- United States

- /

- Consumer Services

- /

- NasdaqGS:PRDO

Discovering Undiscovered Gems with Strong Potential This December 2024

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has achieved a remarkable 24% increase over the past year with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong potential involves seeking out companies that are not only resilient but also poised to capitalize on these favorable growth trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IRADIMED (NasdaqGM:IRMD)

Simply Wall St Value Rating: ★★★★★★

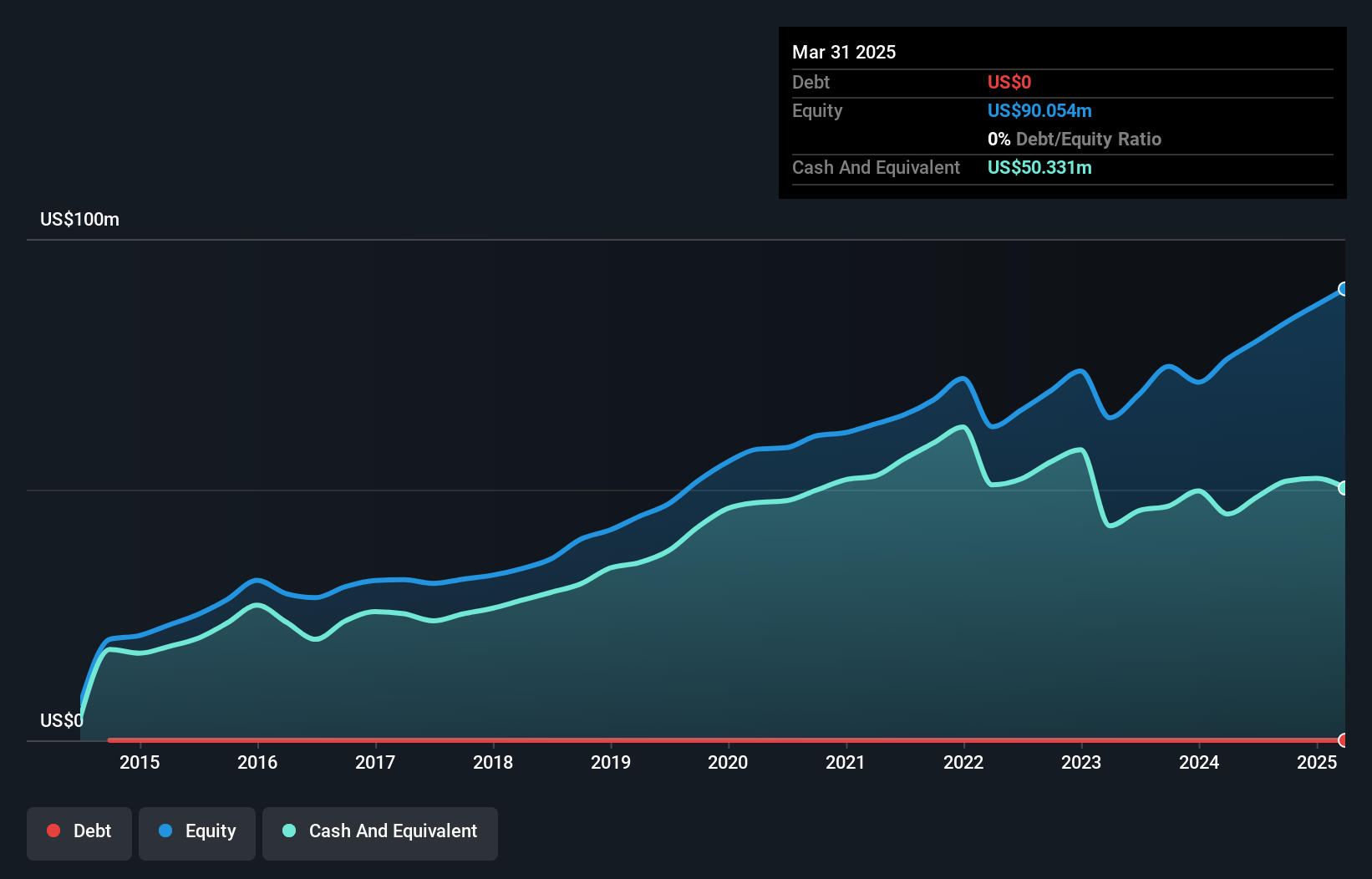

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services in the United States and internationally with a market cap of $692.86 million.

Operations: IRADIMED generates revenue primarily from its patient monitoring equipment, totaling $71.31 million. The company's financial performance is reflected in its gross profit margin, which stands at 76.5%.

IRADIMED, a nimble player in the medical equipment sector, showcases a robust financial profile with no debt and high-quality earnings. Its earnings have grown 27.7% annually over the past five years, yet recent insider selling could signal caution. Trading at 45.4% below fair value estimates suggests potential upside, though its earnings growth of 14.1% lagged slightly behind industry peers last year. The company anticipates revenue between $72.7 million and $73.1 million for 2024 and has raised its EPS guidance to $1.49-$1.52, reflecting confidence in strategic initiatives like their new MRI-compatible pump launch slated for late 2025.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

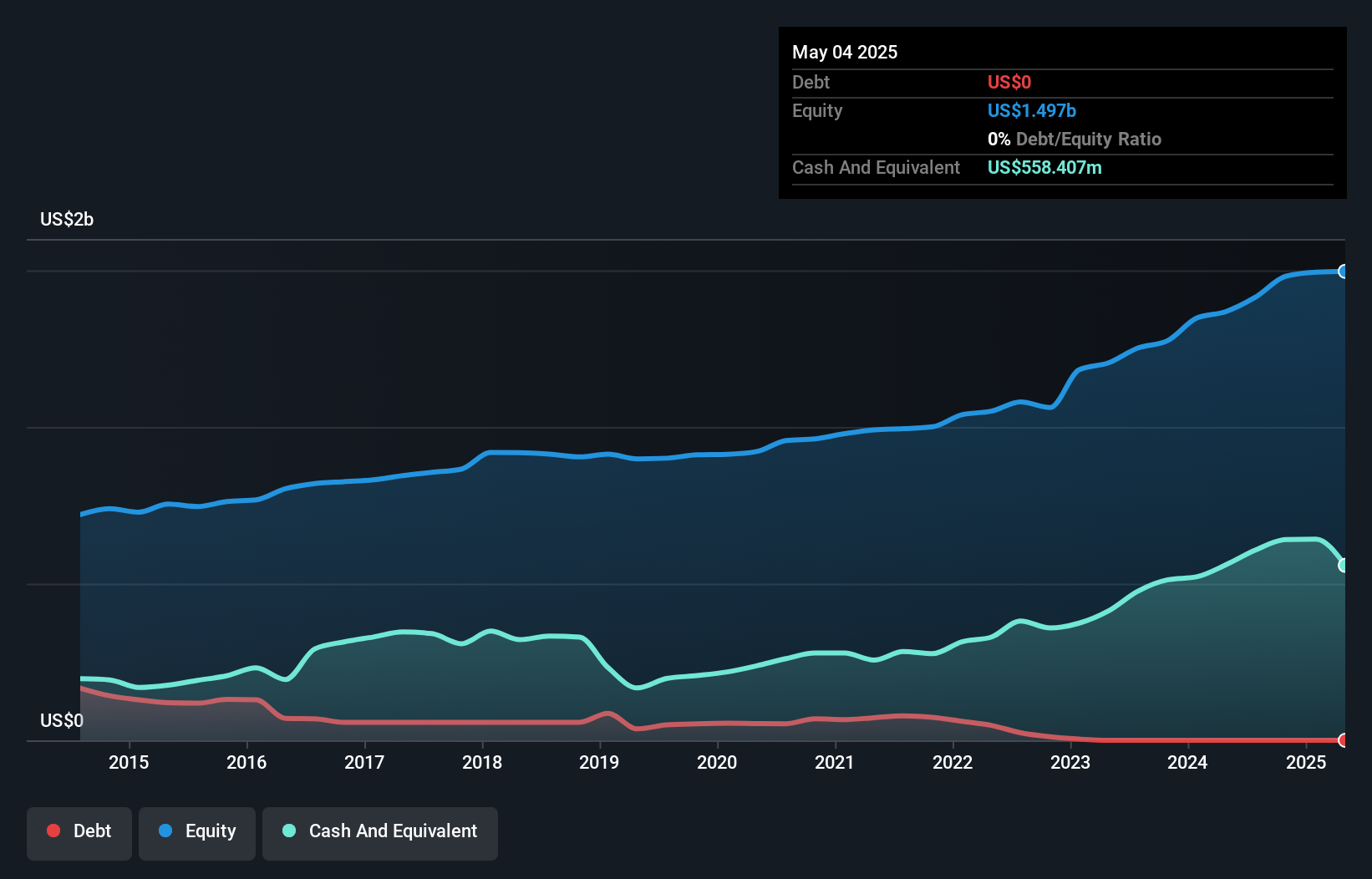

Overview: Photronics, Inc. is a company that manufactures and sells photomask products and services across various regions including the United States, Taiwan, China, Korea, Europe, and other international markets with a market cap of approximately $1.51 billion.

Operations: Photronics generates revenue primarily from the manufacture of photomasks, with reported sales of $866.95 million. The company's financial performance can be analyzed through its net profit margin trends, which provide insight into profitability relative to total revenue.

Photronics, a nimble player in the semiconductor space, has no debt today compared to a 5.8% debt-to-equity ratio five years ago. Its earnings grew by 4.1% last year, outpacing the industry average of -3.6%. Despite significant insider selling recently, the company trades at nearly 30% below its estimated fair value and boasts high-quality earnings. While strategically expanding in China and investing $200 million into U.S. capacity for ICs, geopolitical risks could impact margins slightly as analysts foresee annual revenue growth of 6.3%, with profits reaching $151 million by late 2027.

Perdoceo Education (NasdaqGS:PRDO)

Simply Wall St Value Rating: ★★★★★★

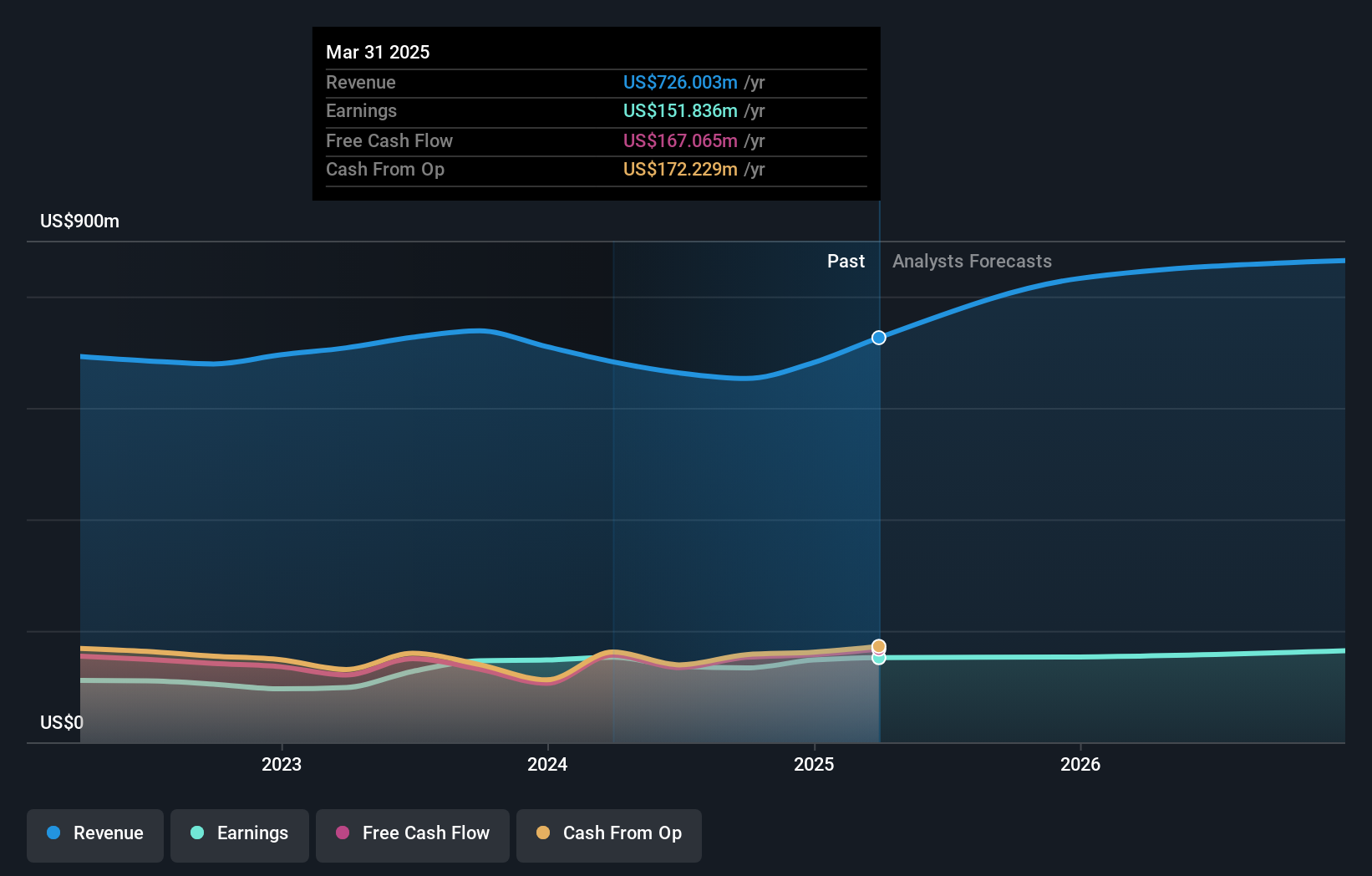

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States, with a market cap of $1.73 billion.

Operations: The company generates revenue primarily from its two main segments: Colorado Technical University (CTU) with $446.73 million and American InterContinental University (AIUS) with $205.29 million.

Perdoceo Education, a small cap contender in the education sector, is trading significantly below its estimated fair value by 57.3%, presenting a potential opportunity for investors. Despite a recent earnings drop of 9% against an industry average growth of 34.8%, it remains debt-free with high-quality past earnings and positive free cash flow. The company reported third-quarter revenue at US$169.83 million and net income at US$38.26 million, slightly lower than the previous year’s figures but still maintaining profitability with basic EPS from continuing operations at US$0.58 compared to US$0.63 last year, indicating resilience amidst operational shifts and strategic acquisitions like the University of St Augustine aimed at diversifying revenue streams and improving efficiency through tech investments.

Seize The Opportunity

- Click this link to deep-dive into the 245 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRDO

Perdoceo Education

Provides postsecondary education through online, campus-based, and blended learning programs in the United States.

Flawless balance sheet and undervalued.