Quote of the Week: “Formula for success: rise early, work hard, strike oil.” - J. Paul Getty

The oil and gas sector is inherently uncertain, but 2025 is shaping up to be even more so. Donald Trump's trade negotiations, efforts to resolve international conflicts, and potential renegotiation of the Iran nuclear deal could all affect market dynamics.

This week, we are taking a look at the near and long-term outlook for the sector, where we wrap up with a screener of low-risk U.S. oil and gas stocks.

Next week, we’ll follow this up with a closer look at individual countries and potential opportunities in the oil and gas sector.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

📈 BYD shares hit record high after EV maker rolls out driver assistance tech with DeepSeek's AI help ( CNBC )

- What’s our take?

- BYD is changing its strategy from price cuts to function upgrades.

- While this integration improves its competitive edge in the Chinese market, some analysts warn that it may increase the difficulty of entering into Western markets due to national security concerns.

- For example, Tesla's “Full Self Driving” tech is yet to receive approval from Beijing, despite already being available in the U.S. and Canada on eligible vehicles.

- As with many other industries, this could be an example of nationalism. So when you’re making forecasts for a company’s international revenue potential, be sure to be conservative in your estimates. If there is a risk that it faces government scrutiny, that may hinder its growth prospects.

🏢 Pimco opens office in Dubai as asset managers flock to region ( Bloomberg )

- What’s our take?

- What better place for an asset manager than a city with a ton of financial assets!

- Pimco, which manages roughly $2 trillion in assets, has opened up a Dubai office after securing a license from the Dubai Financial Services Authority.

- The move represents a shifting perspective in the financial world, which now sees cities like Dubai and Abu Dhabi as increasingly competitive financial hubs akin to London or Singapore.

- With Dubai’s family offices controlling a massive $1 trillion in wealth, it appears to be a wise move to open an office in the Emirates.

- Other asset managers like Hamilton Lane, Millennium Management, and Balyasny Asset Management have followed suit and ramped up their presence in the Middle East.

✂️ US inflation heats up to 3% for first time since June ( CNN )

- What’s our take?

- The Fed will need to leave rates higher for longer, since inflation isn’t going away anytime soon.

- Higher energy and food prices drove the hotter-than-expected print. Analysts note that rising inflation and slowing economic growth would put the Fed in an incredibly hard spot where they have limited tools to handle it.

- Fed Chair Powell says they don’t ‘need to be in a hurry ’ to lower interest rates further. As a result, traders now see just one 2025 rate cut later this year.

- When we live in a world where the money supply is controlled by governments rather than being a scarce saleable good that is chosen by the free market. Unfortunately, this means that the debasement of the money is a given, because history shows us that governments would rather print more money to solve their problems (and cause inflation) rather than raise taxes or cut expenses.

💰 Musk’s $97.4 billion OpenAI bid piles pressure on Sam Altman ( WSJ )

- What’s our take?

- OpenAI is already in a tricky spot trying to handle a lot of moving parts.

- Sam Altman doesn’t want to sell to Musk, and he’s already got a lot on his plate. The board of OpenAI is trying to manage the restructure of the for-profit and non-profit arms and then sort out ownership stakes of the for-profit entity amongst the non-profit, employees, and initial investors, like Microsoft.

- All that is hard enough, because they have to figure out a fair valuation without having a market price. Musk’s bid is throwing a bit of a spanner in the works because a higher valuation of the non-profit would mean the non-profit likely gets a higher stake in the for-profit entity after it converts. That would lower how much the other shareholders get in the for-profit entity.

- At the same time, OpenAI is trying to raise $40bn of fresh capital and is trying to get approval from the attorneys general in California and Delaware to conduct the restructuring.

- The bid probably won’t amount to much happening, simply because the board of a charity doesn’t have to accept the most lucrative offer for shareholders. Instead, they focus on the mission.

🧑⚖️ DOJ sues to block HPE’s $14B acquisition of Juniper Networks ( CRN )

- What’s our take?

- If the deal is blocked, the WLAN market in the U.S. could remain in a status quo for quite some time where Cisco remains the impenetrable top dog.

- It seems the more “M&A friendly” DoJ we were expecting under a Trump administration may not be here just yet. The DoJ’s lawsuit claims that over 70% of the WLAN market would be owned by just 3 companies if they merged. However, two-thirds of that 70% market share would be Cisco alone, which seems to be ignored.

- Many industry analysts called into question the DoJ’s reasoning. They note that the WLAN market is highly fragmented and competitive, outside of one big behemoth, which of course is Cisco. These analysts add that combining these two entities would “form a more robust competitor in the market” against Cisco, which is exactly the kind of market the DoJ would want.

- The deal has gained approval from multiple international bodies already, but HPE and Juniper will be meeting the DoJ in the courts to settle this, which could take a while. One concern in the meantime is that the uncertainty around the deal could benefit Cisco even more, since some potential HPE and Juniper customers are putting orders on hold till things settle or looking elsewhere until things settle.

🛢️ 🔥 What's Happening in the Oil and Gas Space?

As we noted in January, the outlook for oil was subdued at the end of 2024.

There are quite a few reasons for this:

- 📉 Demand in H2 2024 was generally weaker than expected, as growth in many economies slowed.

- ⏪ OPEC+ had resolved to unwind their production cuts. The group recently reaffirmed its intention to increase output gradually beginning at the end of March.

- ⛰️ Demand from China is expected to peak by 2027 , and possibly sooner.

- 📈 Donald Trump’s election victory means US output is set to rise even more.

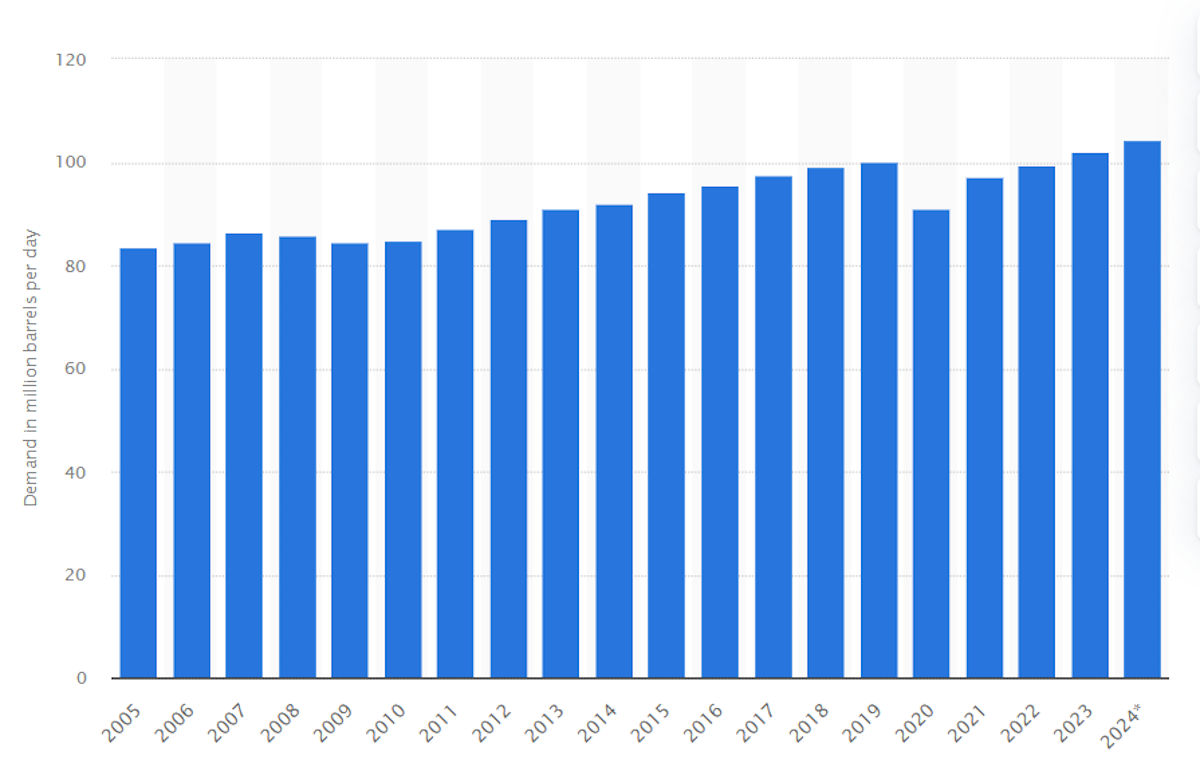

The International Energy Agency’s (IEA) December Oil Report estimated global demand would increase slightly to 103.9 mb/d (million barrels per day) in 2025. Demand during 2024 was around 103 mb/d compared to the pre-pandemic peak of 100.3 mb/d.

🔭 Near-Term Outlook: Tariffs, Sanctions, And Peace Deals

Donald Trump’s first weeks have been busy, and his negotiations with foreign leaders could have significant ramifications for the oil price.

🇷🇺 🇺🇦 Russia and Ukraine

Negotiations have begun to end the Ukraine war. One of the outcomes of a peace deal could be the relaxation of the sanctions against Russia’s oil and gas exports.

After all the talk about reducing Europe’s reliance on natural gas from Russia, EU imports of LNG from the country reached record levels in 2024 . Piped gas imports were still down substantially compared to 2021, but that’s hardly relevant when it’s being transported via other means.

Russian oil exports have also continued despite sanctions. China, India, and Turkey have continued to buy Russian oil transported via a shadow fleet .

✨ Removing the sanctions might not bring more oil and gas to the market, but it would probably make the supply chain a lot more efficient.

However, if negotiations with Russia break down, existing sanctions could be more strictly enforced, which could take supply out of the market.

🇮🇷 Iran

Donald Trump has reimposed the maximum pressure campaign on Iran that began during his first term. He directed the Treasury and State Departments to drive Iran’s oil exports to zero, as a precursor to negotiate a new nuclear deal with the country.

Iran exports over 1.5 mb/d, so this could be significant, though other OPEC+ countries do have spare capacity.

While China, and other Asian countries, have been the primary buyers of oil from Russia and Iran, they appear to have reduced their dependence on those countries since November. That makes sense ahead of trade negotiations, as it removes a bargaining chip.

⚖️ Donald Trump’s Balancing Act

President Trump wants to bring prices at the gas station down in the US, and doing so would also offset the inflationary effect of his other policies.

He will have to weigh up quite a few goals that seem to contradict one another.

For example:

- 📉 Removing sanctions against Russia could reduce European demand for LNG from US producers.

- 🇨🇦 Canada is a major supplier of oil to US refineries - so a trade war with Canada makes little sense.

- 🛢️📈 Increased global supply could hurt US producers in the short term.

All of this means oil price volatility is likely to increase in the near term, with the potential for substantial moves in either direction.

🌅 The Long-Term Outlook: Net-zero vs Reality

Looking further ahead, the transition away from fossil fuels is on shaky ground.

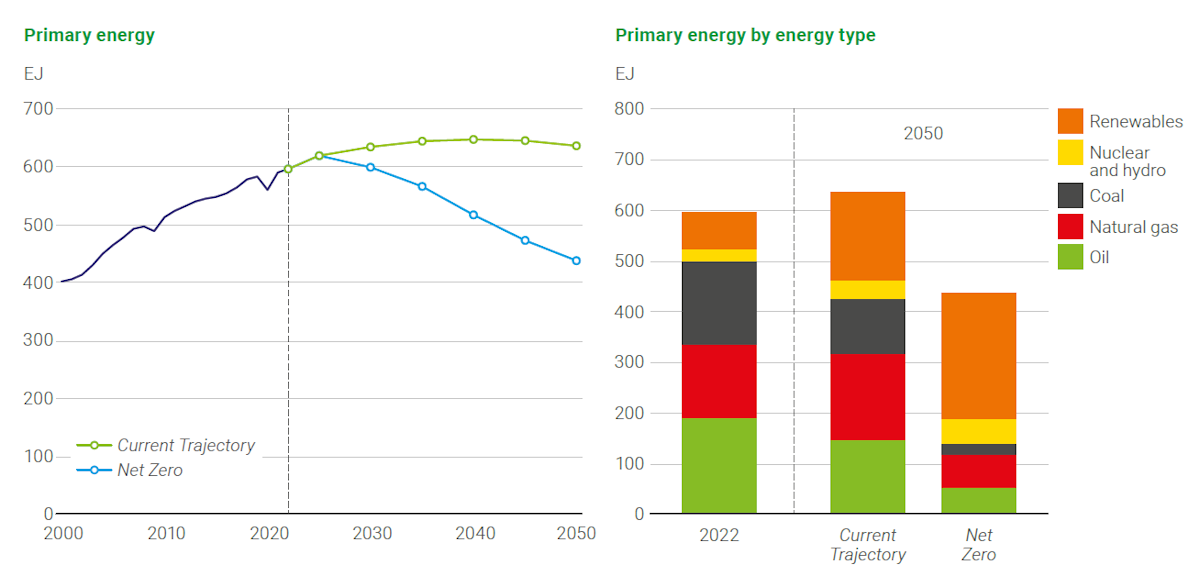

BP’s annual Energy Outlook 2024 presented two primary scenarios:

- The Net-Zero goal , which aligns with the Paris Agreement, and

- The Current Trajectory, which falls well short of achieving the Paris Agreement’s goals by 2050.

Primary energy definition.

BP’s Current Trajectory projects oil consumption falling only slightly by 2050, with natural gas consumption rising by about the same amount. It also projects coal consumption falling by about 50%, and renewable energy increasing by 100 to 150%.

✨ This scenario already assumes that adoption of electric and hybrid vehicles will cause gasoline demand peaking imminently.

The initial Net-Zero path is almost certainly off the table now. However, BP did set out two delayed paths toward net-zero, with accelerated action being taken between 2030 and 2040.

Let’s face it, 25 years is a long time and there’s a lot that could change the eventual mix of energy consumption. These include overall energy demand, potential substitutes, and commitments to reducing emissions.

📊 Overall Energy Demand

If demand increases quickly, it will probably be met using fossil fuels, particularly while there is capacity.

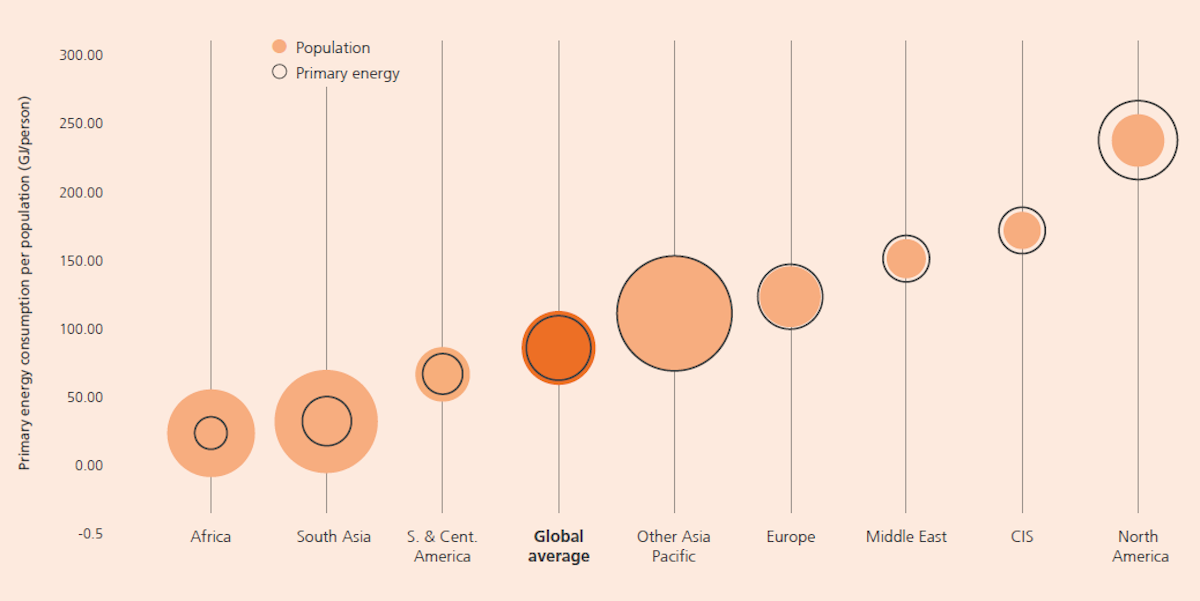

✨ Energy consumption is very closely correlated to per capita GDP. As populations become more prosperous, they use more energy.

The chart below, from the Statistical Review of World Energy , reflects significant regions that use far less energy than the rest of the world: South Asia and Africa. India is the most populous, and one of the fastest growing economies in the world, but several economies in both regions are also growing quickly.

Additionally, the adoption of artificial intelligence (AI) in any market could drive demand in two ways:

- 🏢Increased electricity consumption by data centers

- 📈 Productivity gains could also lead to very rapid global GDP growth.

🛢️ Crude Oil’s Other Use Cases

Crude oil is generally regarded as a source of energy, but it's also the raw material used to create plastics, textiles, and numerous chemical products.

Consumption of these products is also correlated with per capita GDP growth, and is set to continue regardless of the energy mix.

🌲 Renewable and Nuclear Innovation ☢️

Wind and solar energy have already become competitive with fossil fuels when it comes to power generation - but not storage. Nuclear power is competitive, but requires large upfront investments, and years to build.

Nevertheless, nuclear power is already back on the table with the backing of Big Tech .

Hundreds, if not thousands, of companies are working on potential solutions in the form of:

- Battery storage

- Green hydrogen

- Fusion reactors

- SMRs (small modular reactors)

These technologies have yet to be proven at scale, but breakthroughs in one or more areas could be a game changer - and take demand away from fossil fuels.

🖼️ The Big Picture

For now, the commitment to reducing CO 2 emissions seems to be waning, partly for political reasons and partly for financial reasons.

Wind and solar capacity are still being added at record levels, but the scale now makes subsidies unaffordable. More investments will also be required to increase the capacity of power grids.

This could change if the impact of climate change continues to increase - or if renewable alternatives become economically competitive, particularly to supply base load power.

Fossil fuels will eventually be depleted, or become too expensive to extract - so renewable sources are probably inevitable.

✨ In the meantime, it seems plausible that the prospects for oil and gas producers could be good for the next 10 to 15 years, and then begin to decline.

💡 The Insight: Keep An Eye On Big Oil

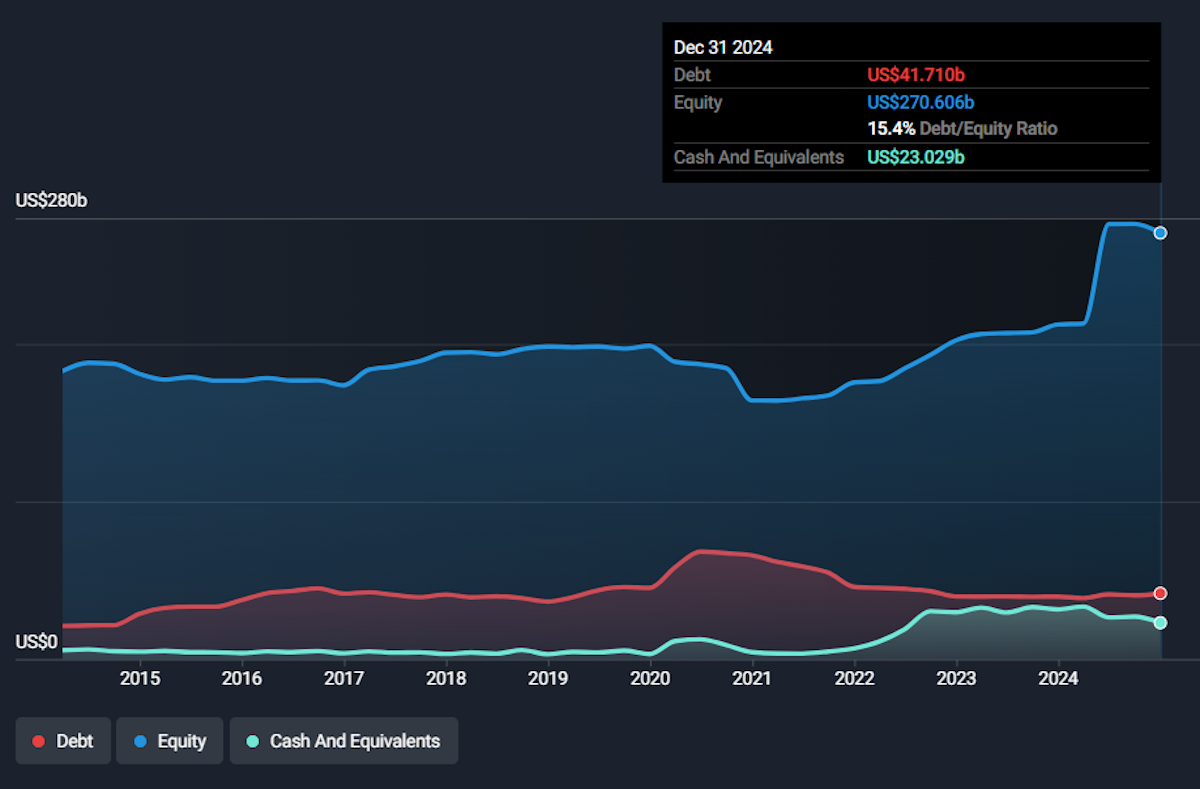

The largest oil and gas producers, including the likes of ExxonMobil, Chevron, BP, and Shell have been preparing for the future by focussing on efficiency and de-leveraging.

They have divested from low-margin assets while making acquisitions that improve their margins. Exxon (below) has reduced its debt to just 15% of equity and nearly doubled its net margin over the last few years.

Some of these companies have also scaled back investments in renewable projects - although those investments were mostly quite small to start with.

✨ The oil majors spend a lot on research and strategic planning - and their actions are an indication of what they think will happen over the next decade or longer.

It will be interesting to see whether they begin to invest more aggressively or remain cautious.

While a new innovation could disrupt the demand for oil and gas, if our energy demands continue to increase as they are for all the reasons mentioned, then these oil and gas companies could do well in the medium-longer term since they'd be relied upon to meet those energy needs.

You'd want to get exposure to those higher quality businesses, where they have efficient production, low leverage and no huge risks.

While there are 548 oil and gas companies listed in the US, we’ve created a screener to narrow your search down to just 38 companies that we consider low-risk oil and gas plays.

If you create your own screener, you can add more filters to narrow your search even more. Then you can save it to be notified when new stocks meet your criteria!

Key Events During the Next Week

Monday

- 🇯🇵 The first estimate for Japan’s 4th quarter GDP growth rate will be released. The consensus estimate is 0.5%, up from 0.2% in Q3.

Tuesday

- 🇦🇺 Australia’s central bank is expected to cut the benchmark rate by 0.25% to 4.1%.

- 🇬🇧 UK unemployment is forecast to remain 4.4%.

- 🇨🇦 Inflation data will be published in Canada. Consumer price inflation is forecast to remain at 1.8% year-on-year.

Wednesday

- 🇬🇧 UK consumer price inflation is expected to fall slightly, from 2.5% to 2.4%.

- 🇺🇸 US housing starts are forecast to be lower at 1.35 million, down from 1.5 million. Building permits are also forecast to be down marginally.

- 🇺🇸 The minutes from the last FOMC meeting will be published.

Thursday

- 🇦🇺 Australia’s unemployment rate is expected to remain at 4%.

- 🇺🇸 US initial jobless claims are forecast to be 220k, up from 213k.

Friday

- 🇯🇵 Japan’s inflation rate is expected to rise slightly, from 3.6% to 3.7%.

- 🇺🇸 The University of Michigan consumer sentiment index is expected to fall from 71 to 67.8.

Earnings season continues with the first of the retailers and a few foreign listings. The largest companies scheduled to report are:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.