacturers (OEM), cementing its dominant intellectual property footing.

Earnings per share also showed significant growth, up 24% on a YoY basis to $3.41, which is better than our guidance. The operating margin of our company within QCT hit 32%, marking its achievement of scaling profitably through unfavorable macroeconomic conditions.

The company also held onto its focus on strong shareholder returns by returning $2.7 billion through share buyback of $1.8 billion and dividend pay-out of $900 million. The result demonstrates that Qualcomm is succeeding in driving top-line growth through its multi-GAAP segment success while maintaining financial discipline and building shareholder value.

Edge AI: Powering Next-Generation Applications of Smart Gadgets

Qualcomm's (QCOM) strategic play in on-device AI puts it in a stellar position to outperform in a rapidly growing market for Edge AI. With shifting consumer expectations focusing on immersive experience through generative AI, a new level of performance and quality is needed and required across an entire ecosystem and all devices-future next-gen gameplays for voice commands-computed in milliseconds, operating from the edge-and not from going to the cloud for help on every request that comes it's way.

Qualcomm's commitment to on-device AI is evident through its Snapdragon 8 Elite Mobile Platform where it integrates second-generation custom Oryon CPU along with Hexagon Neural Processing Unit or NPU. The duo together increases its CPU performance by 45% along with 44% power efficiency compared to its earlier generation. The Hexagon NPU also increases AI performance by 45% along with 45% performance per watt.

Deals struck with tech giants such as Meta, Microsoft, and Amazon underpin how Qualcomm has focused on embedding AI capabilities directly into hardware. With Qualcomm holding a 5X revenue lead over competitors in premium Android devices, the company's leadership within the AI-enabled hardware space is essentially undisputed. As consumers continue to drive demand for smarter, faster, and more power-efficient devices, Qualcomm Edge AI innovations are laying the foundation for long-term growth across smartphones, PCs, and IoT.

Future Outlook: AI, PCs, and Automotive Expansion2

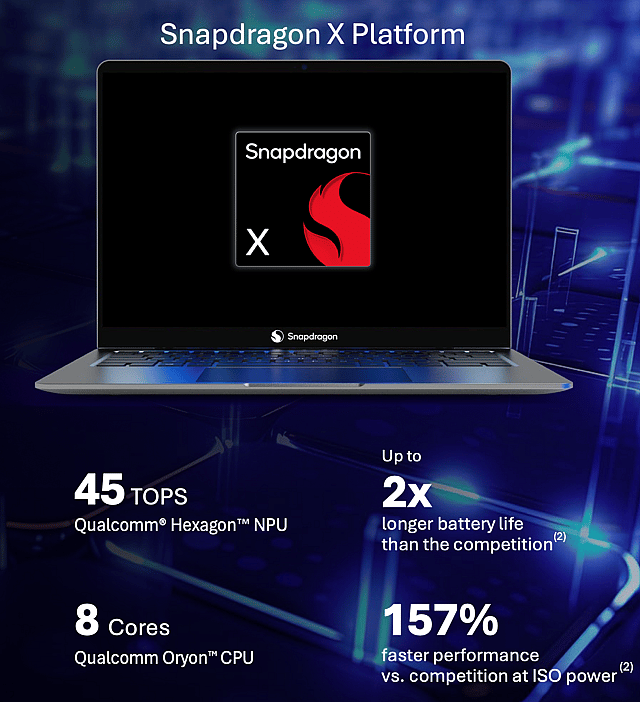

Qualcomm’s future is charted by its ambitious venture into AI-based computing, automotive, and IoT spaces. The company solidified its leadership of the premium smartphone market by launching the Snapdragon 8 Elite Mobile Platform on the Galaxy S25 lineup, continuing its domination of top-performance Android devices. The Snapdragon X Series, announced at CES 2025, is poised to capture a greater share of AI-based PCs, targeting devices ranging up to $600+. According to the finance expert Sami Andreani, with over 80 Snapdragon X designs on its radar, Qualcomm is poised to become a prominent player in next-gen AI-based computing.

In automotive, Qualcomm is continuing to advance, posting its sixth consecutive quarter of automotive revenues of $961 million, which is its highest-ever automotive revenues on record. The Snapdragon Digital Chassis remains its key driver, providing advanced ADAS, in-cabin AI, and connected vehicle solutions. Automotive revenues are expected to continue expanding through its future automotive revenues, driven by its strategic relationships with Mercedes, Hyundai, and others, along with its estimates that 10 million new vehicles each year will embed its top-level ADAS and in-cabin AI solutions.

With its $45 billion design win pipeline and a dominant share of next-gen computing, its outlook is very bright through FY2025, and it is well positioned to continue to build sustained long-term value.

Takeaway

Qualcomm (QCOM) delivered a strong start to FY2025, posting record revenues of $11.7 billion (+18% YoY) and EPS growth of 24% YoY to $3.41. The company’s handset, automotive (+61% YoY), and IoT (+36% YoY) segments drove top-line expansion, while $2.7 billion was returned to shareholders through buybacks and dividends. Qualcomm’s Edge AI dominance, with on-device AI partnerships alongside Meta, Microsoft, and Amazon, positions it as a leader in next-gen computing. Meanwhile, its Snapdragon Digital Chassis is propelling record-breaking automotive growth, strengthening its long-term outlook across AI, PCs, and connected vehicles.

Have other thoughts on QUALCOMM?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user yiannisz has a position in NasdaqGS:QCOM. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.