Last Update 21 Nov 25

Fair value Decreased 3.43%The "Reset" Before the Ramp

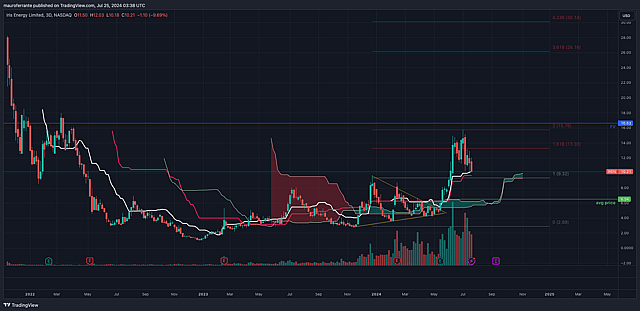

If you’ve been watching the ticker lately, IREN’s recent correction from its highs is undeniably painful. However, for those willing to look past the daily volatility, the Q1 FY26 results reveal a company that is fundamentally stronger today than it was at its peak. IREN is currently caught in a temporary dislocation between its volatile past and its contracted future: a classic "time arbitrage" opportunity for patient capital.

The "Double Beta" Trap

To understand the drop, you have to ignore the company for a moment and look at the market. IREN is currently trading as a proxy for two of the most volatile asset classes on earth: AI Equities and Bitcoin. Unfortunately for the share price, both sectors hit an air pocket simultaneously.

With fears of an "AI Bubble" causing a rotation out of high-growth names and Bitcoin recently sliding below key technical levels, IREN was hit by a "double beta" whammy. Algorithms see a Bitcoin miner and sell; sector rotators see an AI high-flyer and take profits. But this creates a disconnect, because the IREN of today (which the algorithms are selling) is not the IREN of tomorrow (which the smart money is buying).

A Tale of Two Income Statements

The Q1 earnings report perfectly illustrates this identity crisis. On the surface, IREN is still a crypto miner: Bitcoin mining generated $232.9 million in revenue this quarter, while AI Cloud services brought in just $7.3 million.

However, the signed Microsoft contract tells a radically different story. That deal alone locks in $1.94 billion in Annualized Recurring Revenue (ARR). We are standing at a transition point where the company’s "real" revenue is about to flip from volatile crypto-mining to utility-grade, contracted cash flow. The market is pricing the former, while the contract guarantees the latter.

The New Risk: "Can They Build?"

The thesis has officially shifted from demand risk ("Will they get a client?") to execution risk ("Can they build it in time?"). The contract requires IREN to deploy capacity in phases through 2026. Missing these deadlines could jeopardize the revenue ramp.

However, for those who have followed IREN closely over the last 18 months, confidence remains high. This is a team that has consistently overdelivered on its infrastructure targets, rapidly scaling operations and securing power when others stalled. They are not retrofitting old warehouses; they are purpose-building 4 x 50MW liquid-cooled super-centers. If their recent track record is any indication, they are well-equipped to handle the logistics of this buildout.

The Hidden Behemoth and the Funding Coup

What’s most exciting is that this massive Microsoft deal, worth $9.7 billion in total value, utilizes only 16% of IREN’s secured power portfolio. Waiting in the wings is the Sweetwater site, a 2,000MW giant scheduled for energization in April 2026. If 200MW creates a ~$10B contract, the latent value of the 2GW pipeline is staggering.

Crucially, IREN has figured out how to build this without drowning shareholders in dilution. A major bear case was that the $5.8 billion GPU capex bill would break the balance sheet. Instead, IREN secured a $1.9 billion prepayment from Microsoft (20% of the contract) and $2.5 billion in vendor financing enhanced by Microsoft’s credit rating.

Final Take: A Moat, Not a Bunker

If we assume execution proceeds according to plan, the bear case retreats to two macro fears:

- Capex Exhaustion: The fear that the "AI bubble" will pop, causing hyperscalers to abruptly slash spending and leaving IREN’s future gigawatts stranded without partners.

- Commoditization: The fear that AI hosting will devolve into a low-margin "race to the bottom."

The Q1 data offers a robust, ,though not invincible, rebuttal to both.

First, the ~85% Estimated Project EBITDA margin confirms that elite infrastructure currently commands elite pricing; this is not yet a commodity market. Not yet, at least.

Second, regarding the "bubble" risk: while no company is immune to a total market collapse, IREN’s 3GW power portfolio offers a distinct survival advantage. In a world of infinite AI demand, power is a growth engine. But in a world of shrinking budgets, secured power becomes a "flight-to-quality" asset. If hyperscalers are forced to high-grade their portfolios, they will likely prioritize partners with secured, low-cost energy over expensive, speculative greenfield projects.

The "Earnings Flywheel" is now primed with the Microsoft contract, providing a safety net of committed revenue. The risk profile has fundamentally changed: it is no longer about "going to zero", it is about pricing power. The uncertainty isn't whether IREN will survive, but whether the next 2GW can be sold at the same premium economics as the first 200MW. For now, the contracts are signed, the funding is secured, and the execution clock is ticking.

A Note to New Readers:

Welcome. What you are about to read is my original narrative for IREN, first published in September 2024.

I have left it completely unchanged.

When I wrote this, I viewed IREN as a best-in-class Bitcoin miner, and I was quite skeptical of its "pivot" to AI. You'll see I even called it a "PR effort." I was focused on mining efficiency, energy contracts, and Bitcoin cycles.

I was wrong.

Over the past year, that "PR effort" proved to be the single most important, high-conviction part of the thesis. I watched IREN's management execute relentlessly, moving light-years ahead of its mining competitors. Many of them (like WULF, RIOT and CIFR) have only woken up to the AI transition in the last few months, while others still haven't even committed to buying GPUs (CLSK).

I invite you to read this original narrative to understand my starting point. Then, read the updates that follow to see the journey of how this company proved its skeptics wrong and became a core AI infrastructure play.

-----------------------------------------------------------------------------------------------------------------------------------

"Investing in a bitcoin miner?! How dare you!"

Summary

- IREN owns and operates 4 Bitcoin mining sites in North America, powered by 100% renewable energy, leveraging 'stranded energy' from hydro and solar power plants.

- IREN's goal is to capitalise on excess renewable energy and support energy networks. Bitcoin mining is just an effective way to do so.

- The company is also exploring HPC and AI services to diversify revenue, with initial successes but still early in development.

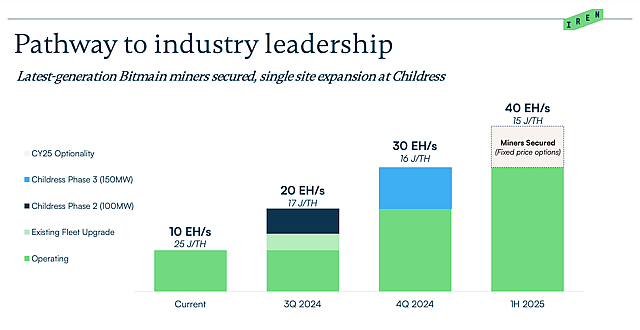

- IREN stands out among other miners for its energy efficiency. It aims to improve it further to 16 J/TH by deploying a new fleet of Bitmain S21 PRO miners this year.

- Unlike competitors, IREN sells 100% of its mined Bitcoin daily, ensuring better cash flow management.

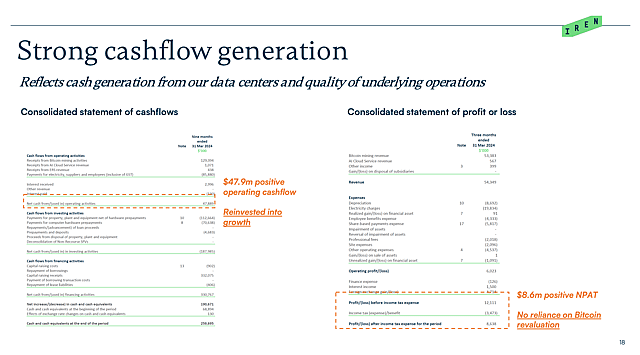

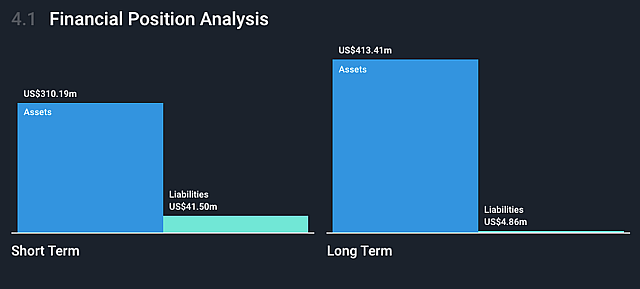

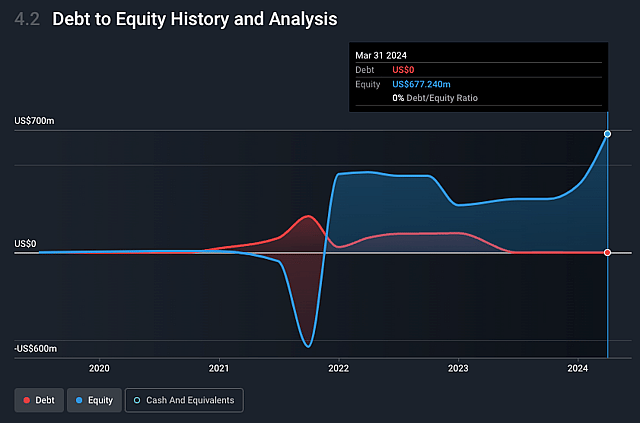

- The company is in good shape financially after large share dilutions, holding $425.3 million in cash reserves, has no debt, and became profitable in Q1 2024 with $8.6 million net profit.

- IREN has recently expanded its mining capacity to 10 EH/s, 2 months earlier than expected. It's planning to increase it to 30 EH/s by the end of the year, with further potential growth to 40 EH/s in 2025.

- Estimated fair value per share is $16, with significant upside potential, though dependent on Bitcoin price increases and successful strategic execution.

The company

IREN is an Australian Bitcoin miner powered by 100% renewable energy. It owns and operates 4 sites in North America, strategically located next to hydro and solar power plants for key energy partnerships.

- Canal Flats, British Columbia (Canada) 30MW

- Childress County, Texas (USA) reacently increased to 750MW operating capacity 24th July 2024 update

- Mackenzie, British Columbia (Canada) 80MW

- Prince George, British Columbia (Canada) 50MW

The company was founded by two Australian brothers, Dan and Will Roberts. Dan’s experience lies in building wind and solar farms across Europe and Australia at Macquarie Bank and Palisade Investment Partners, while Will’s experience is in energy infrastructure financing at Macquarie Bank, as well as co-founding the bank's digital assets team in 2018.

The two brothers combined their expertise in Bitcoin, energy, and infrastructure finance to found IREN, with the intent to capitalise on excess renewable energy and support energy networks.

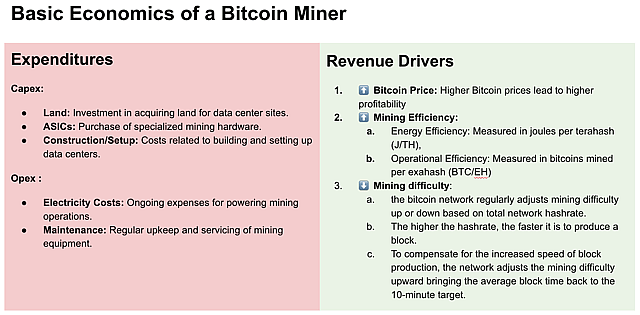

The Basics of Bitcoin Mining

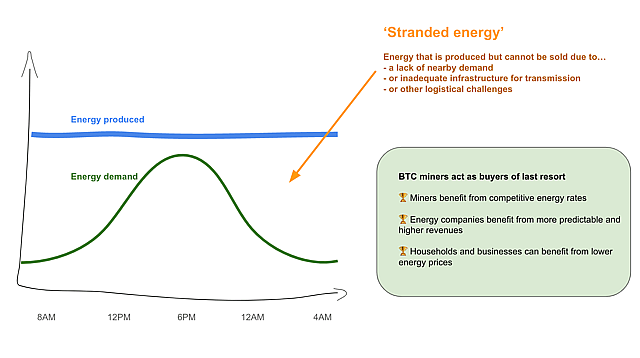

All miners must find the cheapest electricity possible to ensure profitability. Because of this, miners are incentivized to seek out 'stranded energy'—excess energy from power plants that would otherwise be wasted, often in remote locations.

IREN acts as a buyer of last resort, benefiting from competitive electricity costs (averaging around $0.05 per kWh as of late 2023) while simultaneously supporting electricity networks through automatic dynamic load management. Their data centers can adjust electricity usage based on demand and renewable energy production. This flexibility allows them to adapt dynamically to fluctuating costs. This symbiotic relationship between the energy company and the miner creates a virtuous cycle where IREN secures highly competitive energy rates, energy companies benefit from increased revenues and predictability, and households and businesses enjoy a more stable grid and lower energy prices.

As of June 2024, the company’s cost per Bitcoin mined was approximately $39,466, providing a post halving gross margin of 41%. The company expects to reduce this further this year with the upgrade of the miners fleet.

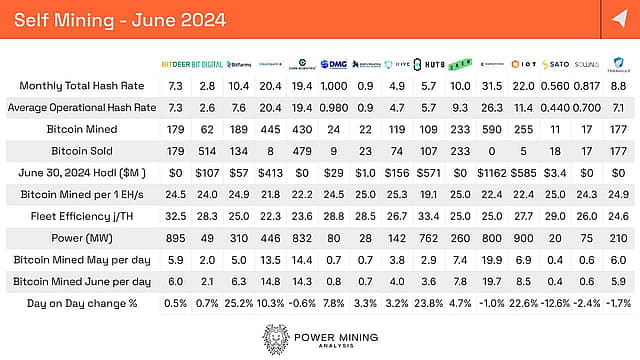

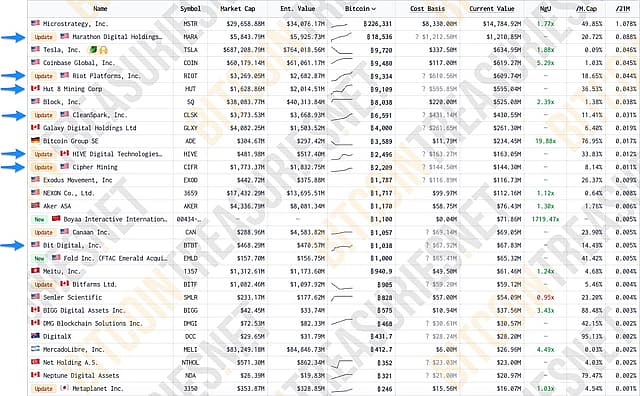

Peer comparison

IREN is a mid-tier miner that stands out due to its superior energy and mining efficiency (25 J/TH vs most of competitors being above 27) ranking first with 25 bitcoins mined per 1 EH/s. The company plans to improve further by the end of the year targeting of 16 J/TH with the deployment of a fully updated fleet of Bitmain S21 PRO miners, already secured through recent capital raising via substantial share dilution.

Unlike most other miners, IREN sells 100% of its mined Bitcoin daily, regardless of the price. This strategy benefits the company by eliminating the need for custody and improving cash flow. In contrast, Marathon has accumulated a record amount of BTC as company treasury (currently 18,536 bitcoins, valued at approximately $1.23 billion), while Cleanspark tends to accumulate during bear markets and sell during bull markets. Each strategy has its pros and cons, which is why I diversify my investments across multiple miners, including shares in Marathon and Cleanspark.

https://bitcointreasuries.net/

Financials

The company holds $425.3 million in cash reserves, raised through significant share dilution over the past year. Despite this, the successful capital raise ensures robust funding for expansion and strategic initiatives without the immediate need for external financing. IREN is, at the time of writing, in good financial shape with no debt and just recently became profitable in Q1 2024, reporting strong cash flow of $47.9m and USD$8.6m in net profit. It is important to note that Q1 2024 was pre-halving (mining rewards halved in April 2024; at the time of writing, we still don't have official data for Q2).

Growth Catalysts

- Ambitious Plans to Expand Mining Capacity: IREN surpassed its H1 2024 growth target, reaching 10 EH/s more than a month ahead of schedule. The company now aims to achieve 20 EH/s by September 30, 2024, and 30 EH/s by the end of the year. The image below highlights the ongoing construction at the Childress site, which is set to increase from 100 MW of operational power to 350 MW by December 31, 2024. Update (July 24, 2024 ): The Company announced it has reached 750MW of available power capacity at its Childress siteA successful upgrade to 30 EH/s by year-end would place IREN among industry leaders like RIOT, MARA, and CLSK, who are also planning to expand towards a staggering 70 EH/s. However, the expansion to 30 EH/s appears to be only partially funded, raising concerns about potential further dilution in 2024, which I will monitor closely. The company is also considering a further expansion to 40 EH/s in 2025.

- Strategic Diversification: IREN is exploring HPC and AI applications to diversify its revenue streams, particularly during BTC price cycle downturns. Its AI Cloud Services, featuring 816 NVIDIA H100 GPUs, saw a 21% revenue increase in June 2024 due to higher utilisation by their customer, Poolside AI, and the onboarding of new customers. This growth reflects the company's expanding service capabilities in both reserved and on-demand markets.I remain somewhat skeptical about this strategy, as it could distract from the company's core mining business. The CEO has addressed these concerns, emphasising that this is not a pivot away from mining but an exploration of a complementary business. He clarified that while AI data centers are typically close to end users to minimise latency, this is only necessary for inference, not for AI training, which is IREN’s focus. Furthermore, IREN's data centers are built with high energy capacity in mind, given that the H100 GPU requires significant power (70kW per rack). Thus, setting up an AI data center with their existing infrastructure is primarily a matter of integrating these GPUs.While it's early to determine the success of this strategy, I currently view it more as a PR effort to enhance their brand, especially for potential investors and banks. The CEO mentioned the challenges of raising capital due to Bitcoin mining's negative reputation with traditional financial institutions, so this diversification may help improve their standing in the financial community.

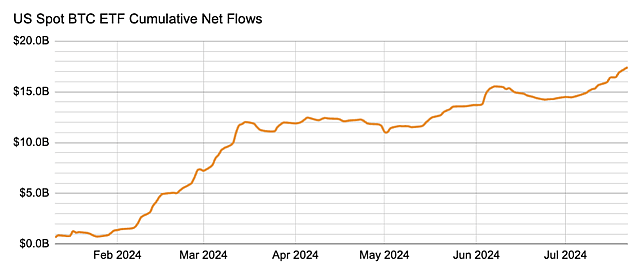

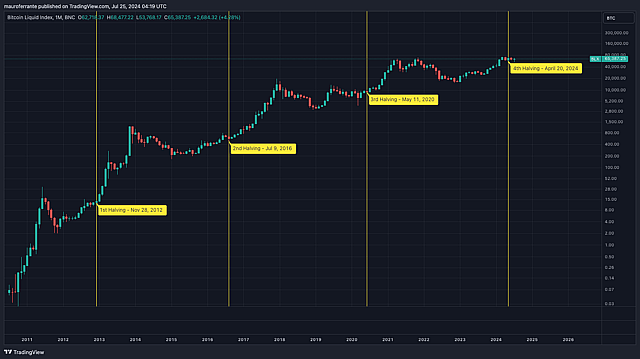

- Bitcoin Price: I expect Bitcoin price to keep rising into 2025 driven by:

- Sustained ETF inflows & institutional demand

- Rate cuts and an increase in global liquidity

- More favourable regulations in the US

- Less sell pressure after halving event, German Gov. dumping and Mt.Gox distribution

- Sustained ETF inflows & institutional demand

- Regulatory Tailwinds: A Republican win in the upcoming elections would present a significant regulatory catalyst. This favourable environment could further legitimise and bolster the industry. Ex-President Trump has recently stated his support for Bitcoin and miners, following meetings with companies like Cleanspark. While it’s challenging to trust any politician, it’s unlikely he would continue the strategies pursued by the current administration over the last few years, which has also shown recent signs of a pivot away from their anti-crypto stance.

- Unlocking Value from Land and Energy Contracts: IREN is exploring strategies to unlock value from its land and energy contracts, considering that current data center growth is hampered by grid connection wait times, as reported by Morgan Stanley in a recent report. According to the firm, it takes five years for an existing data center to increase its energy capacity, which until now wasn’t required to run a regular data center. However, AI requires high amounts of energy, and miners are already positioned to support that. This strategic move may enhance revenue streams and profitability in the future.

Risks

- Bitcoin Price, Cyclicality, and Unpredictability: The success of IREN is heavily dependent on the continuous increase in Bitcoin prices over the coming years. Regardless of IREN's efforts to update its fleet of miners and run the company efficiently, these efforts will be in vain if Bitcoin's price does not stay sufficiently high to maintain profitability. The inherently unpredictable and cyclical nature of the Bitcoin market, characterised by its boom and bust cycles, adds a significant layer of uncertainty to the business.

- Need for Dilution: Iren has drastically diluted shareholders in the past. To maintain growth and fund new mining equipment, IREN may need to resort to more equity dilution unless it remains consistently profitable. Investors should be prepared for potential substantial dilution.

- Operational Risks: The technical complexities of HPC and AI services require IREN to develop the necessary software and expertise. The highly competitive nature of these markets means IREN must establish strong value propositions to attract and retain clients.

- Regulatory Risks: Adverse regulatory developments could pose significant risks to operations and profitability, such as the introduction of a Bitcoin mining tax proposed by Elizabeth Warren and her ‘anti-crypto army’ in the past.

- Short sellers: A short seller's report published in July 2024 by Culper Research criticised Iren for operational inefficiencies and financial issues, including significant cash burn and share dilution, while noting the CEOs' recent share sales. Analysts at Bernstein SG have disputed Culper's claims, maintaining an "outperform" rating and a target price of $26 for Iren shares. However, more short reports might emerge, considering the company is widely misunderstood, which could create further volatility.

Valuation

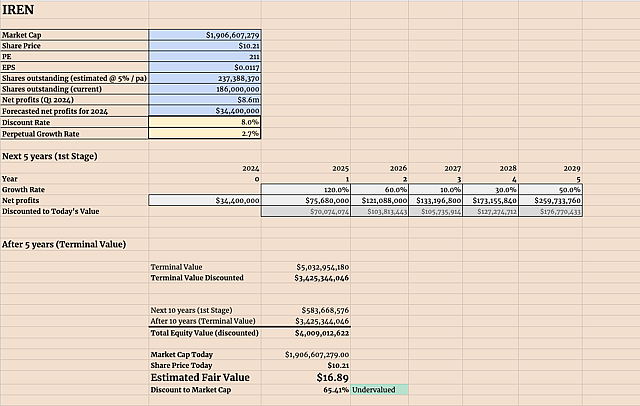

At the time of writing, I approximate the fair value per share to be around $16.89, still presenting a solid upside from the current share price of $10.11.

Hypothesis Underlying the Valuation

The valuation is based on the assumptions that

- Bitcoin price continues to increase in the next 12 months and reaches US$100,000

- In the next cycle low, Bitcoin won't go below US$60,000

- IREN achieves its goals to expand mining capacity in 2024 to 30 EH/s.

- IREN maintains and strikes new deals with energy companies to ensure low energy costs (less than $0.05/kW)

- The company's strong financial position can support its expansion plans with minimal dilution. I do have factored in a 5% annual increase in shares outstanding.

- The successful transition into HPC and AI services starts to generate meaningful amount of revenues during bitcoin's cycle lows (20% of mining).

Earnings Projections:

- 2024: $34.4 million calculated as $8.6M x 4 qtr

- 2025: $75.68 million, growth of 120% YoY

- 2026: $121.09 million, growth of 60% YoY

- 2027: $133.19 million, growth of 10% YoY

- 2028: $173.15 million, growth of 30% YoY

- 2029: $259.28 million, growth of 50% YoY

DCF Valuation:

- Discount Rate: 8.0%

- Perpetual Growth Rate: 2.7%

- Shares Outstanding: 237,388,370 (5% dilution p.a from 186,000,000)

Conclusion

IREN represents an intriguing yet risky investment opportunity in the evolving landscape of Bitcoin mining and computational services. With its leading efficiency, strategic diversification into HPC and AI, and strong financial footing, IREN is well-positioned to capitalise on future growth opportunities. However, given the inherent risks, it's wise for investors interested in the Bitcoin mining space to diversify with other miners that have different strategies, such as Marathon, Cleanspark, Wulf, and Core Scientific.

Investors should monitor both the company and Bitcoin closely, considering the high risks associated with market volatility and potential further dilution. The estimated fair value per share suggests significant upside, but the valuation is simplistic, and the company must deliver on all its strategic initiatives to realise this potential, with Bitcoin needing to continue to rise.

Major red flags in the short term include potential issues with the deployment of new ASICs to get to 30 EH/s and further dilution in 2024.

One final question remains: Why should someone bullish on Bitcoin invest in miners and IREN specifically instead of simply buying the underlying digital commodity? The answer is simple: outperformance. I expect IREN to trade as a beta play to Bitcoin, following its trajectory but with greater swings, providing the possibility to outperform Bitcoin over the next 12 months and potentially in the future.

Disclaimer: I'm NOT a financial advisor, this is NOT financial advice. Please do your own research.

Have other thoughts on IREN?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:IREN. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.