📈 Markets Break Records: Q3 2025 in Review, Q4 Outlook Ahead

Reviewed by Michael Paige, Bailey Pemberton

Quote of the Week: “The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” -William Arthur Ward

Q4 2025 is off to a flying start with record highs being printed left, right, and center.

US and Japanese stocks made fresh new highs, while the gold price powered through $4,000 for the first time, and Bitcoin crossed the $126k level.

Is this all a case of USD weakness, irrational exuberance, or solid fundamentals? This week, we are reviewing Q3 market performance, Q2 earnings season, and the outlook heading into the end of 2025…

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🤖 AI’s grip on the S&P has Morgan Stanley’s top analyst ‘very concerned’ ( Fortune )

- AI-linked stocks are now responsible for 75% of S&P gains, 80% of profits, and 90% of capex. Morgan Stanley’s Lisa Shalett says that’s too much risk concentrated in too few hands.

- Nvidia is at the center of it all with multi-billion-dollar investments in OpenAI and indirect ties to AMD. The web of financing is starting to look circular, and that’s got echoes of Cisco 2000.

- Deals like Oracle’s $300B OpenAI partnership (funded mostly by debt) are setting off alarms. Shalett’s watching Oracle’s credit default swaps (CDS) spreads as a potential early-warning signal.

- Some research firms expect the hyperscaler’s free cash flow to be 16% lower over the next 12 months, even as this capex adds 100bps to GDP (which is tenfold more than underlying consumer spending growth).

- Bulls like BofA say Nvidia’s deals are manageable, but even they admit digestion is coming. The runway is getting shorter.

- If AI capex were to cool, then that is the market’s core engine slowing down, and you can expect investors to react accordingly with lower prices for lower spending.

📈 Dell lifts long-term growth targets on surging AI demand ( WSJ )

- All that CapEx has to go somewhere.

- At its analyst meeting, Dell hiked long-term forecasts, citing "insatiable" AI server demand, shifting focus from traditional hardware. The company sees revenue growing at 7 to 9%, with EPS increasing by 15%/year over the longer term. The company also committed to increasing its dividend by 10% annually through 2030.

- Just 2 years ago, Dell’s PC business was nearly 50% larger than its infrastructure segment. Over the last 12 months the infrastructure business has generated slightly more revenue than the PC business, due to surging demand for servers, and a sluggish PC market.

- The race to build AI capacity is paying off big time for companies selling chips, hardware and electricity. Of course that means expectations are riding on continued capex spending by big tech (and OpenAI).

- The question now is whether the PC market could bounce back, and whether that could offset any slowdown in AI spending.

🤦 Deloitte Australia refunds government for AI-generated report ( Fortune )

- Deloitte's Australian arm used AI to generate a government report, but the report contained fabricated references and quotes. The firm will refund the last payment and update the report, but a senator says they should refund the full $290,000.

- Companies risk reputational and financial consequences when AI models make mistakes - and when they get caught out. The more this happens, the more cautious companies are going to be about using AI.

- Human oversight could be a necessary reality until models are more reliable. This has been the case with robo-taxis, with human ‘observers’, either in the vehicle or monitoring remotely. This could slow the expected ‘jobs bloodbath’ that many were expecting from AI.

- Another implication is that companies viewed as more cautious with AI safety and governance might gain an edge.

🇺🇸 US demands EU dismantle green regulations in threat to trade deal ( FT )

- The US is leaning hard on Brussels to weaken core EU green rules just months after inking a trade deal in July.

- Washington wants the EU to drop rules like mandatory climate transition plans and supply-chain due diligence, but isn’t offering anything in return. The message is essentially: water down the rules or risk the trade deal falling apart.

- US firms are threatening to exit Europe, spooked by liability risks and steep penalties (up to 5% of global turnover) under EU environmental laws.

- This pressure campaign is part of a broader push by the Trump administration to kneecap climate rules at global institutions and shift momentum back toward fossil fuel investment.

- With Brussels already delaying or softening key rules amid internal EU backlash, any investors betting on long-term ESG tailwinds may need to reassess the pace and direction of regulatory momentum.

💹 Japan's Nikkei surges to record high on pro-stimulus PM election ( Reuters )

- Japan’s Nikkei blasted through 47,000 after Sanae Takaichi won the LDP leadership, with markets betting on big spending and delayed rate hikes.

- Traders are reviving the “Takaichi trade” (going long equities and short Japanese government bonds), as she’s seen as a loyal Abenomics disciple with a love for stimulus.

- BoJ rate hike odds for December collapsed to 41% (from 68%), pushing down short-end yields and the yen, and hammering bank stocks on margin concerns.

- Defense stocks like Mitsubishi Heavy soared on expectations of a hawkish military pivot under Takaichi. But rising long-term yields show markets are jittery about growing debt.

- Political risk remains: the LDP is still a minority, and her stimulus dreams may get checked in parliament.

- The Nikkei loves Takaichi’s playbook, but if bond vigilantes or coalition politics get in the way, this rally could reverse fast.

⚖️ Fed minutes show committee divided on number of rate cuts by year-end ( CNBC )

- Fed officials are broadly aligned on cutting rates, but are split on whether one or two more 25bps cuts are needed by year-end, with one lone official pushing for a bigger 50bps cut.

- The shift in tone is driven by rising concern over labor market weakness, which most officials now see as a bigger threat than stubborn inflation.

- Despite ongoing tariff-driven price bumps, the Fed doesn't see trade tensions as a long-term inflation risk, which gives it more cover to ease.

- Some still argue policy isn’t that restrictive, hinting that cuts could pause if financial conditions stay loose.

- A prolonged government shutdown could complicate decision-making by starving the Fed of critical data ahead of the Oct. 28–29 meeting.

- While markets are pricing in two more cuts this year, if labor data stays soft (or goes dark), the Fed might have to move faster and fly blind.

🏆 Q3 Winners, Losers, and Key Themes

Artificial Intelligence remained a key theme in Q3, but other sectors and asset classes joined the rally - despite the policy uncertainty and geopolitical risks lurking in the background.

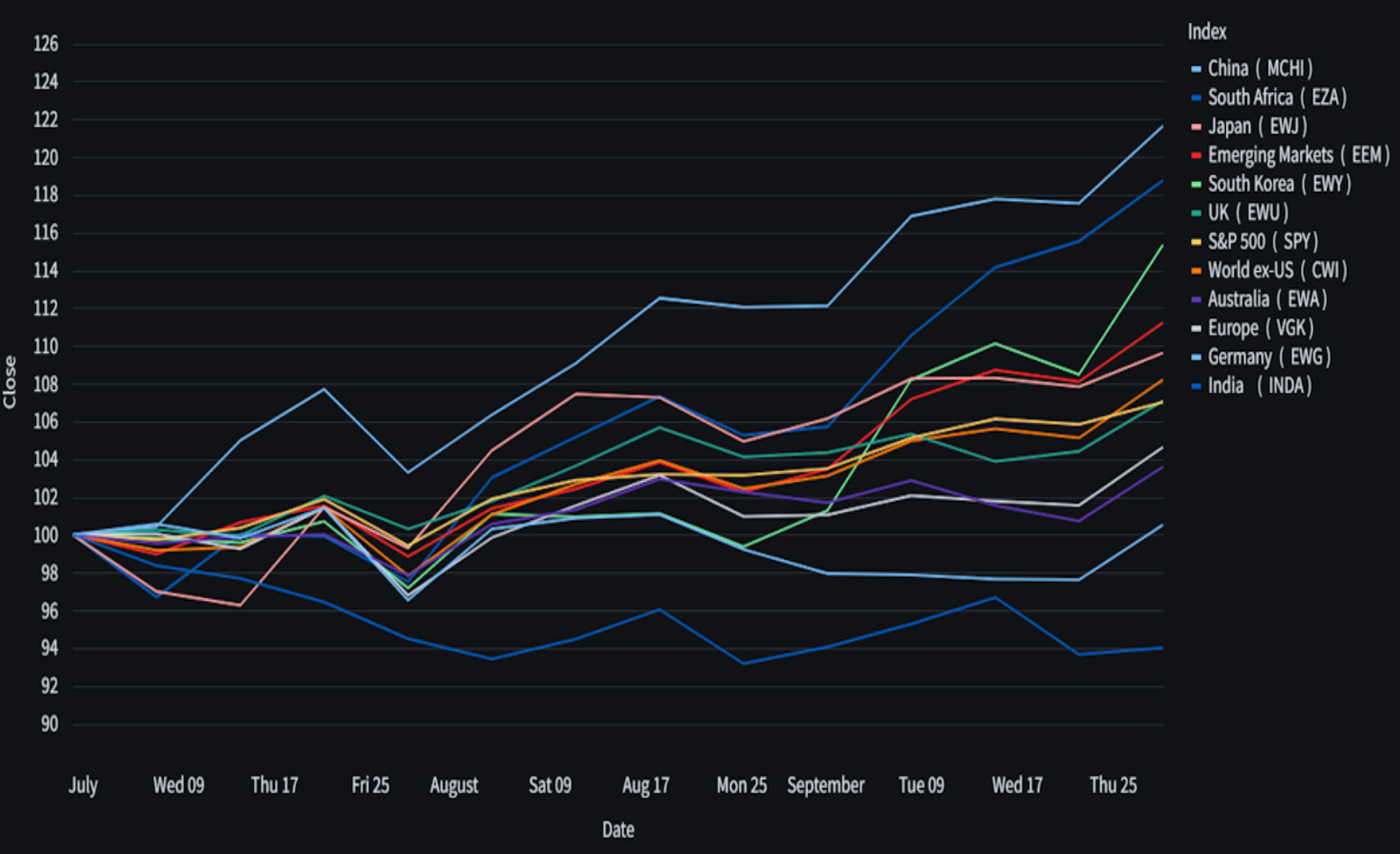

Third quarter Performance (Market Index ETFs)

Here are some of the key themes we noticed:

💰 Risk was back on. Investors rotated into cyclical assets and riskier plays as optimism returned to markets.

🤖 Speculative AI stocks surged across the U.S. and China, even as talk of an “AI bubble” got louder. For this quarter, momentum trumped caution.

🌍 Emerging Markets surprised to the upside , outperforming developed peers on a weaker U.S. dollar and thawing U.S.–China trade relations.

📈 Small caps stole some spotlight , beating large caps in several markets as investors hunted for growth beyond the megacaps.

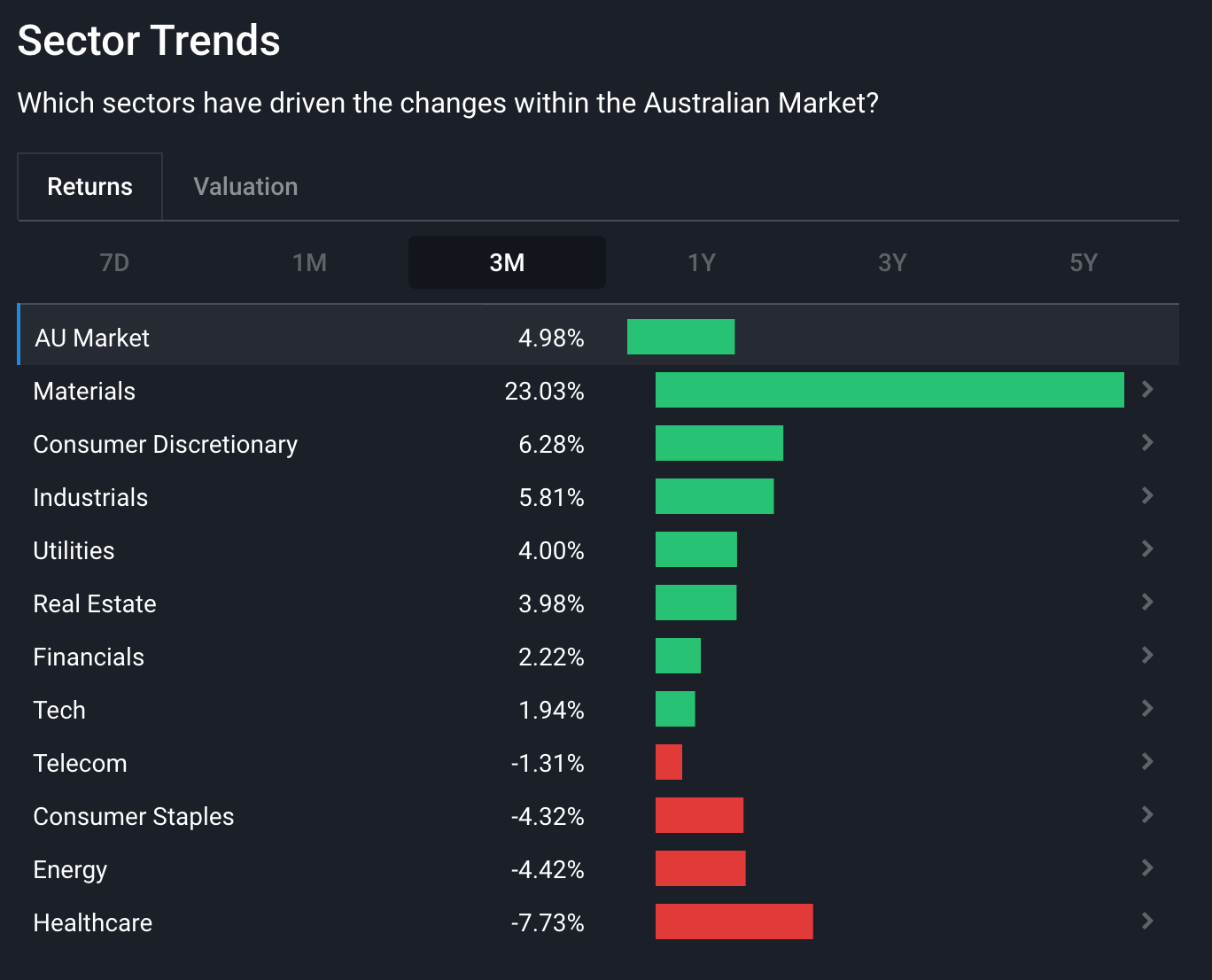

🥇 The weak-USD trade roared back. Gold and Bitcoin climbed as the dollar lost favor, while gold-heavy markets like Canada, Australia, South Africa, and the UK shone brightest. The chart below is similar for all four markets.

Australia 3-Month Sector Performance- Simply Wall St

Here’s how different regions stacked up…

🇺🇸 United States

The U.S. market stayed powered by tech, but the story is getting more nuanced.

💪 Mega-caps still dominate, but not equally. Some names kept soaring while others cooled, which is a sign that mean reversion and selective conviction are taking hold.

📊 Small-caps edged ahead , hinting that investors are broadening their exposure beyond the giants and spotting value in the market’s overlooked corners.

🚀 Growth beat Value once again , fuelled by AI-driven revenue gains and a dash of speculative enthusiasm. The appetite for innovation still outweighs caution.

The communications sector ( Alphabet , Meta ) delivered the strongest earnings growth, backed by resilient ad spend and deepening AI integration. Meanwhile, energy lagged behind as crude oil prices slipped, dragging sector earnings lower.

🇪🇺🇬🇧 Europe & The UK

- Europe lagged after a stronger performance earlier in the year, and the ECB signaled that inflation risks are now more balanced .

- UK indexes were buoyed by metal prices, strong performance in healthcare and a rate cut in August.

🌏 Asia

- 🇯🇵 Japan : Reached new equity highs , supported by global AI demand and improved corporate governance. Japanese REITs were top performers.

- 🇨🇳 China : Delivered the strongest equity returns among major markets, reflecting a stabilizing economy, stimulus and positive US-China trade progress.

- 🇮🇳 India : Continues to lag as global investors stayed with the momentum in China and Japan.

🌎 Emerging Markets (Ex-Asia)

More broadly, emerging markets rode the wave of improved risk sentiment, stronger commodity prices, and the weaker USD (which makes imports cheaper).

Now, as for earnings season, here are some key takeaways we had, primarily for companies in the U.S.

📅 Q2 Earnings Season

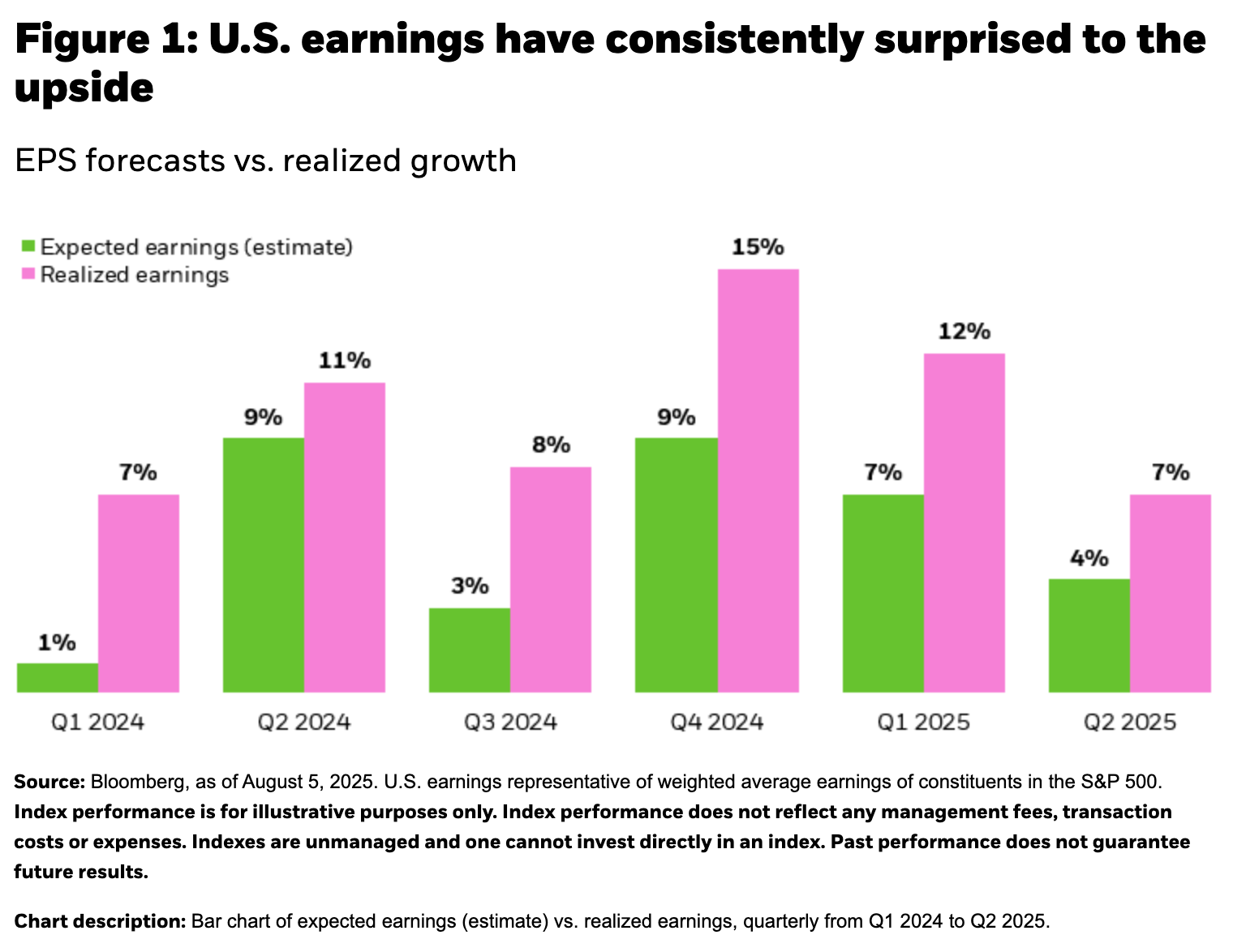

Corporate earnings completely blew past the doom-and-gloom forecasts!

Considering the market volatility in April, it was a remarkable quarter that screamed corporate resilience .

- 🥊 Big Beat: 82% of S&P 500 companies beat EPS estimates , with nearly 60% raising their full-year guidance. However, considering that the average percentage that beat estimates is 78% (post-pandemic), it seems many analysts might be too conservative with their estimates.

- 📈 Earnings growth is slowing, as expected, but still managing to outpace estimates.

US Quarterly Earnings: Realized vs Estimates - iShares

- 💸 AI spending and a nice tailwind from the weaker US dollar contributed to corporate performance.

- 📦 Tariff Tango: They were less of a killer and more of a nuisance.

- Companies used productivity gains and strategic partnerships to effectively manage the cost squeeze. Well, so far anyway.

- 🏅 Sector Standouts:

- Tech and Communications led the pack, with the latter translating AI into serious ad revenue.

- Healthcare leveraged digital tech for efficiency and innovation.

- Lagging :

- 🛢️ Energy remains depressed as the oil price remains under pressure.

- Rate-sensitive sectors (real estate and utilities) struggled as financing costs ate into margins.

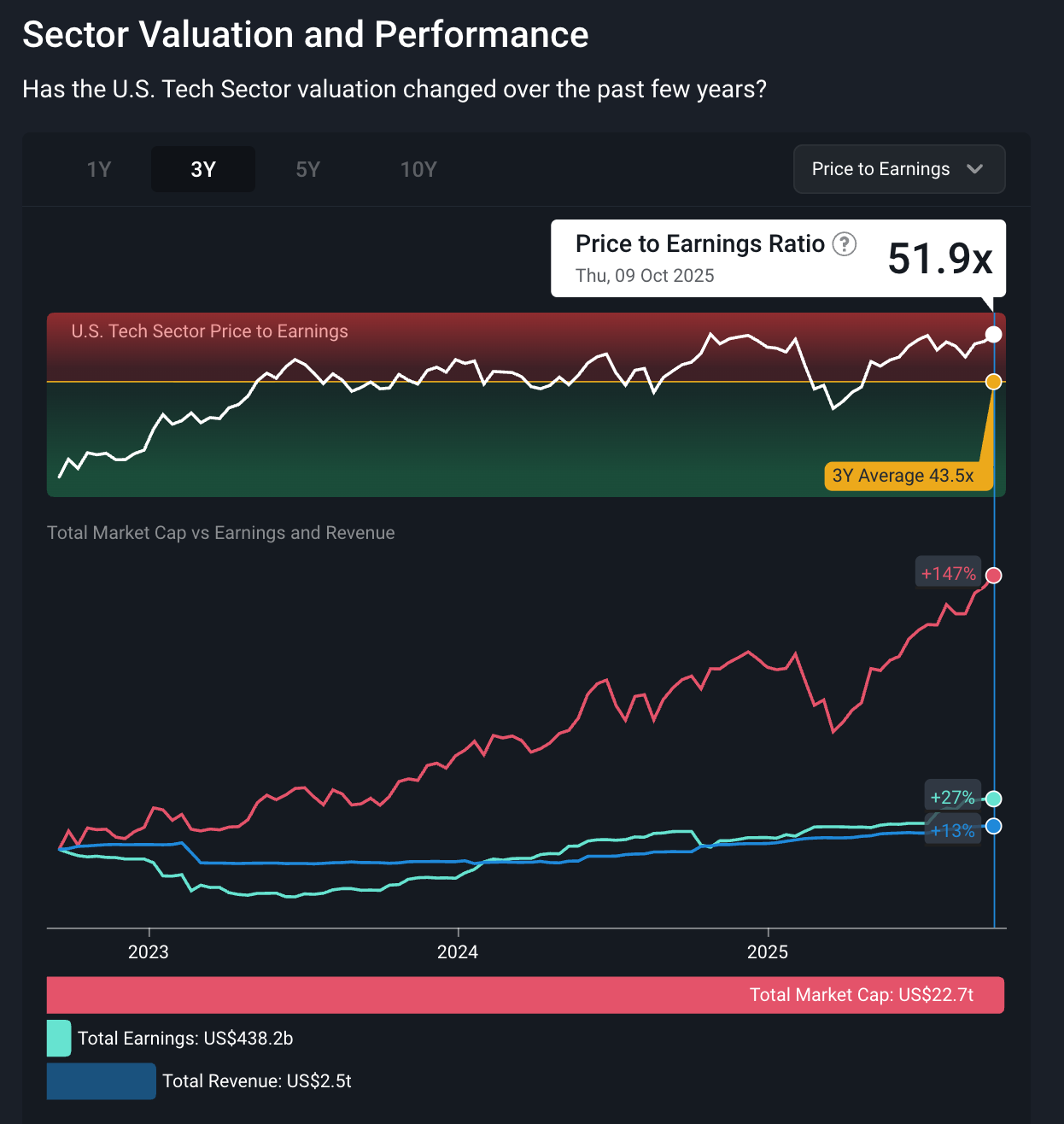

✨ Keep in mind, while tech stocks continue to power ahead, price multiples are actually where they were a year ago. So essentially, earnings growth has kept pace with price gains.

US Tech Sector P/E Ratio, Revenue, Earnings and Market Cap - Simply Wall St

💰 Economic Themes: Rate Cuts vs an Economic Slowdown

After sitting at 4.33% for the whole of 2025, Q3 finally brought the first official rate cut from the Fed.

Markets are now betting on them joining the global easing party, anticipating up to 125-150bps in cuts over the next year. This was enough to offset investor fears of a recession or a rebound in inflation .

But globally, it’s not the same. US Treasury yields dipped on expected Fed cuts, while Treasury yields in the UK and the Eurozone actually rose . Everyone's marching to a different policy drum.

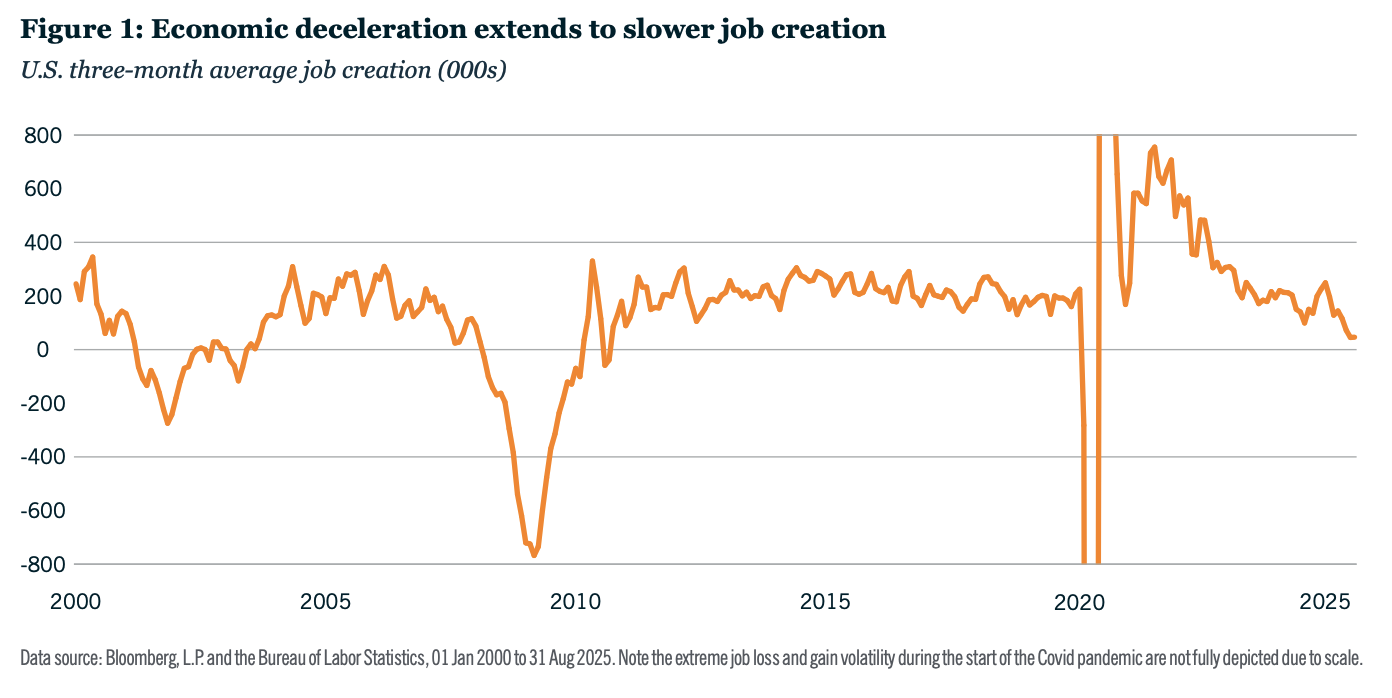

A softening US labor market gave the Fed the green light to keep easing without panicking. While job growth is indeed slowing, so far, unemployment is remaining stable.

US 3-Month Average Job Creation - Nuveen

Now, globally speaking, while economic growth is slowing, some positives have emerged in the form of:

- 🛢️ Lower oil prices

- 💵 The weaker USD

- ▶️ Inflation has been stable, and

- 🪖 For the most part, the global trade war has moderated.

🔮 The Q4 Outlook: An AI Endurance Test

In t he US, there is cautious optimism. Fundamentally, it’s strong, but its valuation and concentration in the AI space are both sounding alarm bells for some analysts.

- ✅ Pros: Strong corporate earnings and AI spending provide a solid floor. Upcoming fiscal stimulus could boost cyclical value sectors (like Financials and Industrials).

- ❌ Cons: High valuations and persistent policy uncertainty (read: tariff risk) warrant caution.

Meanwhile, n on-US markets are looking more attractive, but sentiment is still correlated with the US.

Some key risks to keep in mind are :

- 🇺🇸 US policy uncertainty. This could affect the USD, inflation, and interest rates (which have ramifications globally), and

- 🇨🇳 China’s economy . It’s still a concern for other emerging markets and commodity exporters, so worth keeping an eye on.

🎯 The Insight: Diversification and Quality are a Solid Defense

It’s clear that a lot is riding on continued AI spending.

Sure, that’s what everyone was saying a year ago (us included), and the CapEx cycle is still going strong.

Trying to call a top isn’t easy and all too often means you miss out on gains. But maintaining a diversified portfolio of quality stocks is as important as ever.

It can be the most resilient approach to capturing the ongoing tech gains without being blindsided by the inevitable volatility.

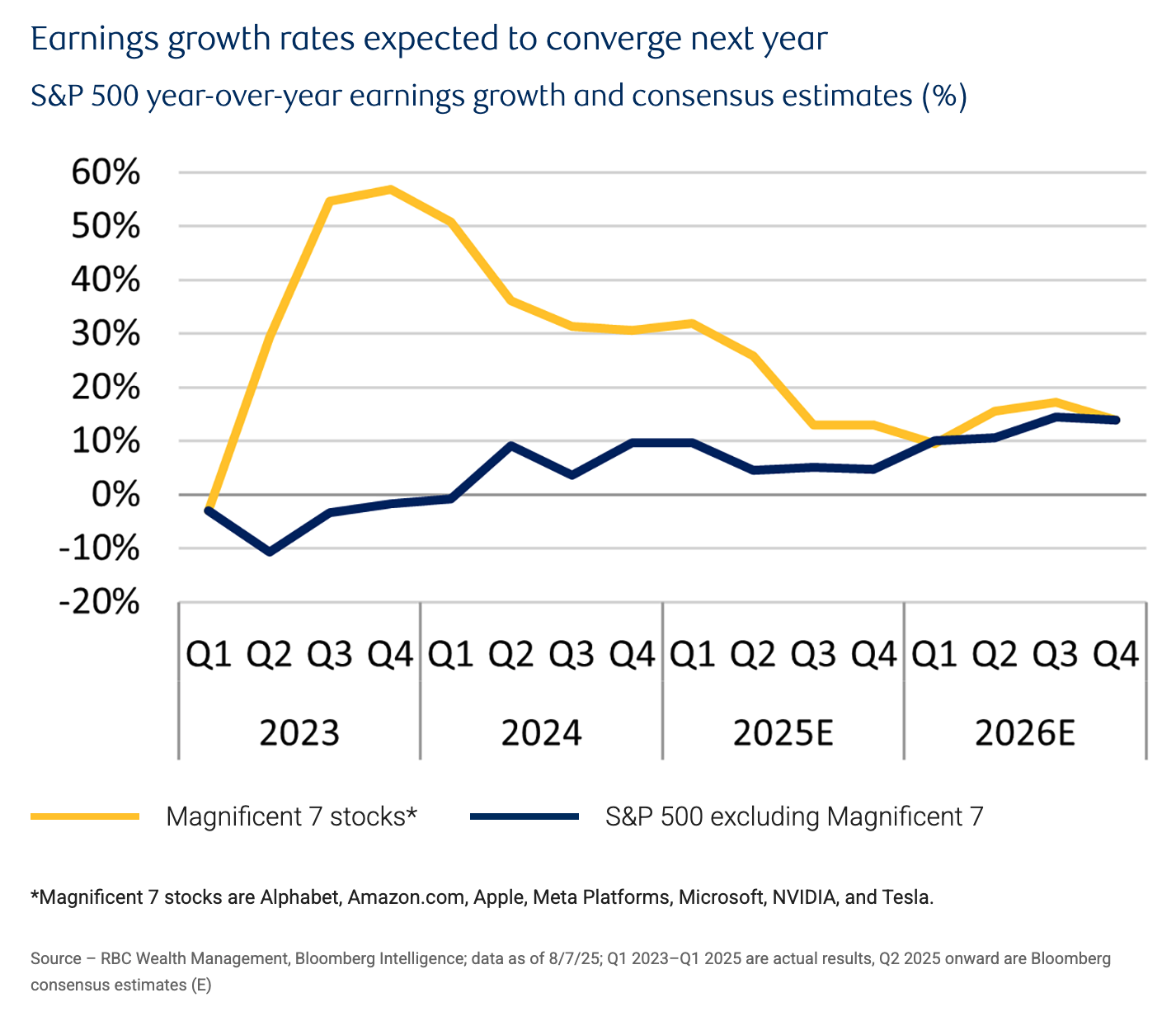

Within the US market, earnings growth from the Mag 7 companies is expected to converge with the broader market next year.

- If that’s the case, your non-tech holdings should help to offset ‘Big Tech’ volatility.

- On the other hand, if the AI cycle continues to surprise to the upside, those Mag-7 stocks could keep on delivering.

Earnings Estimates: Mag 7 vs Remaining S&P 500 Companies - RBC

The same applies to non-US stocks, which are now particularly sensitive to the USD and US policy uncertainty.

✨ A portfolio of quality stocks that benefit from different market dynamics can help reduce the potential volatility.

The bigger risk is owning too many speculative stocks that are currently benefiting from increased risk appetite. High-quality stocks typically bounce back eventually, which often isn’t the case for those high-flying speculative ones.

Use our company reports to assess the downside risks and future potential, estimate a fair value that is conservative to reduce the risk of overpaying, and use our portfolio tool to make sure your exposure is balanced among sectors that meet your investing objectives, risk profile, and expectations of the future.

Key Events During the Next Week

Tuesday

- 🇬🇧 UK Unemployment Rate

- ▶️ Forecast : 4.70%, Previous: 4.70%

- ➡️ Why it matters : A steady unemployment rate indicates a stable labor market, and the BOE is likely to remain cautious on further rate cuts.

Wednesday

- 🇺🇸 US Inflation Rate YoY

- 📈 Forecast : 3.00%, Previous: 2.90%

- ➡️ Why it matters : While the headline inflation rate is expected to tick higher, core inflation is expected to fall slightly, which would support the Fed’s current stance.

Thursday

- 🇦🇺 AU Unemployment Rate

- 📈 Forecast : 4.30%, Previous : 4.20%

- ➡️ Why it matters : The slight uptick in unemployment suggests some cooling in the labor market, potentially giving the RBA more room to lower rates.

- 🇺🇸 US PPI YoY

- 📉 Forecast : 2.5%, Previous : 2.6%

- ➡️ Why it matters : A slight decline is expected, which would support the Fed’s dovish stance. A surprise increase could limit the number of rate cuts by year's end.

Friday

- 🇺🇸 US Housing Starts MoM

- 📈 Forecast : 1.00%, Previous : −8.50%

- ➡️ Why it matters : After recent weakness, economists are hoping to see a recovery in the housing market as lower mortgage rates boost the sector.

Q3 Earnings season kicks off this week with the big banks setting the tone:

- Johnson & Johnson

- JPMorgan Chase

- BlackRock

- ASML Holding

- Bank of America

- Abbott Laboratories

- American Express

- Wells Fargo

- Goldman Sachs

- Morgan Stanley

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.