- United States

- /

- Banks

- /

- NYSE:LOB

US Growth Companies With Insider Ownership To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable downturn, driven by significant declines in major technology stocks, investors are closely monitoring the broader implications for growth companies. In this environment, companies with high insider ownership can offer unique insights into potential resilience and long-term value, making them particularly interesting to watch as we approach December 2024.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.8% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Spotify Technology (NYSE:SPOT) | 17.6% | 29.7% |

Underneath we present a selection of stocks filtered out by our screen.

Nordstrom (NYSE:JWN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordstrom, Inc. is a fashion retailer offering apparel, shoes, beauty products, accessories, and home goods for all age groups with a market cap of approximately $3.99 billion.

Operations: Nordstrom's revenue is primarily derived from its fashion retail offerings, which include apparel, shoes, beauty products, accessories, and home goods for a diverse customer base.

Insider Ownership: 25.3%

Earnings Growth Forecast: 21.3% p.a.

Nordstrom, Inc. is expanding its Nordstrom Rack footprint with new locations across the U.S., supporting its "Closer to You" strategy. Despite a high level of debt and an unstable dividend track record, the company shows strong earnings growth potential, forecasted at 21.33% annually, outpacing the US market average. Recent earnings reports indicate revenue growth but declining net income year-over-year. Insider ownership remains substantial without significant insider trading activity recently noted.

- Click here and access our complete growth analysis report to understand the dynamics of Nordstrom.

- Upon reviewing our latest valuation report, Nordstrom's share price might be too pessimistic.

Live Oak Bancshares (NYSE:LOB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Live Oak Bancshares, Inc. is the bank holding company for Live Oak Banking Company, offering a range of banking products and services in the United States with a market cap of approximately $1.78 billion.

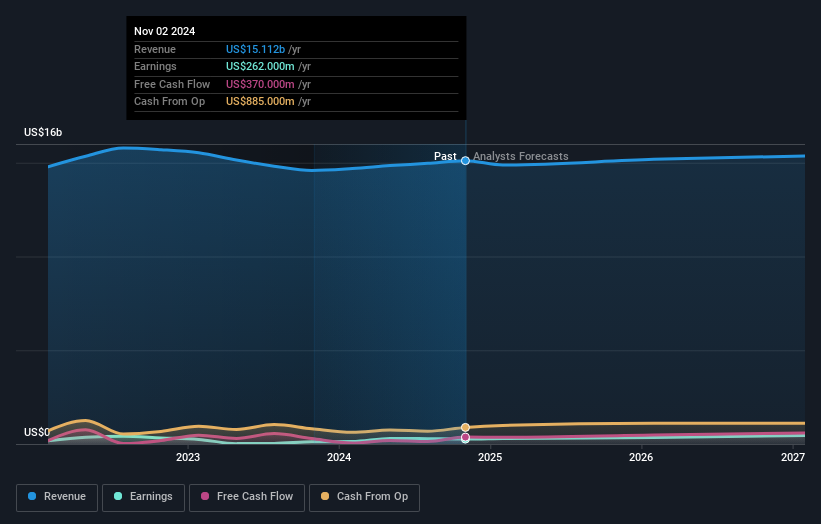

Operations: The company's revenue segments include $415.44 million from banking and $4.23 million from fintech operations.

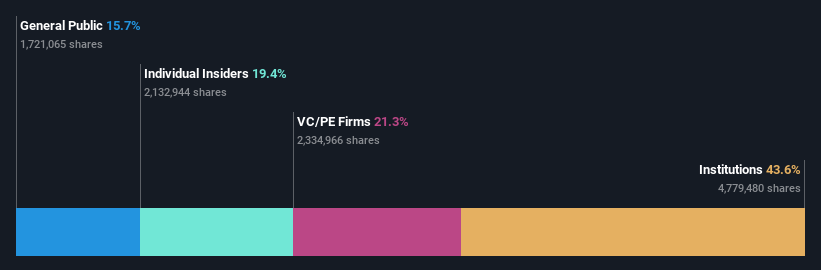

Insider Ownership: 23.7%

Earnings Growth Forecast: 31.4% p.a.

Live Oak Bancshares shows potential with forecasted earnings growth of 31.4% annually, surpassing the US market average. Despite a high level of bad loans at 2.8%, the company maintains a low allowance for these loans at 61%. Recent financial results indicate increasing net interest income but declining quarterly net income year-over-year. Insider ownership is significant, with more shares bought than sold in recent months, though no substantial buying occurred in the past quarter.

- Unlock comprehensive insights into our analysis of Live Oak Bancshares stock in this growth report.

- In light of our recent valuation report, it seems possible that Live Oak Bancshares is trading behind its estimated value.

MoneyLion (NYSE:ML)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MoneyLion Inc. is a financial technology company that offers personalized financial products and content to American consumers, with a market cap of approximately $961.14 million.

Operations: The company generates revenue from its data processing segment, amounting to $500.28 million.

Insider Ownership: 20.4%

Earnings Growth Forecast: 89.9% p.a.

MoneyLion's growth trajectory is underscored by expected annual earnings growth of 89.88%, outpacing the US market average. Recent financials reveal profitability with a net income of US$7.42 million for the first nine months of 2024, compared to a loss previously. Insider ownership remains significant, with more shares bought than sold recently. The company is set to be acquired by Gen Digital Inc., which could influence its strategic direction and shareholder value moving forward.

- Dive into the specifics of MoneyLion here with our thorough growth forecast report.

- The valuation report we've compiled suggests that MoneyLion's current price could be inflated.

Next Steps

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 198 more companies for you to explore.Click here to unveil our expertly curated list of 201 Fast Growing US Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential with solid track record.