- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

US Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed performance amid an earnings deluge, with the Nasdaq rising for its fifth consecutive session, investors are keeping a close eye on potential opportunities in various sectors. Penny stocks, though often seen as relics from earlier market days, continue to capture interest due to their potential for growth and value within smaller or emerging companies. By focusing on those with solid financial health and clear growth prospects, investors can potentially uncover promising opportunities among these lower-priced stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.83 | $45.02M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.62 | $137.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $96.23M | ★★★★★☆ |

Click here to see the full list of 753 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Baozun (NasdaqGS:BZUN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baozun Inc. offers comprehensive e-commerce solutions to brand partners in China and has a market cap of approximately $199 million.

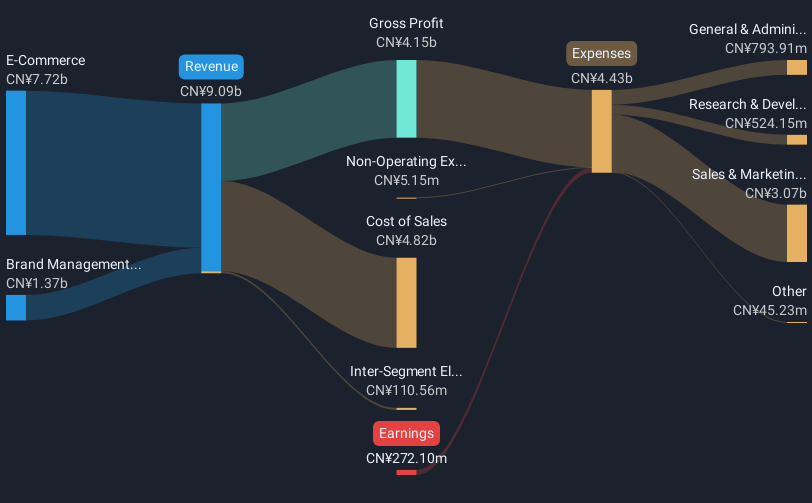

Operations: The company's revenue is primarily derived from its E-Commerce segment, generating CN¥7.72 billion, and its Brand Management segment, contributing CN¥1.37 billion.

Market Cap: $198.99M

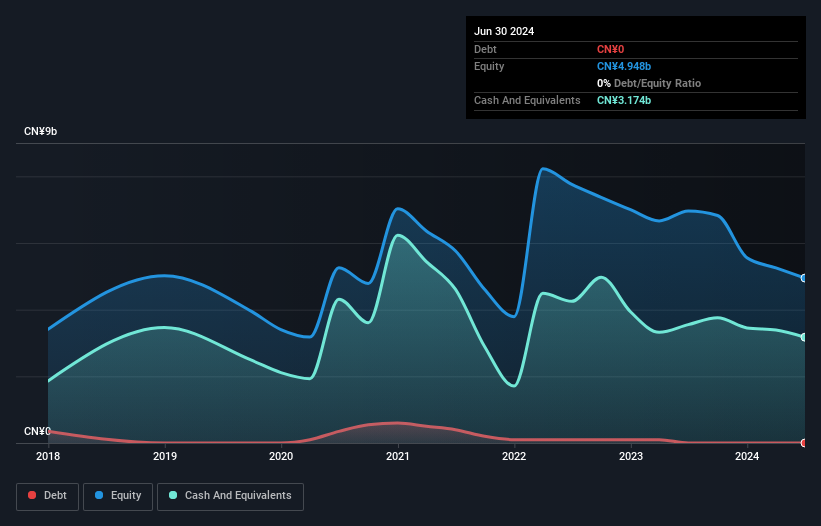

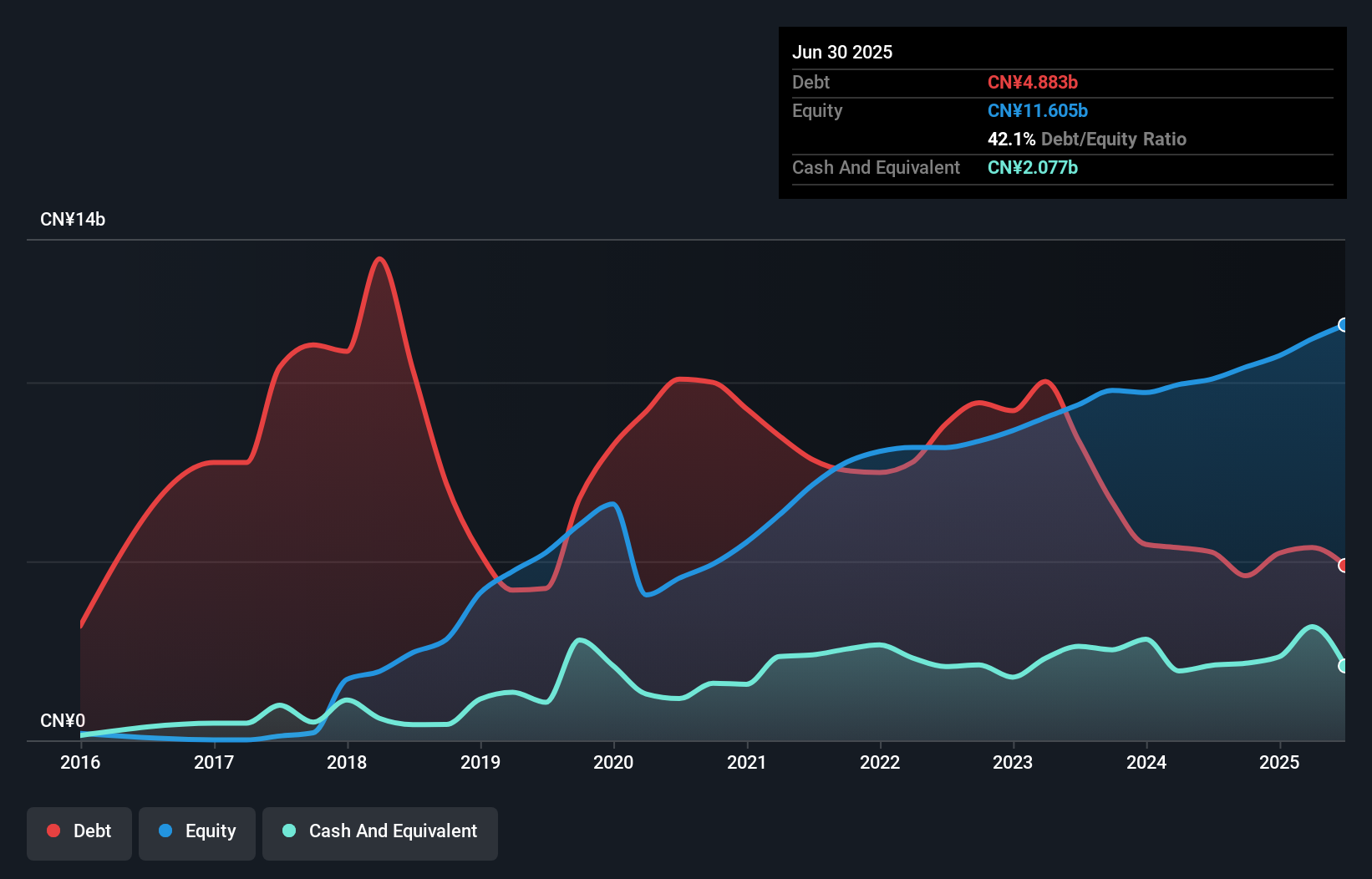

Baozun Inc., a company providing e-commerce solutions in China, has shown resilience despite challenges. It maintains a strong cash position with short-term assets of CN¥6.9 billion exceeding both its short and long-term liabilities, suggesting financial stability. Although currently unprofitable with net losses increasing over five years, Baozun's debt-to-equity ratio has significantly improved from 89.2% to 19.8%, indicating better financial management. Recent activities include being added to the S&P Global BMI Index and completing a share buyback program worth $2.88 million, reflecting strategic efforts to enhance shareholder value amidst ongoing volatility in earnings performance.

- Navigate through the intricacies of Baozun with our comprehensive balance sheet health report here.

- Understand Baozun's earnings outlook by examining our growth report.

Dada Nexus (NasdaqGS:DADA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dada Nexus Limited operates a platform for local on-demand retail and delivery services in the People's Republic of China, with a market cap of approximately $415.69 million.

Operations: The company generates revenue from business services amounting to CN¥10.18 billion.

Market Cap: $415.69M

Dada Nexus Limited, operating in China's local on-demand delivery sector, faces challenges typical of penny stocks. The company reported a net loss for the recent quarter and has seen increased volatility with its share price dropping from the FTSE All-World Index. Despite being unprofitable, Dada's short-term assets significantly exceed both short and long-term liabilities, suggesting some financial resilience. Recent strategic agreements with JD Logistics aim to bolster operational capacity through Dada’s platform. However, leadership changes and high volatility remain concerns as it navigates growth opportunities in a competitive market landscape.

- Jump into the full analysis health report here for a deeper understanding of Dada Nexus.

- Review our growth performance report to gain insights into Dada Nexus' future.

LexinFintech Holdings (NasdaqGS:LX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LexinFintech Holdings Ltd. operates as an online consumer finance service provider in the People's Republic of China, with a market cap of approximately $517.90 million.

Operations: The company generates revenue from its online retail segment, amounting to CN¥13.90 billion.

Market Cap: $517.9M

LexinFintech Holdings, operating in China's online consumer finance sector, presents both opportunities and challenges typical of penny stocks. The company reported revenue growth to CN¥3.64 billion for Q2 2024 but experienced a decline in net income due to a large one-off loss impacting earnings. Despite this, LexinFintech's short-term assets significantly exceed liabilities, indicating solid financial footing. Its debt levels are well-managed with satisfactory coverage by cash flow and EBIT. However, the stock exhibits high volatility and declining profit margins compared to last year, which may concern investors seeking stability amidst growth forecasts.

- Click to explore a detailed breakdown of our findings in LexinFintech Holdings' financial health report.

- Examine LexinFintech Holdings' earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Jump into our full catalog of 753 US Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Provides online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.