Last Update25 Apr 25

A Precision Approach to Hard-to-Treat Cancers

RenovoRx, Inc. (Nasdaq: RNXT), based in Mountain View, California, is a clinical-stage biopharma company taking a new approach to cancer treatment. Using its Trans-Arterial Micro-Perfusion (TAMP™) platform, the company aims to solve a major issue in cancer care: how to get strong doses of chemo directly to the tumor while avoiding harmful side effects throughout the body.

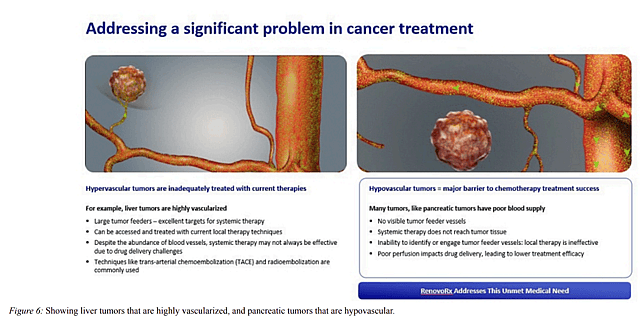

The Problem: Conventional Treatment Limitations

Standard IV chemotherapy doesn’t work well for some cancers—especially pancreatic cancer. One reason is that these tumors don’t have obvious blood vessels feeding them, so chemo delivered through the bloodstream often doesn’t reach them effectively.

At the same time, these drugs travel through the whole body, causing serious side effects. This is especially problematic for patients with locally advanced pancreatic cancer (LAPC), where limited treatment options hurt both survival chances and quality of life.

The Solution: RenovoRx's TAMP™ Platform

RenovoRx’s TAMP™ platform changes the game in targeted drug delivery.

At the heart of this system is the RenovoCath® device, which is already FDA-cleared. It’s a special dual-balloon catheter designed to deliver treatments right where they’re needed.

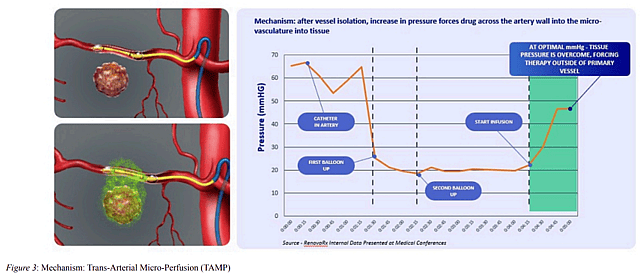

Here’s how it works:

- A small incision is made in the leg to insert the RenovoCath® system.

- It’s guided into the artery near the tumor.

- The double balloons block off a section of the artery, forcing the chemotherapy to cross the artery wall and reach the tumor directly.

This smart method soaks the tumor in treatment, while sparing the rest of the body from exposure.

Promising Results and Clinical Progress

RenovoRx’s main product combines the well-known chemo drug gemcitabine with their unique delivery system. It’s currently being tested in the Phase III TIGeR-PaC trial for treating LAPC.

Early data looks good. At the 2025 Society of Surgical Oncology meeting, researchers shared findings showing that this local delivery method leads to lower chemo levels in the rest of the body than standard IV methods—meaning potentially fewer side effects.

Plus, interim results from the trial show:

- A 6-month improvement in median survival

- A 65% drop in side effects compared with usual care

These results highlight the potential to impact both survival rates and quality of life for pancreatic patients.

Market Opportunity and Growth Potential

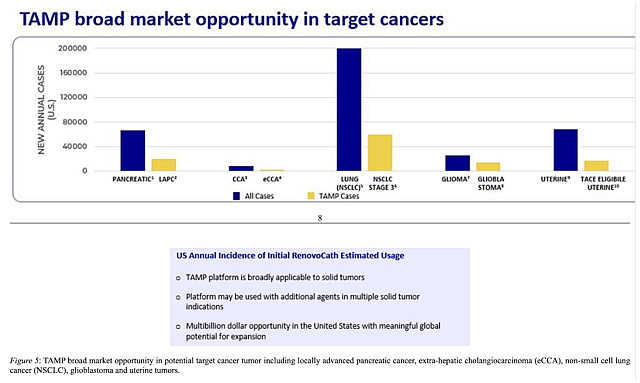

RenovoRx is targeting a significant market opportunity, estimated at $1 billion globally for pancreatic cancer alone.

However, the versatility of the TAMP™ platform could be useful for more than just pancreatic cancer. It may also help treat other tough-to-reach tumors like bile duct cancer and glioblastoma.

The company continues to strengthen its competitive position with more patents and research partnerships. RenovoRx's commercial strategy is gaining momentum, with new purchase orders received from several high-volume National Cancer Institute-designated centers.

Valuation

RenovoRx has the potential to carve out a meaningful slice of a billion-dollar cancer treatment market. By 2030, the company could be generating around $100 million in annual revenue, based on a careful rollout of its lead product, RenovoGem. That projection includes treating about 1,000 pancreatic cancer patients per year and another 100 with cholangiocarcinoma, both priced near $90,000 per treatment. And that’s without factoring in future indications or international expansion.

Thanks to the low cost of the drug (gemcitabine) and efficient production of the RenovoCath® system, net margins of 35–40% are within reach. That would put net income at roughly $36 million on $100 million in sales.

Valuing that income stream at a 15x price-to-earnings ratio—a middle-of-the-road multiple for small-cap biotech firms with one or two commercial treatments—gets you to a 2030 market cap of about $540 million.

If the company ends up with 30 million shares outstanding after future fundraising, that translates to a future share price of around $18.

Discount that back at 20% annually—a typical rate for early-stage biotech—and the present value lands near $7 per share. That’s a sharp rise from where the stock trades today (around $1), assuming the company continues to hit key clinical and commercial milestones.

For context, RenovoRx’s current $30 million market cap sits well below peer companies like Delcath Systems ($125 million) and TriSalus Life Sciences (~$170 million). If the TIGeR-PaC trial stays on track, RenovoRx could start moving into the same valuation range as other emerging oncology players—$300 to $500 million isn’t out of the question.

Leadership and Expertise

Under the leadership of CEO Shaun Bagai and founder/CMO Dr. Ramtin Agah, RenovoRx benefits from a management team with deep expertise in interventional medicine and oncology.

The company's approach has garnered support from leading medical institutions and respected oncologists who recognize the potential of the TAMP™ platform to transform treatment paradigms.

Investment Considerations

Here are some things investors should know when looking at RenovoRx:

- Innovative Technology: Their delivery method tackles a long-standing cancer treatment challenge and could work for several cancer types.

- Clinical Progress: Phase III trial is underway, and early signs are positive.

- Market Opportunity: A substantial addressable market in pancreatic cancer alone, with expansion potential to other indications.

- Commercial Traction: Initial sales of the FDA-cleared RenovoCath® device indicate early market acceptance.

- Intellectual Property: A strengthening patent portfolio provides competitive protection for the company's core technologies.

Risks to Consider

As with any investment in emerging biotech companies, there are a few factors to be aware of when considering RenovoRx. These points, based on recent SEC filings, offer helpful context for making informed decisions:

- Clinical Trial Uncertainty: RenovoRx’s TAMP™ platform is currently in advanced clinical testing. While early results are promising, the final success of the platform depends on continued progress in clinical trials and eventual regulatory approval.

- Financial Challenges: As a development-stage company, RenovoRx may need additional funding to support operations and advance its products toward commercialization. This is a common scenario in biotech and reflects the long-term nature of medical innovation.

- Market Competition: The biotech industry is competitive, with other companies also working on novel cancer treatments. However, RenovoRx’s proprietary platform and intellectual property give it a differentiated position in this space.

- Stock Volatility: Like many early-stage biotech firms, RNXT shares may experience price swings based on trial results, regulatory news, or broader market conditions. Long-term investors should be prepared for short-term fluctuations.

- Potential Dilution: To fuel its growth and R&D efforts, RenovoRx may issue additional shares in the future. This could dilute existing shareholders but also reflects the company’s ability to access capital markets when needed.

- Regulatory Risks: The healthcare sector is heavily regulated, and changes in regulatory policies or delays in approval processes could impact the timing or success of bringing new products to market. However, the FDA clearance of the RenovoCath® device provides a solid base of validation.

Looking Ahead: Potential Catalysts

RenovoRx's near-term trajectory will likely be influenced by several potential catalysts:

- Continued data releases from the Phase III TIGeR-PaC trial

- Grow sales of the RenovoCath® device

- Potential new indications and applications for the TAMP™ platform

- Strategic partnerships to accelerate development and market penetration

Conclusion

RenovoRx is taking a fresh, targeted approach to getting cancer drugs right to where they’re needed most—at the tumor. With promising trial data, a clear game plan, and a big market opportunity, it could be a key player in treating some of the toughest cancers.

As with all biotech investments, there are risks—especially since the treatment is still in trials. But for investors looking at companies tackling major medical challenges with innovative technology, RenovoRx offers an interesting opportunity.

This narrative is sponsored content. Stock Research Today provides this information for educational purposes only and not as investment advice. Always conduct thorough research and consider consulting a financial advisor before making investment decisions.

How well do narratives help inform your perspective?

Disclaimer

The user Stock_Research_Today holds no position in NasdaqCM:RNXT. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Sponsored Content Notice

This Narrative has been sponsored by RenovoRx (the Sponsor), which has paid Simply Wall St a fee for its publication on our platform and subsequent promotion. Any relationship between Simply Wall St and RenovoRx does not influence how we produce or moderate other content on this website. The Sponsor has a financial interest in the subject matter of this narrative. Simply Wall St has not independently verified any statements or projections made by the author, and does not endorse or guarantee the accuracy or completeness of the information provided.