- United States

- /

- Consumer Finance

- /

- NYSE:QD

3 Undiscovered Gems In The US Market With Promising Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.4% drop, yet it remains up by 11% over the past year with earnings forecasted to grow annually by 14%. In light of these conditions, uncovering stocks with strong fundamentals and growth prospects can be key to identifying promising opportunities in this dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jiayin Group (NasdaqGM:JFIN)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiayin Group Inc., listed on NasdaqGM under the ticker JFIN, operates in the online consumer finance sector within China and has a market capitalization of $672.46 million.

Operations: Jiayin Group generates revenue primarily from its online consumer finance services, with reported earnings of CN¥5.80 billion.

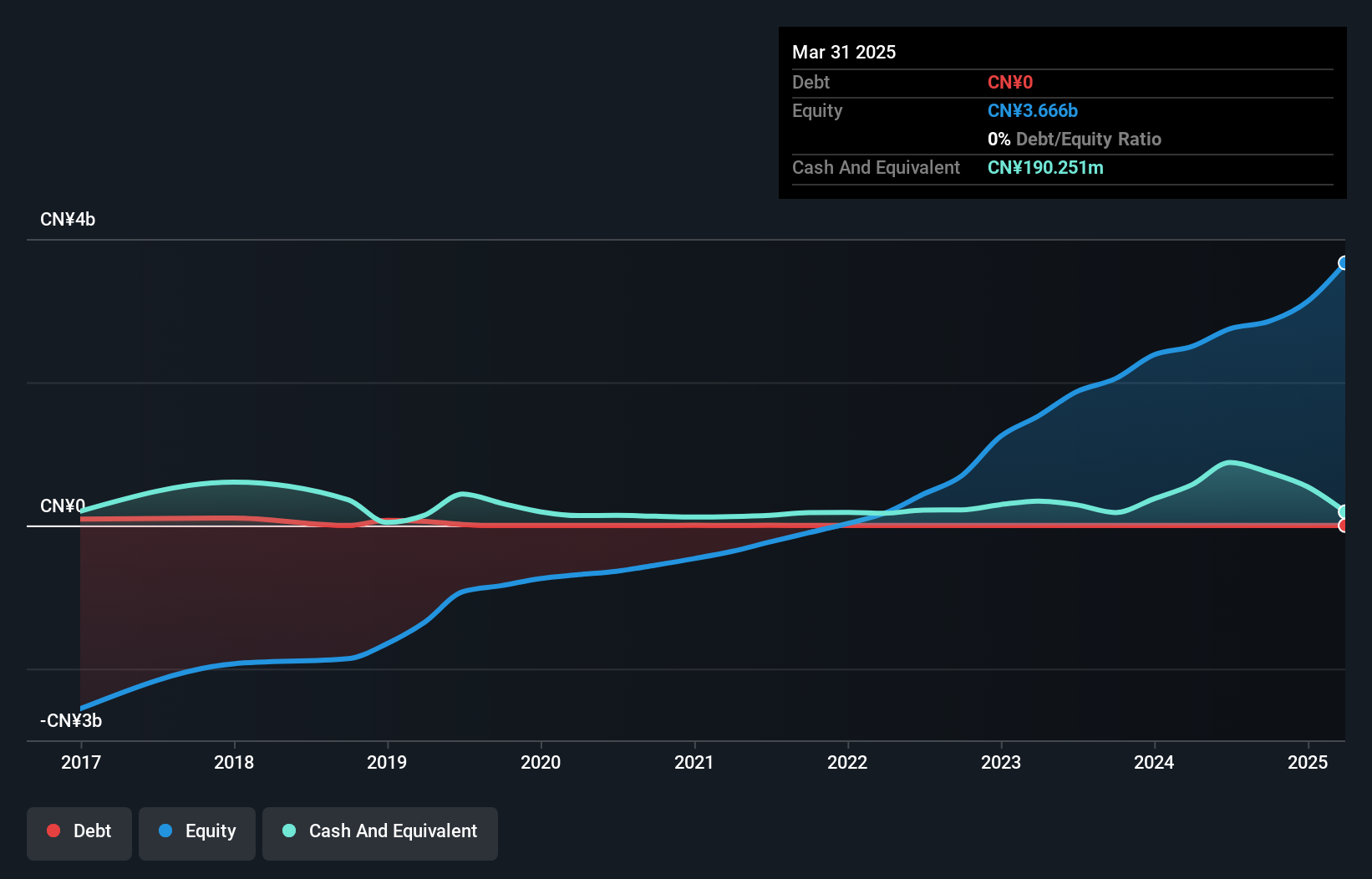

Jiayin Group, a nimble player in the finance sector, is trading at 69.5% below its estimated fair value, offering an intriguing opportunity for investors. Despite having no debt and high-quality earnings, the company experienced negative earnings growth of -18.6% over the past year compared to the industry average of 14.9%. Recently, Jiayin announced dividends of US$0.20 per share and completed a buyback of 7.1% shares for US$16.8 million from June 2022 to March 2025. While net income dipped from CNY1,297 million to CNY1,056 million in 2024, dividends remain a focus with policy adjustments promising potential future returns.

- Dive into the specifics of Jiayin Group here with our thorough health report.

Explore historical data to track Jiayin Group's performance over time in our Past section.

Qudian (NYSE:QD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qudian Inc. is a consumer-oriented technology company based in the People’s Republic of China, with a market cap of $460.70 million.

Operations: Qudian generates revenue primarily through its Installment Credit Services, which contributed CN¥216.43 million. The company's financial performance is reflected in its net profit margin trends, providing insights into operational efficiency and profitability.

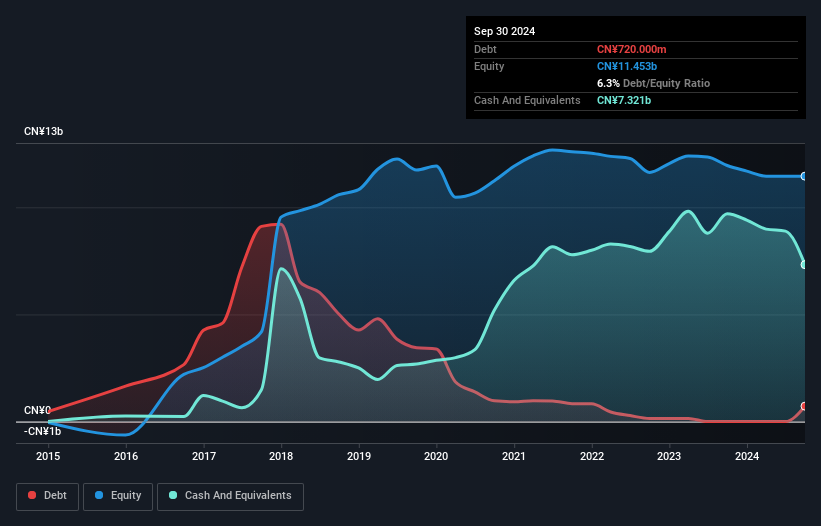

Qudian, a smaller player in the consumer finance sector, has shown impressive earnings growth of 134% over the past year, outpacing the industry average of 15%. Despite this surge, its earnings have fallen by 57.5% annually over five years. The company's debt-to-equity ratio improved significantly from 28.4% to 6.4%, indicating better financial management. However, Qudian posted a net loss of CNY 66 million for Q4 2024 compared to CNY 117 million previously. Recent buybacks saw the company repurchase about 9% of its shares for $41.2 million, reflecting confidence in its valuation and potential recovery prospects.

- Take a closer look at Qudian's potential here in our health report.

Examine Qudian's past performance report to understand how it has performed in the past.

X Financial (NYSE:XYF)

Simply Wall St Value Rating: ★★★★★☆

Overview: X Financial operates as an online personal finance company in the People's Republic of China, with a market cap of $734.44 million.

Operations: X Financial generates revenue primarily through its online personal finance services in China. The company reported a market cap of $734.44 million, reflecting its valuation in the financial market.

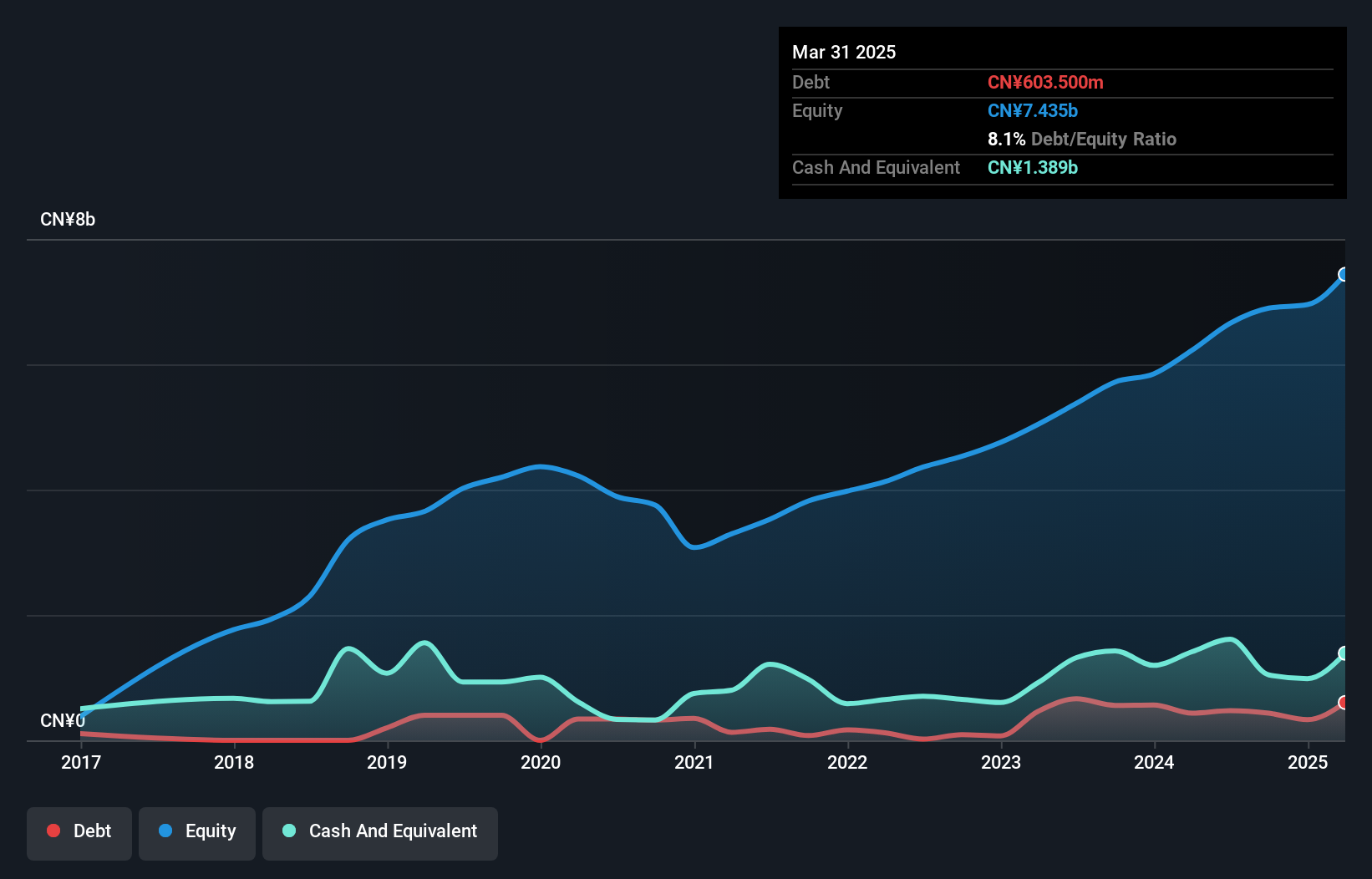

X Financial, a player in the consumer finance sector, has shown impressive growth with its earnings rising by 29.2% over the past year, outperforming the industry average of 14.9%. Despite this growth, its financial results were impacted by a significant one-off loss of CN¥2.3 billion as of March 31, 2025. The company trades at a substantial discount to its estimated fair value by about 60.6%, suggesting potential for value investors. Recently announced share repurchase programs and consistent dividend payments underscore management's confidence in future prospects while offering returns to shareholders through buybacks and dividends alike.

- Click here to discover the nuances of X Financial with our detailed analytical health report.

Gain insights into X Financial's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 285 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qudian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QD

Qudian

Operates as a consumer-oriented technology company in the People’s Republic of China.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives