- United States

- /

- Metals and Mining

- /

- NYSE:CSTM

3 Stocks Trading At Discounts Of Up To 48.8% Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of volatility with mixed earnings reports and geopolitical tensions, investors are keenly observing opportunities amid fluctuating indices. In such an environment, identifying stocks trading below their intrinsic value can offer potential for long-term growth, making them attractive considerations for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $135.66 | $259.94 | 47.8% |

| Peapack-Gladstone Financial (PGC) | $28.75 | $56.16 | 48.8% |

| Metropolitan Bank Holding (MCB) | $78.61 | $152.30 | 48.4% |

| Investar Holding (ISTR) | $22.725 | $45.32 | 49.9% |

| First Busey (BUSE) | $23.32 | $45.91 | 49.2% |

| Dime Community Bancshares (DCOM) | $29.87 | $57.26 | 47.8% |

| Corpay (CPAY) | $287.78 | $550.54 | 47.7% |

| Constellium (CSTM) | $15.91 | $31.09 | 48.8% |

| AGNC Investment (AGNC) | $10.02 | $19.46 | 48.5% |

| AbbVie (ABBV) | $226.22 | $431.17 | 47.5% |

Here's a peek at a few of the choices from the screener.

Enovix (ENVX)

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion battery cells both in the United States and internationally, with a market cap of approximately $2.59 billion.

Operations: The company's revenue is primarily derived from its Batteries / Battery Systems segment, which generated $26.60 million.

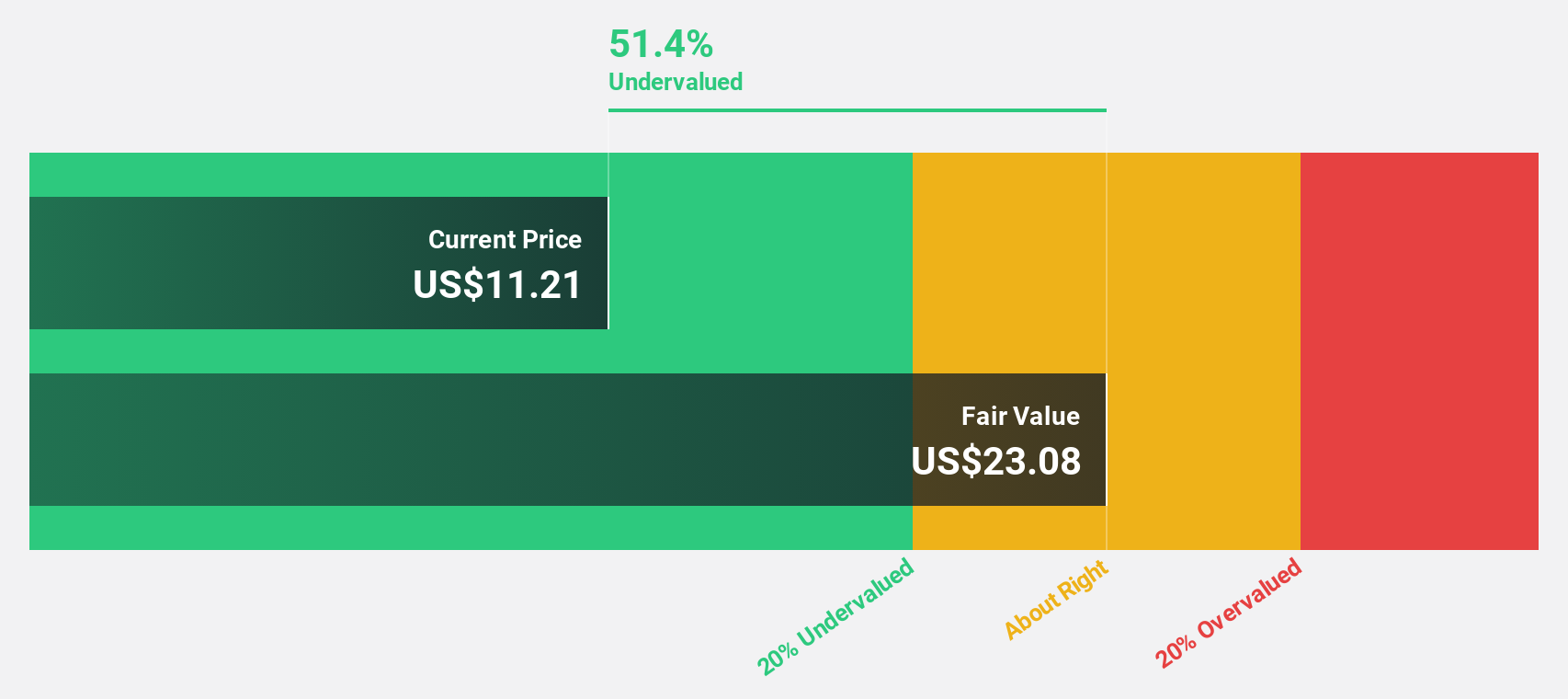

Estimated Discount To Fair Value: 43%

Enovix, trading at US$13.19, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of US$23.15. The company forecasts strong revenue growth of 42.4% annually and expects to achieve profitability within three years, indicating robust potential despite recent index exclusions and share price volatility. Recent strategic moves include a $300 million fixed-income offering and expansion into an R&D Center in India to accelerate battery platform development, enhancing future cash flows prospects.

- Our expertly prepared growth report on Enovix implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Enovix with our comprehensive financial health report here.

Constellium (CSTM)

Overview: Constellium SE, along with its subsidiaries, specializes in designing, manufacturing, and selling rolled and extruded aluminum products for various sectors including aerospace, packaging, automotive, commercial transportation, general industrial, and defense; the company has a market cap of approximately $2.14 billion.

Operations: Constellium's revenue is primarily derived from three segments: Packaging and Automotive Rolled Products ($4.52 billion), Aerospace and Transportation ($1.81 billion), and Automotive Structures and Industry ($1.46 billion).

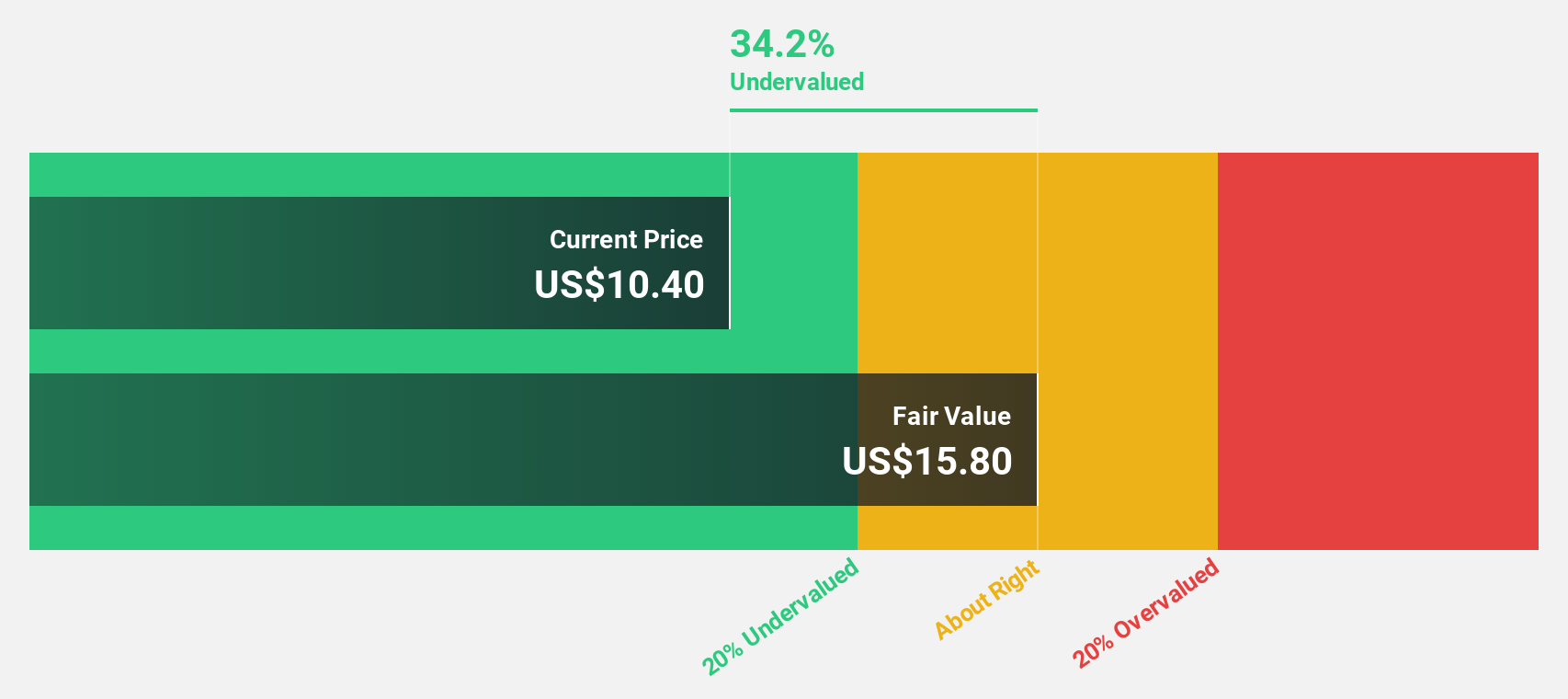

Estimated Discount To Fair Value: 48.8%

Constellium, trading at US$15.91, is highly undervalued with a fair value estimate of US$31.09 per discounted cash flow analysis. Despite lower profit margins compared to last year, its earnings are expected to grow significantly at 46.6% annually, surpassing market averages. Recent strategic initiatives include extending a supply partnership with Embraer and advancing decarbonization efforts through plasma technology integration in aluminum remelting processes, potentially enhancing future cash flows and aligning with sustainability goals amidst rising global aluminum demand.

- Our growth report here indicates Constellium may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Constellium.

Genius Sports (GENI)

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of $2.79 billion.

Operations: The company generates revenue from its data processing segment, which amounts to $558.44 million.

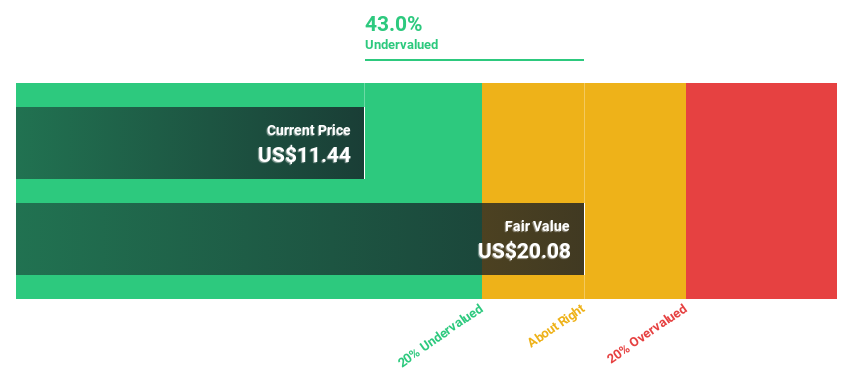

Estimated Discount To Fair Value: 36.9%

Genius Sports, trading at US$12.24, is significantly undervalued with a fair value estimate of US$19.41 according to discounted cash flow analysis. The company forecasts revenue growth of 14.8% per year, outpacing the US market average and expects profitability within three years. Recent developments include expanding its partnership with Hard Rock Bet and securing exclusive data rights for Serie A, enhancing its content portfolio and potentially boosting future cash flows despite current net losses.

- Our comprehensive growth report raises the possibility that Genius Sports is poised for substantial financial growth.

- Take a closer look at Genius Sports' balance sheet health here in our report.

Seize The Opportunity

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 175 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSTM

Constellium

Engages in the design, manufacture, and sale of rolled and extruded aluminum products for the aerospace, packaging, automotive, commercial transportation, general industrial, and defense end-markets.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives