Quote of the Week: “ There is nothing that war has ever achieved we could not better achieve without it.” - Havelock Ellis

In January 2025, Donald Trump’s return to the White House set off seismic shifts across a number of industries. We’ve recently covered what the new Administration could mean for the automotive and fossil fuel industries, but now it’s time to turn our attention to an industry that in vitally important, albeit quite a sensitive topic.

Following a meeting in late February with Ukrainian President Volodymyr Zelenskyy, discourse on the global defense industry has reignited.

With record-breaking budgets, strategic realignments, and evolving geopolitical dynamics, the industry finds itself in an era of unprecedented change.

This week, we’ll take a look at how the defense industry is evolving in 2025 and how this could impact global markets.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🤖 Nvidia hosted the Super Bowl of A.I. ( The New York Times )

- Nvidia’s GTC conference has evolved from an academic event to a global spectacle, solidifying its dominance in AI. With 25,000 attendees and industry heavyweights present, CEO Jensen Huang made the case for AI’s future.

- The company unveiled its next-gen Rubin GPUs, promising a 14x performance boost by 2026. Nvidia is banking on these chips to maintain its edge as Big Tech firms develop in-house AI hardware.

- Wall Street remains skeptical about AI’s profitability, and challengers like China’s DeepSeek prove efficiency can disrupt Nvidia’s grip.

- Nvidia’s AI empire is thriving, but the competition, and cost, of staying on top is heating up.

🤝 Alphabet to buy cloud security provider Wiz for $32 billion ( Reuters )

- Google is shelling out a whopping $32b for cybersecurity startup Wiz, its biggest acquisition ever, as it tries to gain ground on AWS and Azure. The high price, up from a failed $23b bid last year, signals Google’s urgency in bolstering its cloud security offerings.

- Regulatory approval remains a wildcard, but Google is positioning Wiz as a multi-cloud player to try to ease antitrust concerns. As we mentioned a few weeks ago, the M&A landscape is shifting with Trump back in office, and Google seems confident the deal will pass.

- Investors are wary of Google’s history with big-ticket deals, and financing may be needed to close this one by 2026

- Overall, it seems Google is betting big on cloud security, but at $32b, it needs Wiz to be a game-changer, and not just a “nice to have”.

📈 Powell fuels rare rally in both stocks and bonds ( Bloomberg )

- Fed Chair Jerome Powell struck a soothing tone, keeping rates unchanged and sticking to two expected cuts in 2025. Markets rallied, with both stocks and bonds surging, something rarely seen on Fed decision days.

- Investors shrugged off stagflation concerns as Powell downplayed Trump’s tariff impact and highlighted economic resilience. The S&P 500, Nasdaq, and speculative tech stocks all bounced after weeks of selling pressure.

- While optimism is rising, some analysts warn this rebound lacks conviction and could fade without sustained buying.

- The Fed is keeping markets calm, but traders are still navigating shaky ground.

📺 Roku shares stream higher after Guggenheim hits the “buy” button ( Sherwood )

- Roku shares surged 6% after Guggenheim reaffirmed its “buy” rating, citing strong US and Mexico growth. With 92 million global streaming households expected by Q1, Roku’s reach is expanding.

- Ad revenue is picking up, with Roku’s platform business surpassing $1 billion in Q4 for the first time. More users are starting their TV time on Roku, boosting its ad appeal.

- Despite optimism, Guggenheim trimmed its price target to $100, citing valuation concerns. Still, that’s 40% upside from current levels.

- It seems Roku’s ad business is gaining traction, but valuation remains a sticking point for investors.

⚔️ Defense Takes Center Stage

This year, defense stocks are commanding global attention again as geopolitical tensions reshape markets. As Trump returned to the White House, little time was wasted in shaking up the status quo with some notable changes.

There was an unprecedented shake up among the top brass of the military, with the Chairman of the Joint Chiefs of Staff sent packing , and defense strategy was upended, as relationships with other major global powers were put to the test.

Trump's administration, advocating an "America First" approach, is reconsidering its international commitments, stepping away from a prior stance of unwavering support for Ukraine in the Russia-Ukraine war.

As the balance of US defense priorities shift from an international setting to a more domestic one, investors must now navigate an increasingly complex landscape defined by shifting alliances, surging European defense budgets, and evolving American policies.

📈 From Stability to Surge

Unfortunately, as a consequence of geopolitical unrest, the past five years marked a substantial shift in the market for defense stocks. Throughout the early 21st century, much of the focus for the defense industry was fighting the war on terror.

However, as the U.S. military withdrew from Afghanistan in 2021, the book closed on one era of global security, despite threats still looming.

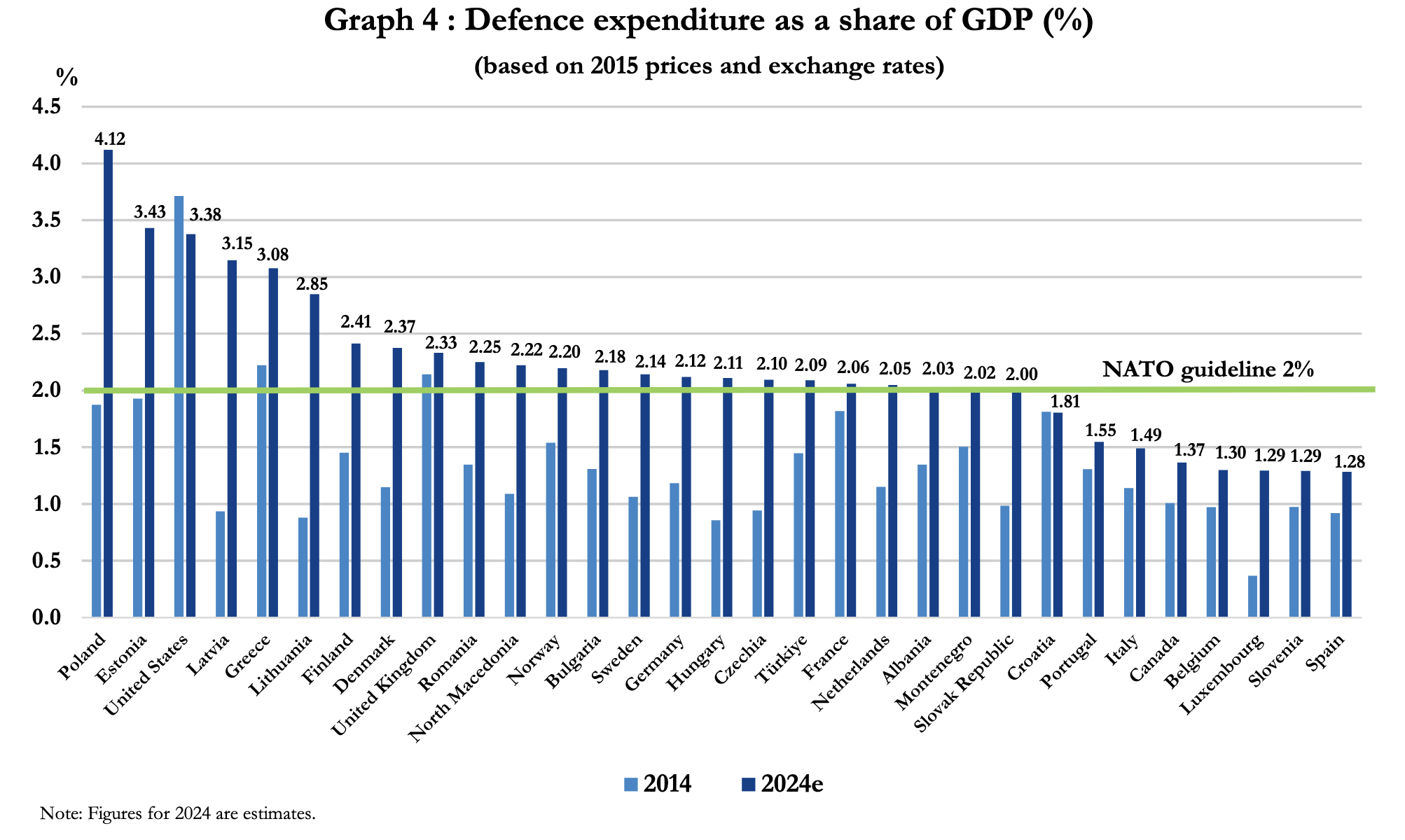

Many European nations had long underinvested in defense, benefiting from a post-Cold War “peace dividend.” That status quo abruptly changed in February 2022, when Russia invaded Ukraine, marking Europe’s biggest security crisis in decades.

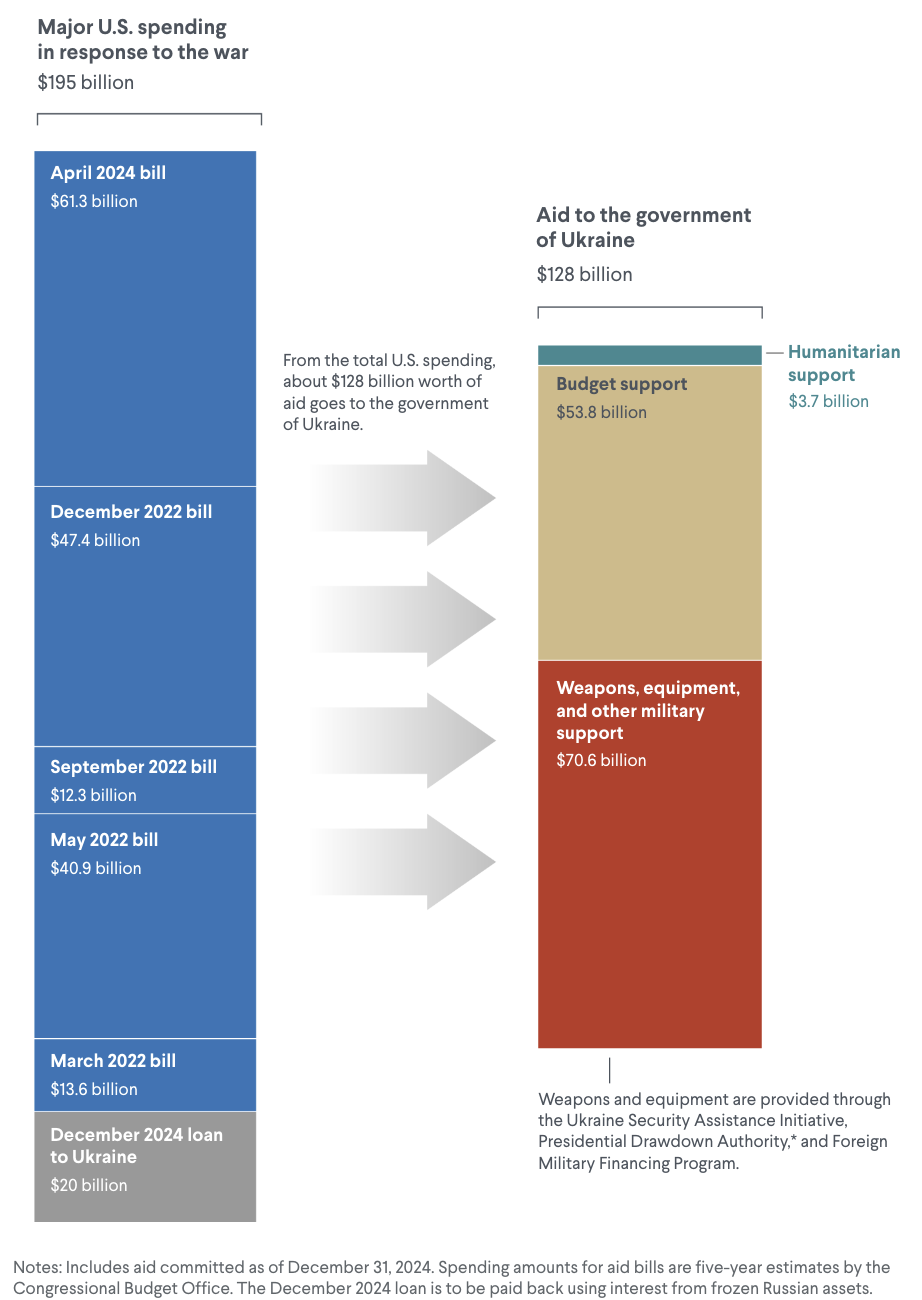

The U.S. initially led the charge, providing Ukraine with over $120 billion in aid. As U.S. arms made their way to Ukraine, U.S. defense stocks (tracked by the SPADE Defense Index) rose +8.6%, even while the S&P 500 sank nearly 20% throughout 2022 . An outperformance of close to 28 percentage points.

Europe reacted swiftly. Germany broke historical constraints, pledging a €100 Billion special fund for defense . Europe's defense stocks became the flavor of the month, with firms like Rheinmetall and Leonardo seeing record gains.

However, the renewed interest didn’t actually see a material change in the income statements for most of these companies with soaring share prices. Actual production lagged behind market enthusiasm due to supply chain constraints.

Companies built massive backlogs rather than immediate revenues, underscoring investor expectations for future growth rather than current earnings.

🇺🇸🛡️ U.S. Defense Under Trump's Second Term

Jumping forward now to 2025, we seem to be entering yet another era of change within a global security context. Trump's administration has paused additional military aid to Ukraine pending peace negotiations.

With Washington reconsidering its stance on overseas involvements, major U.S.contractors, like Lockheed Martin and RTX , are now faced with some uncertainty. These companies which had benefitted from huge orders that would see them replenishing US arsenals that had been sent over to Ukraine now face the reality of this demand source drying up.

✨ While fundamental demand still remains strong (there’s an unwavering need for countries to be able to defend themselves), future orders for these replacement weapons may be delayed or even cancelled now.

Investors have been acutely aware of these impacts, with valuations slipping for US defense contractors across the board in early 2025. Although, investors would be forgiven if they were slightly confused about the narrative for defense stocks, with the Trump administration sending mixed signals to the market throughout the beginning of 2025.

Depending on the day, investors may have heard:

- 🇺🇸 “ The US rhetoric is shifting towards an inwards focus”

- This should be fine for US defense contractors, right? With the composition of spending likely shifting from aid to more domestic initiatives, spending on areas supported by the domestic defense industry like next-generation fighter jets, naval ships, and cybersecurity may become a priority.

- 📉 “Pentagon spending could be halved”

- While Trump wasn’t referring to an immediate realignment of the defense budget, he did insinuate it was a possibility for the future when “things settle down” .

- 💪 “The US needs a strong military”

- This seems obvious, the best offense is a good defense, but surely that would require strong levels of military spending. Trump even passed an executive order to develop an “Iron Dome for America” . A large undertaking which would undoubtedly carry a hefty receipt.

- 💰 “The Pentagon will cut $50 Billion a year”

- Following input from the newly minted Department of Government Efficiency, the Pentagon could be forced to cut some fat from its eye-watering $842 Billion budget and re-prioritize spending.

So it's pretty understandable why the defense industry is seeing some volatility in the market. But this is also only thinking about things from a US-centric perspective.

Many of the large US defense contractors have significant overseas contracts and with the position on military spending in Europe being a little more steadfast, there’s still ample opportunity within the defense space.

🪖 The US Players

While the long-term outlooks for the US defense industry are uncertain, it’s undeniable that the largest US defense companies will still be relevant in a global context irrespective of what transpires.

To give you a quick overview of some of the major players operating out of the US, check out our US Aerospace & Defense Screener , which covers industry giants like:

- Lockheed Martin , the top U.S. arms seller, which benefited from the ongoing F-35 fighter jet purchases by the U.S. and allies.

- RTX , a major player in missiles (Patriot, Stinger) and defense electronics, has seen strong international demand – notably replenishment orders for munitions and air defenses from NATO countries and new sales to Asia.

- Northrop Grumman , which leads two legs of the nuclear modernization program (the B-21 stealth bomber and the Sentinel ICBM), which are high-priority and well-funded projects unlikely to be cut. Any budget allocated toward Indo-Pacific deterrence (e.g. long-range strike, surveillance drones) tend to favor Northrop.

- Boeing , although better known for commercial jets, has a sizable defense arm. While it has faced setbacks on several of its programs, it could gain from potential new orders of F-15EX fighters or rotorcraft if the Pentagon looks to boost capacity quickly with existing designs.

🇪🇺🛠️ Europe Steps Up With Historic Defense Spending

Europe, in contrast, is in full expansion mode. Trump's inward-looking policies prompted Europe to react and ramp up defense spending dramatically.

Trump’s fiery warning that Europe must take more responsibility for its own security prompted change, and rather quickly. The European Union's mobilization of €800 billion to modernize and expand military capabilities has reignited excitement in European defense firms.

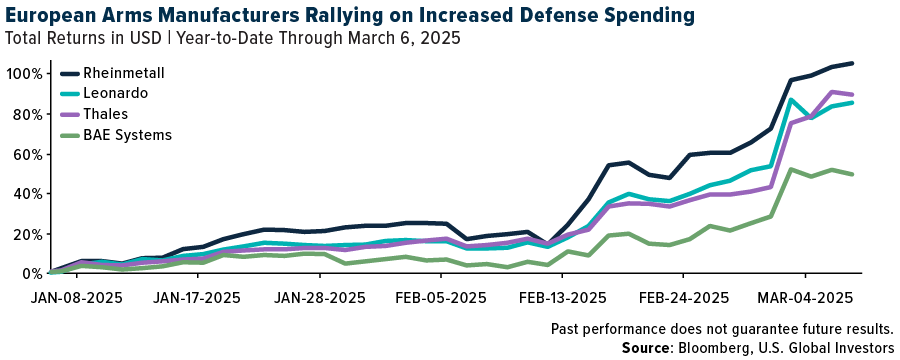

Stocks like Germany’s Rheinmetall has risen by a scarcely believable 140% since the start of the year, to the beginning of this week, while Italy's Leonardo and France’s Thales have also surged by roughly 85%.

The renewed hype in Europe is so significant, that it now has Europe’s largest fund managers scrambling to increase their exposure to the sector. This has become so important, that firms like UBS are now reviewing defense sector exclusions across its funds, once again highlighting the nuances of ESG investing, as we covered the other week .

The rally around European defense stocks even outpaced the tech sector, which has long been in the driver's seat for growth following the AI surge.

Europe's concerted effort to achieve sustained defense expenditure above 2% of GDP ensures continuous demand, and has the opportunity to reshape Europe’s defense sector over the coming years as a united front among European nations could see the emergence of a new powerhouse in global security.

🪖 The European Players

The future for European defense companies seems a little more clear-cut, with a fairly universal pledge among EU and NATO nations to increase military budgets. But as we’ll outline a bit further down, there’s no guarantee that this will be a boon for the industry from a market perspective.

With that being said, there’s been a renewed interest in the in Europe, as indicated by the abundance of green yearly return figures on our European Aerospace & Defense Screener. While past performance is no indicator of future performance, it could be worth your time checking out some of the big players on the other side of the pond:

- Rheinmetall , Europe’s top ammunition and armored vehicle supplier, and a prime beneficiary of the continent’s new era of rearmament. There have been some fascinating Narratives from the Simply Wall St Community for Rheinmetall that are worth a read!

- Leonardo , Italy’s aerospace and defense champion. The firm co-produces the Eurofighter Typhoon and is a leader in military rotorcraft, recently securing orders from NATO allies (like Poland’s purchase of 32 AW149 helicopters).

- Airbus , Europe’s largest aerospace group. Its collaborative projects align with NATO’s push for improved airlift, combat aircraft, and unmanned capabilities as European nations bolster their forces and reduce reliance on U.S. equipment.

- BAE Systems , the UK’s biggest defense contractor. It produces everything from fighter jets and submarines to artillery and armored vehicles—co-developing the Eurofighter Typhoon and leading Britain’s Tempest stealth fighter project.

🌏 It’s Not Just The Western Hemisphere Opening Up Their Wallets

In the Asia-Pacific region, it’s been a similar story. Allies such as Japan, South Korea, and Australia have embarked on significant military expansions. Japan led the charge in 2022, when it announced a five-year, ¥43 trillion (US$287 billion) defense build-up, aiming to double its annual defense budget to reach 2% of GDP by 2027 . A pretty remarkable shift for a country that traditionally capped defense around 1% of GDP.

The new spending is directed at countering threats from China and North Korea – including investments in long-range missiles, missile defense, cyber capabilities, and unmanned systems.

Interestingly, the Trump administration has pressed Japan to go even further, a Pentagon nominee argued Japan should target 3% of GDP and accelerate its military upgrades, though Japanese leaders insist budget decisions remain sovereign.

South Korea continues to raise defense funding as well, focusing on missile defense and conventional deterrence against the North. Meanwhile, Australia has committed to a multi-decade plan to acquire nuclear-powered submarines and advanced strike capabilities under the AUKUS partnership , a program which has come under some significant scrutiny.

In the Middle East, many states remain high spenders on defense, though the impetus is more regional rivalries (Iran, Yemen conflict, etc.) and not directly tied to Trump’s policies.

China, while not a U.S. ally, is the other global giant in defense expenditure. Beijing’s military budget has been increasing by single digits annually, reaching an estimated US$230 billion in 2024 (second only to the U.S.). China’s rapid military modernization has been a strong motivator for the U.S. and its allies to in the region to invest more, creating a security dilemma dynamic on a global scale.

💡 The Insight: To Be Well-informed, First You Must Think Contrarily

While the narrative around defense is undoubtedly bullish, but investors should be aware that this is a sector that can change overnight, in quite a literal sense. The outbreak of a new conflict or the peaceful resolution of another could fundamentally change the market landscape at the drop of a hat.

That’s not a bad thing, peaceful resolutions are something we should unequivocally strive for, but there are flow-on effects to the market that investors should be cognizant of.

So while defense stocks continue to be the talk of the town, here are some things that investors should keep in mind, to ensure they’re well-equipped in a defense-centric market:

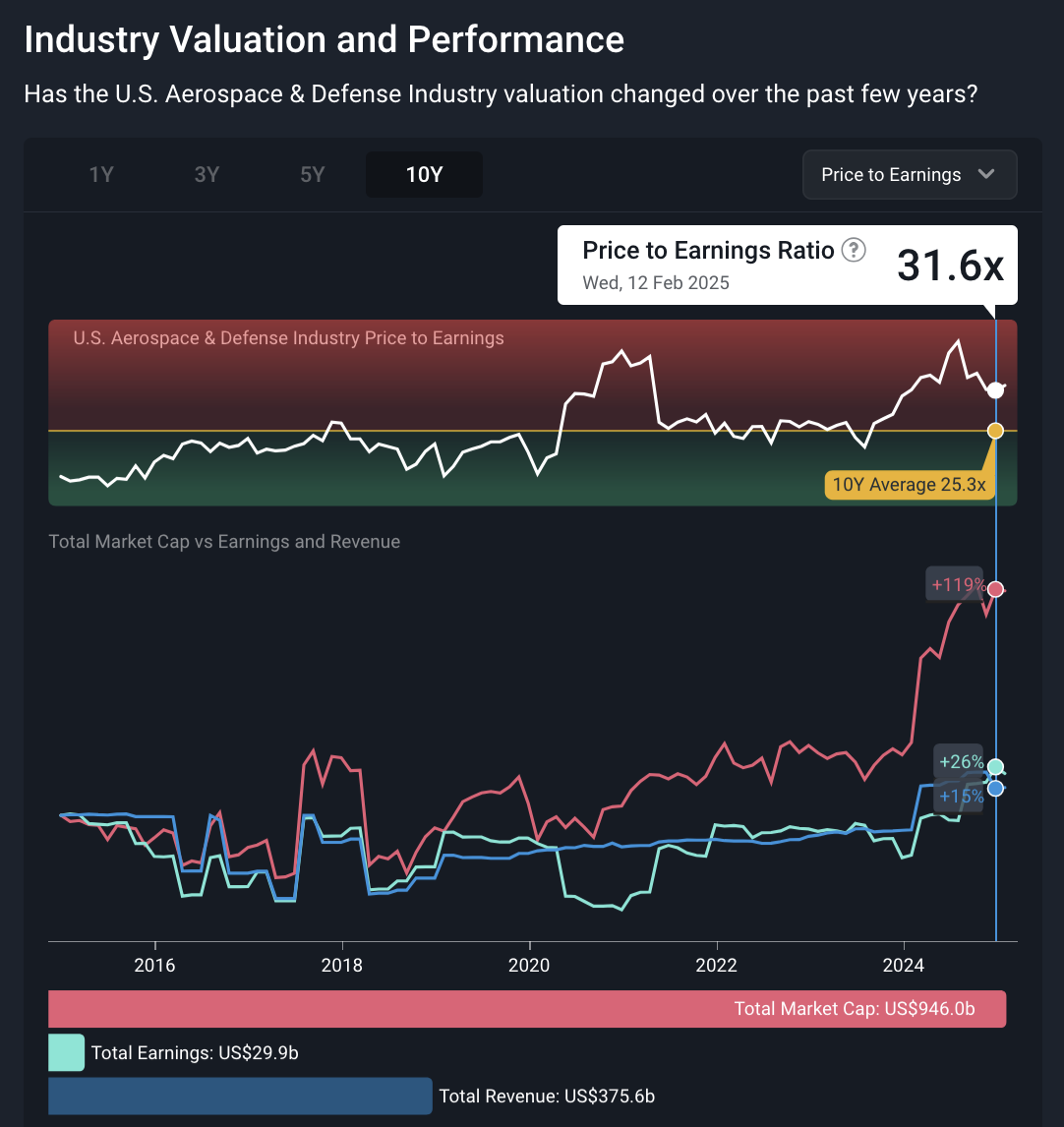

- ⚖️ Defense valuations are still stretched and hang in a delicate balance

- Defense stocks currently trade at historically elevated multiples. In fact, taking a look at some of the valuation metrics for some large US based defense contractors show that current valuation levels are well above historical means. While valuations have cooled slightly over the last month or two, the chart below still shows that the US Aerospace & Defense industry is still trading above 10y averages. Investors should be wary of potential reversions to the mean if anticipated growth doesn't materialize rapidly.

- 🕊️ Peace Dividend vs. Lasting Demand

- Defense spending cycles are notoriously lumpy – they surge in times of conflict and can stagnate or decline if threats recede. Recent share price appreciation in the defense sector would seem to indicate that the consensus is high geopolitical tensions will persist for years.

- If this is the case, then higher levels of military expenditure can be expected, supporting the backlogs of many defense contractors. If this isn’t the case, we could see a hasty redirection of military funds and a likely ‘recalibration’ in the market.

- It’s important for investors to understand the concept of a “Peace Dividend”. In a scenario where geopolitical de-escalation has been achieved, it’s common to see excess military budgeting be reallocated towards more socially beneficial incentives. So astute investors will look to reposition accordingly.

- 🚢 Contracts are one thing, supply chains and execution are another

- Signing on the dotted line to secure government supply contracts is one thing, converting those orders into profits is another thing entirely. Labor shortages, parts scarcity, and inflation in materials have already hit subcontractors hard.

- For instance, in 2023, top contractors like Lockheed and RTX actually saw slight dips in their defense revenues despite overflowing order books . The issue was an inability to scale production fast enough – from rocket motors to semiconductors, certain components became choke points.

Thinking contrarily is a necessary tool in arriving at a rational investment decision, but it's difficult to do so without a fairly intimate knowledge of a given company's circumstances.

These tidbits shared above are applicable across the board, but to understand their degree of relevance, it'd help to be well-read on the companies they could apply to.

There's no better place to do so than Simply Wall St's Community! Check out thousands of Narratives from our knowledgeable users on companies defense-related or otherwise.

Start a discussion on a Narrative you find intriguing, or try your hand at creating your own!

Key Events During the Next Week

It’s yet another week of inflation watching for investors, with a few preliminary figures being reported throughout the next week.

Tuesday

- 🇩🇪 The Ifo Business Climate indicator for Germany is being reported on Tuesday. Expectations are that sentiment is picking up, with the index forecast to hit 89.9, up from 85.2 the prior month.

Wednesday

- 🇬🇧 The UK’s year-on-year inflation for February is due. Initial forecasts indicate that inflation is likely to remain flat at 3%.

Thursday

- 🇺🇸 The US GDP growth rate for Q4 2024 is expected on Thursday. Consensus among analysts is an easing of GDP to 2.3%, down from 3% the prior quarter.

Friday

- 🇬🇧 UK retail sales figures are due for the month of February. Analysts are forecasting minor growth of 0.2%.

- 🇫🇷 France's preliminary inflation rate for March is due. Early forecasts are anticipating inflation climbing slightly to 1% for the year to February, up from 0.8%.

- 🇺🇸 US Core PCE Price Index is due for the month of February. The index is forecast to rise to 0.4%, up from 0.3%

- 🇺🇸 US Personal income figures are due, with income expected to rise a further 0.3% over the previous month.

- 🇺🇸 US Personal Spending is also set to be reported on Friday. Analysts anticipate that growth will be fairly inconsequential, coming in at only 0.1% higher than January.

Earnings continues with a few companies worth noting:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.