- United States

- /

- IT

- /

- NasdaqGS:VNET

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has been flat yet it has shown a robust 24% increase over the past year with earnings expected to grow by 15% annually in the coming years. In this dynamic environment, identifying high growth tech stocks that align with these optimistic projections can be crucial for investors seeking opportunities in sectors poised for expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Grid Dynamics Holdings (NasdaqCM:GDYN)

Simply Wall St Growth Rating: ★★★★☆☆

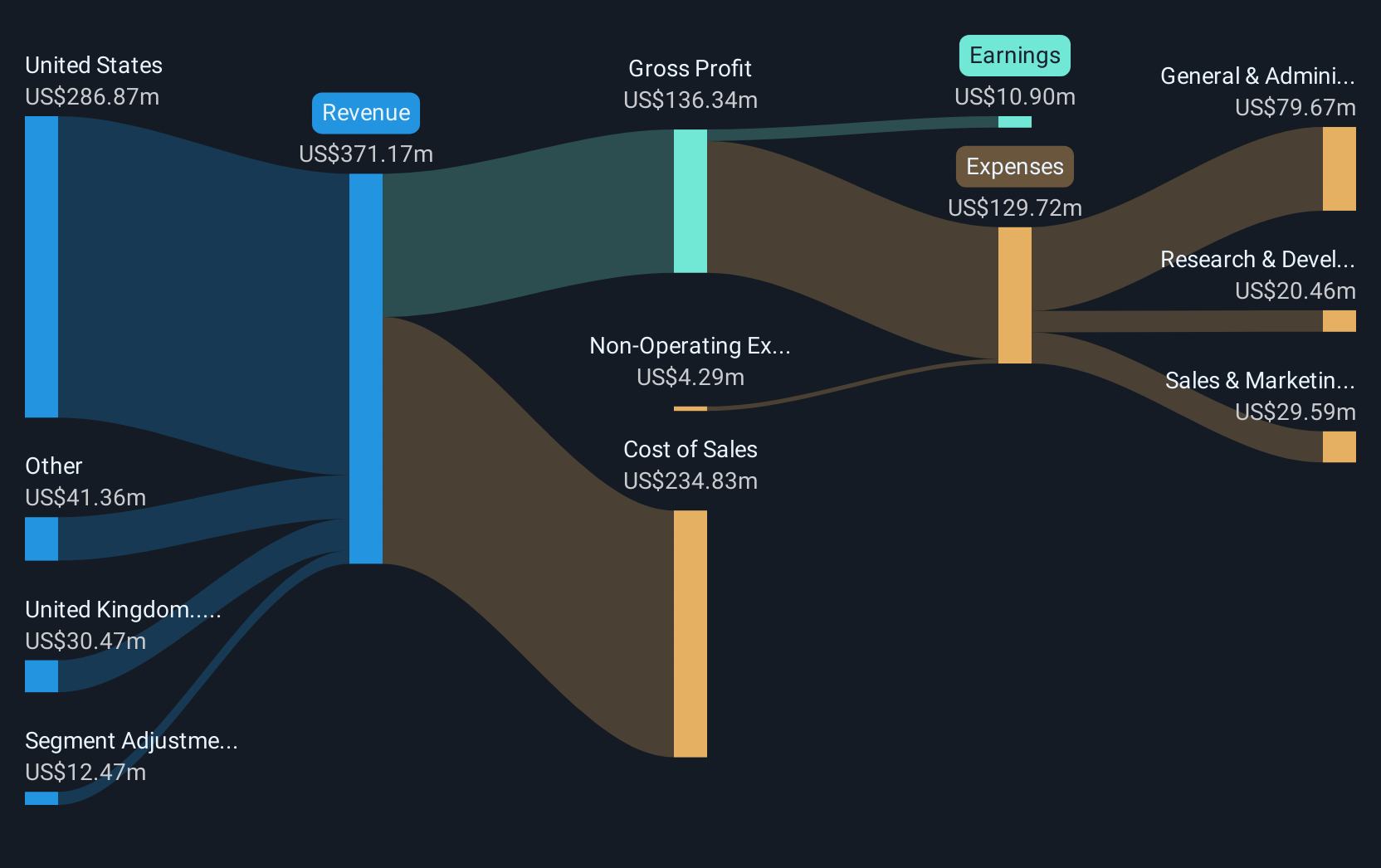

Overview: Grid Dynamics Holdings, Inc. offers technology consulting, platform and product engineering, and analytics services across North America, Europe, and internationally with a market cap of approximately $1.89 billion.

Operations: Specializing in computer services, Grid Dynamics Holdings generates revenue of $328.36 million through its technology consulting and engineering solutions across various regions.

Grid Dynamics Holdings, Inc. (GDYN) has demonstrated robust growth with a notable 17% annual revenue increase and an impressive 81.3% forecasted annual earnings growth, outpacing the US market averages of 9.2% and 15.3%, respectively. Recently, the firm launched a developer portal to enhance software lifecycle management, reflecting its commitment to innovation in tech solutions. This move aligns with industry trends towards streamlined development processes and could significantly boost client productivity and project management efficiency. Despite some challenges like a one-off loss of $4.2 million affecting recent financial results, GDYN's strategic initiatives suggest strong future prospects in high-tech environments.

- Click here and access our complete health analysis report to understand the dynamics of Grid Dynamics Holdings.

Understand Grid Dynamics Holdings' track record by examining our Past report.

Ardelyx (NasdaqGM:ARDX)

Simply Wall St Growth Rating: ★★★★★★

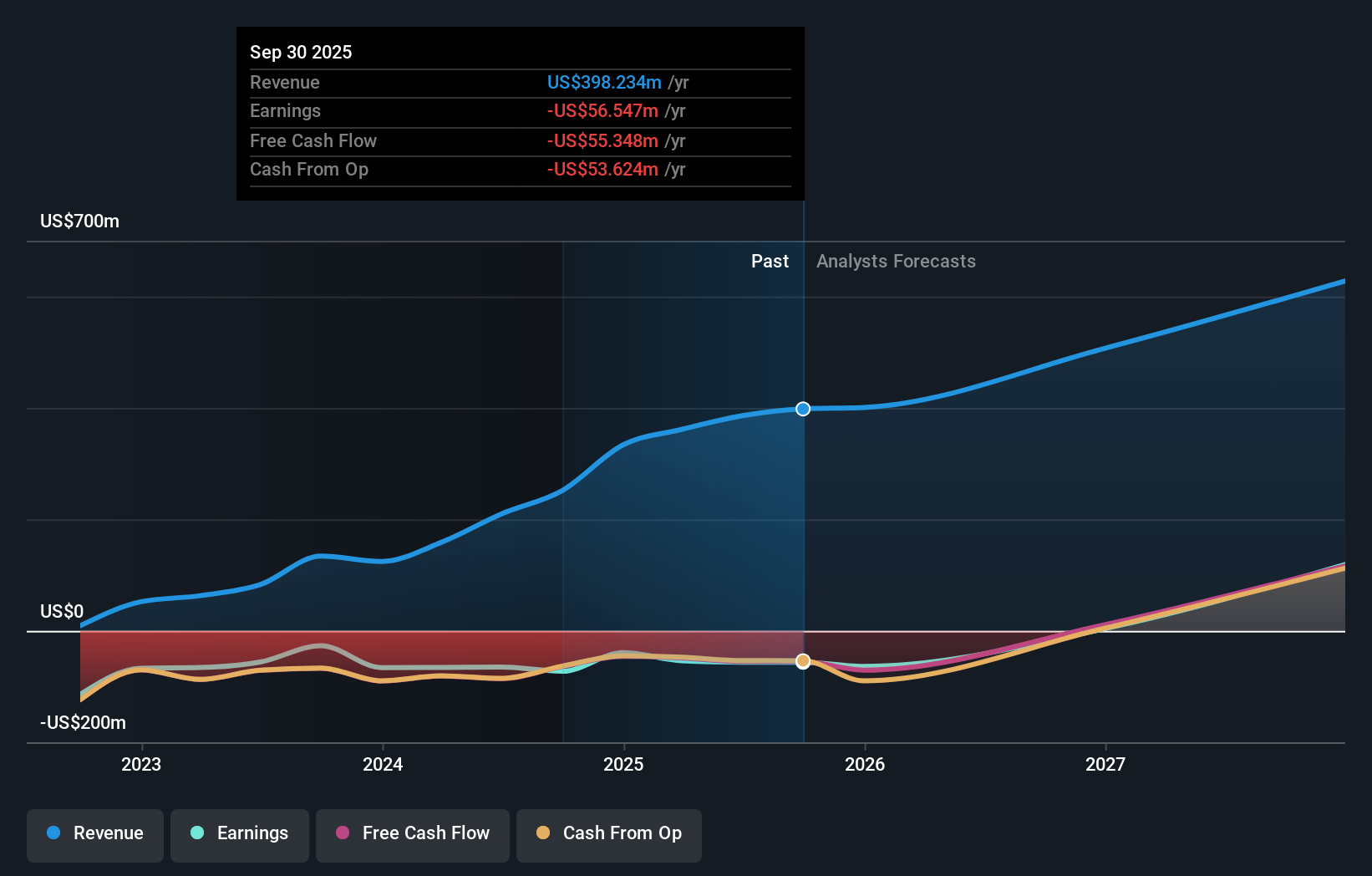

Overview: Ardelyx, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for gastrointestinal and cardiorenal therapeutic areas in the United States and internationally, with a market cap of $1.23 billion.

Operations: The company generates revenue primarily from the development and commercialization of biopharmaceutical products, amounting to $251.85 million. Its operations are centered on addressing gastrointestinal and cardiorenal health issues, catering to both domestic and international markets.

Ardelyx, Inc. has been navigating a transformative phase with substantial revenue growth reported at 25.5% annually, significantly outpacing the broader US market average of 9.2%. This surge is primarily driven by innovative treatments like XPHOZAH®, a pioneering phosphate absorption inhibitor for kidney disease patients, underscoring Ardelyx's commitment to addressing complex medical needs through distinct mechanisms of action. Despite facing challenges such as a recent net loss of $43.78 million and share dilution over the past year, the company's strategic presentations at major healthcare conferences and robust pipeline developments signal strong potential for future profitability and market influence in biotechnology, particularly as it moves towards an anticipated profit growth rate of 69.63% annually within three years.

- Click here to discover the nuances of Ardelyx with our detailed analytical health report.

Evaluate Ardelyx's historical performance by accessing our past performance report.

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

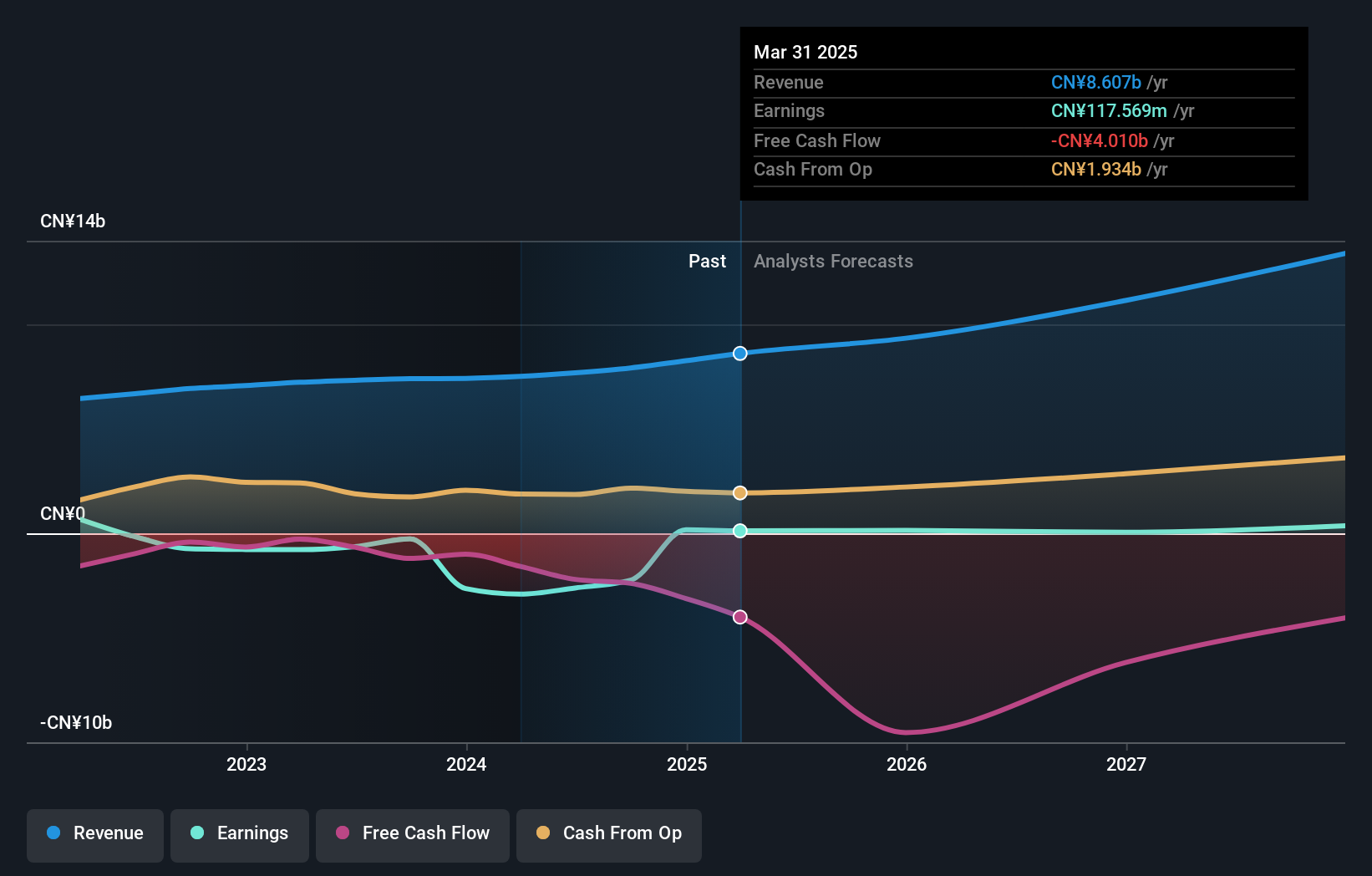

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China, with a market capitalization of $1.14 billion.

Operations: The company generates revenue primarily from hosting and related services, amounting to CN¥7.91 billion.

VNET Group's recent strategic alliance to form a pre-REITs fund targeting hyperscale data centers in China underscores its innovative approach to capitalizing on infrastructure growth, with an initial investment valued at approximately $828.3 million. This move complements their robust Q3 earnings, where sales rose to CNY 2.12 billion, up from CNY 1.89 billion year-over-year, and net income turned positive at CNY 317.63 million compared to a loss previously. The company has raised its full-year revenue guidance by up to 9.3%, reflecting confidence in sustained growth amidst volatile market conditions.

- Navigate through the intricacies of VNET Group with our comprehensive health report here.

Explore historical data to track VNET Group's performance over time in our Past section.

Where To Now?

- Gain an insight into the universe of 236 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Undervalued with reasonable growth potential.