- United States

- /

- Software

- /

- NasdaqGS:ALKT

3 US Stocks Estimated To Be Trading At Discounts Up To 40.9%

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the Dow Jones and Nasdaq showing mixed movements, investors are keenly observing sectors such as technology for potential opportunities amid ongoing economic developments. In this environment, identifying undervalued stocks can be crucial, as these investments may offer significant potential when trading at discounts compared to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $26.98 | $53.27 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | $122.36 | $244.39 | 49.9% |

| Business First Bancshares (NasdaqGS:BFST) | $28.29 | $55.10 | 48.7% |

| West Bancorporation (NasdaqGS:WTBA) | $23.59 | $46.42 | 49.2% |

| Equity Bancshares (NYSE:EQBK) | $46.75 | $92.77 | 49.6% |

| U.S. Physical Therapy (NYSE:USPH) | $94.06 | $187.03 | 49.7% |

| Constellium (NYSE:CSTM) | $11.31 | $22.03 | 48.7% |

| Freshpet (NasdaqGM:FRPT) | $145.69 | $283.12 | 48.5% |

| Equifax (NYSE:EFX) | $265.29 | $529.48 | 49.9% |

| Marcus & Millichap (NYSE:MMI) | $40.82 | $81.04 | 49.6% |

Let's uncover some gems from our specialized screener.

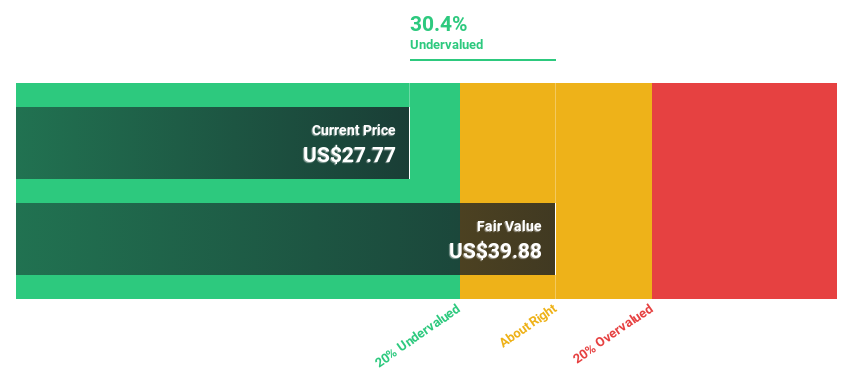

BioLife Solutions (NasdaqCM:BLFS)

Overview: BioLife Solutions, Inc. develops, manufactures, and markets bioproduction tools and services for the cell and gene therapy industry globally, with a market cap of approximately $1.22 billion.

Operations: The company's revenue is primarily derived from its Biopreservation Tools segment, amounting to $146.96 million.

Estimated Discount To Fair Value: 18.3%

BioLife Solutions is trading at US$26.72, below its estimated fair value of US$32.7, suggesting it may be undervalued based on cash flows. Despite recent guidance revisions due to the SciSafe divestiture, the company reported improved quarterly results with a net loss reduction from US$29.13 million to US$1.7 million year-over-year. Revenue growth is expected at 11.1% annually, surpassing the U.S market average of 9%. However, shareholder dilution remains a concern.

- The analysis detailed in our BioLife Solutions growth report hints at robust future financial performance.

- Click here to discover the nuances of BioLife Solutions with our detailed financial health report.

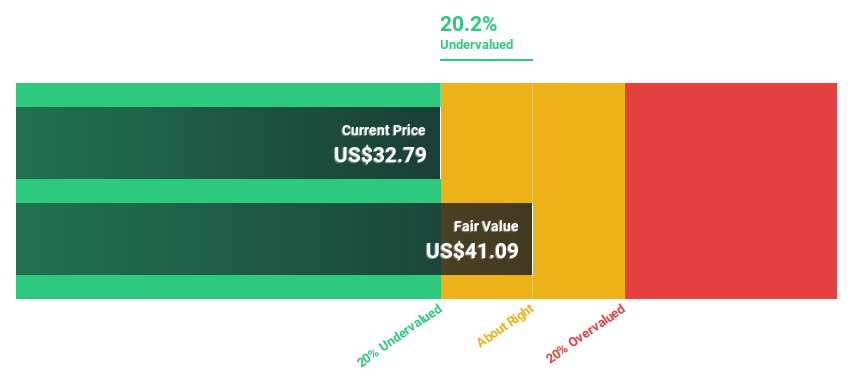

Alkami Technology (NasdaqGS:ALKT)

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of approximately $3.99 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $315.56 million.

Estimated Discount To Fair Value: 10.7%

Alkami Technology, trading at US$39.92, is below its estimated fair value of US$44.72, indicating potential undervaluation based on cash flows. The company forecasts impressive revenue growth of 21.9% annually, surpassing the U.S market average and is expected to become profitable within three years. However, recent insider selling and shareholder dilution could be concerns despite strategic partnerships and product enhancements aimed at driving revenue growth through innovative digital banking solutions.

- Our expertly prepared growth report on Alkami Technology implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Alkami Technology here with our thorough financial health report.

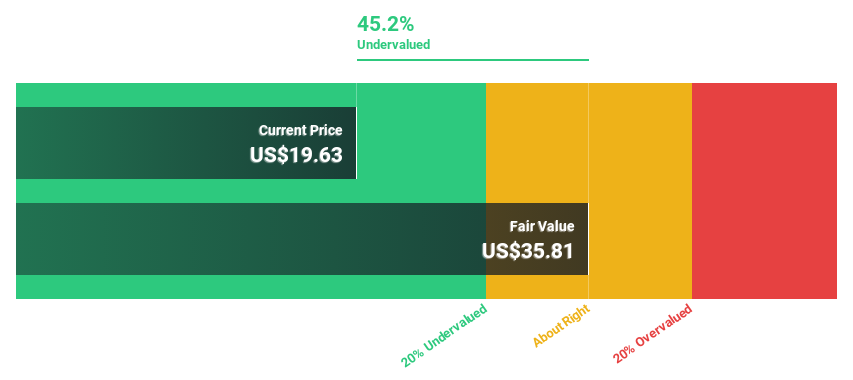

Annaly Capital Management (NYSE:NLY)

Overview: Annaly Capital Management, Inc. is a diversified capital manager involved in mortgage finance with a market capitalization of approximately $11.08 billion.

Operations: Annaly Capital Management generates revenue primarily through its mortgage-backed securities segment, amounting to $369.37 million.

Estimated Discount To Fair Value: 40.9%

Annaly Capital Management, with a share price of US$19.76, trades significantly below its estimated fair value of US$33.41, highlighting potential undervaluation based on cash flows. Despite robust earnings growth and forecasts for revenue to grow rapidly at 90.1% annually, concerns arise from unsustainable dividends not covered by earnings or free cash flows and shareholder dilution over the past year. Recent filings include a US$492.25 million shelf registration for common stock under a dividend reinvestment plan.

- Our earnings growth report unveils the potential for significant increases in Annaly Capital Management's future results.

- Get an in-depth perspective on Annaly Capital Management's balance sheet by reading our health report here.

Key Takeaways

- Click through to start exploring the rest of the 191 Undervalued US Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives