- United States

- /

- Banks

- /

- NYSE:FCF

Exploring 3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

As the U.S. market faces a pause in its recent rally, with major indices like the S&P 500 experiencing fluctuations amid concerns over tariffs and economic outlooks, investors are turning their attention to small-cap stocks for potential opportunities. In this environment, identifying undervalued small caps with notable insider action can offer insights into companies that may be poised for growth despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.4x | 2.8x | 34.88% | ★★★★★☆ |

| Citizens & Northern | 10.7x | 2.6x | 45.46% | ★★★★☆☆ |

| S&T Bancorp | 10.7x | 3.6x | 41.66% | ★★★★☆☆ |

| Gentherm | 31.6x | 0.7x | 29.61% | ★★★★☆☆ |

| FirstSun Capital Bancorp | 11.0x | 2.6x | 47.67% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 23.83% | ★★★★☆☆ |

| Lindblad Expeditions Holdings | NA | 1.1x | 9.19% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 12.35% | ★★★★☆☆ |

| Shore Bancshares | 9.6x | 2.5x | -24.05% | ★★★☆☆☆ |

| Farmland Partners | 7.1x | 8.7x | -43.94% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

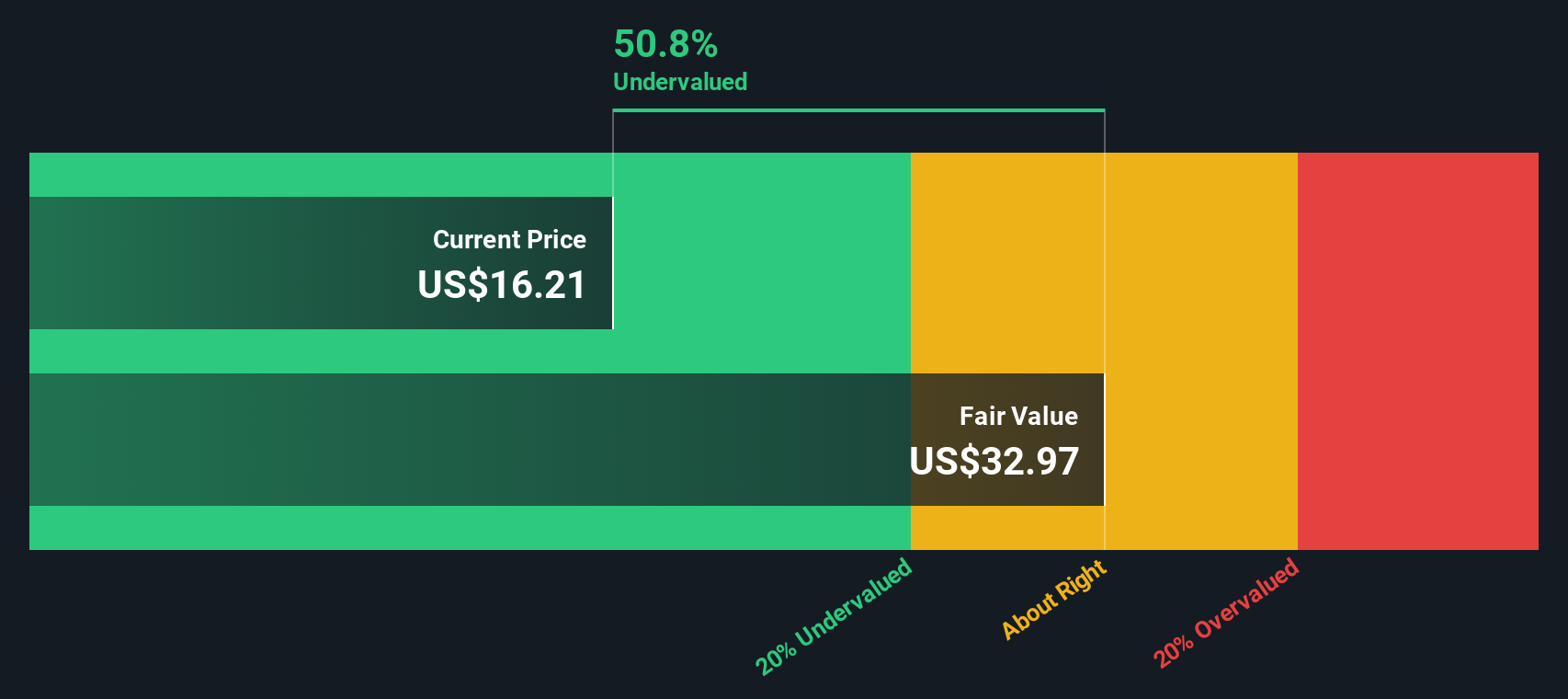

Monro (MNRO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Monro operates a chain of auto repair centers with a market cap of approximately $1.6 billion, focusing on providing automotive maintenance and repair services.

Operations: The company's revenue is primarily generated from its auto repair centers, with recent figures indicating $1.20 billion in revenue. The gross profit margin has shown fluctuations, most recently recorded at 34.52%. Operating expenses are a significant component of the cost structure, consistently comprising a substantial portion of the total expenses over multiple periods.

PE: -22.6x

Monro, a company in the automotive aftermarket industry, recently reported Q1 sales of US$301.04 million, up from US$293.18 million last year, though they faced a net loss of US$8.05 million compared to previous profits. Despite this setback, Monro's earnings are forecasted to grow significantly at 153% annually. The firm has insider confidence with recent executive appointments and strategic merchandising plans under Kathryn Chang's leadership since June 2025, potentially enhancing future performance amidst volatile share prices and reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Monro.

Understand Monro's track record by examining our Past report.

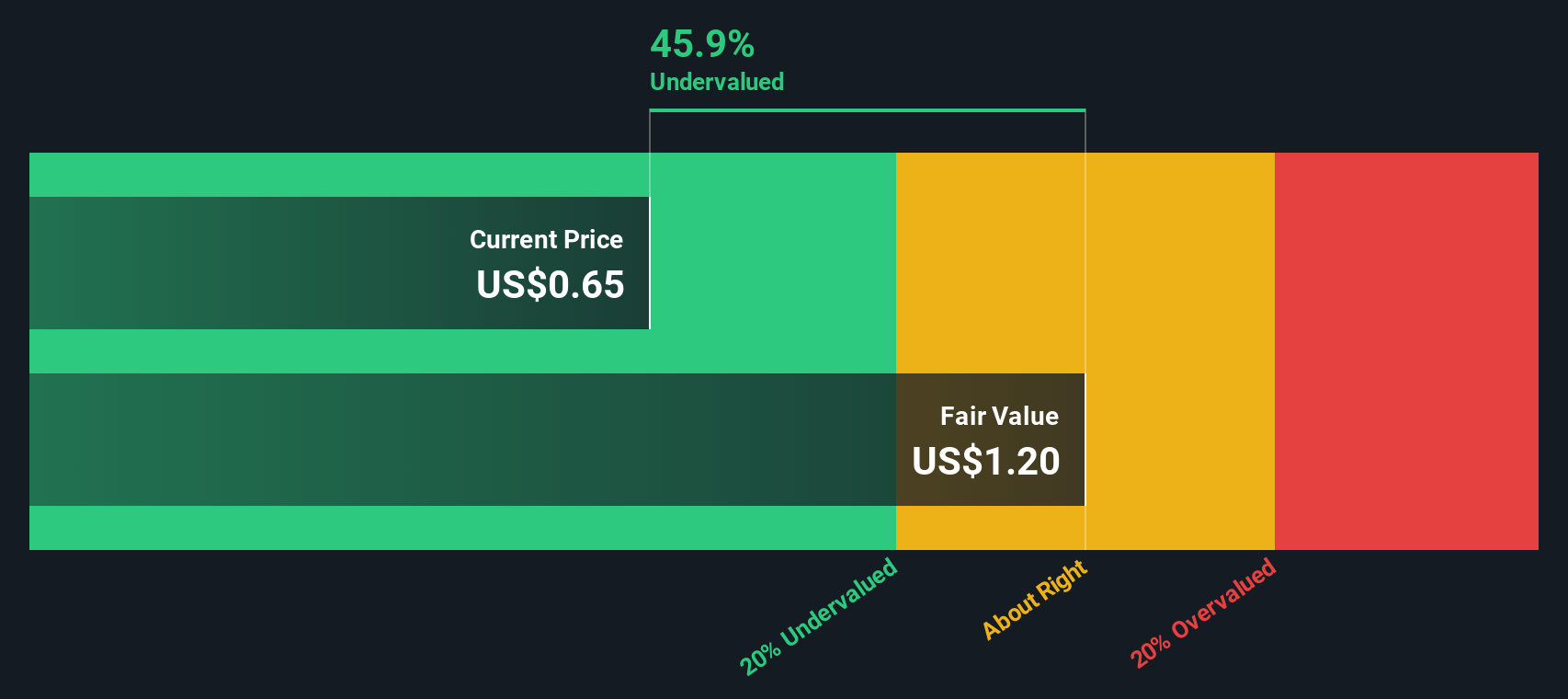

Tilray Brands (TLRY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tilray Brands is a diversified company engaged in the production and distribution of cannabis, beverages, wellness products, and distribution services with operations contributing to its market presence.

Operations: The company generates revenue primarily from its Beverage, Cannabis, Wellness, and Distribution segments. In recent periods, the Gross Profit Margin has shown fluctuations but was recorded at 29.49% as of May 2025. Operating expenses have been significant, with General & Administrative expenses consistently forming a large portion of these costs.

PE: -0.3x

Tilray Brands, a cannabis company with a small market cap, has faced challenges recently. Despite reporting US$224.54 million in sales for Q4 2025, net losses ballooned to US$1.27 billion due to significant impairments of intangible assets and goodwill totaling over US$1.39 billion. The company's share price remains volatile, and it has been dropped from several indices like the S&P/TSX Composite Index in June 2025. However, Tilray continues to innovate with new product launches and global expansions such as Good Supply's entry into Germany's medical cannabis market, aiming for growth despite current financial hurdles.

- Take a closer look at Tilray Brands' potential here in our valuation report.

Examine Tilray Brands' past performance report to understand how it has performed in the past.

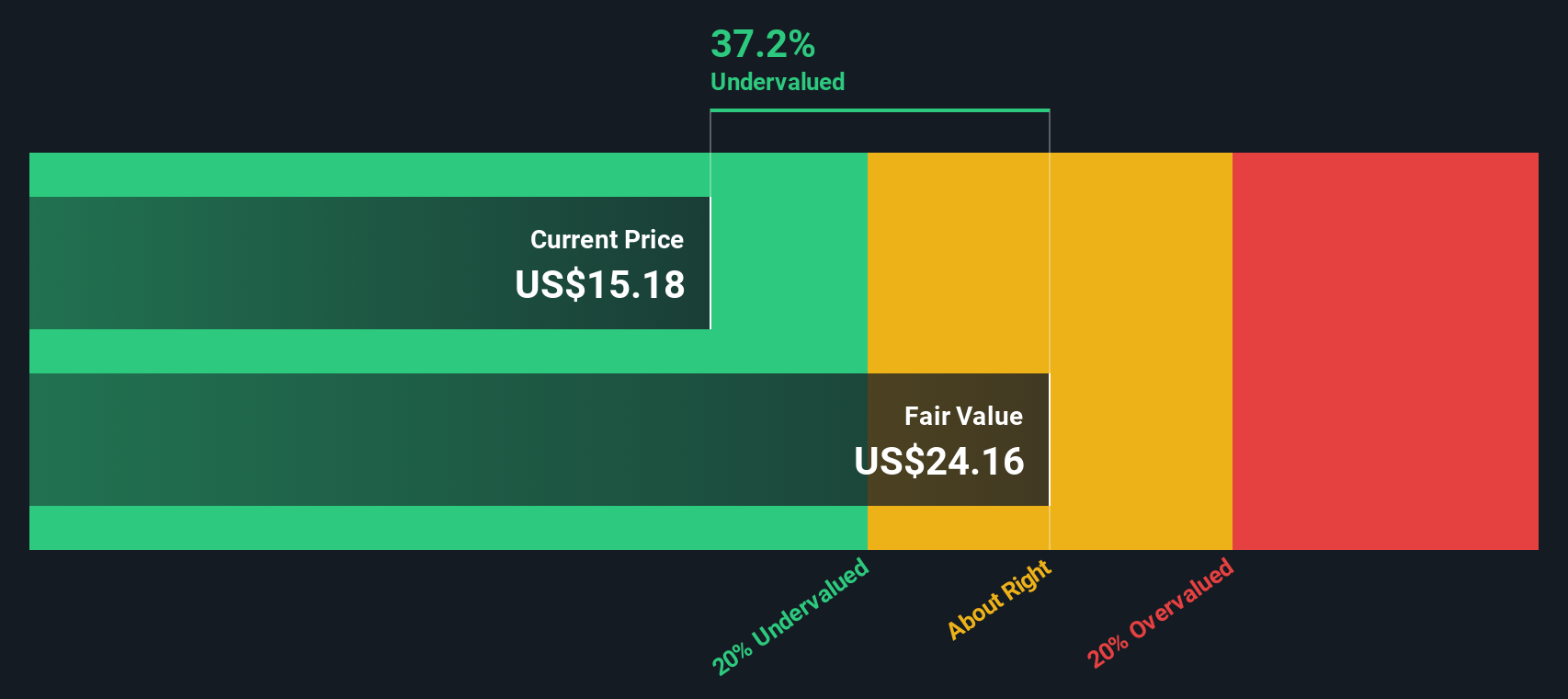

First Commonwealth Financial (FCF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First Commonwealth Financial is a financial services company primarily engaged in providing banking services, with operations contributing to a market capitalization of approximately $1.58 billion.

Operations: The primary revenue stream for FCF comes from its banking operations, with recent figures showing revenue at $454.63 million. The company's operating expenses have been increasing, reaching $266.63 million in the latest period, with significant portions allocated to general and administrative expenses ($217.68 million) and sales & marketing ($6.15 million). Despite these costs, FCF has achieved a net income margin of 29.48%.

PE: 13.0x

First Commonwealth Financial, a smaller player in the financial sector, recently reported net interest income of US$106.24 million for Q2 2025, up from US$94.99 million a year ago, though net income dipped slightly to US$33.4 million. The company has shown insider confidence with share repurchases totaling 3.17 million shares since October 2021 and plans to buy back an additional US$25 million worth of shares. Despite some earnings pressure, the firm projects earnings growth at 21% annually, suggesting potential for value appreciation in this segment.

- Unlock comprehensive insights into our analysis of First Commonwealth Financial stock in this valuation report.

Gain insights into First Commonwealth Financial's past trends and performance with our Past report.

Key Takeaways

- Discover the full array of 79 Undervalued US Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCF

First Commonwealth Financial

A financial holding company, provides various consumer and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)