- United States

- /

- Software

- /

- NasdaqGS:MNDY

monday.com And 2 More Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market faces volatility with sharp declines in major indices following geopolitical tensions and trade uncertainties, investors are increasingly on the lookout for stocks that might be trading below their intrinsic value. In such a climate, identifying undervalued stocks can provide opportunities to capitalize on potential growth when the broader market stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Midland States Bancorp (MSBI) | $16.31 | $31.48 | 48.2% |

| Investar Holding (ISTR) | $22.84 | $45.53 | 49.8% |

| Horizon Bancorp (HBNC) | $15.56 | $30.06 | 48.2% |

| First Commonwealth Financial (FCF) | $16.60 | $32.97 | 49.7% |

| First Busey (BUSE) | $23.29 | $45.18 | 48.5% |

| Equity Bancshares (EQBK) | $40.89 | $78.05 | 47.6% |

| Corpay (CPAY) | $290.85 | $553.44 | 47.4% |

| Atlassian (TEAM) | $147.74 | $280.16 | 47.3% |

| Alnylam Pharmaceuticals (ALNY) | $456.95 | $882.39 | 48.2% |

| AGNC Investment (AGNC) | $10.00 | $19.71 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

monday.com (MNDY)

Overview: monday.com Ltd., along with its subsidiaries, develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $9.50 billion.

Operations: The company's revenue is generated from its Internet Software & Services segment, amounting to $1.10 billion.

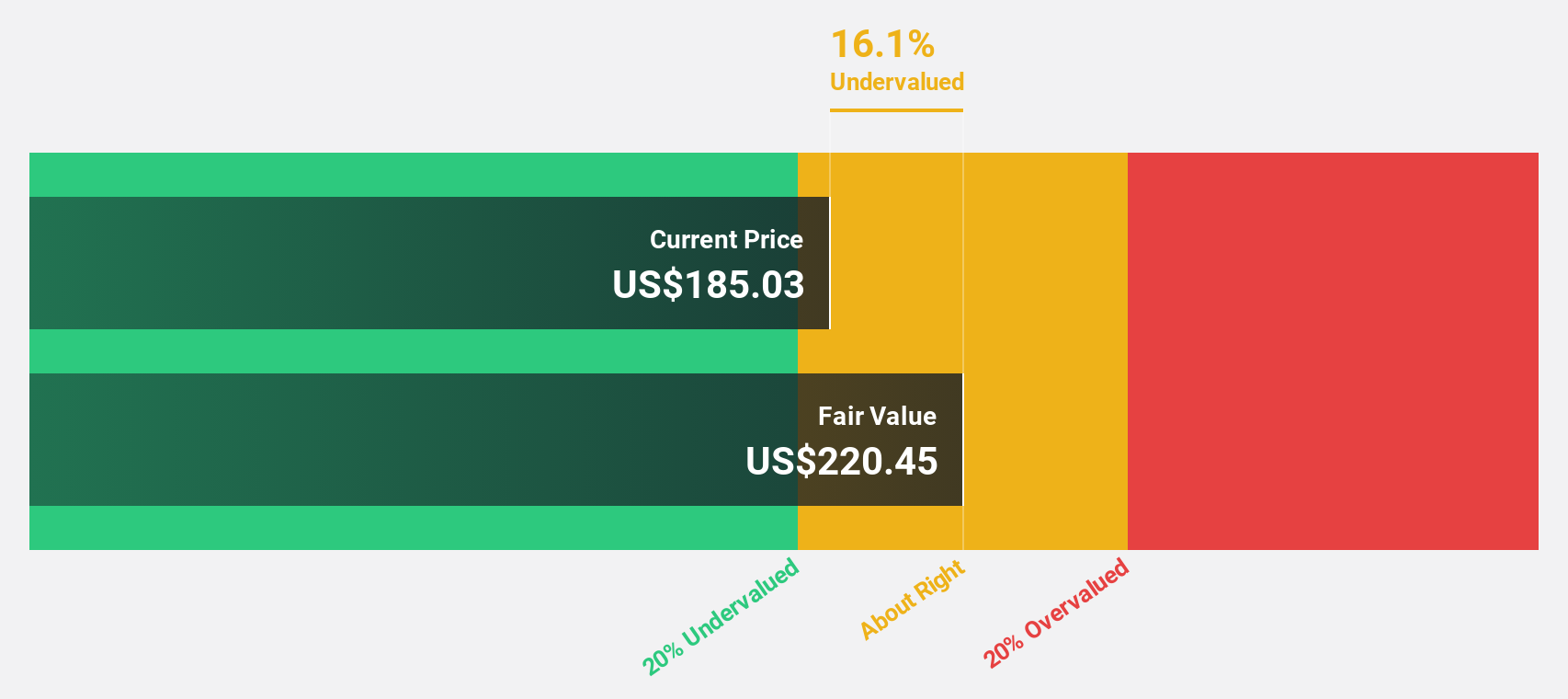

Estimated Discount To Fair Value: 13.2%

monday.com, trading at US$190.61, is undervalued by 13.2% compared to its fair value estimate of US$219.69. Analysts forecast significant earnings growth of 37.3% annually, outpacing the broader US market's growth rate of 15.5%. Recent innovations in AI capabilities and a substantial share repurchase program worth up to US$870 million highlight strategic moves to enhance shareholder value and operational efficiency, potentially boosting cash flow prospects in the future.

- According our earnings growth report, there's an indication that monday.com might be ready to expand.

- Unlock comprehensive insights into our analysis of monday.com stock in this financial health report.

Equifax (EFX)

Overview: Equifax Inc. is a data, analytics, and technology company with a market cap of approximately $29.67 billion.

Operations: The company's revenue is derived from three primary segments: International ($1.37 billion), Workforce Solutions ($2.50 billion), and U.S. Information Solutions ($1.97 billion).

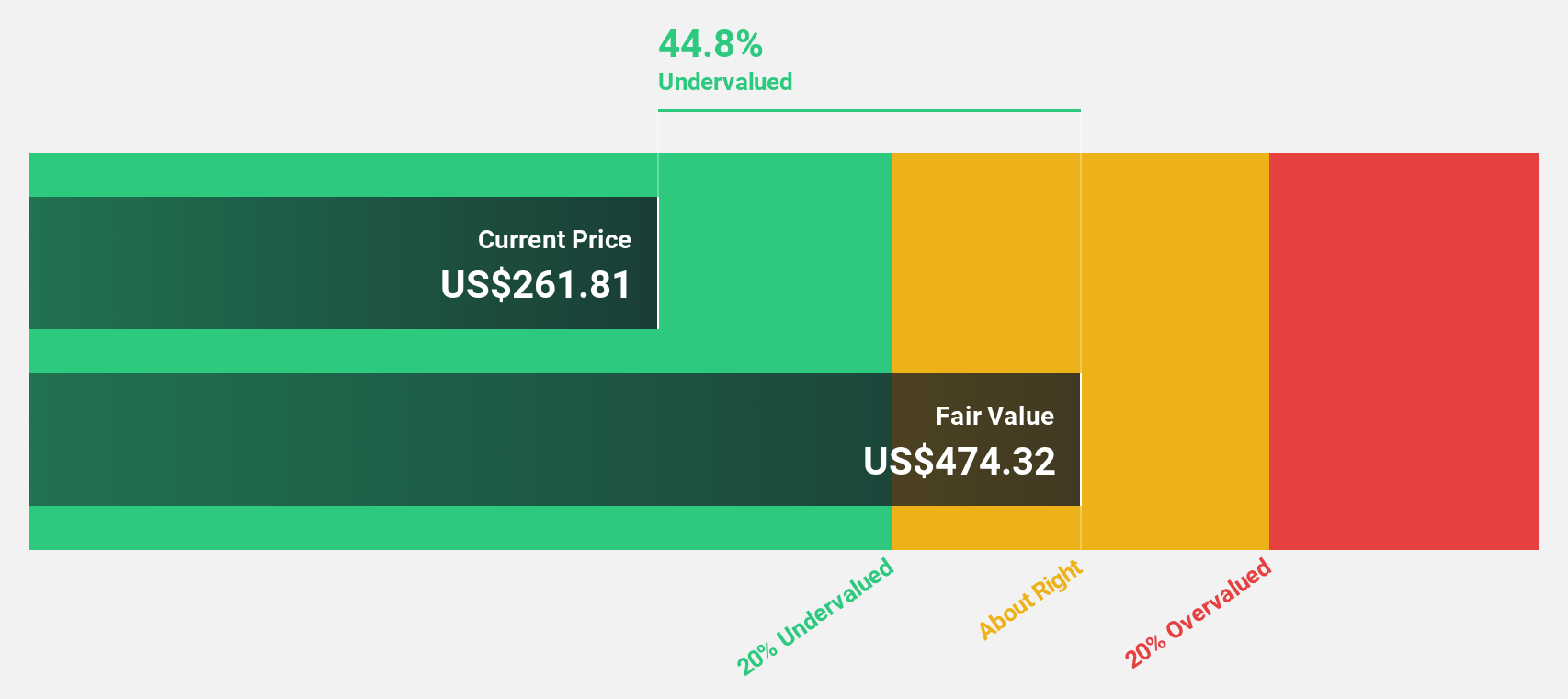

Estimated Discount To Fair Value: 36.8%

Equifax, trading at US$233.25, is undervalued by over 20% compared to its fair value of US$368.88. Its earnings are projected to grow significantly at 20.5% annually, surpassing the US market's growth rate of 15.5%. Despite high debt levels, recent product developments like Identity Proofing in their Kount® platform aim to enhance fraud prevention and customer onboarding processes, potentially strengthening cash flows as businesses increasingly rely on robust identity verification solutions.

- Our earnings growth report unveils the potential for significant increases in Equifax's future results.

- Navigate through the intricacies of Equifax with our comprehensive financial health report here.

Zeta Global Holdings (ZETA)

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $4.71 billion.

Operations: The company generates revenue from its Internet Software & Services segment, totaling approximately $1.16 billion.

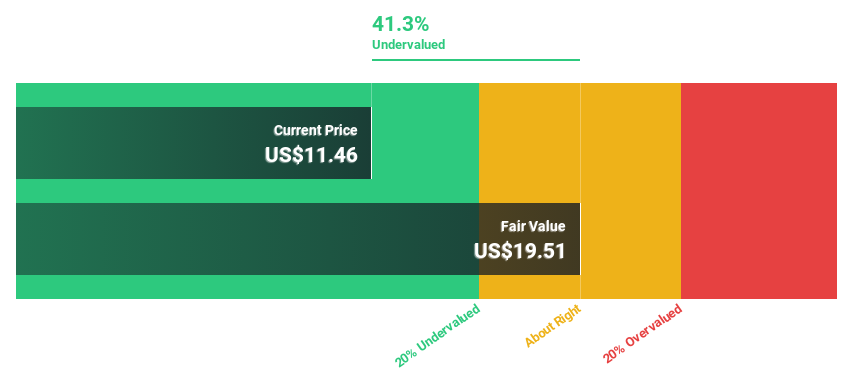

Estimated Discount To Fair Value: 34%

Zeta Global Holdings, trading at US$20.37, is undervalued by more than 20% compared to its fair value of US$30.85. Forecasted to become profitable within three years with earnings growth of 169.97% annually, Zeta's revenue growth outpaces the US market's average. Recent innovations like Athena by Zeta™ and GEO solutions enhance marketing efficiency and AI integration, potentially boosting cash flows despite recent volatility in share price and net losses narrowing from last year.

- Our growth report here indicates Zeta Global Holdings may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Zeta Global Holdings' balance sheet health report.

Turning Ideas Into Actions

- Reveal the 187 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)