- United States

- /

- Banks

- /

- NasdaqGS:INDB

3 Reliable US Dividend Stocks Yielding Up To 5.9%

Reviewed by Simply Wall St

As the U.S. stock market navigates a flurry of earnings reports and geopolitical developments, investors are witnessing fluctuations across major indices like the Dow Jones and Nasdaq Composite. In such an environment, dividend stocks can offer a measure of stability, providing consistent income streams that may appeal to those seeking reliability amidst market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.14% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.56% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.85% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.80% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.63% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.46% | ★★★★★★ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

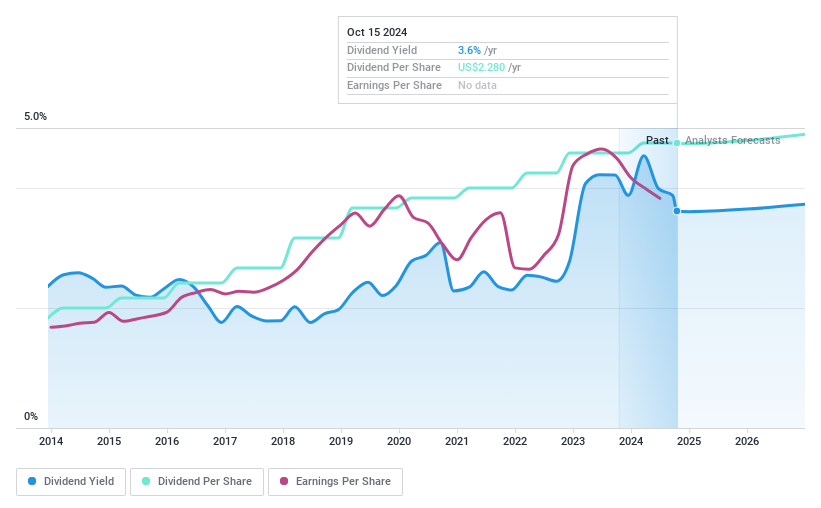

Independent Bank (NasdaqGS:INDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Independent Bank Corp. is the bank holding company for Rockland Trust Company, offering commercial banking products and services to individuals and small-to-medium sized businesses in the United States, with a market cap of $2.81 billion.

Operations: Independent Bank Corp. generates its revenue primarily through its Community Banking segment, which accounted for $653.49 million.

Dividend Yield: 3.3%

Independent Bank Corp. offers a reliable dividend yield of 3.35%, though below the top 25% of US dividend payers. The company maintains stable and growing dividends over the past decade, supported by a manageable payout ratio of 50.4%. Recent earnings showed a decline, with net income at US$192.08 million for 2024 compared to US$239.5 million in 2023, yet dividends remain covered by earnings and are forecasted to be sustainable in three years at a lower payout ratio of 33.2%.

- Unlock comprehensive insights into our analysis of Independent Bank stock in this dividend report.

- Upon reviewing our latest valuation report, Independent Bank's share price might be too pessimistic.

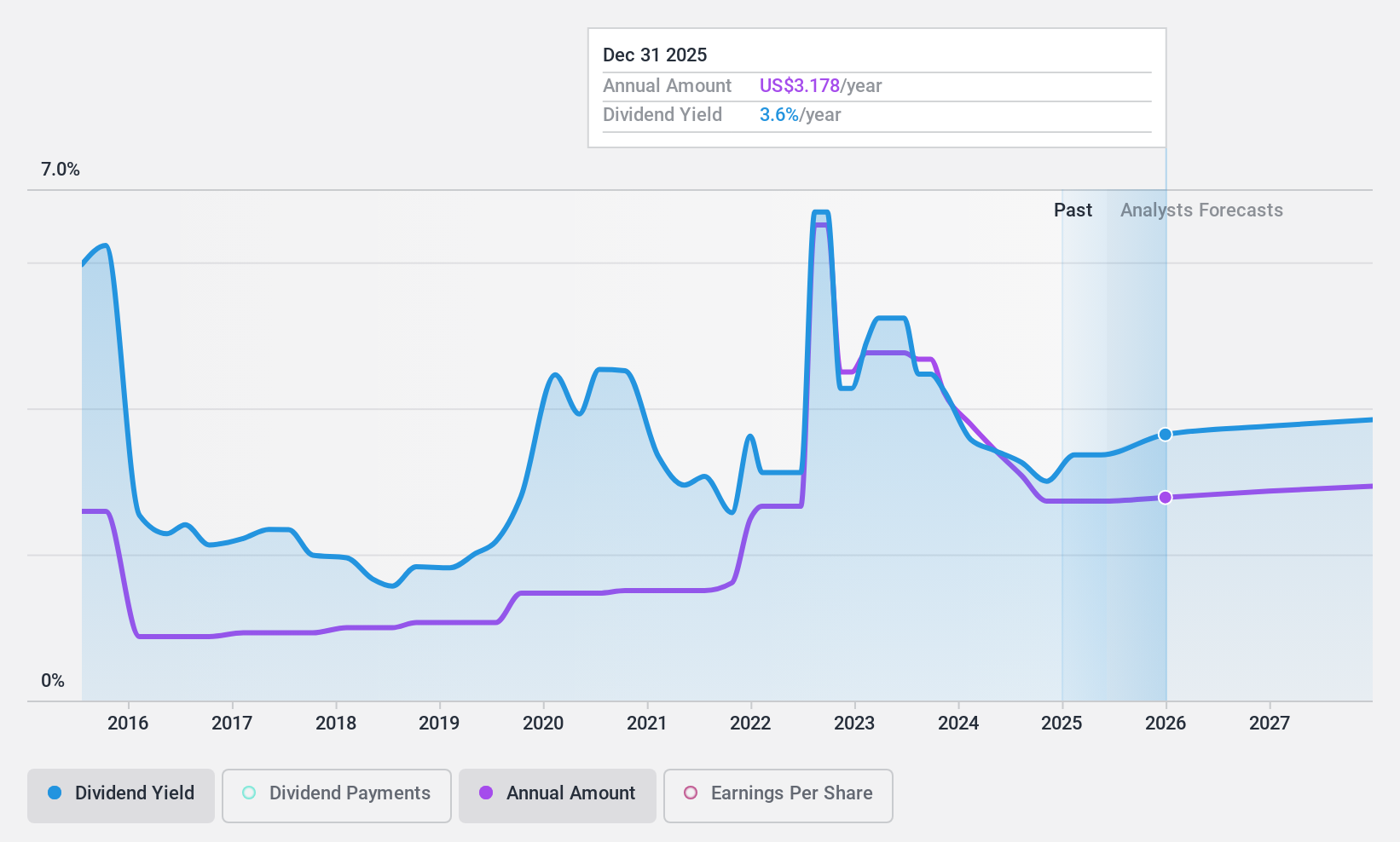

ConocoPhillips (NYSE:COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is an energy company engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids across various international markets with a market cap of $127.39 billion.

Operations: ConocoPhillips generates revenue from several key regions, including $6.79 billion from Alaska, $5.66 billion from Canada, $37.36 billion from the Lower 48 states in the U.S., $3.12 billion from Asia Pacific, and $6.24 billion from Europe, Middle East, and North Africa.

Dividend Yield: 3.7%

ConocoPhillips' dividend yield of 3.7% is below the top quartile of US dividend payers, and its dividend history has been volatile over the past decade. However, dividends are well-covered by earnings with a payout ratio of 41.7% and cash flows at 52%. The company recently engaged in significant debt financing activities related to Marathon Oil's notes exchange offers, potentially impacting future financial flexibility and dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of ConocoPhillips.

- In light of our recent valuation report, it seems possible that ConocoPhillips is trading behind its estimated value.

VAALCO Energy (NYSE:EGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids in Gabon, Egypt, Equatorial Guinea, and Canada with a market cap of $420.16 million.

Operations: VAALCO Energy, Inc. generates revenue of $506.42 million from its activities in exploring and producing hydrocarbons.

Dividend Yield: 6%

VAALCO Energy's dividend yield of 6% places it in the top quartile of US dividend payers, with dividends well-covered by earnings (28.9% payout ratio) and cash flows (65.5% cash payout ratio). Despite a short three-year dividend history, payments have been stable. The company reported strong sales and production volumes for 2024, aligning with guidance. However, recent $200 million shelf registration could influence future financial strategies and dividend sustainability.

- Dive into the specifics of VAALCO Energy here with our thorough dividend report.

- According our valuation report, there's an indication that VAALCO Energy's share price might be on the cheaper side.

Seize The Opportunity

- Discover the full array of 134 Top US Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives