- United States

- /

- Consumer Finance

- /

- NYSE:LC

Insider Action In Undervalued Small Caps Across Regions April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 4.1%, contributing to a year-long climb of 7.9%, with earnings anticipated to grow by 14% annually in the coming years. In this context, identifying small-cap stocks that are potentially undervalued and show insider activity can offer intriguing opportunities for investors seeking growth in a dynamic market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 10.8x | 1.5x | 36.75% | ★★★★★★ |

| Shore Bancshares | 10.0x | 2.2x | 11.44% | ★★★★★☆ |

| Flowco Holdings | 6.3x | 0.9x | 37.96% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 25.32% | ★★★★☆☆ |

| Forestar Group | 6.0x | 0.7x | -415.27% | ★★★★☆☆ |

| Franklin Financial Services | 15.9x | 2.5x | 34.76% | ★★★☆☆☆ |

| PDF Solutions | 178.9x | 4.0x | 20.32% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -13.07% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.3x | -3444.14% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -338.47% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

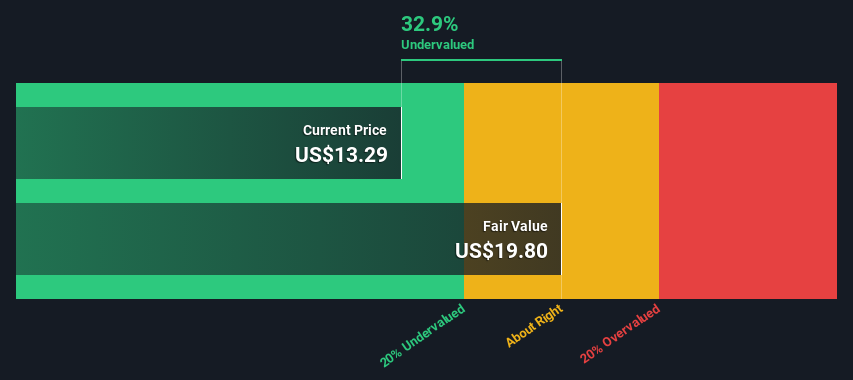

Herbalife (NYSE:HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements and personal care products, with a market cap of approximately $1.41 billion.

Operations: Herbalife's revenue streams are primarily derived from markets such as India, Mexico, and the United States. The company has experienced fluctuations in its net income margin over recent periods, with a notable decrease to 1.73% as of September 2024 before rising to 5.09% by December 2024. Operating expenses consistently form a significant portion of costs, with general and administrative expenses being the largest component within this category.

PE: 2.8x

Herbalife, a smaller company in the investment landscape, has faced challenges with volatile share prices and higher-risk funding sources. Despite these hurdles, insider confidence is evident through recent share purchases in early 2025. The company's net income surged to US$177.9 million for Q4 2024 from US$10.2 million a year prior, demonstrating financial resilience despite declining sales forecasts. Herbalife's partnership with LA Galaxy underscores its commitment to community impact and wellness initiatives, aligning with its broader mission amidst leadership transitions slated for May 2025.

- Dive into the specifics of Herbalife here with our thorough valuation report.

Evaluate Herbalife's historical performance by accessing our past performance report.

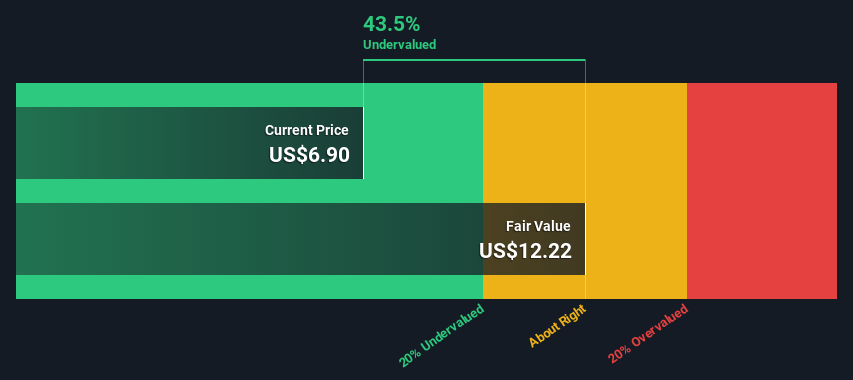

LendingClub (NYSE:LC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LendingClub operates as a digital marketplace bank that offers personal loans and other financial services, with a market capitalization of approximately $1.34 billion.

Operations: Lending Club's revenue primarily comes from its bank operations, contributing $1.13 billion, while its parent entity adds $50.85 million. The company has experienced fluctuations in gross profit margin, reaching as high as 106.86% and dropping to 23.76%. Operating expenses are significant, with sales and marketing being a major component alongside general and administrative costs.

PE: 24.0x

LendingClub is gaining attention for its potential as an undervalued stock, especially after insider confidence was shown by Michael Zeisser's purchase of 20,000 shares for US$257,600 in early 2025. The company reported a full-year net income increase to US$51.33 million from US$38.94 million the previous year, despite a slight dip in quarterly earnings. Recent strategic moves include acquiring a San Francisco property for US$74.5 million to serve as their future headquarters, indicating growth ambitions and asset appreciation potential.

- Click to explore a detailed breakdown of our findings in LendingClub's valuation report.

Examine LendingClub's past performance report to understand how it has performed in the past.

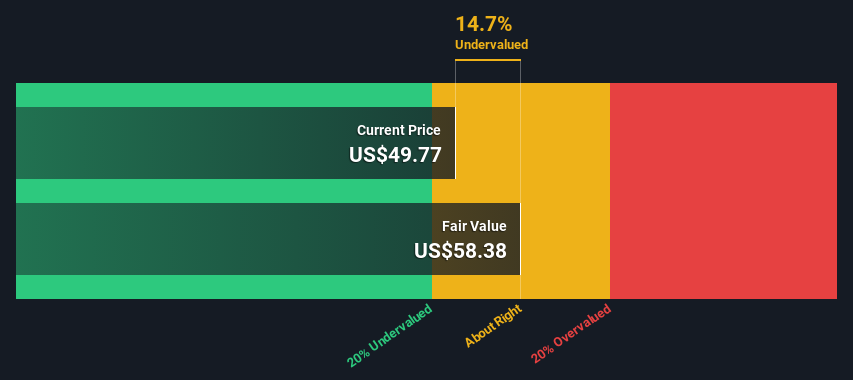

Oxford Industries (NYSE:OXM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Industries is a lifestyle apparel company with operations across several brands, including Tommy Bahama and Lilly Pulitzer, and has a market capitalization of approximately $1.70 billion.

Operations: The company's primary revenue streams are from Tommy Bahama, Lilly Pulitzer, Johnny Was, and Emerging Brands. Over recent periods, the gross profit margin has shown a trend of fluctuation, reaching 63.35% in early 2024 before slightly declining to 62.94% by early 2025. Operating expenses have consistently been a significant portion of the cost structure, with general and administrative expenses being the largest component within this category.

PE: 8.2x

Oxford Industries, known for its apparel brands, is positioned as an intriguing small-cap opportunity. Recent insider confidence is evident with share purchases, signaling potential value recognition within the company. Despite a forecasted earnings decline of 3% annually over the next three years and reliance on external borrowing, Oxford's strategic moves include a $100 million share repurchase program and a 3% dividend increase to $0.69 per share. These initiatives reflect management's commitment to shareholder returns amidst challenging market conditions.

Summing It All Up

- Unlock our comprehensive list of 89 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives