- United States

- /

- Software

- /

- NasdaqGS:APP

3 US Growth Companies With Insider Ownership As High As 38%

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with the S&P 500 and Nasdaq Composite showing modest gains amidst a backdrop of fluctuating indices, investors are keenly observing economic indicators to gauge the economy's resilience. In this environment, growth companies with substantial insider ownership can offer unique insights into potential opportunities, as high insider stakes often signal confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Coastal Financial (NasdaqGS:CCB) | 18.4% | 40.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's explore several standout options from the results in the screener.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

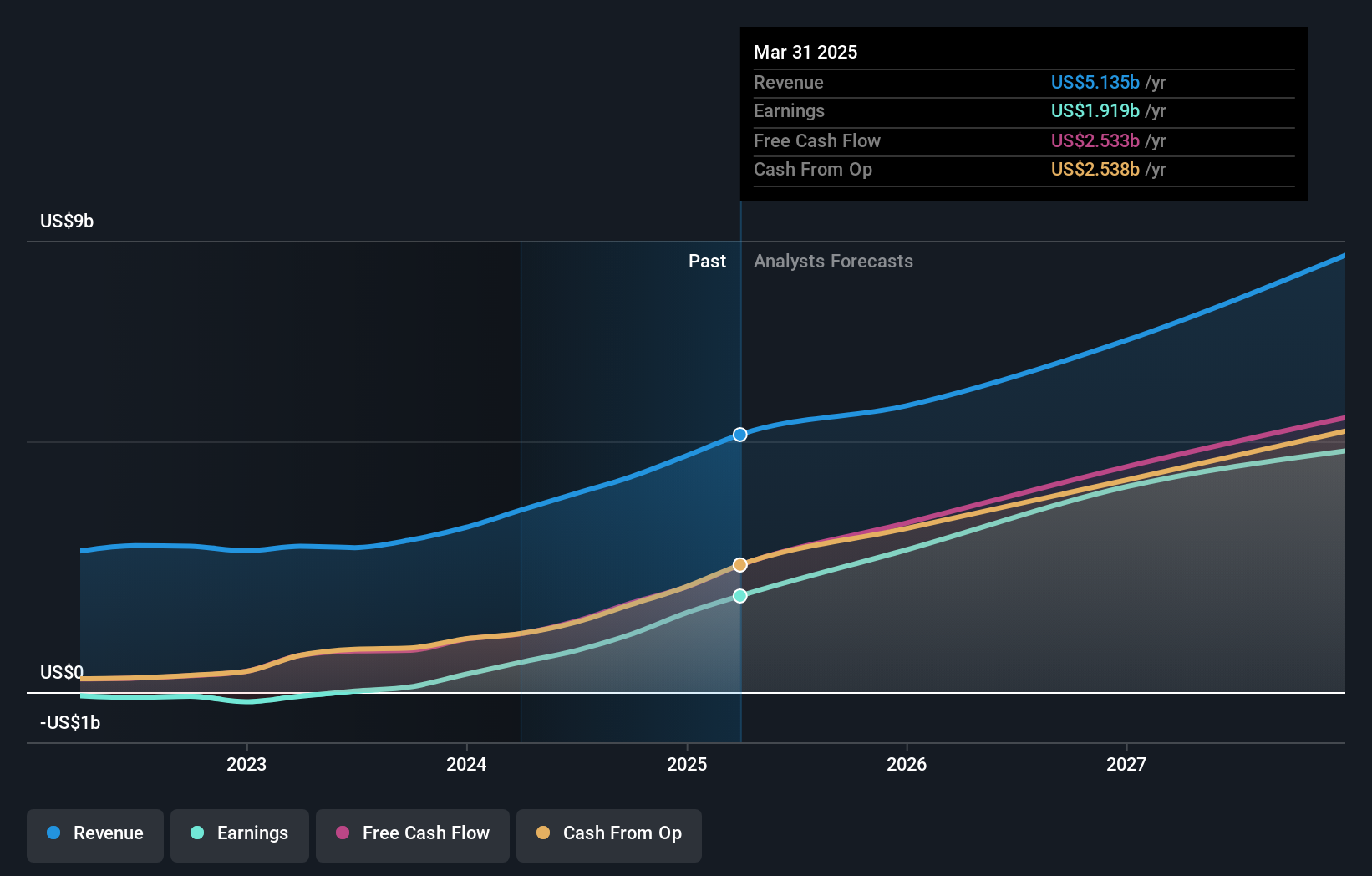

Overview: AppLovin Corporation develops a software-based platform aimed at improving marketing and monetization for advertisers both in the United States and globally, with a market cap of approximately $53.13 billion.

Operations: The company's revenue is derived from two primary segments: Apps, generating $1.49 billion, and the Software Platform, contributing $2.47 billion.

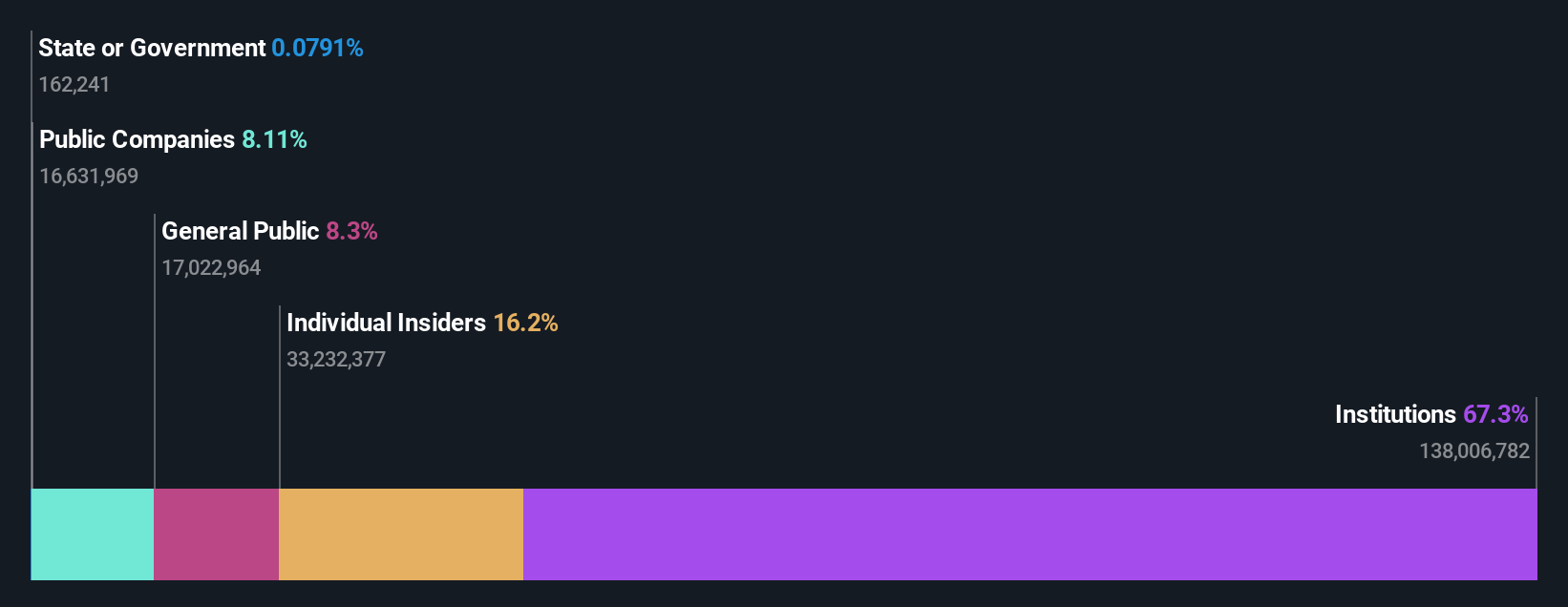

Insider Ownership: 38.3%

AppLovin has been added to the FTSE All-World Index, reflecting its growing market presence. The company reported strong financial performance with significant earnings growth and a net income of US$309.97 million for Q2 2024, up from US$80.36 million a year prior. Although insiders have not substantially bought shares recently, AppLovin's revenue is expected to grow faster than the US market average, and its return on equity is projected to be very high in three years.

- Dive into the specifics of AppLovin here with our thorough growth forecast report.

- According our valuation report, there's an indication that AppLovin's share price might be on the expensive side.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

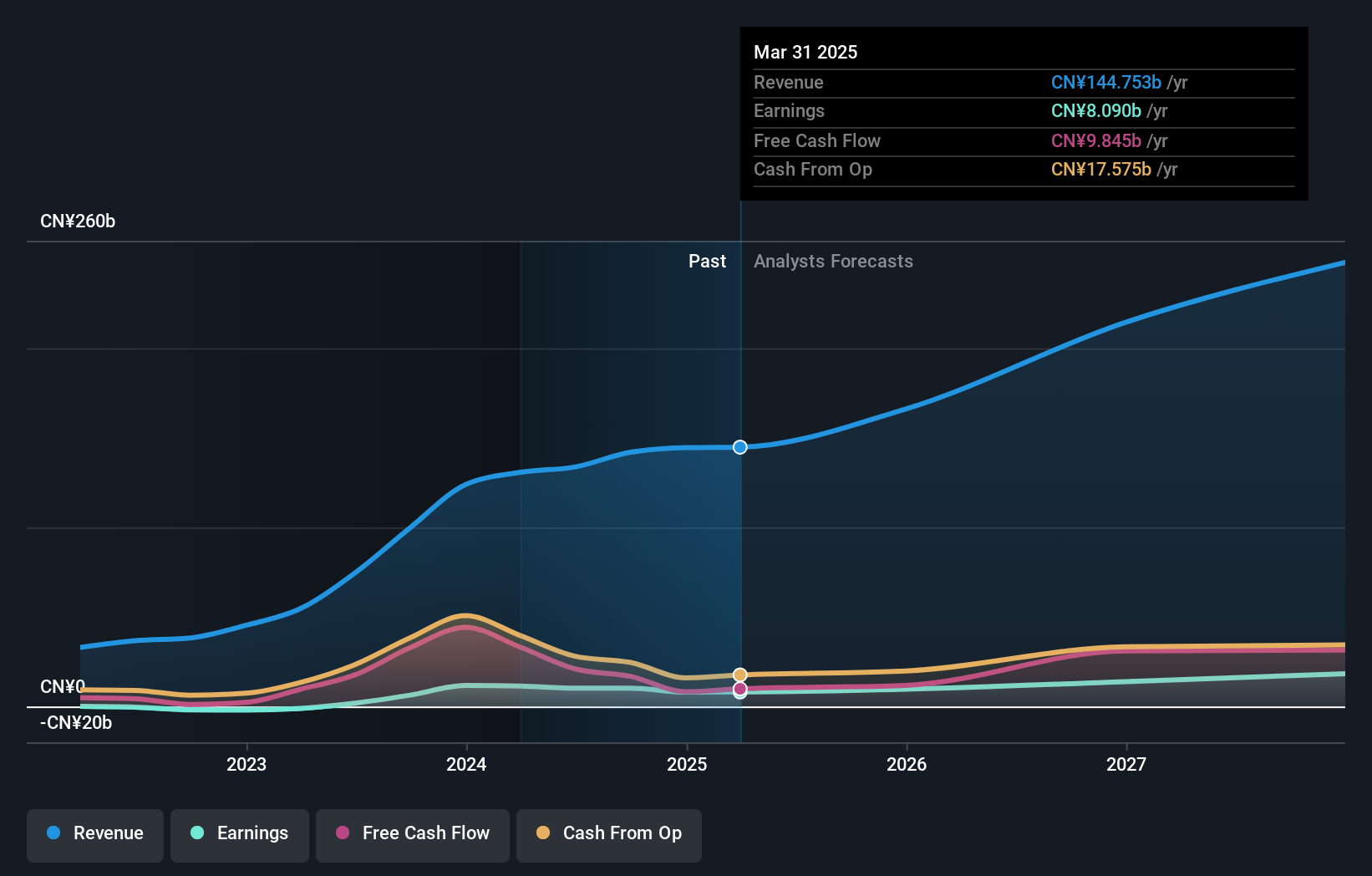

Overview: Li Auto Inc. operates in the energy vehicle market in the People's Republic of China, with a market cap of approximately $26.02 billion.

Operations: The company generates revenue from its Auto Manufacturers segment, amounting to CN¥133.72 billion.

Insider Ownership: 30.4%

Li Auto demonstrates robust growth potential with vehicle deliveries increasing substantially year over year, reaching 341,812 units in 2024. Despite a volatile share price recently, its revenue is projected to grow faster than the US market at 19.5% annually. The company's earnings are expected to rise significantly over the next three years, outpacing the broader market's growth rate. Trading below fair value estimates suggests potential for appreciation despite no recent insider trading activity reported.

- Click here and access our complete growth analysis report to understand the dynamics of Li Auto.

- The valuation report we've compiled suggests that Li Auto's current price could be quite moderate.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $77.84 billion.

Operations: The company's revenue segments include Premium services generating €12.68 billion and Ad-Supported services contributing €1.79 billion.

Insider Ownership: 17.7%

Spotify Technology is experiencing significant growth, with earnings forecasted to increase 31.1% annually, outpacing the US market's average. Despite recent shareholder dilution, it trades at a discount to its estimated fair value. The company became profitable this year and is expanding into video content, partnering with Cineverse Corp., enhancing its platform's appeal. However, revenue growth projections are moderate at 12.8% annually. No substantial insider trading activity has been reported recently.

- Unlock comprehensive insights into our analysis of Spotify Technology stock in this growth report.

- Our valuation report unveils the possibility Spotify Technology's shares may be trading at a premium.

Seize The Opportunity

- Explore the 181 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.