Quote of the Week: “ And now we welcome the new year. Full of things that have never been. ” — Rainer Maria Rilke

First, let us say, Happy New Year!

2024 was a jam packed year, which no doubt kept a lot of us on our toes. So what does 2025 have in store for us?

We’ve taken a look at a bunch of market outlooks from research teams around the world and selected some of the insights we think you’ll find useful or interesting.

This is the first part of our coverage on the outlook for 2025, and looks at the themes and catalysts most commonly mentioned. We’re also highlighting a few insights relevant to specific countries and regions.

Next week, in Part 2, we’ll share the best insights about sectors and key industries in 2025.

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

🪫 Tesla annual deliveries fall for first time as the company fails to strike a chord with consumers ( Reuters )

- What’s our take?

- Could this be a changing of the tides in EV dominance?

- Tesla’s 2024 deliveries slid 1.1% from last year, despite Musk earlier predicting “slight growth” in 2024. The drop reflects the high interest rate environment, Tesla’s aging models, and stiff competition—particularly from China’s BYD.

- Despite offering interest-free financing and free fast-charging, Tesla couldn’t spark enough EV demand amid reduced subsidies in Europe and higher demand for cheaper hybrids in the U.S.

- Elon Musk is pivoting to self-driving taxis and has backed President-elect Trump, hoping easier regulations will help push autonomous tech forward.

- Possible cuts to the federal EV tax credit, plus doubts around Cybertruck’s demand, add to the pressure mounting on Tesla’s outlook for 2025.

-

📉 Trump’s ‘Maganomics’ will damage growth, say economists according to recent polls ( FT )

- Could the bad outweigh the good when it comes to ‘Maganomics’?

- Leading surveys show most economists see Trump’s “America First” stance as undermining global trade, boosting inflation, and weakening the economy over time.

- Ultimately, they view Trump’s changes as a way for the US to score some quick wins at the expense of a slowdown in the global economy, which would undoubtedly come back to haunt the US later on.

- Despite bullish reaction in the markets, many analysts believe Trump’s plans to raise tariffs, deport workers, and solidify 2017 tax cuts will hinder long-term growth.

- The impacts could be quite pronounced in Europe, as economists are worried that higher tariffs on China could flood European markets with cheap goods, hitting Germany’s manufacturing sector hardest.

- The US is still expected to outgrow Europe in 2025, but economists warn that the uncertain policy environment could hold back both business investment and consumer spending.

-

💰 Apple agrees to $95m settlement in Siri privacy class-action case ( Washington Post )

- What’s our take?

- Maybe I wasn’t crazy for thinking our phones are listening to us!

- Apple is paying out $95 million to settle a privacy lawsuit claiming Siri accidentally recorded users’ private conversations and sent them to third parties.

- While Apple did agree to the settlement, they still continue to “deny any and all alleged wrongdoing”. Despite this denied wrongdoing, Apple has agreed to delete recordings collected before October 2019 and be more transparent about its “Improve Siri” program.

- If you owned a Siri-enabled device since 2014, you could file a claim, even if Siri’s mishap was a one-time slip.

- Each claimant can submit accidental-activation claims for up to five devices, with a maximum $20 payout per device.

-

💪 Warren Buffett’s Berkshire Hathaway once again beats the S&P 500 ( CNBC )

- What’s our take?

- The Oracle doing what he does best.

- Berkshire Hathaway soared 25.5% in 2024, surpassing the S&P 500’s 23.3% and recorded its best year of returns since 2021.

- Buffett sold a hefty $133 billion in stocks (including Apple and Bank of America), nearly doubling Berkshire’s war chest to $325 billion.

- GEICO helped drive Berkshire’s operating earnings, rebounding from past telematics woes and more than doubling its underwriting profit.

- While Buffett acknowledges Berkshire’s size may hinder big future outperformance, he expects “slightly better” returns than the average U.S. company.

-

💸 Global corporate borrowing reached $8tn in 2024 ( FT )

- What’s our take?

- This can’t come back to bite them, right?

- Global corporate bond and loan issuance jumped more than a third from 2023, with firms pulling forward 2025 borrowing in the wake of strong investor demand.

- Despite historically tight spreads, overall yields remain higher because of elevated Treasury rates, attracting record inflows of nearly $170bn into corporate bond funds.

- Pharma giants, tech companies, and retailers took advantage of cheaper borrowing costs, while some bankers expect further M&A-fueled debt issuance in 2025.

- Analysts warn, however, that spreads are “priced to perfection,” and any meaningful widening could slow down the current borrowing frenzy.

Now let’s dive into the main piece.

🌍 The Macro Picture

Most economists and strategists are in agreement that global growth will stabilize at around 2.8% to 3.2% in 2025 and 2026. Economies that experienced a recession in 2024 are expected to experience modest growth, while some of the strongest economies of 2024 are expected to experience a slight slowdown.

Inflation is expected to remain under control (with the possible exception of the US) and most economies should see interest rates easing.

While the economic backdrop appears stable, policy uncertainty (i.e. tariffs) is a concern for many countries. JPMorgan Asset Management described it well, saying “Out of the Cyclical Storm and into the Policy Fog”.

Other key themes for the year are the potential impact of China’s stimulus program and what the next phase of the AI boom will look like.

➕ Potential Positive Catalysts

Analysts are cautiously optimistic about equity markets, but there are a few catalysts that could lead to upside surprises.

🤖 Innovation and productivity

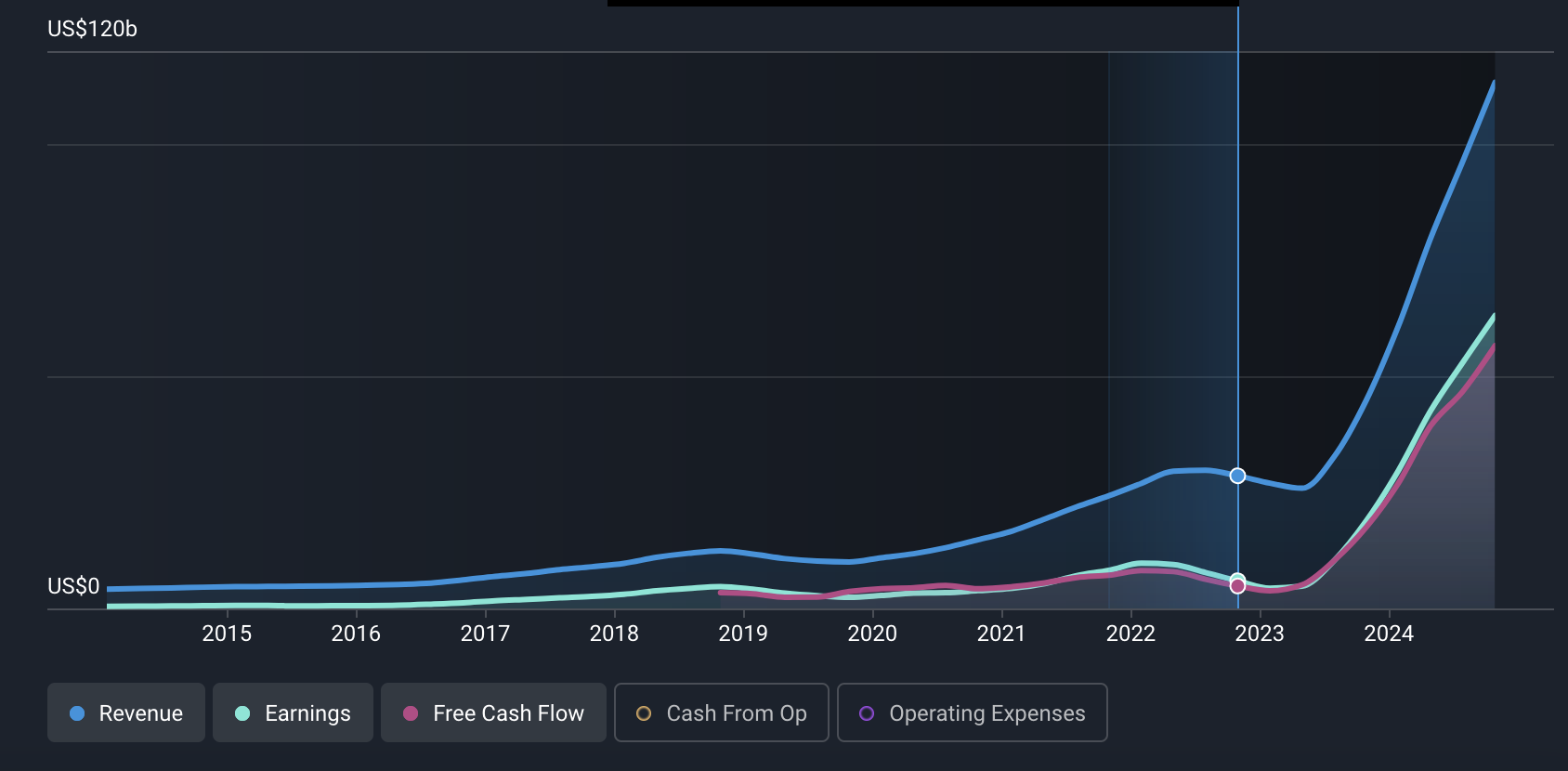

The gen AI investment cycle has been a reminder that innovation leads investment and growth. The models being developed by OpenAI, Google and others led to the investments in computers - with Nvidia being the primary beneficiary.

ChatGPT became a phenomenon in late 2022, and Nvidia’s revenue began to accelerate within months. If AI applications begin to prove themselves, another round of investment is likely to begin.

Deutsche Bank pointed out that productivity gains slowed in recent years after rising for several decades. AI and automation has the potential to lead to a re-acceleration in productivity that will be priced into the market as soon as it looks likely.

💹 Monetary Easing

Most central banks are now in a rate cutting cycle. Lower rates will be a key catalyst for most economies, with the possible exception of the US. If growth weakens, rate cuts should come faster.

🫸 A Fed Put and a Trump Put

Tom Lee from Fundstrat pointed out that higher rates could be very positive for markets. Higher rates would suggest the economy is in good shape , and would also give the Fed lots of room to cut if things go wrong.

Lee also reckons the Trump administration will measure its success by looking at the stock market. Assuming that’s true, Trump might hit the pause button if the market reacts badly to his policies.

These two ‘puts’ imply there’s a safety net protecting markets from a major correction - which is a positive for investor confidence.

➖ Possible Negative Catalysts

On the negative side, there are numerous ‘grey swans’ which could lead to economic or market weakness. Few analysts see these as very likely to be an issue in the next 12 months, but the probability isn’t zero either.

The most likely risk is an escalating trade war. It’s not just the impact of Donald Trump’s planned tariffs, but the response from other countries that could affect trade and inflation.

Apart from tariffs, the geopolitical risks we listed in March haven't gone away. These include the wars in Ukraine and the Middle East, and potential cyberattacks.

Other economic risks include government debt, a possible resurgence of inflation, and China’s economy.

🌏 Countries and Regions

The themes mentioned above are relevant to most countries - but there are also some dynamics specific to individual markets, and to regions.

🇺🇸 US

Charles Schwab’s outlook for 2025 has some great insights on US equities. It’s also a shorter, easier read than some of the other outlooks.

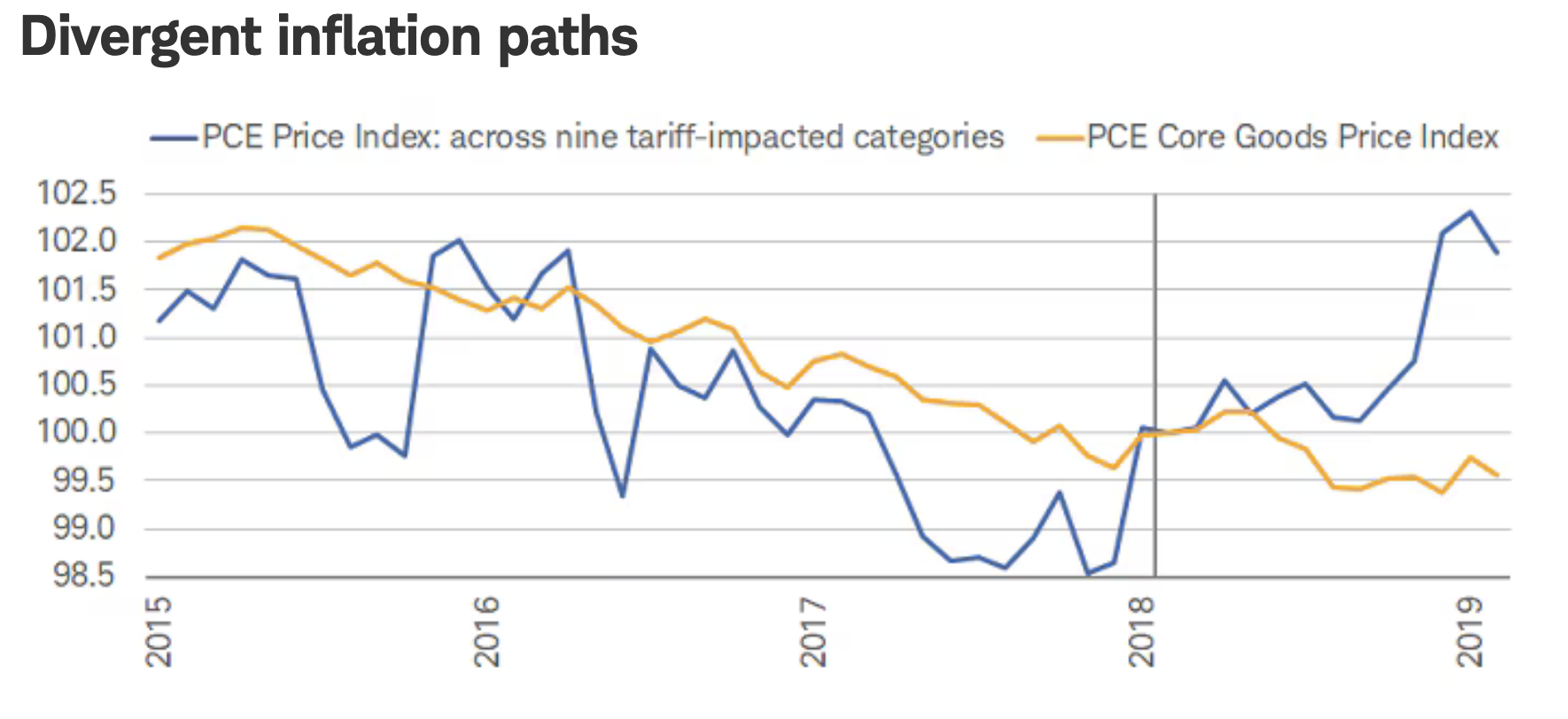

- There’s a 2018 playbook for the impact of tariffs on inflation. This chart shows that companies not affected by tariffs may have a relative advantage.

- Cyclical stocks have outperformed consumer staples over the last two years. Cyclicals are usually correlated with manufacturing, but manufacturing activity is still flat over the same period. So, either manufacturing needs to pick up, or cyclical stocks could mean revert.

- Small cap stocks are also beginning to outperform. There are some catalysts that are very good for smaller companies - but investors need to be selective. Small cap companies have more exposure to floating rate debt, and far fewer small caps are actually profitable. In other words, most small caps are very sensitive to interest rates.

- There are quite a few reasons to expect more volatility in 2025 - including policy uncertainty, the unknown direction of the AI trade and sector rotation. So don’t expect a smooth ride, and be ready to take advantage of it.

Citi’s outlook for the year (and several others) mentioned that Trump’s expected deregulation drive would enable banks to do business more easily and take on more risk. Deregulation could also favor small companies that spend more on compliance on a relative basis.

Fisher Funds pointed out that “the bar for meeting expectations is high, particularly in sectors like technology, raising questions about the sustainability of recent gains.”

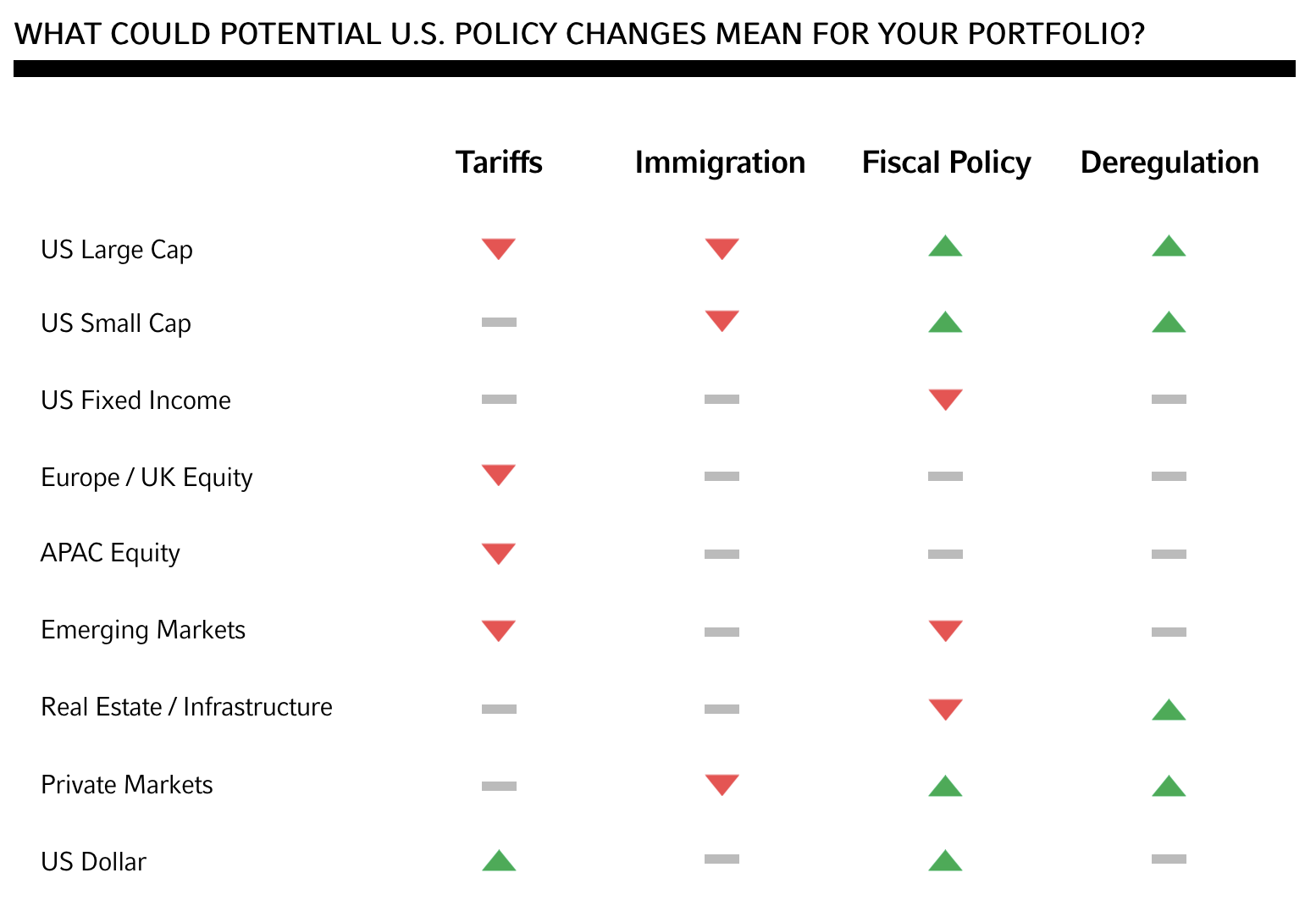

Finally, from Russell Investments , this graphic illustrates the likely effect of US policy changes on various asset classes.

🇨🇦 Canada

Canada is starting the year with some uncertainty over tariffs on exports to the US. RBC doesn’t believe Canada will be the main target of US tariffs , as they would negatively affect the entire manufacturing ecosystem across North America.

Beyond that uncertainty, Canada’s economy should benefit from lower inflation and interest rates, and recently announced tax relief measures. These factors are all positive for consumer spending. BMO favor technology stocks and cyclical sectors like consumer discretionary, financials and REITs .

Energy exports should also benefit from higher production and a weaker currency, however, this also depends on global energy prices. Likewise, other commodity producers stand to benefit from currency weakness, but that will also depend on global demand.

🇪🇺 Europe

There’s quite a lot of consensus on the outlook for Europe - perhaps too much? Economists expect a slight increase in GDP growth from 0.8% in 2024 to 1.2% in 2025. Most agree that Germany will continue to be a drag on the average.

While economic growth is forecast to be underwhelming, many analysts are optimistic about European equities. Reasons include:

- Falling rates, and stable inflation and energy prices.

- Low valuations relative to US stocks.

- The weaker Euro, favoring exports.

- Higher cash flows leading to stock buybacks.

Goldman Sachs are more pessimistic on the economic outlook, but still see upside for stocks. They point out that retailers and travel companies should benefit from lower rates, but have less exposure to potential tariffs in the US.

The GS outlook is a nice, and fairly brief summary of the situation in Europe.

🇬🇧 UK

The UK's government and central bank is having a very tough job balancing budgets, economic growth, inflation and interest rates. The new government’s budget is viewed as inflationary, which means UK interest rates could fall at a slower pace than in Europe.

At the same time, several strategists are very optimistic about UK equities. They point to low valuations, very attractive dividend yields and potential buybacks. This screener lists UK companies that score well on valuation, dividend yield and health.

✨ Quite a few analysts have pointed out that low valuations could make companies in the UK and Europe targets for M&A activity, or outright buyouts by private equity groups. If that happens, it would probably generate even more interest in the region’s equity markets.

If you're after more detail on the UK equity market, Martin Currie published an excellent report on the opportunity for investors.

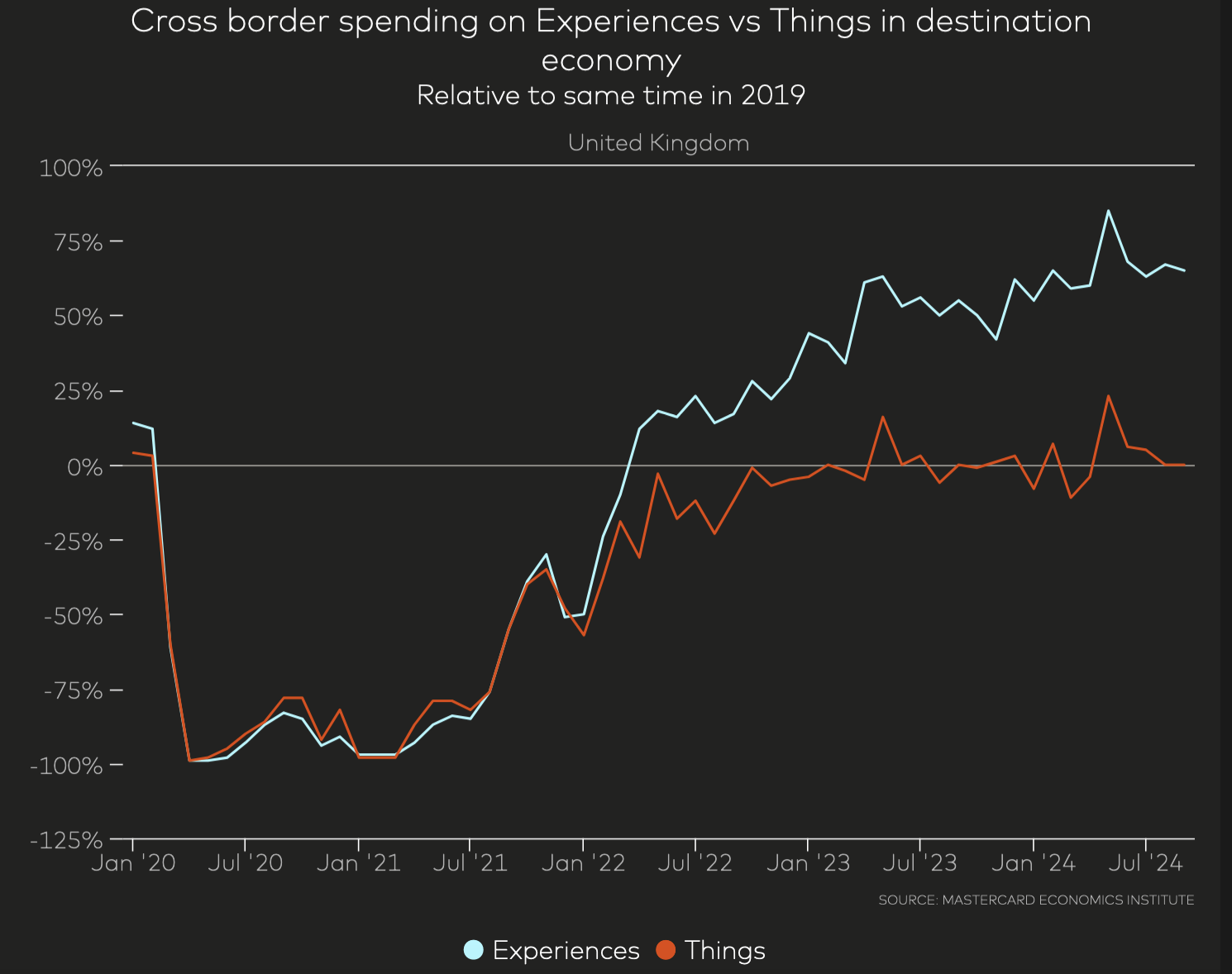

While we are on the subject of the UK, the Mastercard Economics Institute published some interesting charts on the divergence between consumer spending on ‘Experiences Vs Things’. This doesn’t only apply to the UK, it's happening in a lot of countries. The divergence was understandable when the pandemic ended, but it continued until earlier this year. Interestingly, the companies that benefit from this divergence might also be less exposed to tariffs.

🇨🇳 China

China is dealing with the prospect of 60% tariffs at the same time as its growth is subdued, and its property market remains in a slump.

The government is now throwing a growing mountain of fiscal stimulus at the problem. Support for consumption is expected to be between 0.5 to 1 trillion RMB in 2025.

HSBC’s 2025 outlook includes a chapter on the implications of stimulus measures for various sectors. The takeaways include:

- Real estate and local government debt is still in a precarious position. Various stimulus measures are taking time to improve the situations, and a property sector recovery will take at least 2 years.

- 30% of bank loans are tied to real estate, so banks are still vulnerable.

- E-commerce platforms and online retailers are benefitting from a government subsidy program.

- Mobile phones and PC sales are still in a slump.

Some of China’s sector P/E ratios are very high. However, those ratios are for earnings over the last year, after a three-year slump. If the tech sector’s earnings were closer to their peak, the ratio would be around 50x and below the long term average. How this all plays out depends on whether the stimulus program triggers a sustainable growth cycle or not.

🇮🇳 India

India’s economy outpaced every major economy in 2024, growing at about 6.8% which was nearly 2% ahead of China. Economists expect the outperformance to continue in 2025, possibly widening further.

International investors are still optimistic about India, but chose to rotate into Chinese stocks when its stimulus program was announced. India’s fundamentals are still strong, but other markets are viewed as better value.

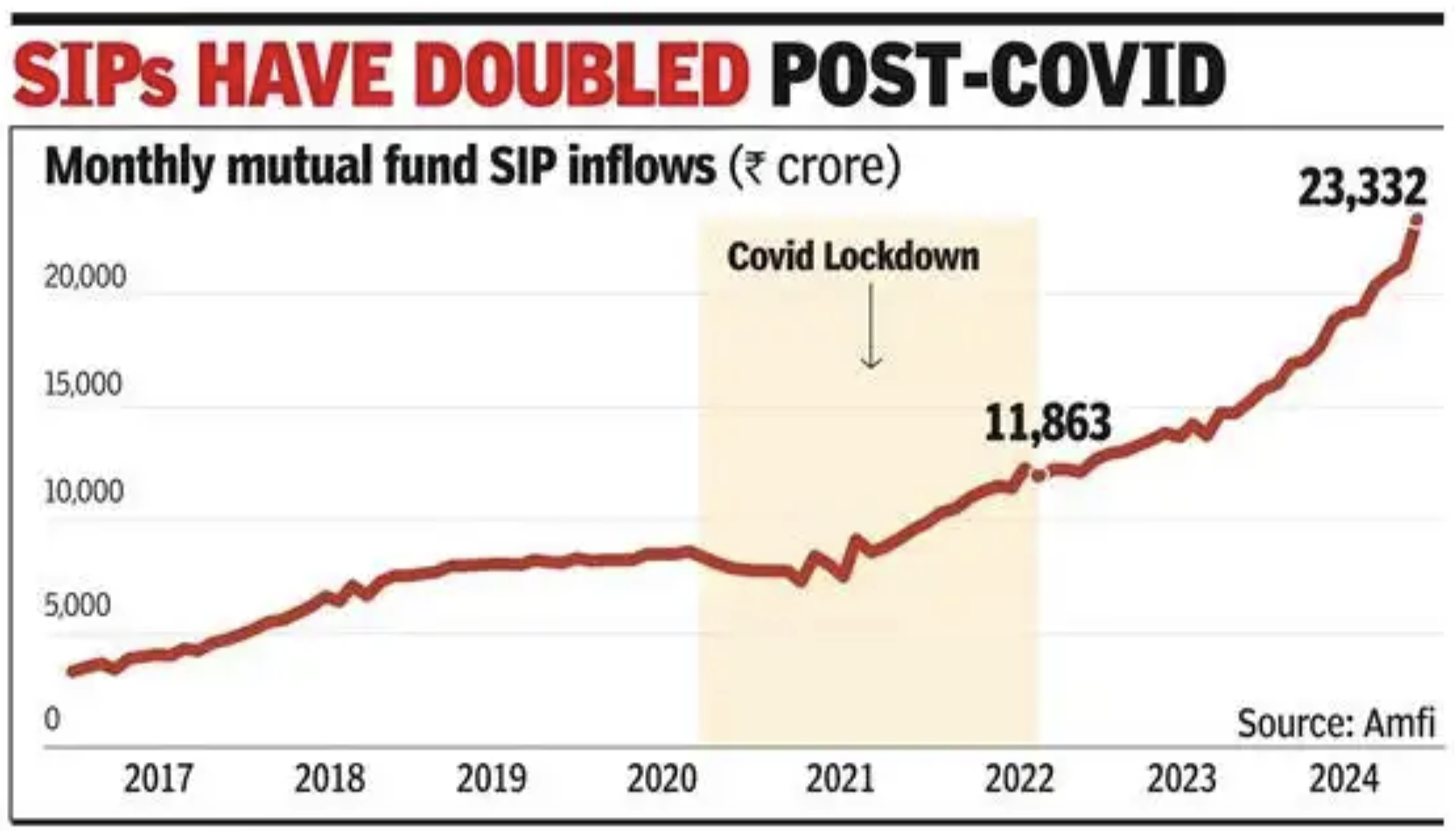

OCBC thinks India’s stock market could see more robust domestic flows , particularly from the SIPs (Systematic Investment Plans). This has actually been happening all along, but monthly inflows from local investors are now becoming significant.

India is benefitting from the virtuous cycle that occurs as more of the population join the formal economy and middle class. Discretionary income increases, which results in more consumer spending, and in this case, more local participation in the stock market.

Lots of sectors benefit from increased consumer spending, including banks. Barclays pointed out that private banks really stand to benefit as the number of affluent consumers increases.

India also stands to benefit from an escalating trade war between the US and China and a possible trade deal with more attractive terms.

🇯🇵 Japan

Japan was another favored market at the beginning of 2024, and equities performed well during the first half of the year. Since then, the Bank of Japan’s policy shift has changed the dynamics. Monetary policy is normalizing, which means higher interest rates and inflation - at least by Japan’s standards.

OCBC’s 2025 outlook highlights a few sectors that stand out:

- With interest rates rising, the Yen is one of the few currencies likely to strengthen in 2025. This favors companies with a domestic focus, and those that import consumer goods.

- Higher inflation also means higher wages and consumer spending. Once again, this is positive for consumer facing businesses and banks.

- Japan’s industrial companies are also positioned to benefit from increasing automation, locally and overseas.

For more detail and insight on Asian markets, have a look at the reports from OCBC and DBS , both based in Singapore.

🇦🇺 Australia

Australia’s economy is in a similar position to others that are hoping for lower rates. As rates come down, consumer spending should increase while the cost of capital decreases. That, along with attractive valuations in some sectors, should be positive for banks and consumer facing businesses.

With regard to exports, Australia has relatively limited exposure to potential US tariffs. On the other hand, Australia has more exposure to demand from China than any other G20 nation.

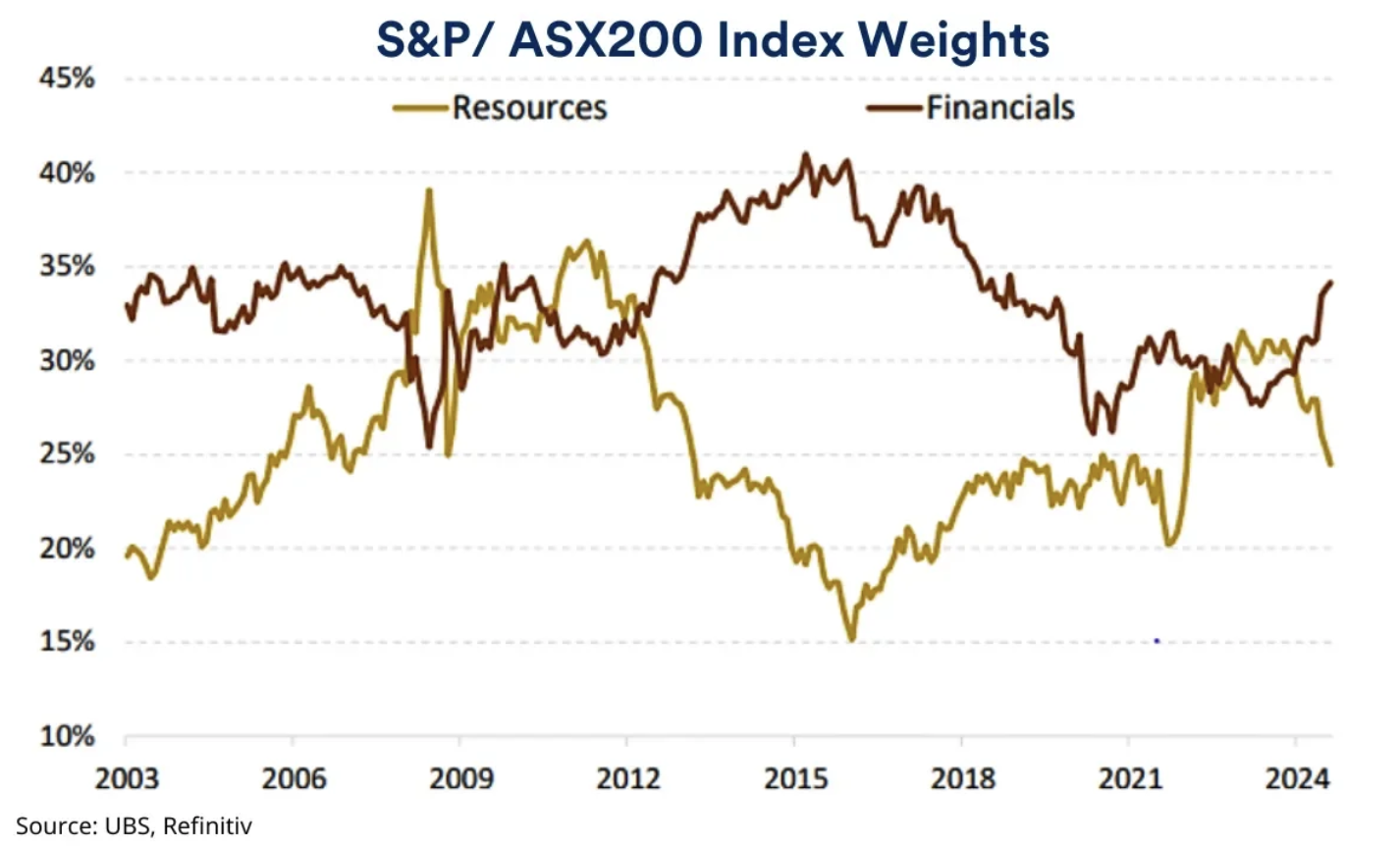

So the success (or failure) of China’s stimulus programs will be pivotal for Australia’s resource producers. They are exposed both to commodity prices and volumes. Schroders’ outlook for the market included this chart showing the relative weight of resource and financial companies in the index. The key point is that signs of rising demand from China could result in substantial rotation from financials to commodity producers.

💡 The Insight: Economic Growth Isn’t Essential For Stocks

Most of the economies expected to see an uptick in growth in 2025 are coming off a very low base, and are now aiming for quite modest growth rates. On the other hand, US growth is seen slowing after a very strong 2024.

Economic growth is positive for the stock market as a whole, and particularly for cyclical stocks - but it really isn’t essential for companies that benefit from long-term secular trends. Companies with growing markets or innovative, disruptive products, can grow earnings in all but the worst economic environments.

It’s also important to differentiate between earnings growth that comes from long-term secular tailwinds (which can continue for decades) or from cyclical factors that may be short-lived.

Reading through narratives written by the Simply Wall St Community is a great way to discover some companies that are likely beneficiaries of these long-term tailwinds.

Key Events During The Next Week

There’s no rest for economists, who are straight back to it in the New Year!

Monday

- 🇩🇪Germany’s preliminary year-on-year inflation rate is due. The previous figure came in at 2.2%, while economists are forecasting a slight dip to 2%.

Tuesday

- 🇫🇷 France’s preliminary year-on-year inflation rate is also due. Forecasts imply that we could see an uptick in the rate to 1.6%, up from 1.3%.

- 🇪🇺 Eurozone YoY inflation for December is due. Expectations are that inflation heats up slightly, with 2.4% forecast, compared to 2.2% from November.

- 🇺🇸 US JOLTs Job Openings for November is due.

Thursday

- 🇦🇺Australia’s balance of Trade is due. The previous mark was A$5.953B.

- 🇩🇪Germany’s Balance of Trade is to be reported. The previous result of €13.4B was noticeably lower compared to other results throughout the year.

Friday

- 🇺🇸 US unemployment rate for December, previously 4.2%, it’s expected to rise slightly to 4.3%

- 🇨🇦 Unemployment rate is due and is forecast to remain flat at around 6.8%.

We’re in the lull between earnings seasons but at the tail end of next week, some of the larger financial institutions begin to kick things off:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.