Last Update 08 Mar 25

Fair value Decreased 67%Catalysts

Preliminary Unaudited Revenue and Cash

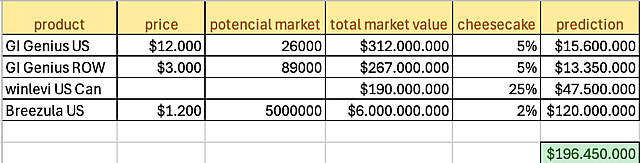

- Revenue: €266.8 million, representing a year-on-year increase of 188% compared to €92.8 million in 2023. This includes significant project-based revenues from GI Genius™ and Winlevi® of €190.2 million.

- Operating profit for fiscal year 2024 was €148.9 million, compared to a restated operating loss of €1.9 million in 2023.

- Gross operating profit (EBITDA) increased by 1,517% year-on-year to €161.2 million.

- Cash, equivalents and investments increased by 239% to €170.4 million, compared to €50.3 million in 2023, with zero debts.

Financial Guide for 2025

The company's forecasts for 2025 are minimal, as it is negotiating licensing agreements, and does not want to give revenue projections based on advanced projects.

Total revenue: €102 – €107 million, of which recurring revenue (royalties and manufacturing revenue) is €85 million to €90 million, reflecting strong performance and double-digit growth of 11% to 17% year-on-year; and project revenues of 17 million euros.

Core business EBITDA: €40 – €42 million, including cost of sales and selling, general and administrative expenses.

Strategic investment in research and development: €40 million, focusing on late- and early-stage assets and AI-driven innovations.

Overall EBITDA, including investments in research and development: Expected to be between €1 million and €3 million.

Cash, equivalents and investments: it is expected to remain above €110 million.

The market has responded to these forecasts with a sharp correction in the share price.

Business and pipeline update

GI Genius™

- The installed base continued to grow in 2024, and now that the U.S. FDA has granted 510(k) clearance for the next-generation Module 300 hardware, powered by Nvidia IGX technology, the devices are ready to launch in the U.S.

- The latest version of Cosmo's polyp detection software is now even more accurate, providing AI-generated information after the procedure, reaffirming Cosmo's leadership in AI-enhanced endoscopy.

- The most recent update also includes a medical-grade tablet for easy interaction with GI Genius, enabling real-time AI feedback and note capture during procedures. The new software interacts with the patient's electronic health record, so clinicians can automatically save and transfer AI-generated notes to their preferred reporting system.

- The AI access platform is moving forward with the launch of a first third-party app in the first half of 2025, specifically focused on upper gastrointestinal (GI) procedures. Further improvements to the platform are expected for the second half of 2025 and throughout 2026.

Winlevi®

- Market Leader: Continues to dominate as the #1 brand name prescription topical acne treatment in the U.S., with over 1.3 million prescriptions written by 17,900+ prescribers since its launch.

- Global expansion: Regulatory approvals were secured in Australia, Singapore, and New Zealand in 2024, with the most recent approvals received in the U.K. and Malaysia this year. The EMA's approval is scheduled for the first half of 2025.

- Commercial growth: Planned launches in 38 countries by the end of 2027.

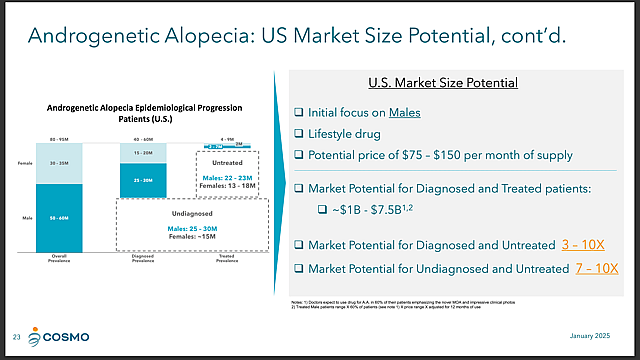

Breezula® Clascoterone Solution for Androgenetic Alopecia (AGA) in Men

- Pipe line progress: Phase III enrollment has now been completed, with 1,495 patients randomized, marking the largest randomized trial conducted by Cosmo to date.

- Key milestone: Semi-annual top-line results are anticipated early in the second half of 2025.

- Breakthrough innovation: The claveterone solution represents the first new mechanism of action (MOA) for AGA in 30 years and is the only topical androgen receptor inhibitor developed for this condition.

- Significant Market Potential: Male AGA affects 30-50% of men by age 50 and represents a potential market size of hundreds of millions of treatments per year. Strategic market research is underway to determine maximum business opportunities.

Other Programs:

- Bile acid diarrhoea (BAD): A phase II proof-of-concept study on the efficacy and safety of Colesevelam MMX is underway in the UK and will be extended to the EU. Obsessive behavior disorder is a major unmet medical need, affecting about 95 million people worldwide, and about 30% of patients with irritable bowel syndrome with diarrhea (IBS-D) suffer from irritable bowel disorder.

- Distal ulcerative colitis (UC) and ulcerative proctitis: A phase II study is underway at 24 centers in seven EU countries to evaluate the enema of 1% rifamycin to induce clinical remission in mild to moderate cases. These conditions affect approximately 3.5 million people worldwide, and 70% of patients with ulcerative colitis experience distal UC or ulcerative proctitis.

- Solid tumors: A Phase I study is progressing well, and is expected to be completed in the second half of 2025. Following this, Cosmo will explore partnerships to align its research and development portfolio with strategic priorities.

Assumptions

Risks

- A lack of information regarding any future partners or acquisitions.

- Increased competition.

- Cosmo’s ability to finance expansion plans.

- The results of Cosmo’s research and development activities.

- The success of Cosmo’s products and partnerships.

- Regulatory, legislative and judicial developments or changes in market and/or overall economic conditions.

Valuation

- The report published by the company on March 6 has caused the share price to fall by 20%, due to the forecast of a decrease in revenues by December 2025 in the absence of a commercial agreement for its new products. This makes me cautious and lower the 3-year growth forecast in the absence of more information.Where do you think the business will be in 5 years? 300M$ (10% a)What do you think your revenue and profit margins will be? 26%What do you think the valuation multiple will be in the future? 15

How well do narratives help inform your perspective?

Disclaimer

The user kapirey has a position in SWX:COPN. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.