- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Top US Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches new highs and the S&P 500 and Nasdaq Composite experience slight declines, investors are closely monitoring market movements influenced by inflation data and Federal Reserve policies. In this fluctuating environment, growth companies with high insider ownership can offer a unique advantage, as significant insider stakes often signal confidence in a company's long-term potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We're going to check out a few of the best picks from our screener tool.

Establishment Labs Holdings (NasdaqCM:ESTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Establishment Labs Holdings Inc., with a market cap of $1.31 billion, is a medical technology company that manufactures and markets medical devices for aesthetic and reconstructive plastic surgery.

Operations: The company generates $151.35 million from its medical products segment, focusing on devices for aesthetic and reconstructive plastic surgery.

Insider Ownership: 10%

Establishment Labs Holdings has high insider ownership and is positioned for significant growth, with revenue expected to increase by 25.4% annually, outpacing the market's 8.7%. The recent FDA approval of its Motiva SmoothSilk implants represents a major milestone, enhancing its product portfolio. Despite recent losses and shareholder dilution over the past year, the company is forecasted to become profitable within three years. New leadership under President Fillipo Peter Caldini may further drive strategic growth initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Establishment Labs Holdings.

- In light of our recent valuation report, it seems possible that Establishment Labs Holdings is trading beyond its estimated value.

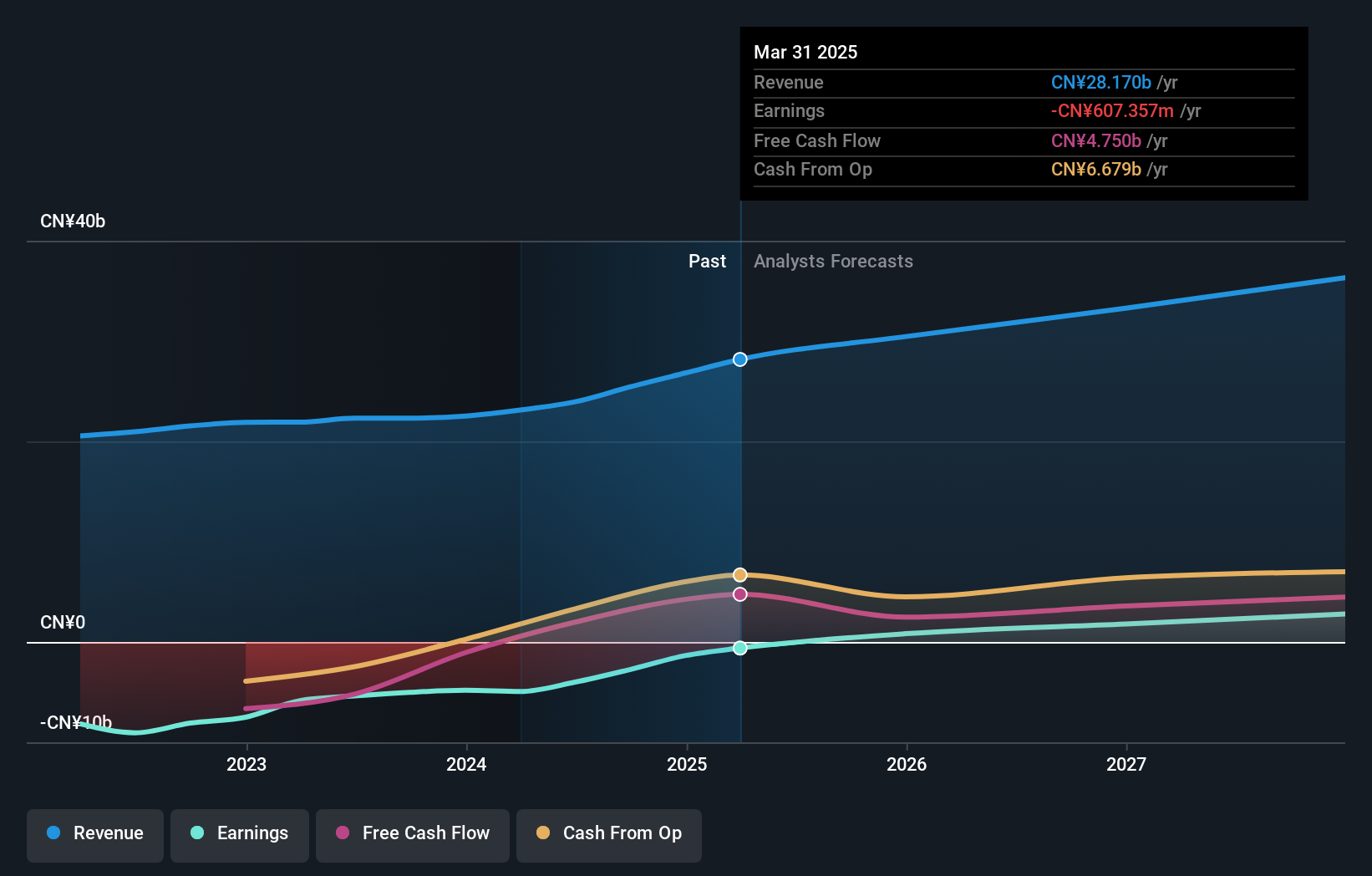

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of $9.50 billion.

Operations: The company generates CN¥23.95 billion from its Internet Information Providers segment.

Insider Ownership: 20.7%

Bilibili has significant insider ownership and is poised for growth, with revenue expected to increase by 11.7% annually, surpassing the US market's 8.7%. The company reported Q2 2024 revenue of CNY 6.13 billion, up from CNY 5.30 billion a year ago, and reduced its net loss to CNY 608.7 million from CNY 1.55 billion. Although Bilibili's share price has been highly volatile recently, it trades at a discount of approximately 22.9% below estimated fair value and is forecasted to become profitable within three years with earnings growing at an annual rate of over 80%.

- Click to explore a detailed breakdown of our findings in Bilibili's earnings growth report.

- The analysis detailed in our Bilibili valuation report hints at an deflated share price compared to its estimated value.

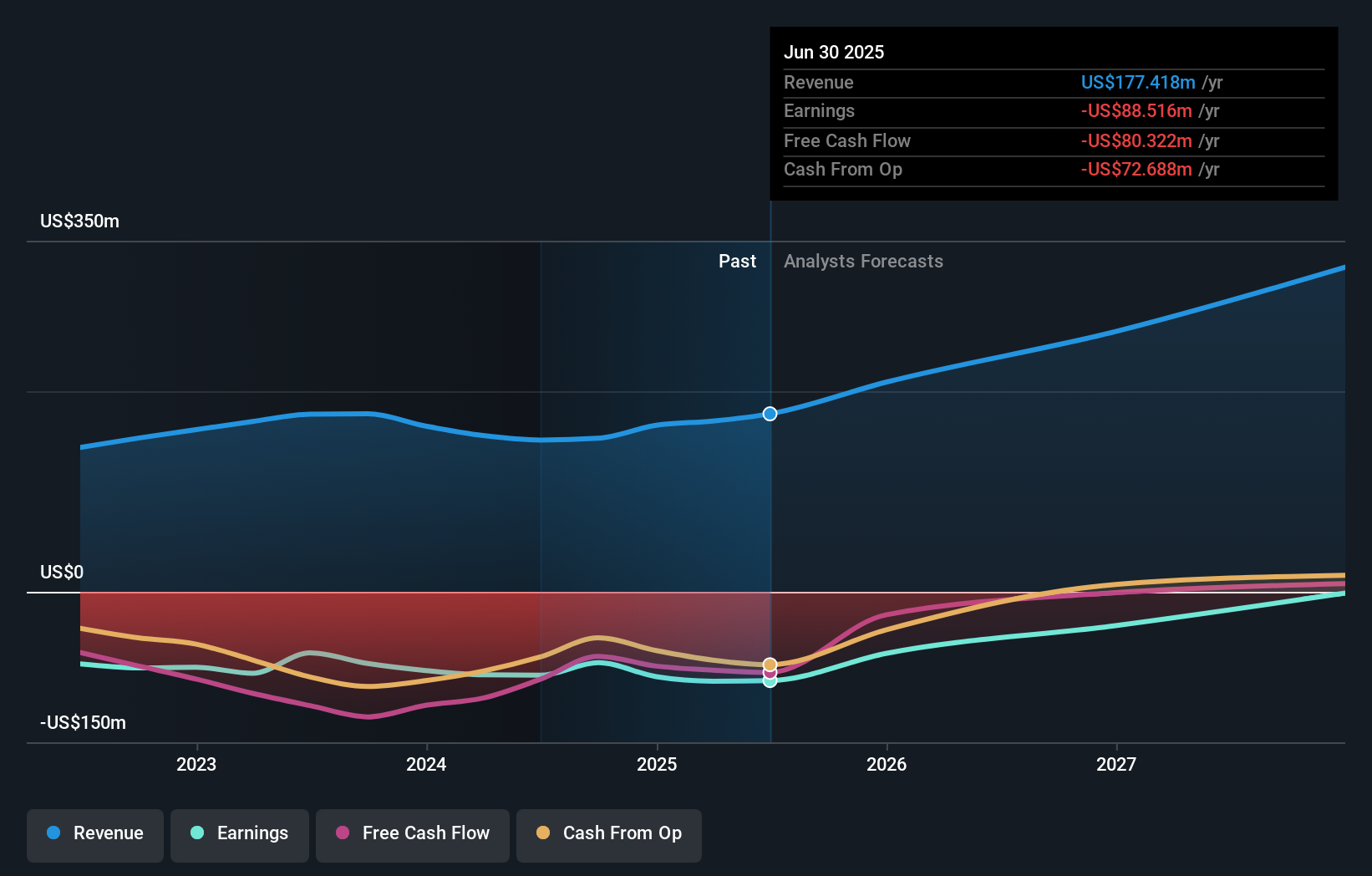

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of $12.11 billion.

Operations: Duolingo generates $634.49 million from its educational software segment.

Insider Ownership: 14.7%

Duolingo, with high insider ownership and no substantial insider selling recently, is experiencing rapid growth. The company reported Q2 2024 sales of US$178.33 million, up from US$126.84 million a year ago, and net income rose to US$24.35 million from US$3.73 million. Duolingo's earnings are forecast to grow significantly over the next three years at 41.6% annually, outpacing the market average of 15.2%. Recent partnerships like with Sony Music aim to enhance user engagement further.

- Click here and access our complete growth analysis report to understand the dynamics of Duolingo.

- Our valuation report here indicates Duolingo may be overvalued.

Summing It All Up

- Get an in-depth perspective on all 184 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.