- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Discover CrowdStrike Holdings And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations driven by economic uncertainties and recent policy shifts, investors are keenly observing opportunities that may arise from these volatile conditions. In this environment, identifying stocks that appear to be trading below their estimated value can offer potential for strategic investment decisions, with CrowdStrike Holdings and two other companies standing out as intriguing possibilities amidst the current landscape.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Eagle Financial Services (NasdaqCM:EFSI) | $32.59 | $63.93 | 49% |

| MINISO Group Holding (NYSE:MNSO) | $20.69 | $41.07 | 49.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $31.25 | $61.43 | 49.1% |

| Semrush Holdings (NYSE:SEMR) | $9.70 | $19.02 | 49% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.28 | $51.75 | 49.2% |

| Valley National Bancorp (NasdaqGS:VLY) | $8.80 | $17.20 | 48.8% |

| Pure Storage (NYSE:PSTG) | $50.92 | $99.56 | 48.9% |

| Brunswick (NYSE:BC) | $57.71 | $114.92 | 49.8% |

| Viking Holdings (NYSE:VIK) | $40.41 | $78.95 | 48.8% |

| OPAL Fuels (NasdaqCM:OPAL) | $1.89 | $3.75 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

CrowdStrike Holdings (NasdaqGS:CRWD)

Overview: CrowdStrike Holdings, Inc. offers cybersecurity solutions both in the United States and internationally, with a market cap of approximately $87.68 billion.

Operations: The company generates revenue primarily through its Security Software & Services segment, which accounted for approximately $3.95 billion.

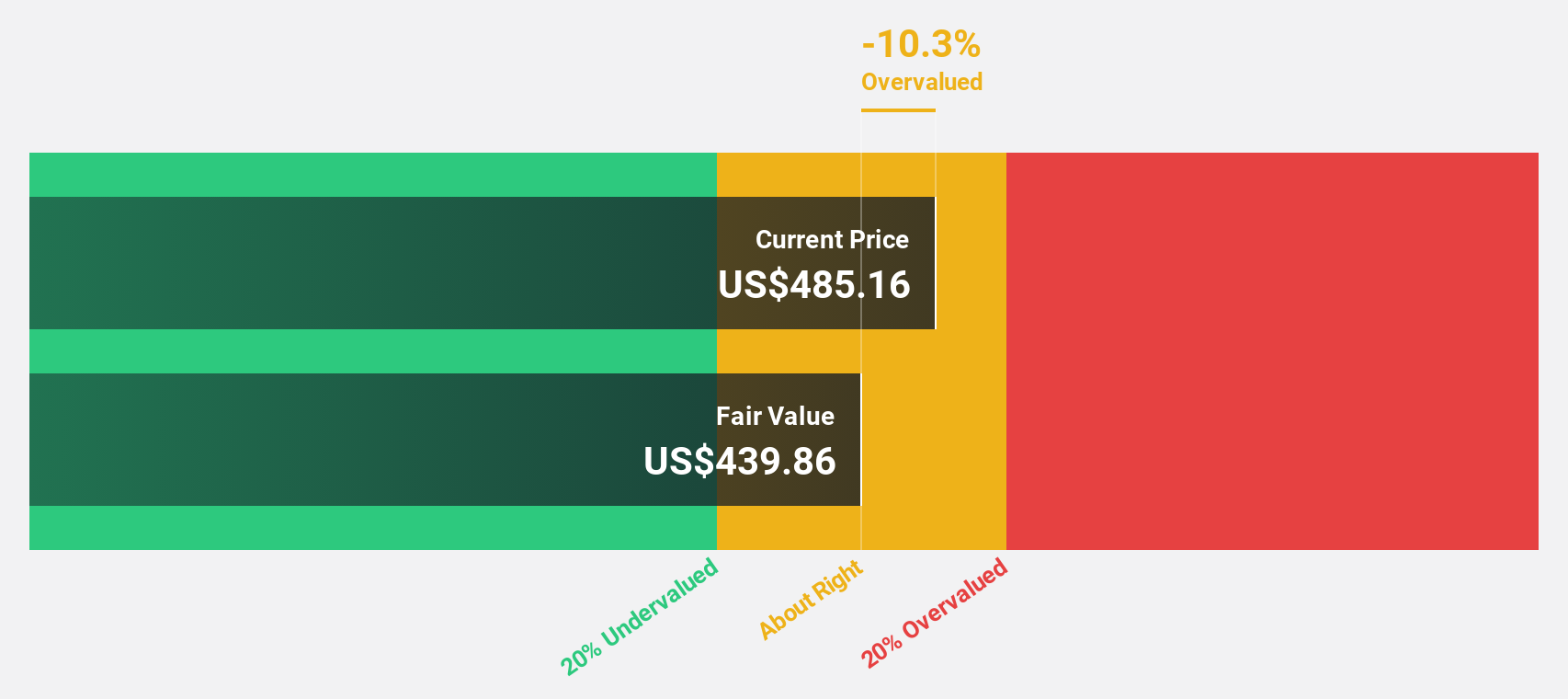

Estimated Discount To Fair Value: 12.4%

CrowdStrike Holdings is trading at US$353.74, below its estimated fair value of US$403.9, suggesting potential undervaluation based on cash flows. The company is expected to achieve profitability within three years, with earnings forecasted to grow significantly at 54.15% annually. Despite recent insider selling and a net loss reported for the last fiscal year, CrowdStrike's strategic partnerships and expanding cybersecurity services could bolster future revenue growth beyond the broader market average.

- Our earnings growth report unveils the potential for significant increases in CrowdStrike Holdings' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of CrowdStrike Holdings.

Marvell Technology (NasdaqGS:MRVL)

Overview: Marvell Technology, Inc. and its subsidiaries offer data infrastructure semiconductor solutions from the data center core to the network edge, with a market cap of approximately $59.54 billion.

Operations: The company's revenue is primarily generated from the design, development, and sale of integrated circuits, amounting to $5.77 billion.

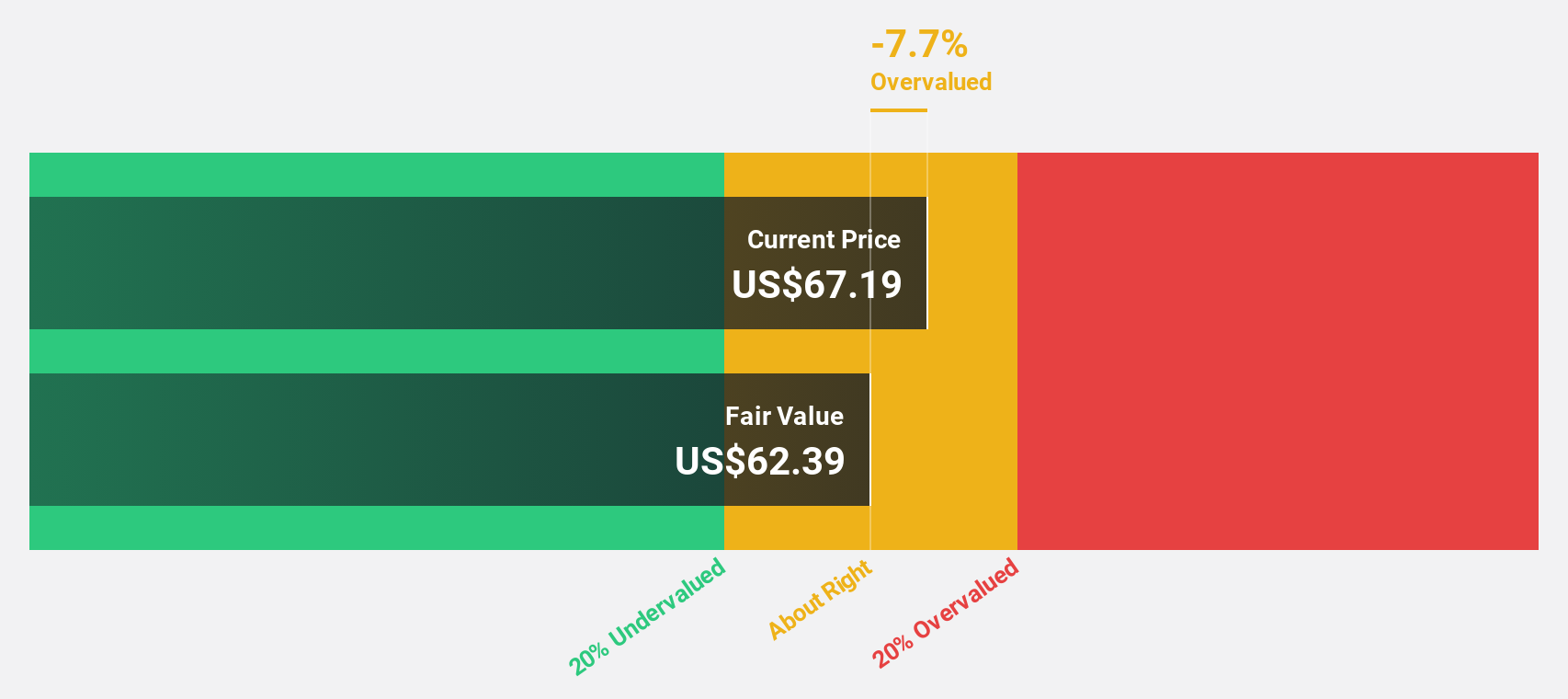

Estimated Discount To Fair Value: 15.3%

Marvell Technology is trading at US$68.74, below its estimated fair value of US$81.18, reflecting potential undervaluation based on cash flows. Revenue growth is forecasted at 18.6% annually, outpacing the broader market's 8.5%. Despite recent volatility and a net loss for the last fiscal year, Marvell's advancements in semiconductor technology and anticipated profitability within three years could enhance future financial performance and align with analyst expectations of a significant price increase.

- Our comprehensive growth report raises the possibility that Marvell Technology is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Marvell Technology's balance sheet health report.

Spotify Technology (NYSE:SPOT)

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of approximately $117.66 billion.

Operations: Spotify generates its revenue primarily from two segments: Premium, which accounts for €13.82 billion, and Ad-Supported services, contributing €1.85 billion.

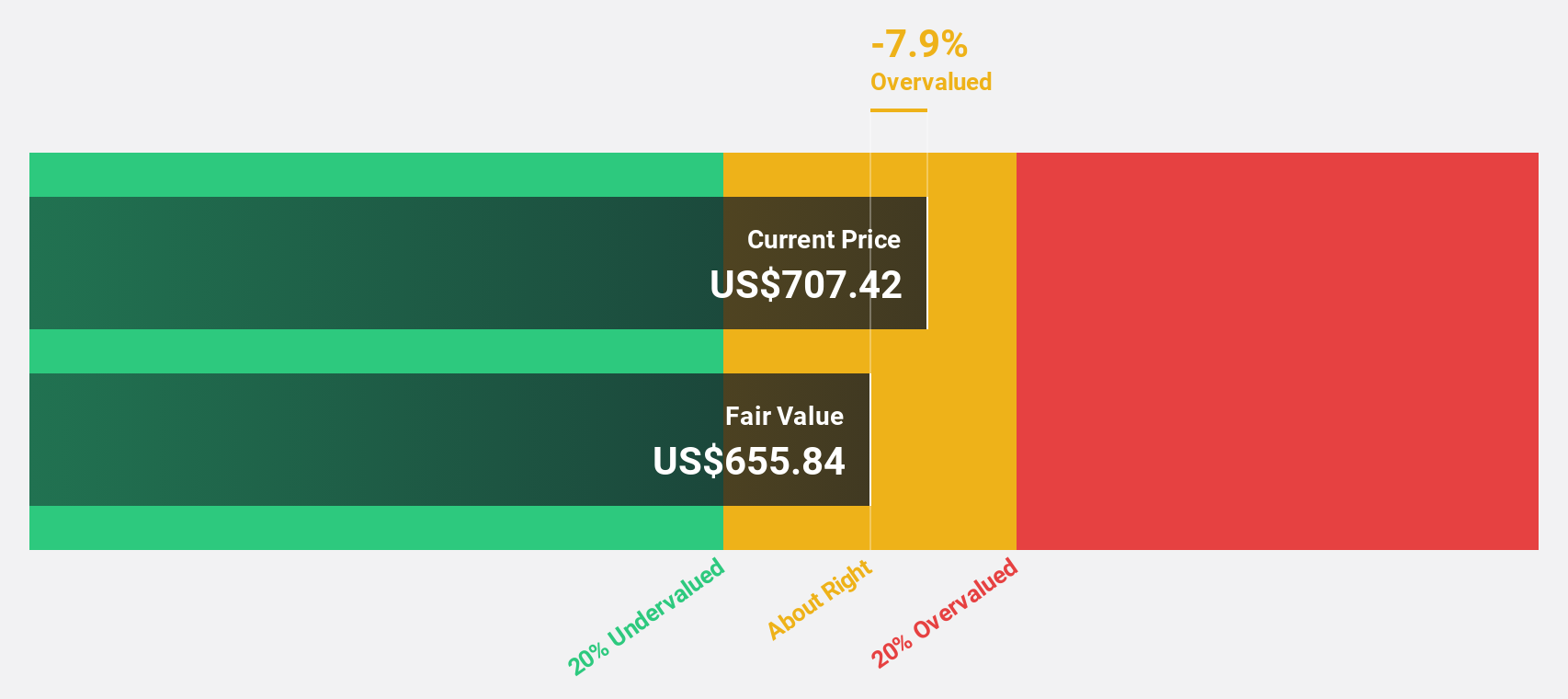

Estimated Discount To Fair Value: 19.4%

Spotify Technology is trading at US$574.79, below its estimated fair value of US$712.88, offering potential undervaluation based on cash flows. Earnings are expected to grow significantly at 26.8% annually over the next three years, surpassing market averages. Recent profitability and a strategic alliance with Warner Music Group bolster Spotify's position in the music ecosystem, enhancing content offerings and artist-centric models that may drive future revenue growth beyond the forecasted 12.1% annually.

- The analysis detailed in our Spotify Technology growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Spotify Technology stock in this financial health report.

Key Takeaways

- Navigate through the entire inventory of 193 Undervalued US Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives