- United States

- /

- Banks

- /

- NYSE:UCB

Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As the United States market grapples with significant volatility due to persistent tariff concerns and tensions over Federal Reserve leadership, investors are seeking stability amid the turbulence. In such uncertain times, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to navigate these challenging market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.49% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.51% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.18% | ★★★★★★ |

| OceanFirst Financial (NasdaqGS:OCFC) | 5.08% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.23% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.75% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.22% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.08% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.34% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

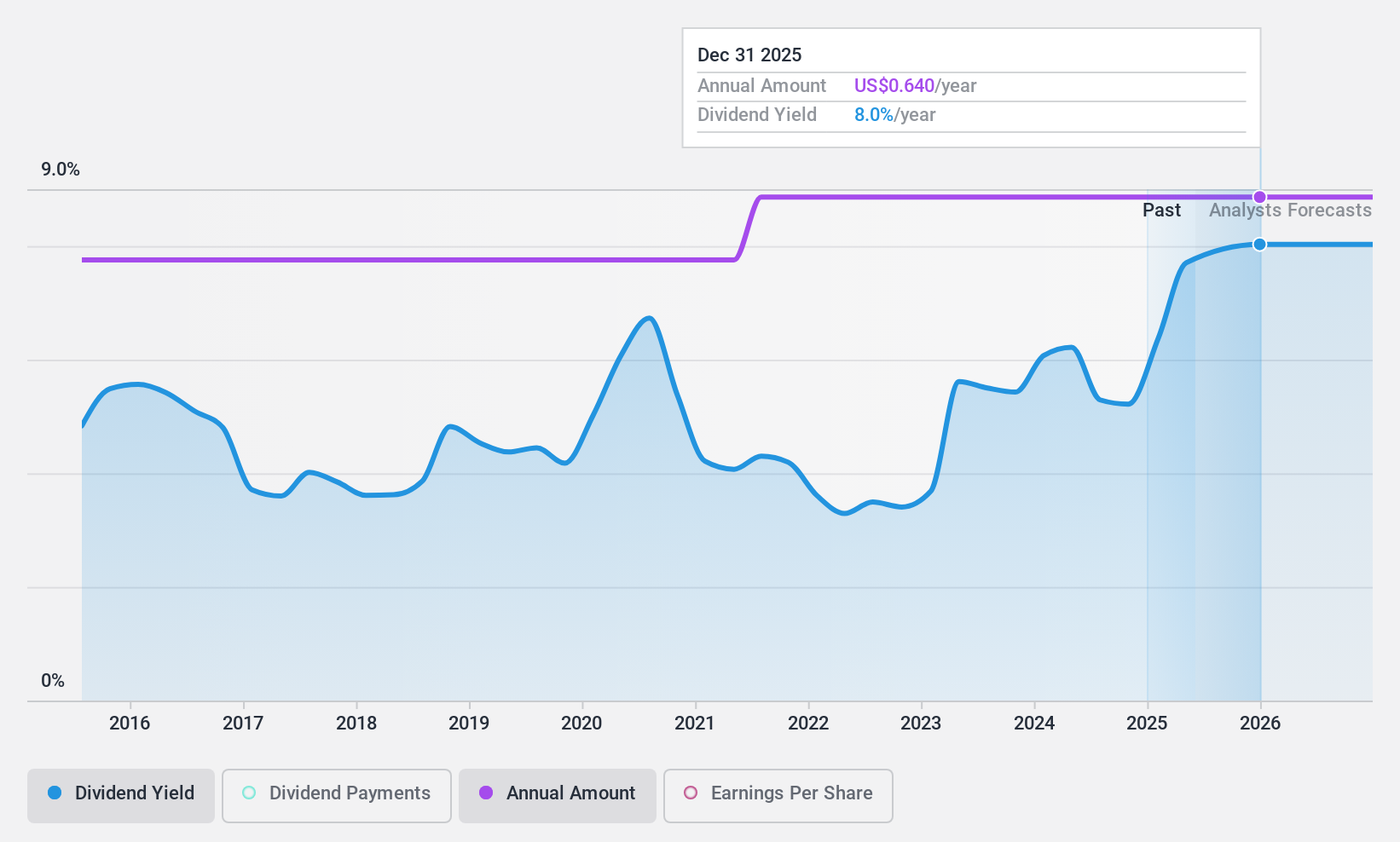

BCB Bancorp (NasdaqGM:BCBP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: BCB Bancorp, Inc. is the bank holding company for BCB Community Bank, offering a range of banking products and services to businesses and individuals in the United States, with a market cap of $162.36 million.

Operations: BCB Bancorp, Inc. generates revenue primarily through its banking segment, which accounts for $83.39 million.

Dividend Yield: 6.8%

BCB Bancorp offers a high dividend yield of 6.77%, placing it in the top 25% of US dividend payers, with stable and growing payouts over the past decade. Its dividends are well-covered by earnings, with a current payout ratio of 64.8% and forecasted to improve to 40.1%. Despite recent declines in net income, BCBP trades at a significant discount to its estimated fair value and maintains strong relative value compared to peers.

- Delve into the full analysis dividend report here for a deeper understanding of BCB Bancorp.

- Our comprehensive valuation report raises the possibility that BCB Bancorp is priced lower than what may be justified by its financials.

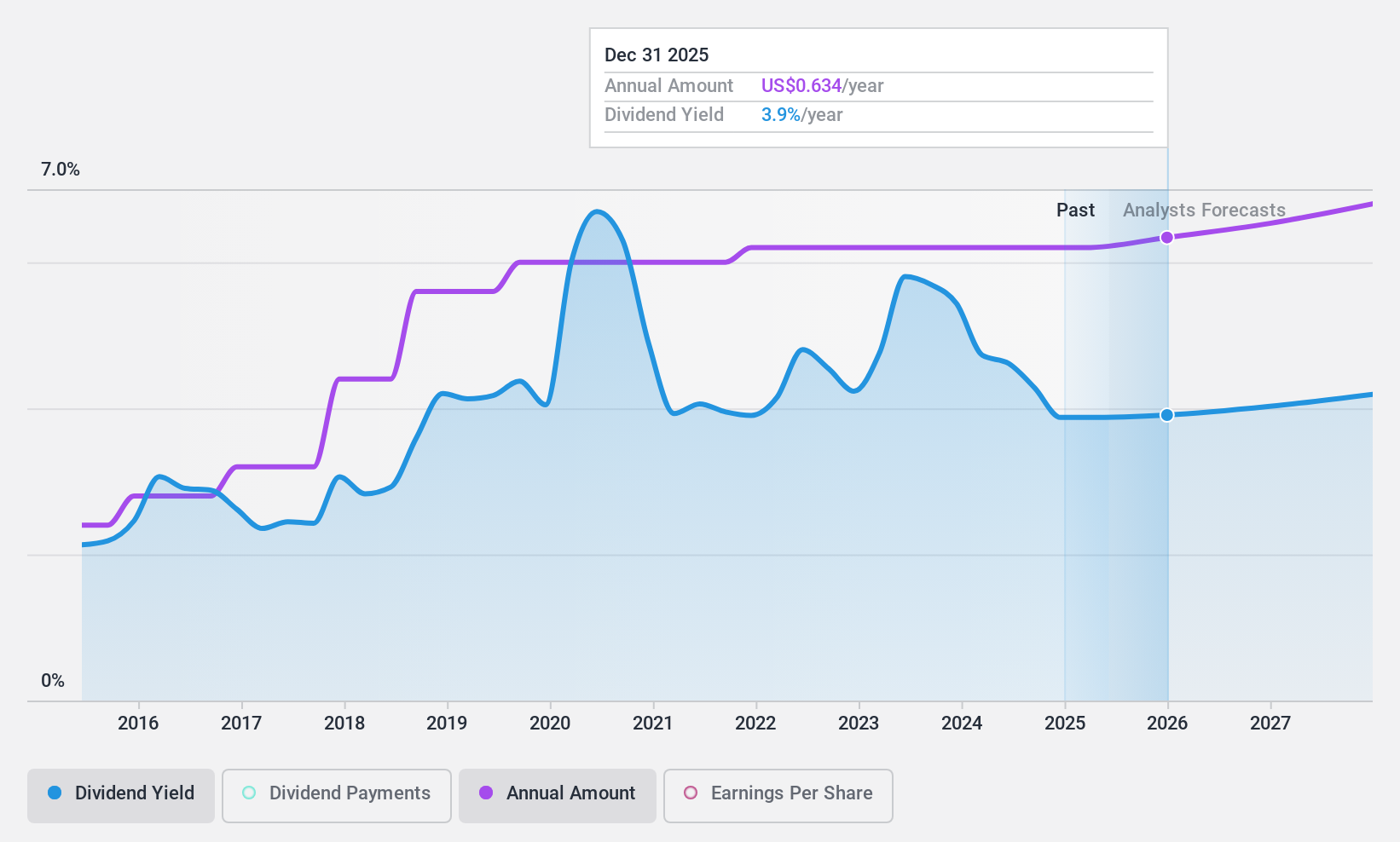

Huntington Bancshares (NasdaqGS:HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States with a market cap of $19.91 billion.

Operations: Huntington Bancshares generates revenue through its diverse banking services, including commercial, consumer, and mortgage banking in the United States.

Dividend Yield: 4.5%

Huntington Bancshares maintains reliable dividend payments, supported by a low payout ratio of 47%, ensuring coverage by earnings. Recent dividends include a quarterly cash dividend of $0.155 per common share and multiple preferred stock dividends. The company reported strong financial performance with net income rising to US$527 million in Q1 2025 from US$419 million the previous year. Although its 4.54% yield is below top-tier payers, it trades significantly below estimated fair value, enhancing its investment appeal for dividend-focused portfolios.

- Click here to discover the nuances of Huntington Bancshares with our detailed analytical dividend report.

- According our valuation report, there's an indication that Huntington Bancshares' share price might be on the cheaper side.

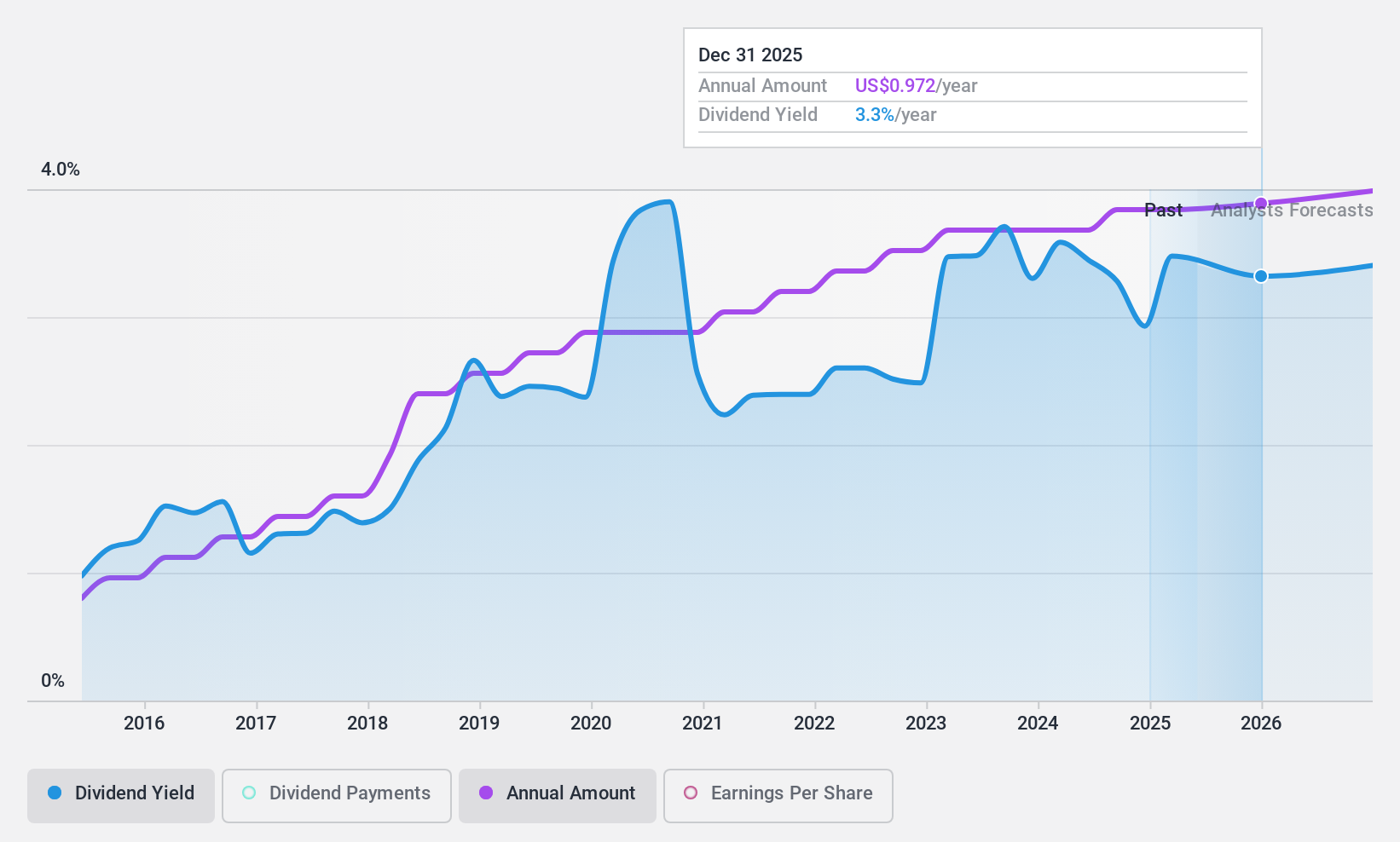

United Community Banks (NYSE:UCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: United Community Banks, Inc. is a bank holding company for United Community Bank, offering financial products and services across various sectors in the United States with a market cap of approximately $2.96 billion.

Operations: United Community Banks, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $901.17 million.

Dividend Yield: 3.9%

United Community Banks offers a stable dividend with a low payout ratio of 46%, ensuring coverage by earnings, and is forecast to remain sustainable at 37.6% in three years. The recent quarterly dividend of $0.24 per share underscores its reliability over the past decade, despite yielding lower than top-tier payers at 3.87%. Strong financial results for 2024, including net income growth to US$252.4 million, bolster its position as an appealing choice for dividend investors.

- Click here and access our complete dividend analysis report to understand the dynamics of United Community Banks.

- Upon reviewing our latest valuation report, United Community Banks' share price might be too pessimistic.

Next Steps

- Get an in-depth perspective on all 170 Top US Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives