- United States

- /

- Medical Equipment

- /

- NasdaqGM:OBIO

US Penny Stocks Spotlight: AC Immune And Two Others To Consider

Reviewed by Simply Wall St

As the U.S. equities market starts the new year with a continued slump, investors are closely monitoring opportunities that might emerge amidst broader market challenges. Penny stocks, often representing smaller or newer companies, remain an intriguing niche for those seeking growth potential beyond the well-trodden paths of large-cap investments. Despite their vintage name, these stocks can still offer surprising value and stability when backed by solid financial foundations.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.11 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.838 | $5.59M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.58 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3267 | $10.67M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.62 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.45 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.01 | $84.54M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.66 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 727 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

AC Immune (NasdaqGM:ACIU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AC Immune SA is a clinical stage biopharmaceutical company focused on discovering, designing, and developing medicines and diagnostic products for neurodegenerative diseases linked to protein misfolding, with a market cap of $267.14 million.

Operations: No revenue segments have been reported for this clinical stage biopharmaceutical company.

Market Cap: $267.14M

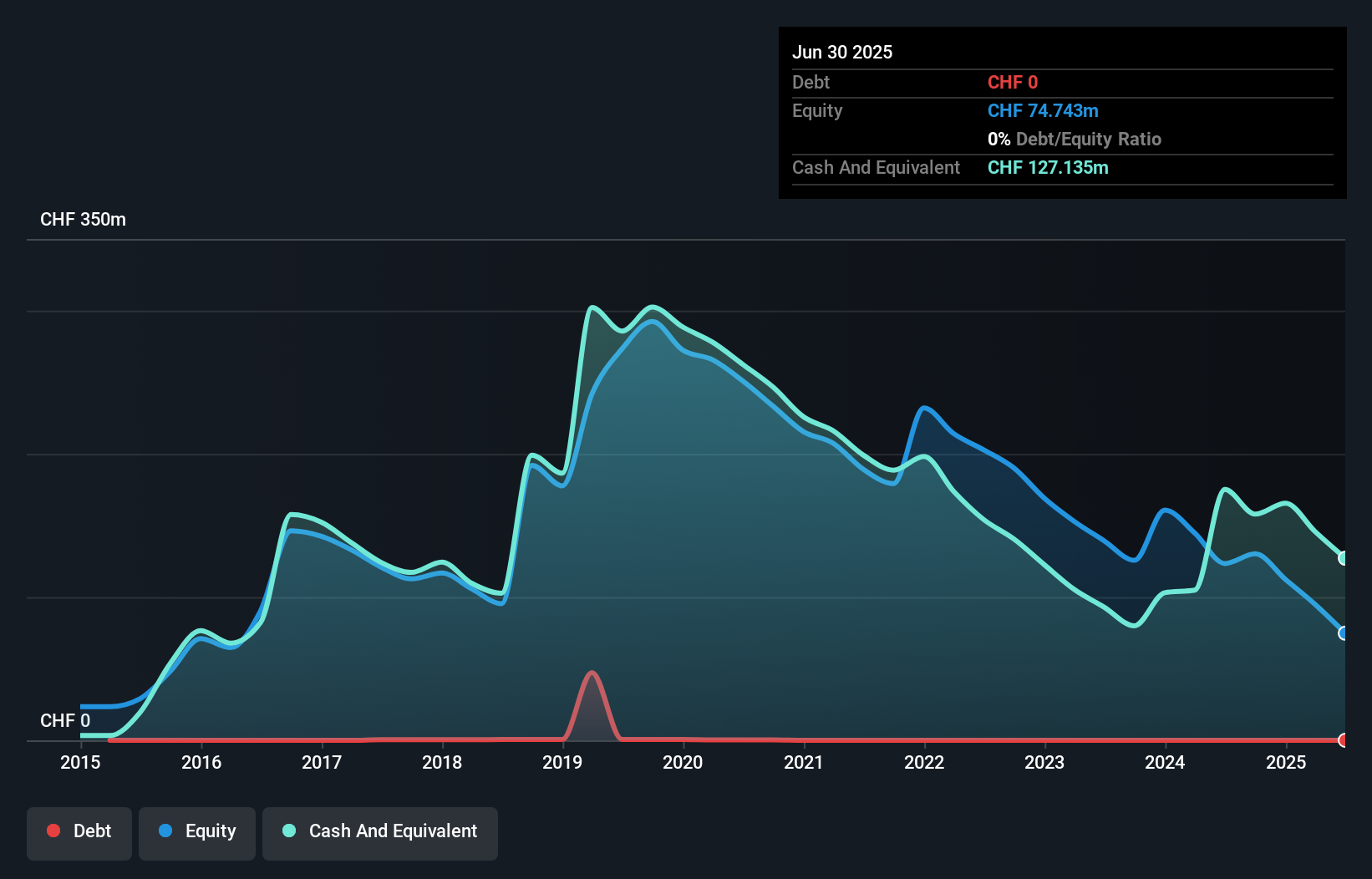

AC Immune, a clinical-stage biopharmaceutical company with a market cap of US$267.14 million, is pre-revenue and primarily focused on neurodegenerative diseases. Recent developments include promising interim safety data from trials targeting Alzheimer's and Parkinson's diseases, with ACI-24.060 receiving Fast Track designation from the FDA. The company's financials show CHF 25.49 million in third-quarter revenue and positive net income after previous losses. Despite being unprofitable overall, AC Immune benefits from strong short-term asset coverage over liabilities and no debt, providing a cash runway exceeding three years if current conditions persist.

- Jump into the full analysis health report here for a deeper understanding of AC Immune.

- Examine AC Immune's earnings growth report to understand how analysts expect it to perform.

Orchestra BioMed Holdings (NasdaqGM:OBIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orchestra BioMed Holdings, Inc. is a biomedical innovation company with a market cap of $152.05 million.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, totaling $2.65 million.

Market Cap: $152.05M

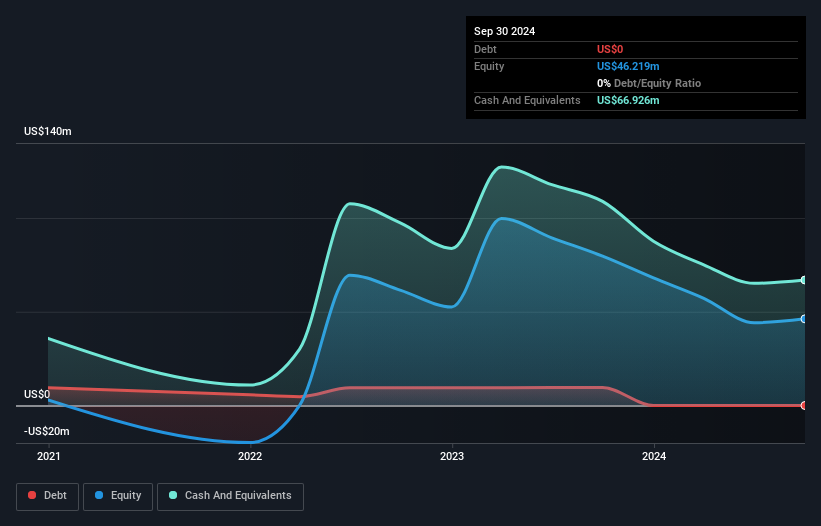

Orchestra BioMed Holdings, Inc., with a market cap of US$152.05 million, is pre-revenue and operates in the biomedical innovation sector. The company reported third-quarter revenue of US$0.987 million, reflecting growth from the previous year but remains unprofitable with a net loss of US$15.43 million for the quarter. Despite this, it has no debt and maintains strong short-term asset coverage over liabilities at US$68.6 million against short-term liabilities of US$16.2 million, providing a cash runway for over a year if current conditions remain stable amidst its volatile share price environment.

- Dive into the specifics of Orchestra BioMed Holdings here with our thorough balance sheet health report.

- Assess Orchestra BioMed Holdings' future earnings estimates with our detailed growth reports.

Quantum-Si (NasdaqGM:QSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quantum-Si is a life sciences company focused on developing a single-molecule detection platform for Next Generation Protein Sequencing, with a market cap of $385.32 million.

Operations: The company generates revenue from its Biotechnology (Startups) segment, totaling $2.27 million.

Market Cap: $385.32M

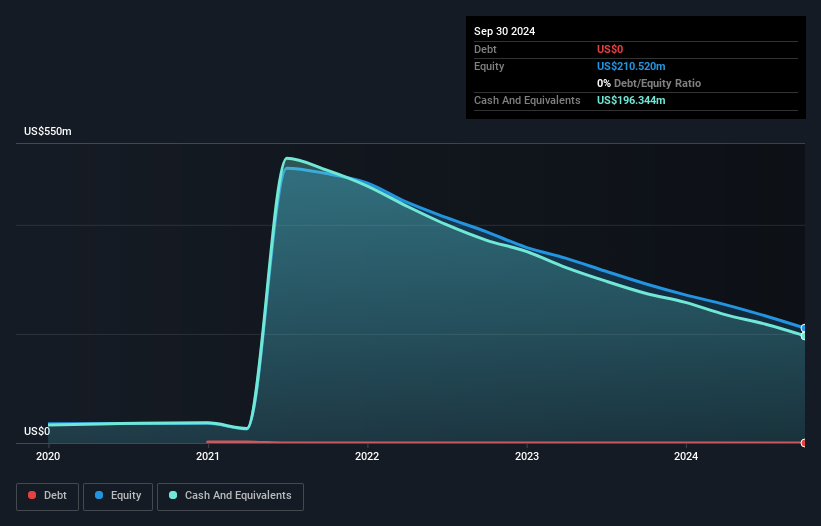

Quantum-Si, with a market cap of US$385.32 million, remains pre-revenue and unprofitable despite recent advancements in its product lineup and strategic collaborations. The company has expanded its international distribution network to 15 partners and introduced innovative tools like the Platinum Library Prep Kit V2 and the protein Barcoding Kit, enhancing proteomics research capabilities. However, it faces challenges such as a Nasdaq delisting notice due to prolonged low stock prices. Quantum-Si's short-term assets of US$205.8 million exceed liabilities, providing a cash runway exceeding one year while remaining debt-free amidst high volatility in share price movements.

- Unlock comprehensive insights into our analysis of Quantum-Si stock in this financial health report.

- Gain insights into Quantum-Si's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Gain an insight into the universe of 727 US Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OBIO

Flawless balance sheet low.

Market Insights

Community Narratives