- United States

- /

- Capital Markets

- /

- NYSE:VRTS

Top Dividend Stocks On US Exchanges For December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences a broad-based sell-off, with significant declines in major indices like the Dow Jones and S&P 500, investors are increasingly seeking stability amidst volatility. In such uncertain times, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to balance risk and reward.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.31% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.70% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.59% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.71% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.86% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.53% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.81% | ★★★★★★ |

Click here to see the full list of 157 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

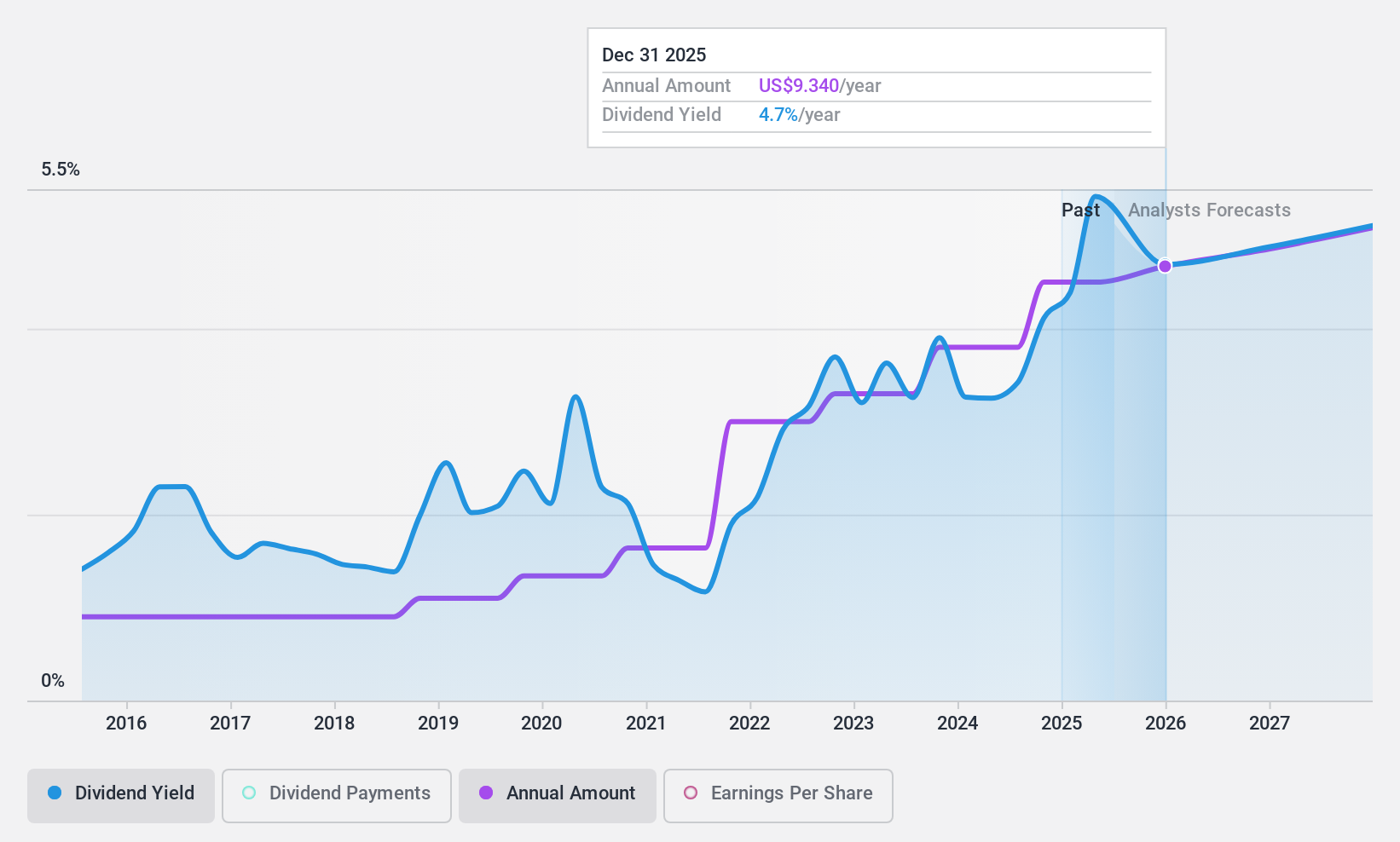

Ennis (NYSE:EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. manufactures and sells business forms and other business products in the United States with a market cap of approximately $547.38 million.

Operations: Ennis, Inc. generates revenue primarily from its Print segment, which accounts for $399.35 million.

Dividend Yield: 4.8%

Ennis, Inc. offers a compelling dividend profile with a reliable history of payments over the past decade and a current yield of 4.75%, placing it among the top 25% in the US market. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 62.9% and 41.2%, respectively. Despite recent sales declines, Ennis affirmed its quarterly dividend at $0.25 per share, highlighting its commitment to returning value to shareholders.

- Click here to discover the nuances of Ennis with our detailed analytical dividend report.

- Our expertly prepared valuation report Ennis implies its share price may be lower than expected.

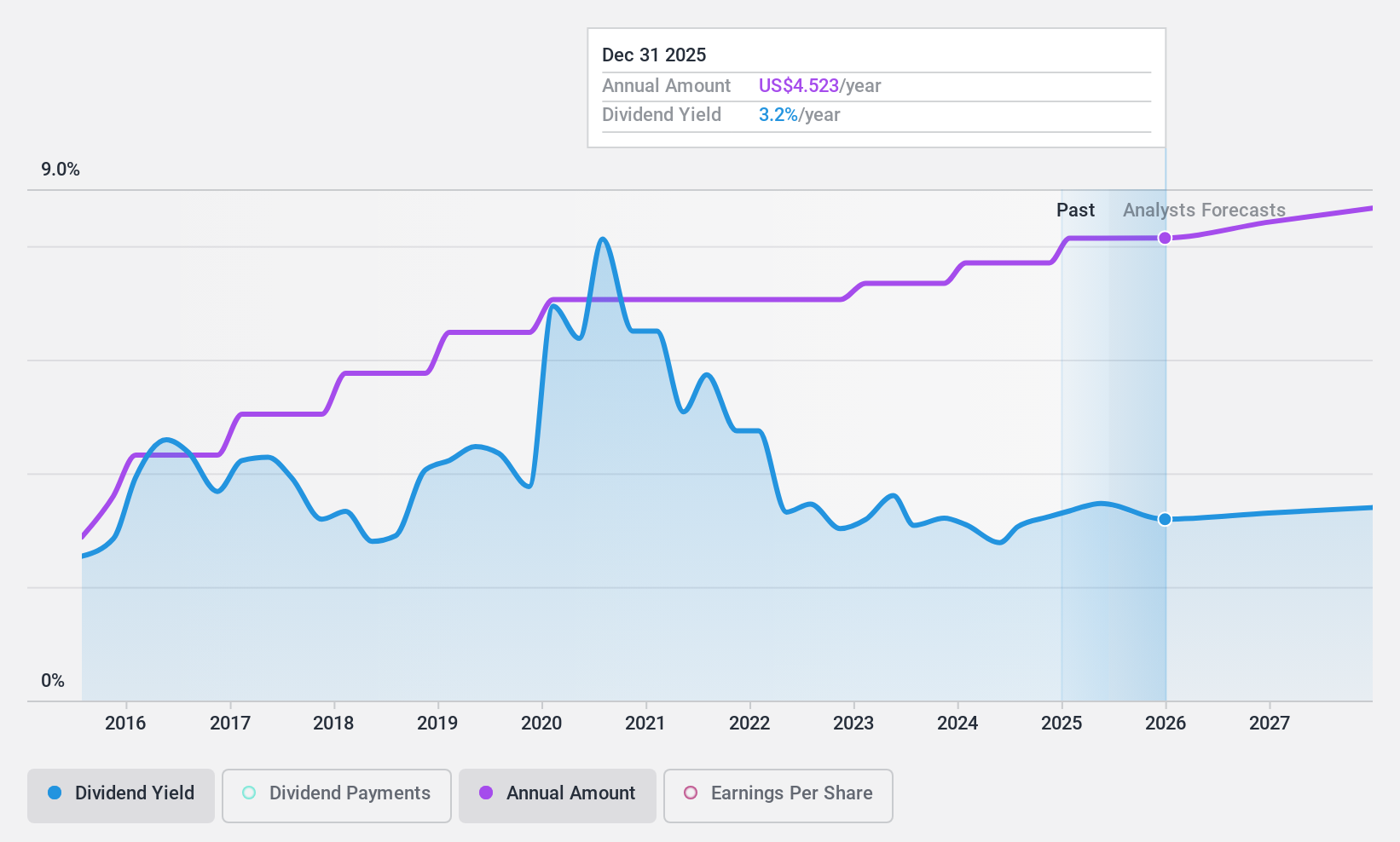

Valero Energy (NYSE:VLO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valero Energy Corporation is involved in the manufacturing, marketing, and selling of petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, the UK, Ireland, Latin America, Mexico, Peru, and globally; it has a market cap of approximately $37.86 billion.

Operations: Valero Energy's revenue segments include Ethanol at $4.70 billion, Renewable Diesel at $5.45 billion, and Refining (including VLP and excluding Renewable Diesel) at $128.08 billion.

Dividend Yield: 3.6%

Valero Energy's dividends have been stable and growing over the past decade, supported by a low payout ratio of 37.5% and cash payout ratio of 22.6%. Despite recent declines in sales and net income, Valero affirmed its quarterly dividend at US$1.07 per share. The company trades below estimated fair value, offering good relative value compared to peers. Recent leadership changes include the retirement of Executive Chairman Joseph W. Gorder, with CEO R. Lane Riggs becoming Chairman effective December 31, 2024.

- Get an in-depth perspective on Valero Energy's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Valero Energy's current price could be quite moderate.

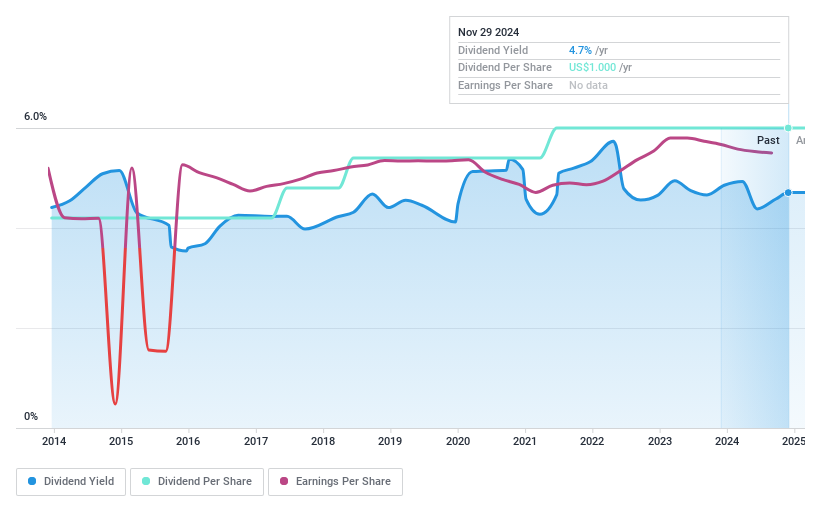

Virtus Investment Partners (NYSE:VRTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Virtus Investment Partners, Inc. is a publicly owned investment manager with a market cap of approximately $1.56 billion.

Operations: Virtus Investment Partners generates revenue primarily through its asset management services, totaling $888.04 million.

Dividend Yield: 4%

Virtus Investment Partners offers a consistent dividend track record with stable and growing payouts over the past decade, supported by a payout ratio of 47.5% and cash flow coverage of 59.7%. Despite trading below its estimated fair value, its dividend yield is slightly lower than top-tier payers in the US market. The recent affirmation of a quarterly dividend at $2.25 per share underscores this stability, while strategic board appointments and product expansions enhance future prospects.

- Navigate through the intricacies of Virtus Investment Partners with our comprehensive dividend report here.

- According our valuation report, there's an indication that Virtus Investment Partners' share price might be on the cheaper side.

Taking Advantage

- Get an in-depth perspective on all 157 Top US Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Excellent balance sheet established dividend payer.