✨Rare Earths: Tiny Market, Outsized Influence

Reviewed by Michael Paige, Bailey Pemberton

Quote of the week: “Changing our energy model already means doubling rare metal production approximately every fifteen years. At this rate, over the next thirty years, we will need to mine more mineral ores than humans have extracted over the last 70,000 years.” Guillame Pitron, The Rare Metals War

Rare earths may be a sliver of the global metals market, but they punch far above their weight. These obscure elements are the invisible wiring of modern life.

The problem is, China controls the chokepoint of refining, leaving the U.S. and its allies scrambling to secure supply chains. That scramble is now turning into action: Washington is writing billion-dollar checks, Australia is scaling up processing, and investors are chasing rare earth miners whose share prices have doubled or tripled.

By the end of this piece, you’ll see why rare earths are less about market size and more about strategic leverage. Plus, we’ll cover how to tell which companies could benefit from the geopolitical arms race, and which are just along for the hype.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🇺🇸The U.S. government shut down as Congress couldn’t reach a funding agreement ( The Guardian )

- The U.S. government has partially shut down again, but this time the stakes are higher. The White House is prepping for permanent layoffs, not just furloughs, and using the shutdown as a tool to shrink federal operations.

- Prolonged disruption could sap consumer confidence, delay federal spending, and weaken Q4 GDP – a potential drag on equities, especially in travel, retail, and defense.

- Bond investors should watch for delayed Treasury auctions or weaker demand amid dysfunction. Risk-off sentiment could push yields lower if the shutdown drags.

- Healthcare, media, and public infrastructure players tied to federal funding are particularly exposed to a drawn-out standoff.

- Political noise is also raising the risk of credit rating scrutiny. Another downgrade could spark market volatility.

🚢 Top shipping players want overhaul of UN ship fuel emissions deal ( Reuters )

- Top shipping firms are pushing back against the UN's proposed Net-Zero Framework, warning it could raise costs and create market distortions without delivering real emissions cuts.

- With the U.S. already threatening retaliation if the deal passes, investor risk around global trade, fuel prices, and port operations is climbing fast.

- If the framework is delayed or derailed, expect slower adoption of green shipping tech and more volatility in carbon credit markets tied to maritime fuel.

- Freight and logistics players like Mærsk , Hapag-Lloyd , and COSCO could face rising compliance uncertainty, while Air Products & Chemicals and Wärtsilä could benefit from new demand.

- Shipping regulation is becoming a geopolitical minefield. Watch for ripple effects in global inflation projections if shipping costs spike under future revised frameworks, and make sure you’re considering these policy risks in your future estimates.

🚗 Automakers are working accounting magic to extend the EV tax credit beyond its deadline ( Sherwood )

- The $7,500 EV tax credit officially expired Sept 30, but Ford, GM, and Lucid are bending the rules via creative leasing tricks to keep the deal alive.

- By fronting down payments on unsold EVs, automakers can lock in the credit and pass it along as lease discounts – a temporary cushion for demand.

- Tesla, meanwhile, went full throttle with end-of-credit markdowns, pulling forward sales that could cannibalize Q4 demand.

- Without the credit, EVs effectively just got $7,500 more expensive overnight, which is a tough sell in a high-rate environment.

- Q4 could be choppy for automakers as they juggle inventory, margins, and tepid post-credit demand.

- Watch leasing activity and Q4 EV sales closely, because they’ll show which brands can thrive without government support artificially inflating demand.

💰 How the Electronic Arts takeover plays into Saudi Arabia's investment strategy ( Axios )

- Saudi Arabia’s $925B sovereign wealth fund (PIF) just backed the biggest buyout ever, attempting to snap up Electronic Arts ( pending shareholder and regulatory approval ) as part of a broader pivot from oil into male-dominated industries like gaming, combat sports, and soccer.

- The playbook appears to be: buy cultural relevance while diversifying revenue streams, with investments spanning golf, combat sports, soccer, motorsports, gaming, e-sports, media, and now AI.

- For U.S. investors, this means more Middle Eastern money flowing into these sectors, so that fresh liquidity could possibly elevate their valuations.

- But there is some backlash: “ comedy-washing ” and “ sports-washing ” controversies could spook investors and create reputational headwinds for partners.

- Historically, the Saudi sovereign wealth fund has paused after mega-deals, but with AI in its sights, the firehose of capital likely isn’t shutting off.

- So if it’s buying into a sector, expect valuations and deal activity there to heat up.

📉 Share buybacks slow worldwide as U.S. tariffs take root ( S&P Global )

- Global share buybacks fell off a cliff in Q3 after U.S. tariff hikes and stretched valuations made repurchases less appealing. Monthly buyback volume dropped from ~$43B earlier this year to just ~$11B in August, which is the weakest since late 2024.

- In the US, activity cratered: $31B monthly in H1 shrank to under $5B by August, with September barely clearing $500M.

- Companies are wary of buying back at peak multiples. The S&P 500’s P/E has sat above its 10-year average all year, while tariffs have added cash flow uncertainty.

- Buybacks are one of the biggest EPS tailwinds, and with them fading, earnings growth will have to do more heavy lifting in Q4.

- Investors should expect thinner corporate demand for shares, which is a headwind for upside momentum in equities.

📈 Robinhood joins the S&P 500 after remarkable rally ( Yahoo )

- Robinhood’s 229% YTD rally makes it the S&P 500’s top performer, fueled by user growth, new products, and a crypto-heavy expansion strategy.

- The company is pivoting from payment for order flow (PFOF) fees toward diversified revenue streams like wealth management, credit cards, and international crypto services, which could be a more durable model, if it sticks.

- Its $1.5B buyback program and $4.2B cash cushion give it firepower to support the stock, but its current valuation compared to peers is considered high relative to its expected earnings growth.

- Regulatory probes across the U.S. and EU remain a real overhang, with past fines suggesting more compliance costs ahead.

- Momentum is strong, but at this premium, investors should size positions carefully – HOOD is priced for perfection.

🚀 Rare Earth Minerals: The Backbone of Modern Technology

Rare Earth minerals have become a geopolitical football, but a lot more painful to kick. With the backing of the Trump administration, stock prices in this industry are flying.

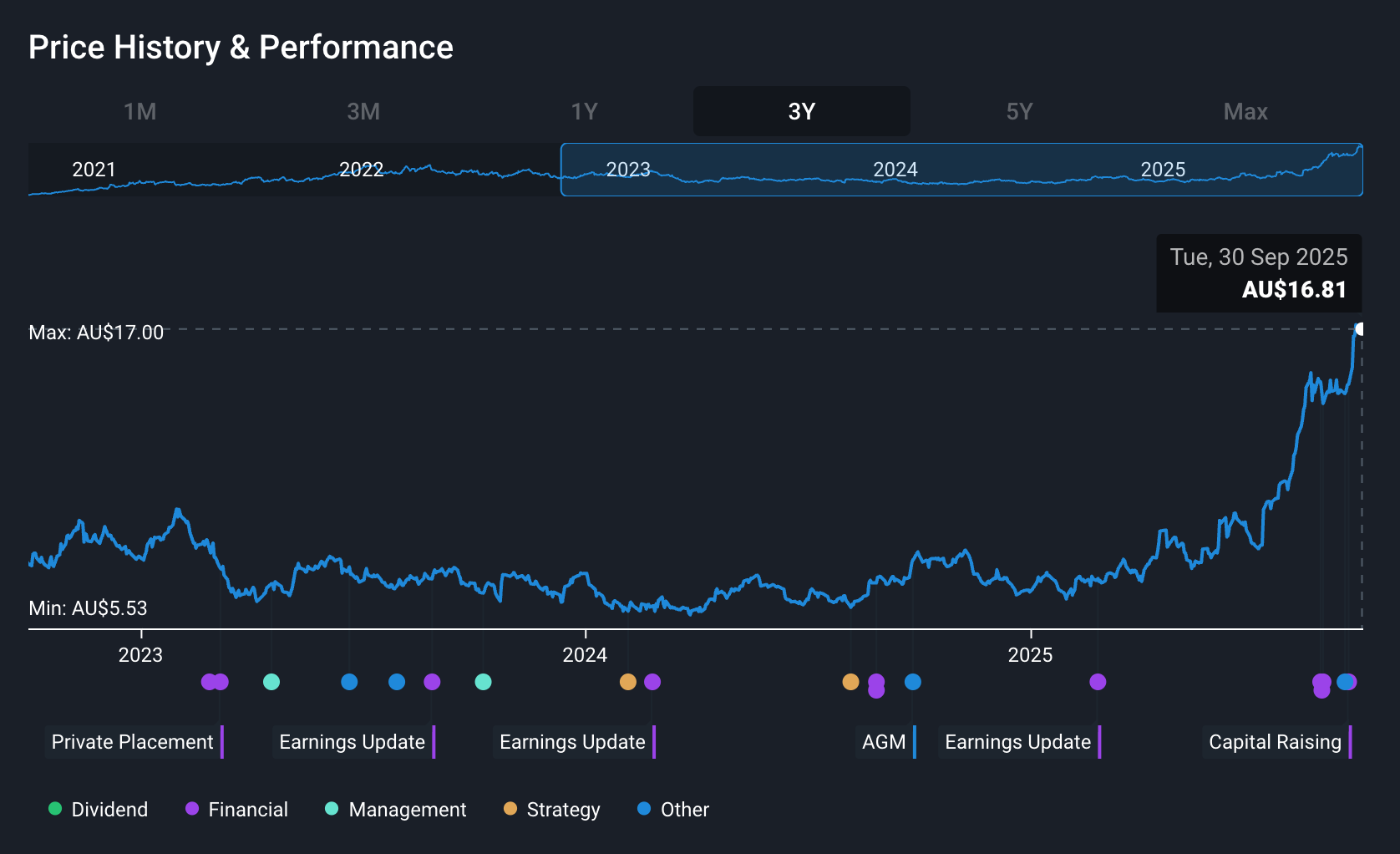

The largest non-China producers have seen their stock prices gain 100% to 200% in the last year alone, with smaller players up even more. Most of the charts look something like this:

Lynas Rare Earths Share Price (12 Months) - Simply Wall St

This list of 17 chemically similar rare earth elements (the REEs ) is basically the VIP list for advanced tech.

They’re what make your devices smaller, faster, and way more powerful. Some of the most valuable ones are:

- Neodymium (Nd): The stuff that makes super-strong magnets.

- Dysprosium (Dy): It helps magnets handle heat, which makes them reliable in things like electric cars and computer hard drives.

- Cerium (Ce): Works like a scrubber in car exhaust systems, helping reduce pollution.

- Lanthanum (La): It’s added to metals to make them stronger and better for things like batteries, cameras, and hybrid cars.

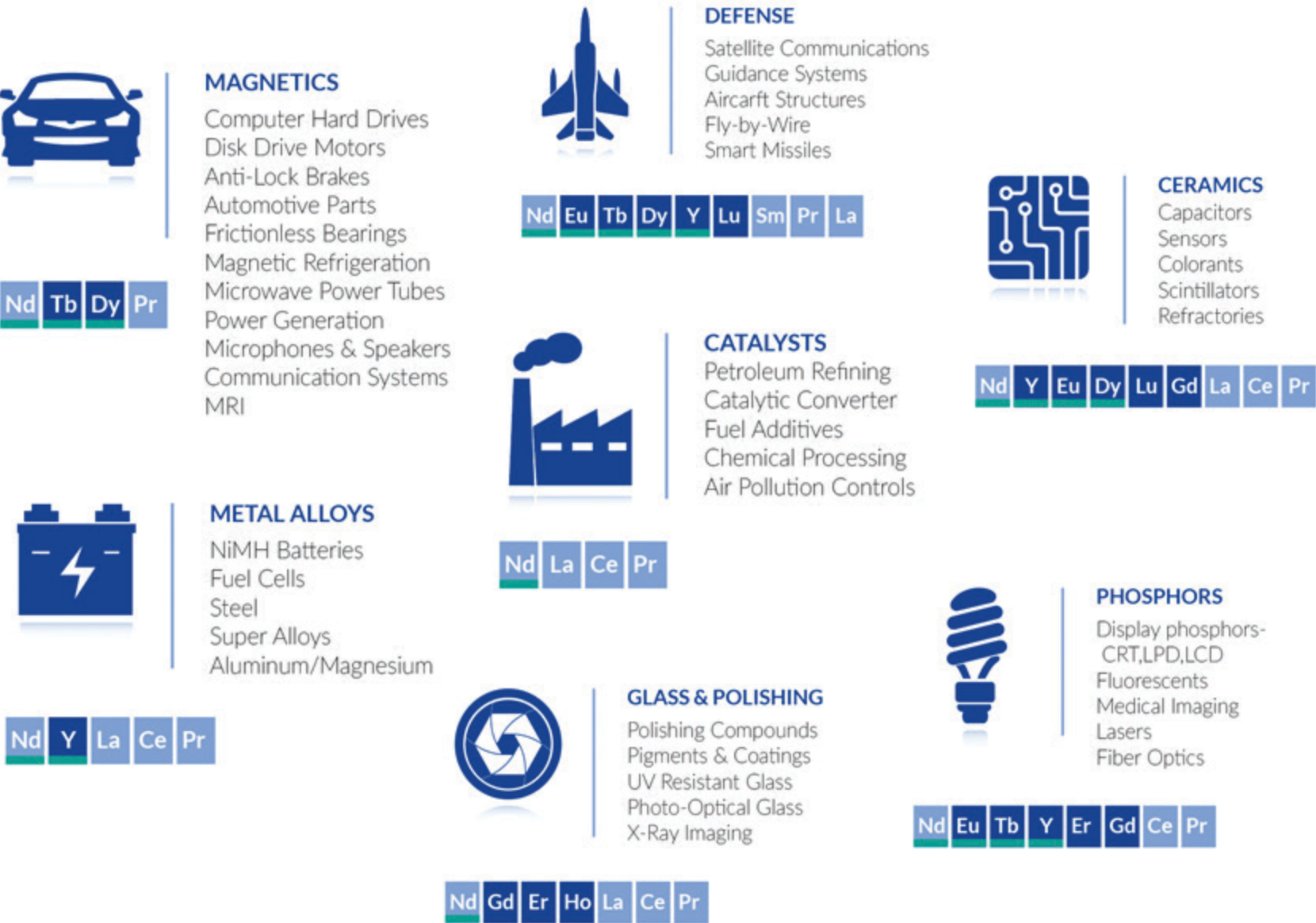

So who needs them? Well, they’re indispensable for:

- ⚡ Energy : Fuel cells, wind turbines, refining oil, and cleaning up exhausts.

- 🛡️ Defense : Guiding missiles and keeping satellite communication online.

- 💻 Computing: The guts of hard drives and key components in modern electronics.

- 🚗 Autos: From electric vehicle systems to essential brake components.

REEs and their associated applications - Natural Energy Technology Laboratory

⛏️The Critical Minerals List

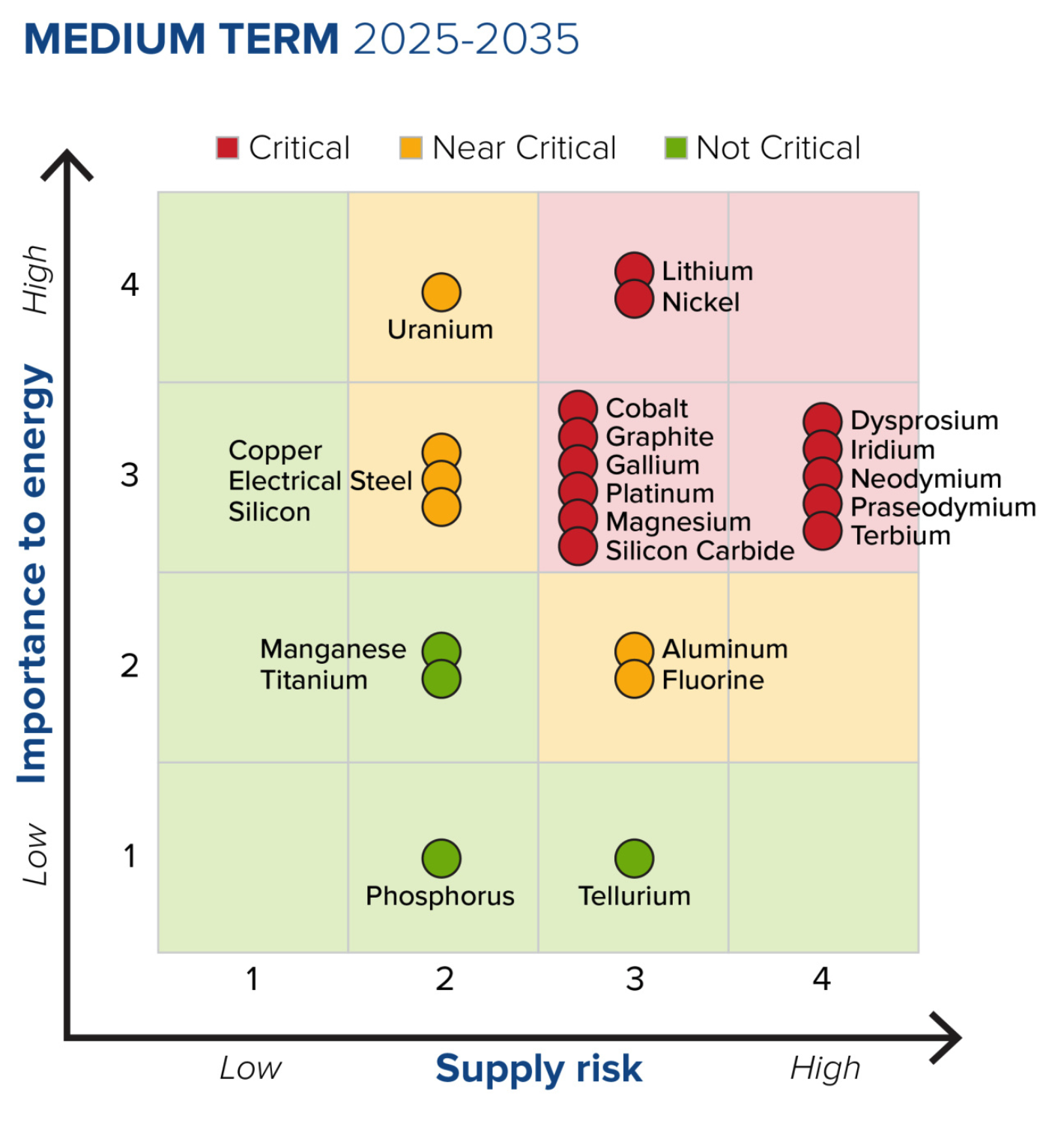

The REEs fall within the broader Critical Minerals classification, though countries differ in terms of what they include on their list based on their own economic, national security, and supply considerations.

This group includes over 40 minerals according to the U.S. Department of Energy.

The full list extends to metals like copper and aluminum, but strategically important ones are:

- 🔋 Battery Powerhouses: Lithium, cobalt, nickel, and graphite are the A-list ingredients for battery technology.

- ☢️ Energy & Nuclear: Uranium and silicon carbide (for high-performance electronics).

- 🧠 Chips: Gallium, germanium, and indium are essential for cutting-edge semiconductors. Think faster processing and AI.

Source: U.S. Department of Energy

⚖️ The Critical Minerals Paradox

Rare earths are one of those fascinating contradictions: they’re vital to modern life, but the market itself is surprisingly small.

The size of the market today is estimated to be only around $5B . To put that into perspective, in 2024:

- The global iron ore market was $274B ,

- The global base metals market was $552B , and

- The global metals and minerals market was $1.3T

Estimates of how big the rare earth minerals market could be in the future vary widely, from $8B to $33B by 2033 . ( There could be some double-counting in these larger estimates, but the point is, they all expect this market to grow ).

**So what’s the catch?

✨While this isn’t a “big dollars” market, it’s a** power play market. Whoever controls rare earths controls leverage over defense, high-tech, and clean energy supply chains.

So it’s a s mall market, with an outsized impact.

🇨🇳 Geopolitical Dynamite: Made in China

China’s grip on rare earths isn’t just about digging them up, it’s about what happens after.

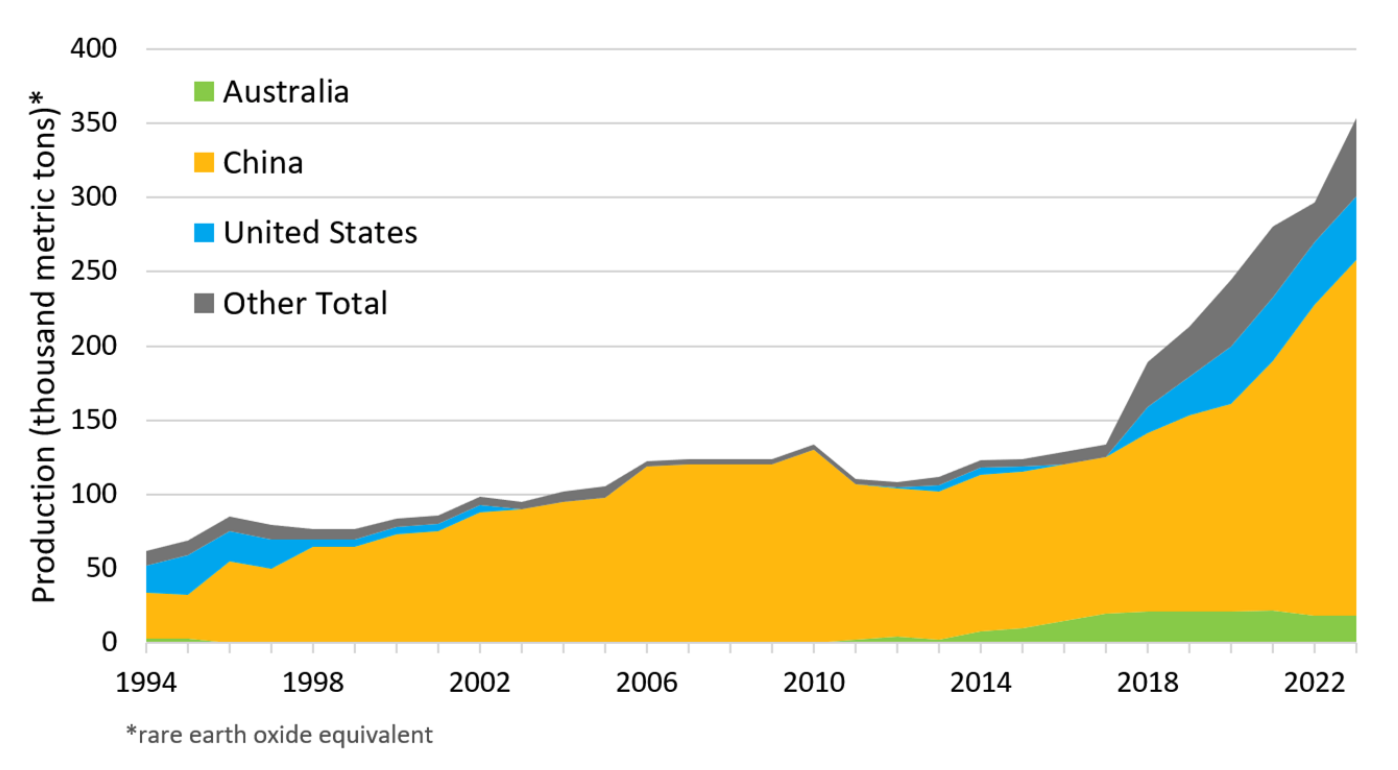

- Mining share: China controls over 60% of global REE production.

- Processing share: It owns ~90% of global refining & separation capacity

That second stat is the real power move.

Refining is where raw ore becomes high-purity oxides, making them usable forms for tech, defense, and clean energy. And that’s the chokepoint.

For years, even non-Chinese mines (like the U.S.'s Mountain Pass) had no choice but to send their concentrate to China for this specialized processing.

Rare Earth Production by Country - NETL

That’s an incredible amount of leverage that China holds.

💰 The Tricky Economics: It’s Not the Rarity, It’s the Refining

So i f rare earths are so critical, why hasn’t the rest of the world just built its own processing plants?

Because the issue isn’t scarcity . D espite the name, rare earths aren’t actually that rare. The challenge is refining :

- 💰 It involves huge upfront capital costs

- 🧠 It requires advanced technical expertise

- 🧑🔧 It needs skilled labor that takes years to train

✨ China has made long-term bets, while the rest of the world hasn’t. The result is that Beijing turned rare earths into a global bargaining chip.

Now, with China restricting certain exports and even banning some refining tech outright , the U.S. and its allies are staring down a painful truth: they don’t control the materials that power their defense, energy, and tech industries.

Global leaders have realized this, and believe it’s time for a supply chain reset.

🤝 The Fix: Public–Private Partnerships

The problem is, the private sector alone can’t take this risk; there’s just too much uncertainty. Supply from China could dry up, or even sneak back into markets indirectly.

That’s why governments are entering the field.

In July, the U.S. Department of Defense (DoD) invested $400M into MP Materials ( via convertible preferred shares ).

- The DoD is effectively underwriting all of MP’s NdPr output for the next 10 years , with a $110/kg price floor .

- Translation: Uncle Sam is de-risking the buildout of a US-based rare earth magnet supply chain .

The U.S. isn’t stopping at MP Materials either. Reports suggest the Trump administration is eyeing similar equity-style deals with other players.

Case in point: Lithium Americas .

Its share price doubled after the White House floated taking a stake . That’s because the Thacker Pass mine in Nevada is set to become North America’s largest lithium producer.

And when you don’t have all the resources yourself, allies become crucial. Both resource-rich and democratic, Australia and Canada are critical to diversifying the US’s supply base.

- Australian companies, in particular, have received significant government backing to establish new processing facilities and forge agreements with U.S. and European end-users.

✨ So as you can see, this isn’t your classic free market story. Governments are stepping in not only as anchoring customers (guaranteeing long-term demand), but as financiers (fronting the heavy capital needed)

⛏️ The Players

Plenty of countries are sitting on rare earth deposits, but outside of China, the real action is happening in the US, Canada, and Australia.

Here are some of the bigger names, the companies valued at over $1 billion:

🔹 MP Materials Corp (US)

- Runs the Mountain Pass mine in California , the biggest rare earth producer in the Western Hemisphere.

- Pushing hard on vertical integration : already separating NdPr and building what could become the first fully integrated U.S. rare earth magnet factory.

🔹 Lynas Rare Earths Limited (Australia)

- The only large-scale producer of separated rare earths outside China.

- Owns the Mt Weld mine in Australia and operates the world’s biggest single rare earth processing plant in Malaysia.

- Long track record as a proven operator in the notoriously tricky processing game.

🔹 Energy Fuels Inc. (Canada/U.S. operations)

- Known as a leading U.S. uranium and rare earths company.

- Finished Phase 1 of its REE separation facilities in 2024 and already kicked off commercial production of separated NdPr.

🔹 Ramaco Resources (US)

- Once a pure-play metallurgical coal producer, now reinventing itself.

- Building a dual platform : coal plus a potentially game-changing rare earth and critical minerals arm.

🔹 Iluka Resources (Australia)

- Owns multiple mining and refining facilities across Australia, including the world’s largest zircon mine.

- Bolstered by substantial government-backed funding to advance rare earths development.

🔹 USA Rare Earth (US)

- Recently grabbed attention by acquiring UK-based Less Common Metals (LCM).

- Still a rookie player , it had zero revenue before this deal, but LCM gives it some production footing.

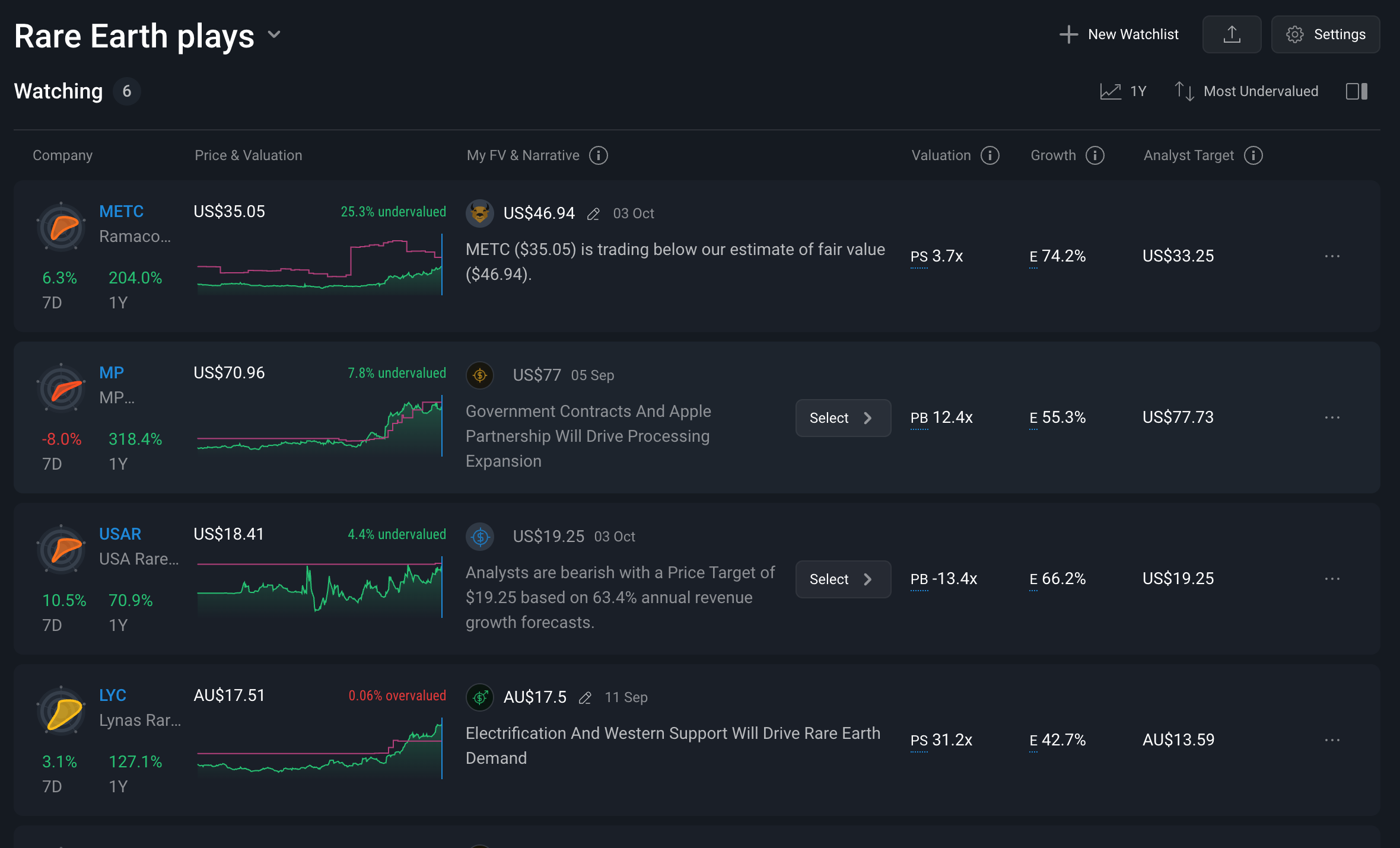

You can add all these names above to a rare earths watchlist and set your fair value to know when to buy, hold or sell.

✨ Outside these big names, most rare earth companies are valued under $500 million, making them potentially higher risk bets.

💡 The Insight: Government Investment = A Margin of Safety, Not Guaranteed Upside

We’re likely to see more government-backed deals like the ones already on the table. It’s the most realistic way to secure the supply of rare earths, and it’s happening in other strategically critical sectors too, like semiconductors.

That’s good news for supply security , but here’s the kicker: it doesn’t make rare earth producers a sure thing for investors.

Government support changes the dynamics of these stocks. Yes, funding injections and price floors give companies breathing room, but shareholders shouldn’t confuse that with guaranteed returns.

A few realities to remember:

- Dilution happens. When a government takes a stake, they’re not buying existing shares on the market; they’re buying newly issued ones. That dilutes existing shareholders.

- Price floors help, but don’t save you from costs. A guaranteed baseline is useful for planning, but costs have a nasty habit of spiraling upwards, just ask the gold miners.

- Buzzword inflation is real. Throw in geopolitics, sprinkle in “AI” and “EVs,” and suddenly everything looks hyped beyond reason.

Bottom line: government support helps, but execution still matters.

These companies must be well-managed, well-financed, and ideally moving toward vertical integration. The real value is unlocked in refining and processing , not just owning the raw resource.

And of course, stick to the basics. Watch for the usual red flags (below) in company reports and make sure management has a track record of overcoming challenges.

NioCorp Risk Analysis - Simply Wall St

Key Events During the Next Week

Tuesday

- 🇦🇺 Westpac Consumer Confidence Change

- 📈 Forecast: 3.2%, Previous: -3.1%

- ➡️ Why it matters: A significant rebound in consumer confidence is a positive signal for future household spending and economic activity.

Wednesday

- 🇦🇺 NAB Business Confidence

- 📈 Forecast: 9, Previous: 4

- ➡️ Why it matters: Stronger business confidence can lead to increased investment and hiring, signaling a robust outlook for the economy.

- 🇺🇸 FOMC Minutes

- ➡️ Why it matters: These minutes provide markets with deeper insight into the Fed's policy discussions and future interest rate path.

Friday

- 🇨🇦 Unemployment Rate

- ▶️ Forecast: 7.1%, Previous: 7.1%

- ➡️ Why it matters: A stable unemployment rate suggests a steady labor market, giving the Bank of Canada room to hold policy.

- 🇺🇸 Uni. of Michigan Consumer Sentiment Index

- 📉 Forecast: 54.0, Previous: 55.1

- ➡️ Why it matters: Worsening consumer sentiment can signal a future slowdown in spending, which is a key driver of the U.S. economy.

This week is a mix of late Q2 and early Q3 quarterly financials. Q3 earnings season kicks off properly on the 14th with the big banks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.