- United States

- /

- Banks

- /

- NYSE:TCBX

Exploring Undervalued Small Caps With Insider Action In July 2025

Reviewed by Simply Wall St

The United States market has shown impressive momentum, climbing 1.5% in the last week and boasting an 18% increase over the past year, with earnings projected to grow by 15% annually in the near future. In this thriving environment, identifying small-cap stocks that are perceived as undervalued and have notable insider activity can offer intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 30.68% | ★★★★★★ |

| Industrial Logistics Properties Trust | NA | 0.8x | 36.13% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 47.54% | ★★★★☆☆ |

| Southside Bancshares | 10.8x | 3.6x | 43.68% | ★★★★☆☆ |

| S&T Bancorp | 11.0x | 3.7x | 43.04% | ★★★★☆☆ |

| Gentherm | 33.4x | 0.7x | 42.16% | ★★★★☆☆ |

| Farmland Partners | 6.9x | 8.4x | 0.86% | ★★★★☆☆ |

| Montrose Environmental Group | NA | 1.1x | 32.59% | ★★★★☆☆ |

| Shore Bancshares | 10.1x | 2.6x | -16.66% | ★★★☆☆☆ |

| MVB Financial | 15.8x | 2.1x | 25.90% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Domo (DOMO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Domo is a software company specializing in cloud-based business intelligence and data visualization solutions, with a market cap of approximately $0.50 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, reaching $317.05 million recently. The gross profit margin has shown a trend of improvement over time, currently at 74.47%. Operating expenses are significant, with Sales & Marketing and R&D being the largest components.

PE: -8.7x

Domo, a small-cap tech company, has been actively expanding partnerships and enhancing its AI-driven data platform. Recently added to multiple Russell Value indices in June 2025, it showcases potential for value-focused investors. Despite a net loss of US$18 million in Q1 2025, down from US$26 million the previous year, Domo's collaborations with firms like Snowflake and Later highlight strategic growth efforts. Insider confidence is evident with recent purchases made by executives within the past quarter.

- Delve into the full analysis valuation report here for a deeper understanding of Domo.

Review our historical performance report to gain insights into Domo's's past performance.

Third Coast Bancshares (TCBX)

Simply Wall St Value Rating: ★★★★★☆

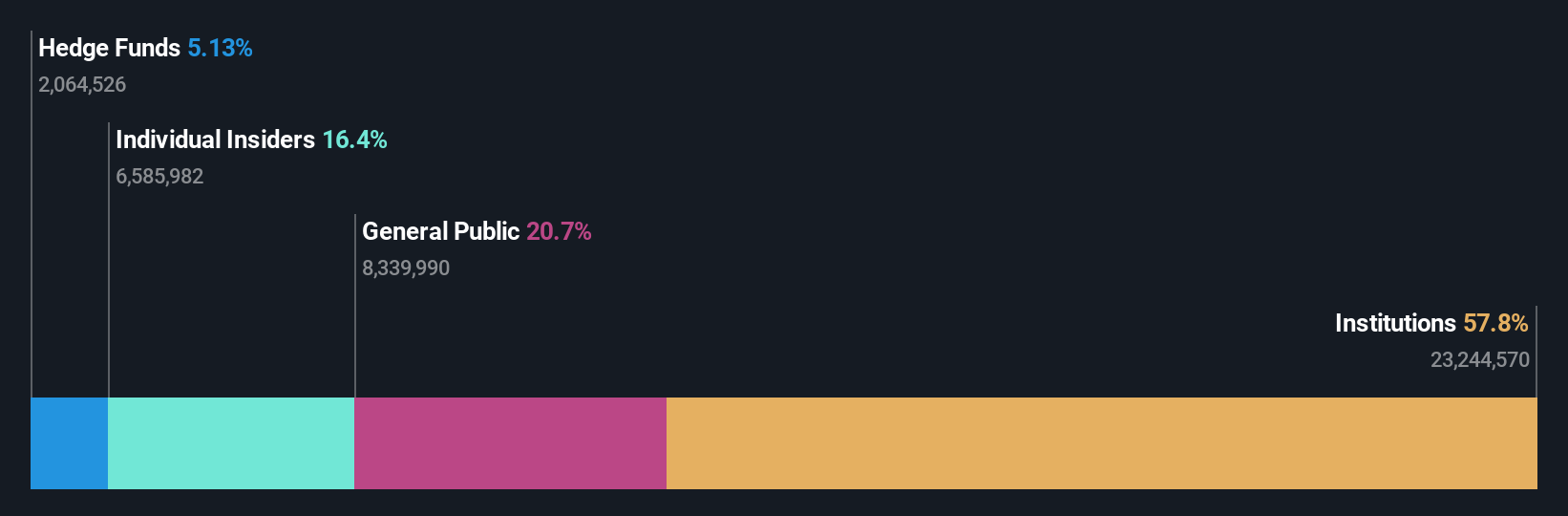

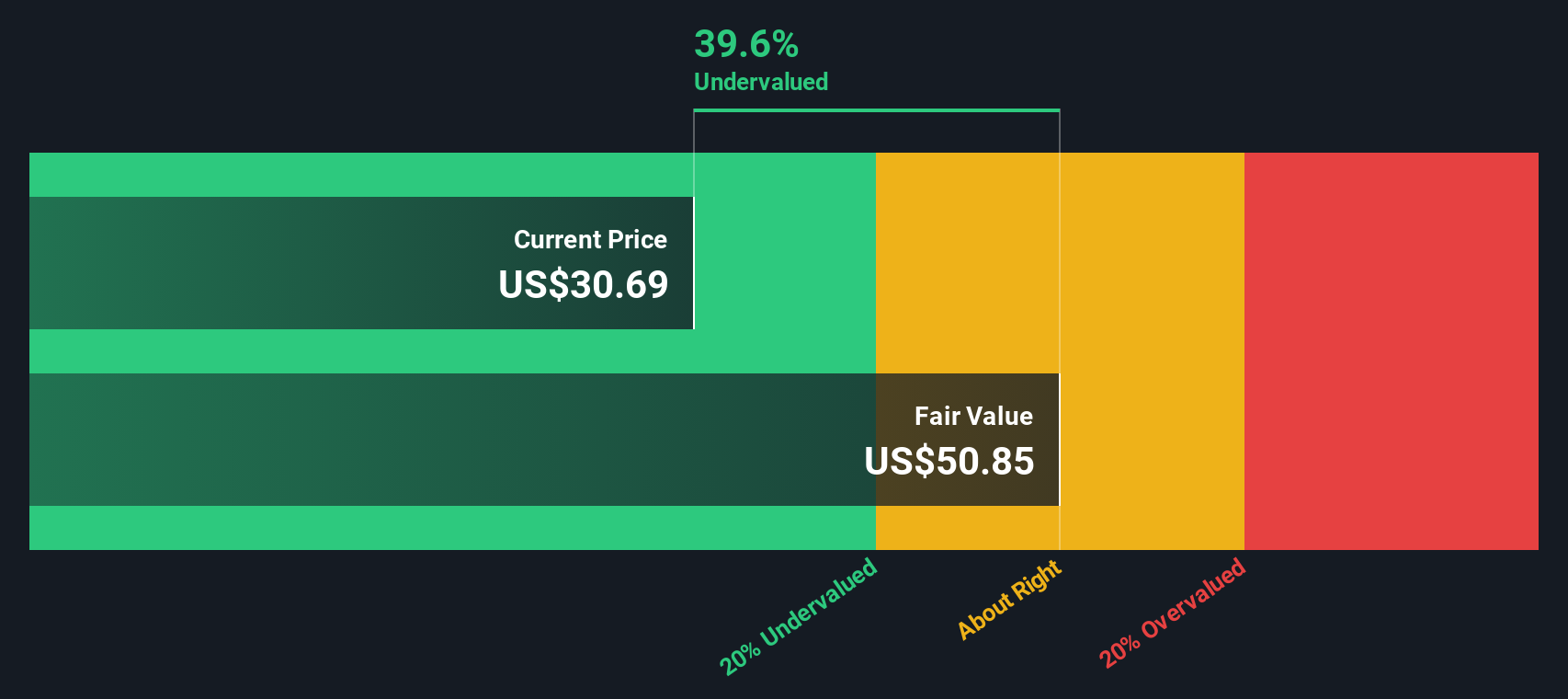

Overview: Third Coast Bancshares operates as a community banking institution, focusing on providing a range of financial services, with a market capitalization of $0.25 billion.

Operations: The company generates revenue primarily through its community banking operations, with recent figures reaching $182.32 million. Operating expenses are a significant component of costs, totaling $108.61 million in the latest period, with general and administrative expenses making up the largest portion at $93.78 million. The net income margin has shown an upward trend, reaching 28.57% in the most recent period analyzed.

PE: 9.9x

Third Coast Bancshares, a smaller player in the U.S. market, has shown promising financial growth with net income rising to US$16.75 million for Q2 2025, up from US$10.8 million the previous year. Insider confidence is evident as an insider acquired 10,000 shares valued at approximately US$292K in June 2025. Earnings are projected to grow annually by over 9%. The company also announced a share repurchase program worth up to US$30 million through May 2026, indicating potential value appreciation strategies despite recent charge-offs of about US$2.4 million for Q2 2025.

- Click here to discover the nuances of Third Coast Bancshares with our detailed analytical valuation report.

Evaluate Third Coast Bancshares' historical performance by accessing our past performance report.

Herbalife (HLF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements, weight management products, and personal care items, with a market presence in various countries including China, India, Mexico, and the United States.

Operations: Herbalife generates revenue primarily from five geographic segments, with the largest contributions coming from 'Others' at $2.27 billion and the United States at $1.02 billion. The company's cost of goods sold (COGS) significantly impacts its gross profit, which has shown a varied trend over recent periods, with a gross profit margin reaching 45.38% as of March 2025. Operating expenses are predominantly driven by general and administrative costs, consistently forming a large portion of total expenses over time.

PE: 3.5x

Herbalife, a smaller company in the wellness sector, has caught attention with its recent product launch, MultiBurn™, which aligns with consumer trends towards non-pharmaceutical health solutions. Despite being dropped from several indices in June 2025 and facing declining earnings forecasts of 9.2% annually over three years, the company reported improved net income for Q1 2025 at US$50.4 million compared to US$24.3 million a year prior. The company's commitment to quality is reflected in its AOAC-certified method for aloe vera products, ensuring high safety standards across their offerings.

- Dive into the specifics of Herbalife here with our thorough valuation report.

Gain insights into Herbalife's past trends and performance with our Past report.

Taking Advantage

- Dive into all 74 of the Undervalued US Small Caps With Insider Buying we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Third Coast Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TCBX

Third Coast Bancshares

Operates as the bank holding company for Third Coast Bank that provides various commercial banking solutions to small and medium-sized businesses and professionals in the United States.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)