- United States

- /

- Metals and Mining

- /

- NYSE:MP

Top US Growth Companies With Insider Ownership In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a temporary pause in its recent rally, with major indexes still posting weekly gains, investors are keenly observing how corporate earnings and AI-related developments influence market sentiment. In this context, growth companies with high insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 48% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| OS Therapies (NYSEAM:OSTX) | 29.4% | 23.8% |

| TeraWulf (NasdaqCM:WULF) | 14.9% | 49.4% |

Underneath we present a selection of stocks filtered out by our screen.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

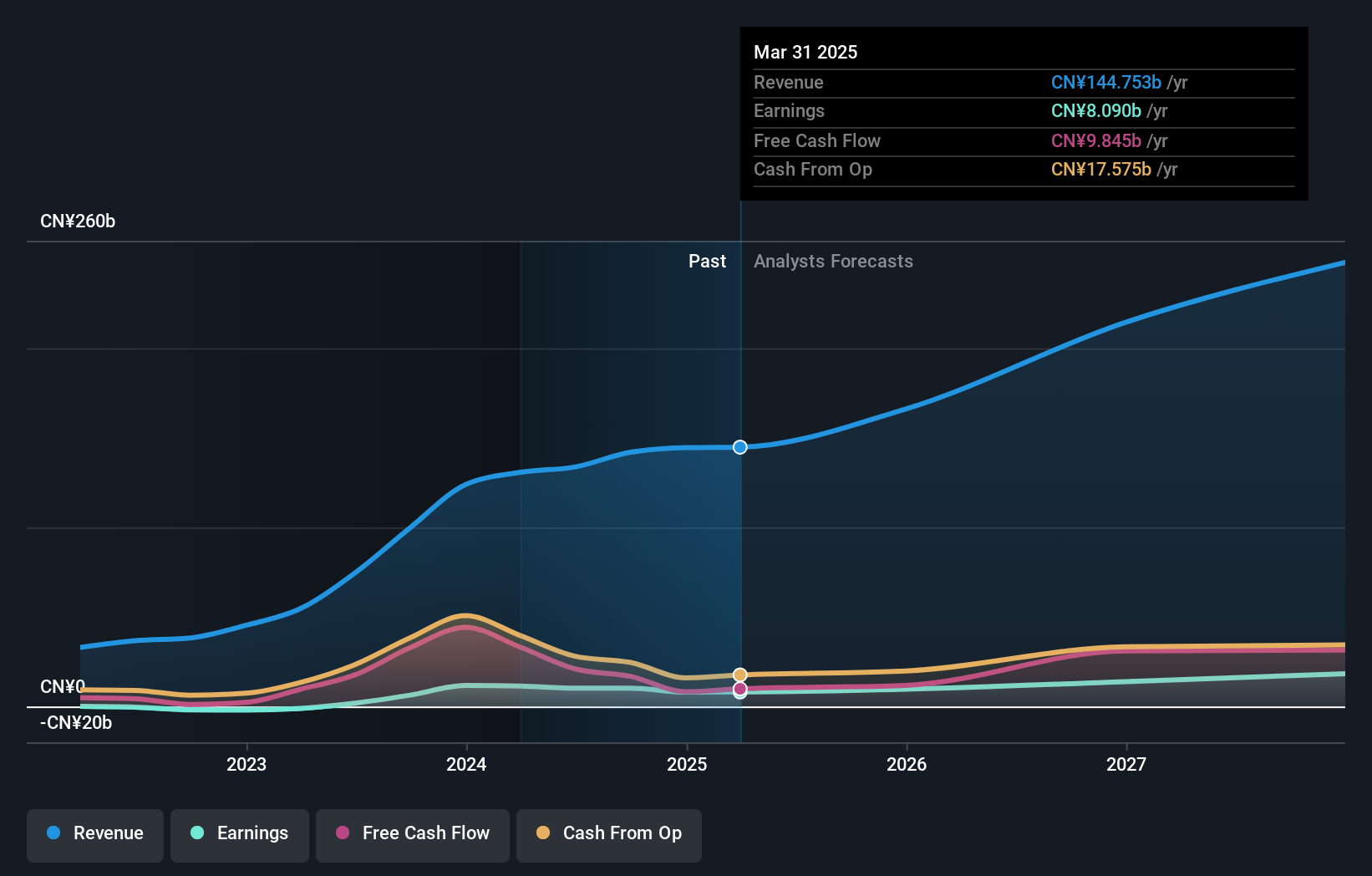

Overview: Li Auto Inc. operates in the energy vehicle market in the People's Republic of China with a market capitalization of approximately $23.15 billion.

Operations: The company generates revenue from its Auto Manufacturers segment, amounting to CN¥141.92 billion.

Insider Ownership: 30.4%

Li Auto is experiencing robust growth, with earnings expected to increase significantly over the next three years. The company's revenue growth outpaces the broader US market, though it remains below 20% annually. Insider activity shows more buying than selling recently, albeit in modest volumes. Li Auto delivered 500,508 vehicles in 2024, a 16.2% year-over-year increase. Analysts predict a stock price rise of nearly 30%, while shares trade below estimated fair value by about 10%.

- Get an in-depth perspective on Li Auto's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Li Auto's share price might be on the cheaper side.

Estée Lauder Companies (NYSE:EL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Estée Lauder Companies Inc. is a global manufacturer and marketer of skin care, makeup, fragrance, and hair care products with a market cap of approximately $29.61 billion.

Operations: The company's revenue is derived from various segments including skin care at $7.80 billion, makeup at $4.45 billion, fragrance at $2.48 billion, and hair care at $620 million.

Insider Ownership: 15.3%

Estée Lauder Companies faces mixed growth prospects, with earnings forecast to grow significantly at 35.8% annually, outpacing the US market. However, revenue growth is slower than the broader market at 2.9%. Recent insider activity shows more buying than selling, though not in substantial volumes. The company has a high level of debt and its profit margins have declined from last year. Recent leadership changes may influence strategic direction amidst these challenges.

- Click here to discover the nuances of Estée Lauder Companies with our detailed analytical future growth report.

- The analysis detailed in our Estée Lauder Companies valuation report hints at an inflated share price compared to its estimated value.

MP Materials (NYSE:MP)

Simply Wall St Growth Rating: ★★★★★☆

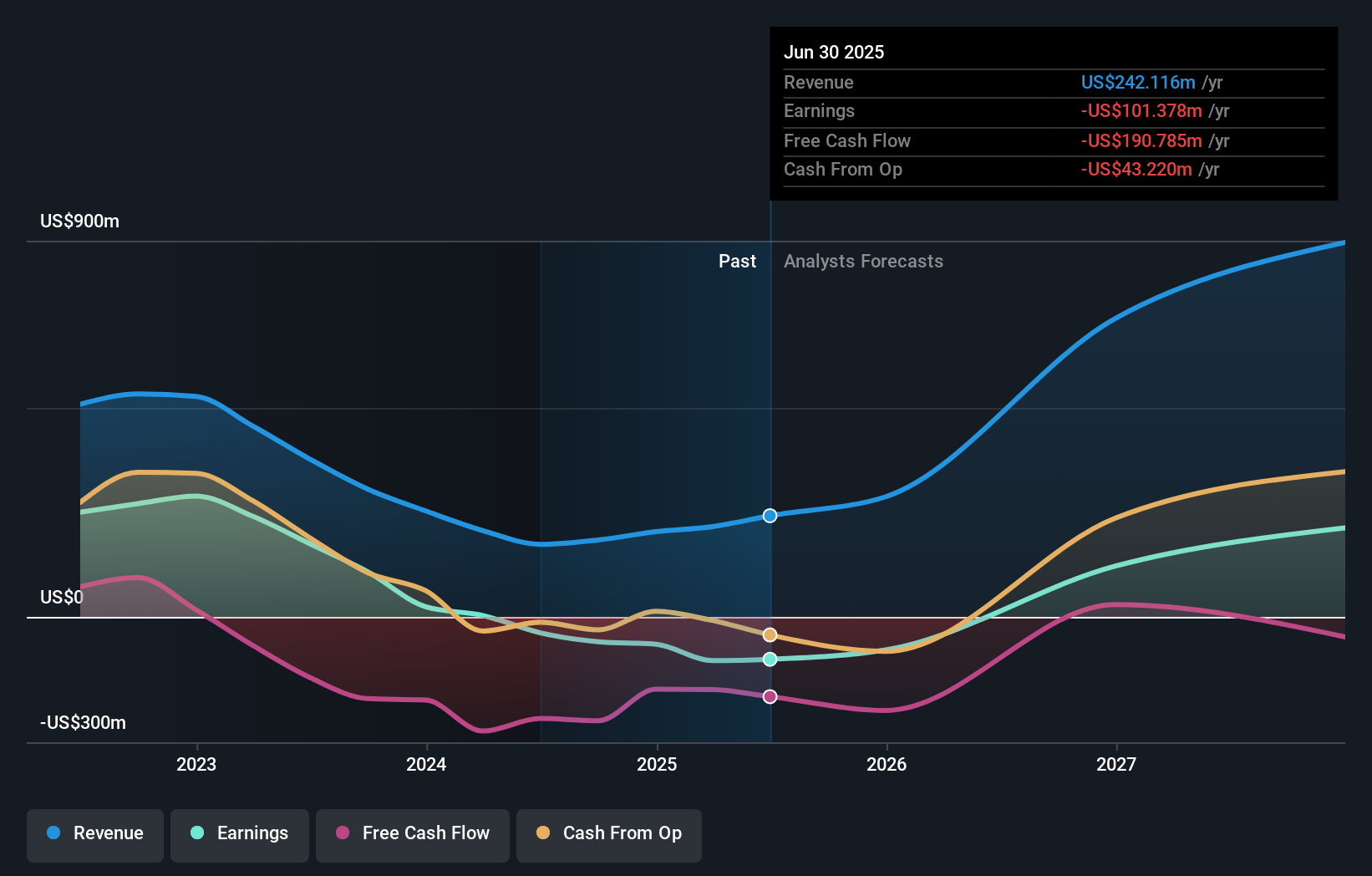

Overview: MP Materials Corp., along with its subsidiaries, is involved in the production of rare earth materials and has a market capitalization of approximately $3.52 billion.

Operations: The company's revenue is derived from its Metals & Mining - Miscellaneous segment, amounting to $184.07 million.

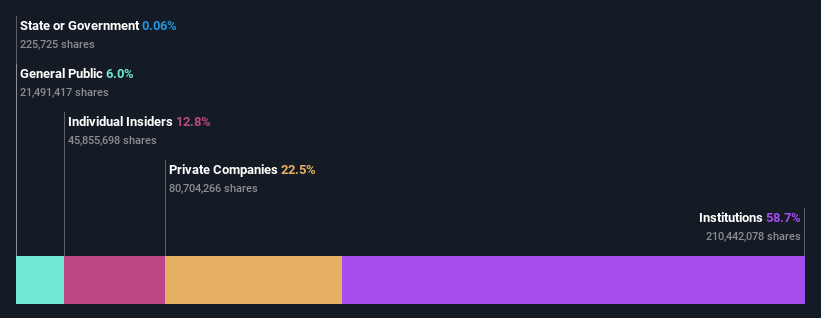

Insider Ownership: 10.9%

MP Materials is positioned for substantial growth, with revenue expected to increase by 36.5% annually, outpacing the US market. The company has achieved significant milestones in restoring the US rare earth magnet supply chain, notably at its Independence facility in Texas. Despite a recent net loss of US$25.52 million and insider selling activity, MP Materials anticipates becoming profitable within three years, supported by its strategic expansion and record production levels at Mountain Pass.

- Dive into the specifics of MP Materials here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that MP Materials is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Fast Growing US Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives