- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

US Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of cautious anticipation, with investors closely watching Federal Reserve decisions and major tech earnings, growth companies with high insider ownership are drawing increased attention. In such an environment, stocks where insiders hold significant stakes can signal confidence in the company's potential and align management's interests with those of shareholders, making them intriguing options to watch for potential growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 48% |

| Smith Micro Software (NasdaqCM:SMSI) | 23% | 85.4% |

| CarGurus (NasdaqGS:CARG) | 16.7% | 42.4% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Red Cat Holdings (NasdaqCM:RCAT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Red Cat Holdings, Inc., along with its subsidiaries, offers a range of products, services, and solutions to the U.S. drone industry and has a market cap of $645.29 million.

Operations: The company generates revenue from its Enterprise segment, amounting to $16.47 million.

Insider Ownership: 20.7%

Earnings Growth Forecast: 106.1% p.a.

Red Cat Holdings is navigating a volatile share price while focusing on growth through strategic partnerships and defense contracts. Despite recent significant insider selling, the company maintains high insider ownership. Red Cat's revenue growth is projected to outpace the market significantly, driven by its innovative drone technologies and collaborations with entities like Palladyne AI Corp. Recent orders from U.S. government agencies underscore its expanding footprint in military applications, although financial losses remain a concern as it strives for profitability within three years.

- Click here to discover the nuances of Red Cat Holdings with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Red Cat Holdings is trading beyond its estimated value.

Root (NasdaqGS:ROOT)

Simply Wall St Growth Rating: ★★★★☆☆

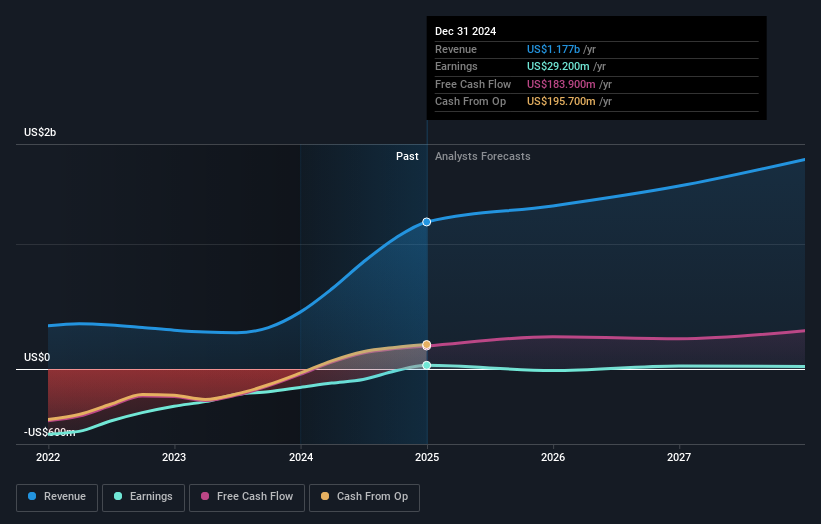

Overview: Root, Inc. offers insurance products and services in the United States with a market cap of $1.22 billion.

Operations: The company generates revenue of $1.04 billion from offering insurance products to customers in the United States.

Insider Ownership: 20.1%

Earnings Growth Forecast: 119.5% p.a.

Root, Inc. is expanding its auto insurance reach, now serving 35 states and covering over 77% of the U.S. population. Recent earnings show a turnaround with revenue reaching US$305.7 million for Q3 2024, up from US$115.3 million a year ago, alongside positive net income figures. Despite recent insider selling and share price volatility, Root's refinancing with BlackRock improves financial flexibility and reduces interest expenses by approximately 50%, supporting strategic growth initiatives amidst forecasted profitability within three years.

- Get an in-depth perspective on Root's performance by reading our analyst estimates report here.

- Our valuation report here indicates Root may be overvalued.

Schneider National (NYSE:SNDR)

Simply Wall St Growth Rating: ★★★★☆☆

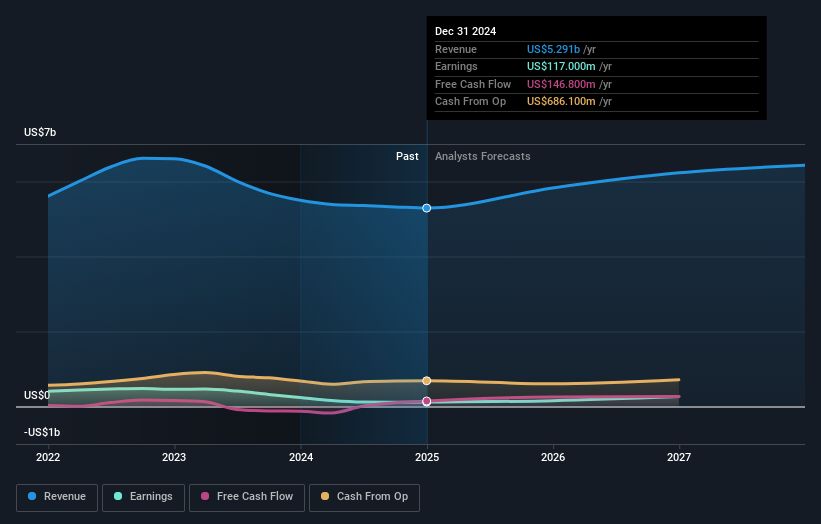

Overview: Schneider National, Inc. offers surface transportation and logistics solutions across the United States, Canada, and Mexico with a market cap of $5.22 billion.

Operations: The company's revenue segments include Logistics at $1.30 billion, Truckload at $2.16 billion, Intermodal at $1.03 billion, and Fuel Surcharge at $619.70 million.

Insider Ownership: 14.1%

Earnings Growth Forecast: 47% p.a.

Schneider National is poised for significant growth, with earnings forecasted to increase 47% annually, outpacing the US market. Despite a decline in profit margins from 5.6% to 2.1%, the company's strategic expansion into intermodal services between Mexico and Texas aims to boost revenue and sustainability efforts by reducing CO2 emissions by 62%. Recent insider activity shows more buying than selling, though not in substantial volumes, while shares trade significantly below estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Schneider National.

- Our valuation report unveils the possibility Schneider National's shares may be trading at a premium.

Turning Ideas Into Actions

- Embark on your investment journey to our 203 Fast Growing US Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROOT

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives