- United States

- /

- Banks

- /

- NasdaqGS:FBNC

3 Stocks That Could Be Trading At Estimated Discounts Of Up To 49.8%

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite reach new highs, buoyed by strong corporate earnings and positive economic data, investors are keenly observing opportunities in undervalued stocks that may offer significant potential for growth. In this environment, identifying stocks trading at estimated discounts can be crucial for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sotera Health (SHC) | $12.11 | $24.19 | 49.9% |

| Semrush Holdings (SEMR) | $9.58 | $19.08 | 49.8% |

| Roku (ROKU) | $90.05 | $174.73 | 48.5% |

| Rapid7 (RPD) | $22.53 | $43.87 | 48.6% |

| Hims & Hers Health (HIMS) | $57.32 | $114.17 | 49.8% |

| FB Financial (FBK) | $48.09 | $93.90 | 48.8% |

| Definitive Healthcare (DH) | $4.00 | $7.90 | 49.4% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $21.74 | $43.44 | 50% |

| ACNB (ACNB) | $42.67 | $84.73 | 49.6% |

| Acadia Realty Trust (AKR) | $18.95 | $36.77 | 48.5% |

Underneath we present a selection of stocks filtered out by our screen.

First Bancorp (FBNC)

Overview: First Bancorp, with a market cap of $1.94 billion, operates as the bank holding company for First Bank, offering a range of banking products and services to individuals and businesses.

Operations: First Bank's revenue is derived from providing a variety of banking products and services tailored for both individual and business clients.

Estimated Discount To Fair Value: 37.2%

First Bancorp is trading at US$49.25, significantly below its estimated fair value of US$78.47, suggesting potential undervaluation based on cash flows. Recent earnings results show robust growth with net income rising to US$38.57 million for Q2 2025 from US$28.71 million a year ago, and earnings per share increasing to US$0.93 from USD 0.7 a year ago, reflecting strong financial performance that supports its attractive valuation profile despite slower revenue growth forecasts compared to profit expectations.

- Our comprehensive growth report raises the possibility that First Bancorp is poised for substantial financial growth.

- Get an in-depth perspective on First Bancorp's balance sheet by reading our health report here.

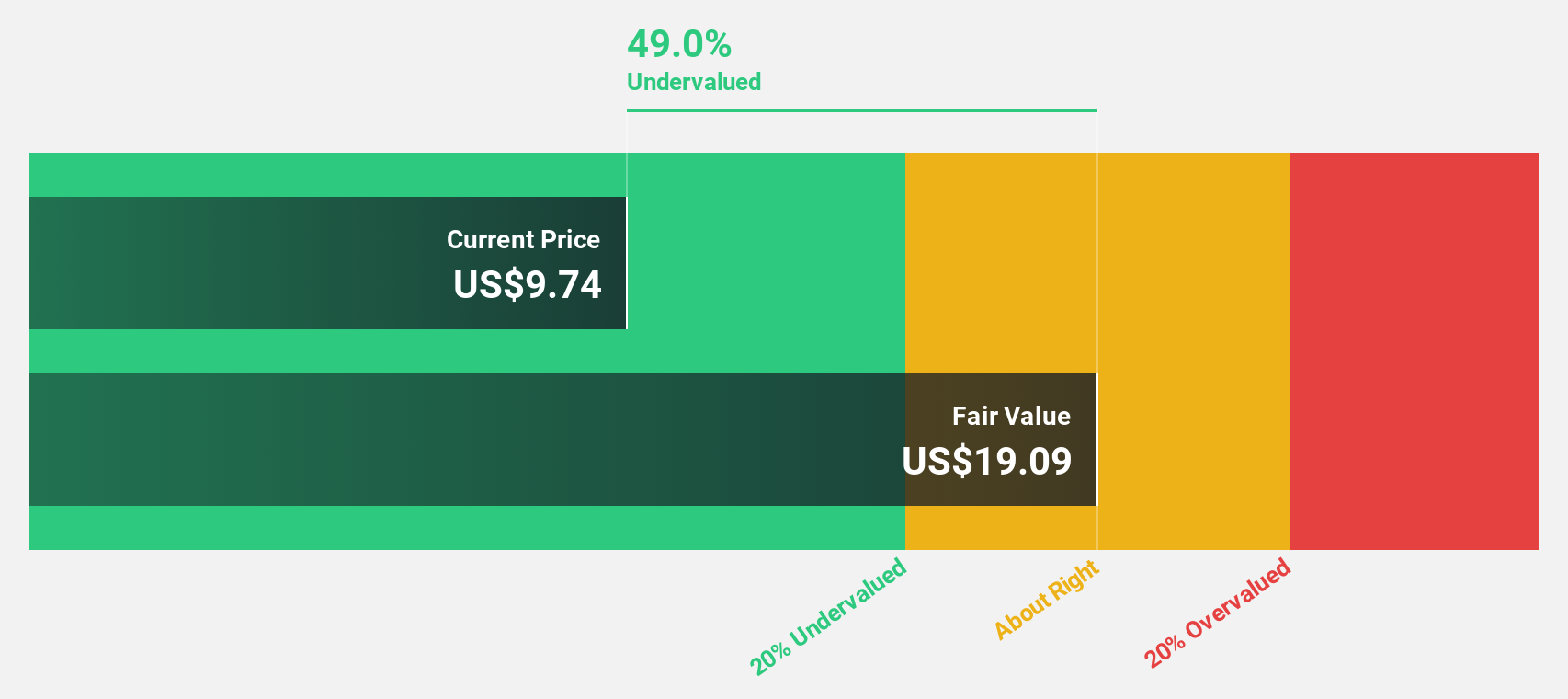

Semrush Holdings (SEMR)

Overview: Semrush Holdings, Inc. operates an online visibility management software-as-a-service platform across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.48 billion.

Operations: The company generates revenue from its software and programming segment, amounting to $396.02 million.

Estimated Discount To Fair Value: 49.8%

Semrush Holdings is trading at US$9.58, considerably below its fair value estimate of US$19.08, reflecting undervaluation based on cash flows. Despite significant insider selling and a decline in profit margins from 4% to 1.8%, earnings are forecast to grow substantially at 61.82% annually, outpacing the market average. The company’s revenue growth is expected to surpass the market rate, with full-year guidance indicating around 20% year-over-year growth in sales.

- Our expertly prepared growth report on Semrush Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Semrush Holdings stock in this financial health report.

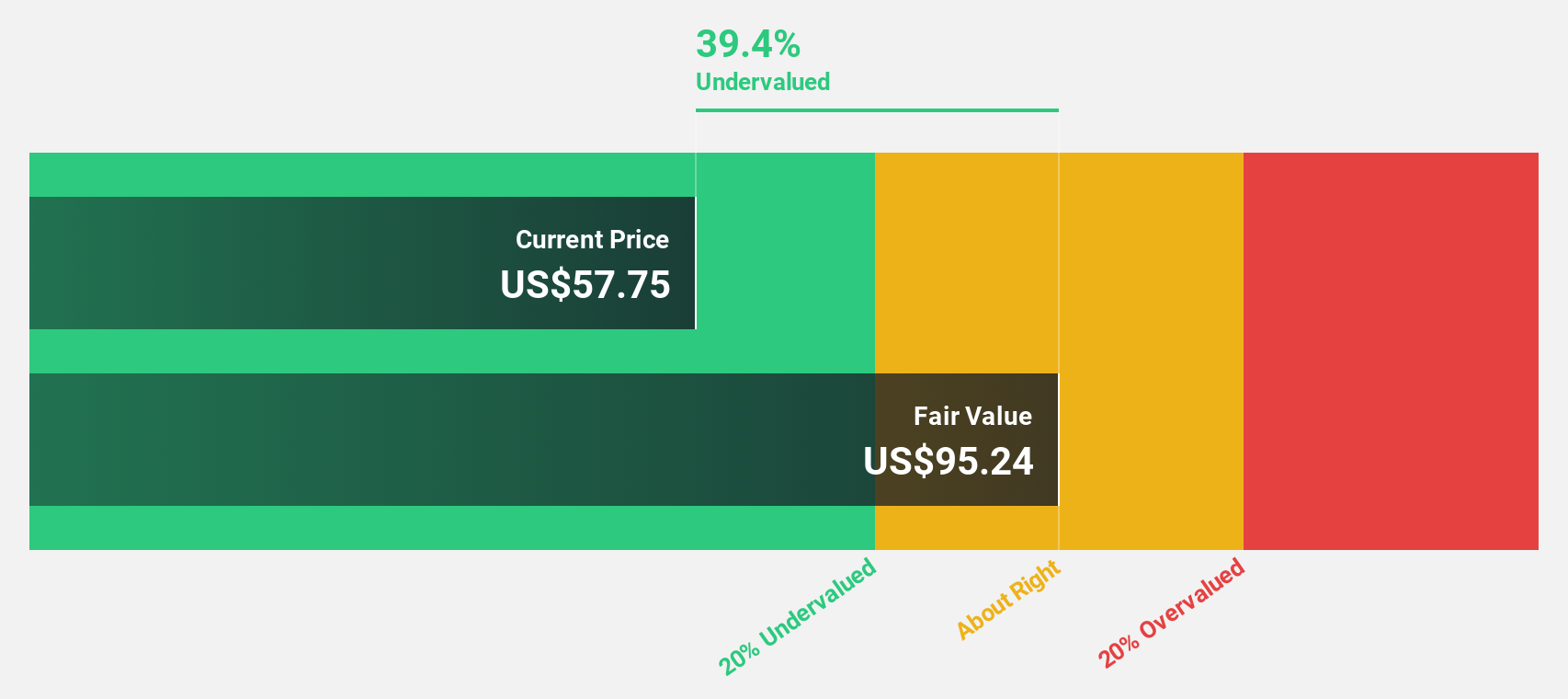

Viking Holdings (VIK)

Overview: Viking Holdings Ltd operates in passenger shipping and other forms of passenger transport across North America, the United Kingdom, and internationally, with a market cap of $25.82 billion.

Operations: The company's revenue segments consist of $2.31 billion from Ocean and $2.70 billion from River passenger transport services.

Estimated Discount To Fair Value: 39.4%

Viking Holdings, trading at US$57.75, is significantly undervalued based on cash flows with a fair value estimate of US$95.24. Despite high debt and negative equity, earnings are projected to grow substantially at 42.7% annually, surpassing the market average. Recent additions to multiple Russell indices highlight its growth potential. The launch of new river and ocean vessels underscores Viking's strategic expansion in experiential travel markets globally, enhancing long-term revenue prospects.

- Our growth report here indicates Viking Holdings may be poised for an improving outlook.

- Click here to discover the nuances of Viking Holdings with our detailed financial health report.

Summing It All Up

- Discover the full array of 169 Undervalued US Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)