Quote of the Week: “It is wholly a confusion of ideas to suppose that the economical use of fuel is equivalent to a diminished consumption. Whatever, therefore, conduces to increase the efficiency of coal, and to diminish the cost of its use, directly tends to augment the value of the steam engine , and to enlarge the field of its operations.” - The Coal Question, William Stanley Jevons, 1865

The market had its first wobble in a while last week - and it had nothing to do with all the executive orders Donald Trump was signing or fourth-quarter earnings season.

This time it was a tiny LLM model from China that got Silicon Valley and Wall Street wondering if investing $600 billion in GPUs was such a great idea after all.

This week, we are taking a closer look at the potential winners and losers from the DeepSeek R1 saga. Plus, we’re also taking a look at the potential winners and losers after Donald Trump’s first 10 days in office.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

🤝 M&A activity in Europe shows signs of recovery in Q4 2024 ( S&P Global )

- What’s our take?

- European and UK banking stocks could see higher fee income from M&As.

- Dealmaking in the region has been subdued for the last few years, but that could be changing. Dealsuite, an M&A sourcing platform, said that trends like “ tech advancements, AI, automation and sustainability and industry consolidation ” will influence market dynamics in 2025. KPMG also believes that global M&A activity is picking up momentum.

- There are a few parties that would benefit from this trend. Firstly, acquisition targets getting bought out by better-financed competitors. Secondly, those with the means to acquire desirable businesses that are trading on the cheap, and lastly, banks, those who are facilitating the deals and make fee income.

🇦🇺 Australia could feed rising tantalum demand ( S&P Global )

- What’s our take?

- Rare earth mineral providers in safer jurisdictions could see tailwinds from this.

- Tantalum, a common byproduct of lithium, is on the “critical minerals list” of several countries, including the US, the UK, India, and Australia. Funnily enough, Australia has the largest estimated reserves, at 25.5% of global supply, but ranks 6th in terms of production, behind the Democratic Republic of Congo, Rwanda, Brazil, Nigeria, and China.

- Demand for the mineral is expected to continue growing slowly since it's a key input in the electronics, aerospace, and medical sectors. However, supply challenges in Africa explain why some Australian mines are well-positioned to benefit.

- Stocks like Pilbara Minerals , Wildcat Resources, and a few other stocks that are microcaps have exposure to this resource being mined in Western Australia.

☕ Starbucks keeps struggling as it waits for its new CEO’s plan to percolate ( Sherwood )

- What’s our take?

- It takes time to change direction on a large boat, and Starbucks’ situation is no different.

- Starbucks beat analysts’ low expectations on its latest earnings report, despite earnings being 23% lower and same-store sales lagging. Analysts want to see change in a few quarters, rather than years. Quite a hard task, but investors are an impatient bunch.

- New CEO Brian Niccol joined in September and has this big task ahead of him. He’s already started implementing plenty of changes to try and get stores back to their “cozy coffeehouse vibes” that enticed customers to visit in the first place. Time will tell if the company can pull it off, but given his track record, and the current stock price, investors seem to think it can.

🏛️Wall Street regulator revokes accounting guidance on crypto assets ( Reuters )

- What’s our take?

- It’s a win for the crypto and banking sector, and yet another pivot away from the prior administration.

- The law, SAB 121, which stands for Staff Accounting Bulletin 121, forced banks that wanted to act as custodians over crypto assets for their clients to record them as liabilities on their balance sheet. This meant they’d need to acquire $1 of assets for every $1 of crypto assets held in custody for clients. As you can imagine, this made it uneconomical for them to do so. Last year, both the House and Senate voted to rescind SAB 121, but the president at the time vetoed the decision.

- Apparently the banking industry has “ welcomed the withdrawal of the guidance ”. The change now restores banks' ability to serve as custodians for clients who want to own digital assets. With this news, we should expect to see banks start to offer custody services in this space.

📈 Bitcoin boosts Tesla profits by almost $600 million after accounting rule change ( Business Insider )

- What’s our take?

- Expect plenty of earnings volatility, both up and down, from companies that hold crypto on their balance sheet.

- FASB rule changes late last year now allow companies to mark their crypto holdings at market value. Previously, they were only allowed to mark it either down if it had declined, or at cost if it was above cost. This $600m boost to Telsa’s GAAP earnings was 9% of its $7.1bn in profit for 2024. Remember, that $600m isn’t cash flow, it’s only paper profits that would become cash flow if it sold. Regardless, Tesla might be regretting selling 75% of their Bitcoin holdings back in 2022 for $1.7bn at $20k each.

- These FASB accounting rule changes remove a pretty large impediment to holding the likes of Bitcoin, so we may see more companies adopt a similar approach with their balance sheets.

📝 Trump’s Week One Executive Orders

As expected, Donald Trump was in the Oval Office signing a pile of executive orders within hours of his inauguration. Below, we've summarized key takeaways from those most relevant to investors.

There’s a sortable list of executive orders, including the actual wording, on the NPR website.

🤝 Trade

As of 29th January, President Trump hadn’t announced any specific tariffs or trade policy action. However, the White House said he still planned to impose tariffs on Mexico and Canada, and possibly on China, on Saturday, 1st February. (* Update February 3rd: Trump implements tariffs ).

He appeared to be using these threats as bargaining chips for those countries to act to stop illegal immigrants and fentanyl from entering the US.

Trump also directed various agencies to investigate unfair trade policies, currency manipulation, and trade agreement violations by other countries.

❓ Implications for Investors

After all the rhetoric, it was a little surprising to see no action on day one. With so many economists warning that blanket tariff policies will be detrimental to the economy, it’s possible that Trump is backing off his initial plan. (* As of February 3rd, the tariffs have been implemented ). Alternatively, there may be ongoing negotiations behind the scenes.

✨ Markets are already pricing in some impact from tariffs - so a meaningful softening of trade policy could lead to a weaker dollar and lower rates, which would be good news for companies exporting from the US, and foreign companies importing from the US.

⚡ Energy

Trump signed several executive orders aimed at increasing US oil and gas production. These include:

- 🛢️ Removing restrictions on oil and gas drilling, particularly in Alaska, offshore, and on 16 million acres of land protected by a Biden directive.

- 🏗️ Fast-tracking permits for Alaska LNG projects.

- 📃 Reviewing LNG export projects and permits - issuing new export permits had been paused.

❓ Implications for Investors

These actions were largely anticipated. The fact that they were amongst the first orders to be signed reflected that energy production is a priority.

✨ But, there is more to increasing oil and gas production than issuing more permits to drill.

Refining, storage, and pipeline capacity must also be increased, all requiring capital. And for these changes, investors must look beyond the next four years.

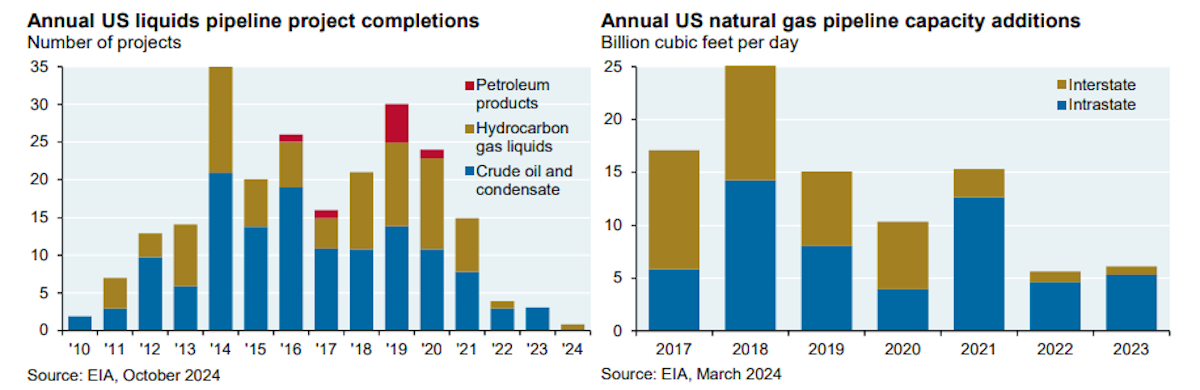

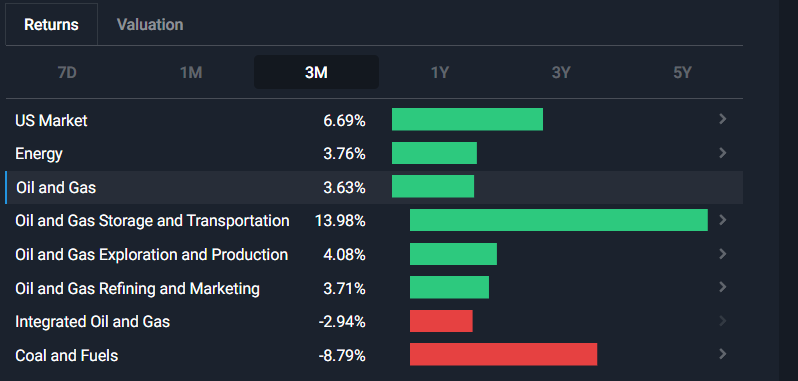

The chart above from JP Morgan shows how new pipeline capacity has fallen during the last decade. And, below, we see which part of the industry has seen the most gains since the election.

Some analysts have also warned that OPEC+ countries could retaliate by increasing production, causing prices to fall below the production costs of US producers.

The diversified oil producers like Exxon Mobil and Chevron are already focussing on high-margin assets - but would need to increase investments to ramp up production substantially.

Smaller companies may have the opportunity to increase production significantly - but would also be very sensitive to lower oil prices. Make sure you check what the company’s cost per barrel to produce is. Those with more buffer will see less impact on their margins if the oil price reduces.

☀️ The Environment and Renewable Energy

The Trump administration was also quick to withdraw from the Paris Agreement and roll back Biden’s policies that favored renewable energy.

These included:

- 🌬️ Halting offshore wind leasing and onshore wind permitting

- 💵 Prioritizes economic efficiency over environmental concerns

- 🔌 Revoking a mandate for zero-emission vehicles

- ✂️ Disbanding the Interagency Working Group on the Social Cost of Greenhouse Gases.

❓ Implications for Investors

These actions were also widely expected and are bad news for the renewable energy industry. Most stock prices in these industries already reflect this sentiment.

However, the administration is also likely to face legal and political challenges, particularly when it comes to projects that have already been approved.

Many of the projects initiated under Biden’s ‘Inflation Reduction Act” have resulted in new jobs, which would be lost if some projects are terminated.

✨ The wind energy industry is certainly in the crosshairs, while solar projects are less affected - though they probably can’t expect any government support. Legacy automakers may begin to reconsider their EV plans.

🛂 Immigration

Trump's executive orders concerning immigration were wide-ranging. The orders aim to make legal and illegal immigration to the country more difficult. Deportations have already begun across the country.

❓ Implications for Investors

These actions were also no surprise, and are expected to cause far lower net migration.

Regardless of the actual number of deportations, lower immigration rates are likely to affect the labor market for certain industries, particularly agriculture, hospitality, and manufacturing.

The increased focus on border security should benefit certain defense contractors.

💸 Crypto

The Strengthening American Leadership in Digital Financial Technology executive order lays out several initiatives to develop the digital asset industry.

Key initiatives include:

- 📃 Directing federal agencies to collaborate on developing a regulatory framework that promotes innovation while mitigating risks.

- 🥇 Encouraging U.S. leadership in shaping global digital asset standards.

- 🛡️ Establishing guidelines to safeguard consumers and investors from cybersecurity threats and fraudulent activities.

- 💰 Evaluate the potential creation of a digital asset stockpile.

- 💵 Prioritizes dollar-backed stablecoins over central bank digital currencies (CBDCs)

❓ Implications for Investors

Developing a proper regulatory framework is a huge step for the industry. Unfortunately, it was also overshadowed by Trump issuing his own meme coin three days before he took office, and some are questioning his motives.

The working group has 180 days to deliver their recommendations, so don’t expect clarity in a hurry. This delay could lead to uncertainty and volatility in the crypto market in the near term.

✂️ Deregulation

Trump issued wide-ranging orders regarding regulation across several industries. This included rescinding 78 executive orders and memorandums signed by former President Biden, all regarding regulations.

❓ Implications for investors

Deregulation has always been a cornerstone of Trump’s agenda, and these actions were in line with expectations.

Removing the cost of remaining compliant is particularly helpful for smaller companies (small caps). It’s also a positive for the financial sector when more deals are approved and more financing is needed.

Of course, deregulation can also lead to increased systemic risk, which typically only becomes apparent at a later date.

⚖️ Executive Orders Vs Reality

Executive orders do have certain limits. Typically, an EO takes 6–12 months to implement, but some can take just a matter of days. They can also be challenged in court, causing even longer delays.

In addition, certain orders are subject to funding that must be approved by Congress. That shouldn't be a problem, assuming he manages to keep the GOP in line.

✨ All this means there could still be a level of uncertainty in the first year - which may well lead to periods of volatility. Retaliation on trade tariffs - or the suggestion of retaliation - would probably lead to volatility too. Towards the end of the year, there should be more clarity on policy direction.

🤖 DeepSeek Upends AI Industry

A few weeks ago, few people had heard of DeepSeek, a Chinese AI start-up. By last week most of the world, and every Nvidia shareholder, was learning about DeepSeek, its open-source R1 model, and Jevons Paradox.

Because plenty of other publications have covered the technical side of things, we aren’t going to go into too much detail about the model itself. Instead, we’re going to focus on the possible implications for investors.

If you do want a more detailed overview, Ben Thompson wrote an excellent DeepSeek FAQ on his Stratechery blog.

🤷 What's All The Fuss About?

While we’re not going to get too technical, we do need to cover a few things about the model. DeepSeek’s R1 model is noteworthy for more than one reason.

- 🏃 Cheap and dated hardware: Firstly, it was trained on H800 Nvidia chips, which are both dated and intentionally inferior to the latest Nvidia chips available outside China. The final training run cost $5.6m which is a fraction of the cost incurred training the most advanced models developed by OpenAI, Anthropic and other leading LLM developers.

- 🧠 New techniques: The model uses several innovative techniques to reduce memory use during training AND inference.

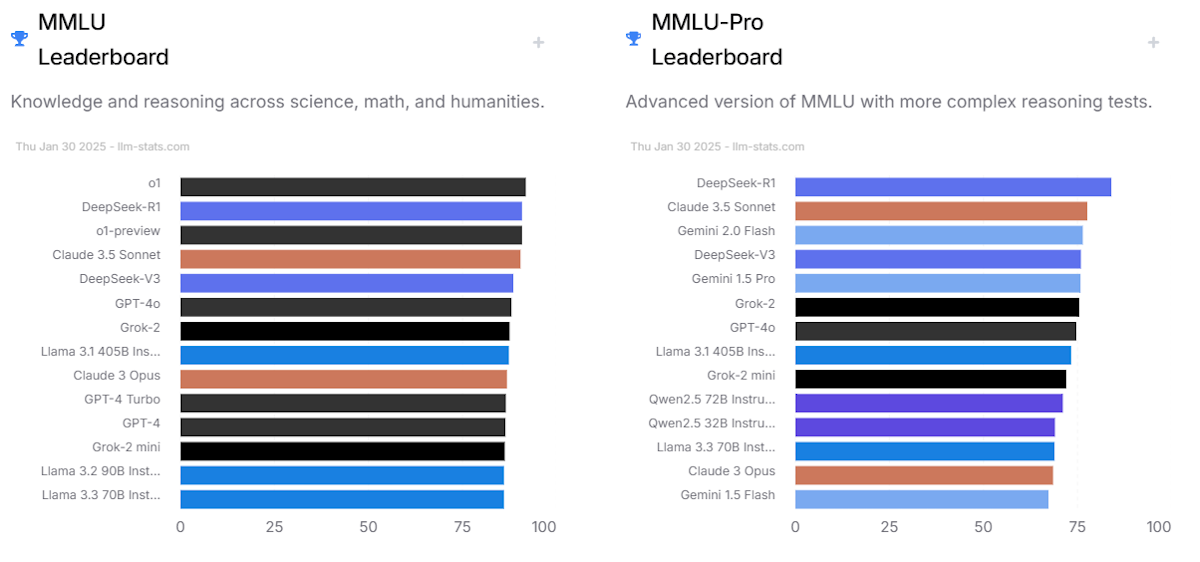

- 🧑🏫 Outperformance: It’s particularly adept at reasoning where it outperformed every other model apart from OpenAI’s o1. When it comes to more advanced reasoning, it beats every model, including o1. Interestingly, it was less competitive with mathematics questions and coding tasks.

❗ BTW: The LLM-Stats site is a fascinating resource to compare LLM models across various benchmarks and tasks. You can also see how quickly all the models are advancing.

🤔 Is DeepSeek's R1 Model Really As Good As Claimed?

There have been numerous criticisms about the process DeepSeek used to build and train its models. The company likely used OpenAI models (and others probably) to train its model. So Microsoft and OpenAI are probing into how they obtained the data.

✨ That means the efficiency claim is somewhat misleading, as R1 benefited from all the GPUs and expenses that went into training those models, rather than starting from scratch.

Also, LLM models can be trained to score on certain tests. If you are a start-up looking to make a name for yourself, you’ll optimize your model to perform on the test. If you have bigger goals, you might pay less attention to test results.

Assuming R1 was trained using other models, it would have to be updated using other models to remain competitive. So it may not be as much of a leading edge model as the table above suggests.

However, DeepSeek’s R1 model does prove a few things:

- 🤖 Firstly, the potential of distillation , where the capabilities of a large model can be transferred to a smaller, more efficient model to perform specific tasks.

- 🇨🇳 China isn’t as far behind in AI as some may have thought. And banning chip exports to China might not be very effective.

- 🧑💼 Open-source LLMs are for real , and open-source projects often attract talented engineers.

There are also numerous security and privacy concerns about the app that’s available for smartphones. Those concerns may well be warranted, but they are a separate issue from the underlying model.

🔄 Implications For Investors And For companies In The AI Ecosystem

It didn’t take long for DeepSeek to make it onto the Wikipedia page for Jevons paradox , and it’s an excellent example of the paradox in action.

Jevons paradox suggests that as a resource becomes more efficient to use, people find new uses for it, causing overall consumption to increase. This has occurred with coal, oil, steel, electricity, motor vehicles, and the internet.

Returning to generative AI, more efficient models will reduce the cost of inference. This will make it cheaper to build and run applications, which may well speed up the adoption of those applications.

A year ago, we wrote about the six layers in the AI value chain. This is relevant to the potential impact of more efficient models. Below are the six layers and examples of companies within each layer.

- 💻 Hardware: Nvidia, Broadcom, Super Micro Computer

- ☁️ Cloud Providers : Microsoft, Alphabet, Amazon

- Electricity generation is adjacent to this layer.

- 🧑💻 LLM model developers : Alphabet, Meta, Anthropic, DeepSeek

- 🤖 Model hubs and MLOps: Databricks, Microsoft Azure ML, Hugging Face.

- 👾 Applications: Meta, Alphabet, Salesforce, and AppLovin

- 💼 Services: IBM, Kyndrl, HPE, and Accenture

In the near term, cheaper or more efficient inference could lead to more rapid development and adoption of applications built on top of LLMs. That would be good news for app developers and the companies that support them.

For the infrastructure layers (1-3) more efficient models could lead to a drop in demand for compute power (and electrical power). Data Centers might struggle to recoup their investment in GPUs and might decide to buy fewer of those GPUs.

Ultimately, faster adoption should lead to more demand for compute power. If that’s the case, it’s really a matter of timing. Will AI adoption increase fast enough to generate demand for compute power at the rate it’s currently being built - or will there be a lag with Nvidia GPUs sitting idle in data centers?

💡 The Insight: Look At Both Sides Of The Story Then Assess The Probabilities

Generative AI is likely the most important secular trend of this era, and Nvidia has understandably been the biggest winner so far.

However, any company is likely to face challenges from time to time. The higher the market’s expectations, the bigger the correction when cracks appear in the bull case.

✨ Diversifying across the AI value chain is one way to reduce risk. The other is to make sure you are aware of potential bearish scenarios.

Simply Wall St’s collection of narratives written by community members is growing by the day. There are now 10 narratives for Nvidia presenting a wide range of potential outcomes.

This narrative, published in 2023, highlighted the risk of oversupply as GPU performance accelerates:

You can make sure you’re aware of potential catalysts you may have missed, particularly those that contradict your thesis. Even if you don’t agree with the overall thesis, you can add them to your list of potential risks to keep an eye on.

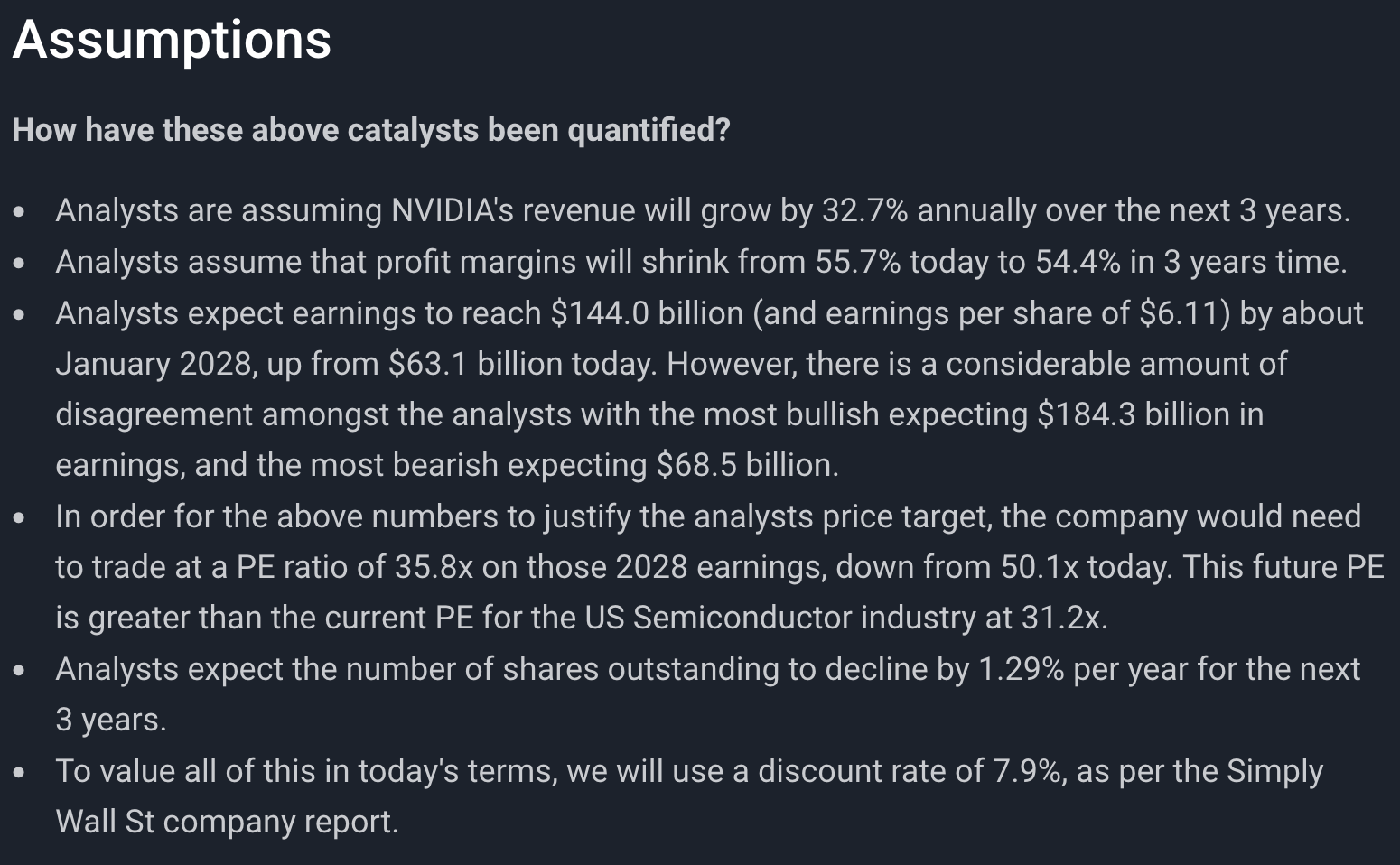

Speaking of AI, Simply Wall St’s WarrenAI generates narratives incorporating analyst estimates, price targets, and commentary from earnings call transcripts.

These narratives create a fair value estimate around analyst price targets. It’s a bit like a reverse-engineered price target, which gives you an idea of what those price targets imply for the company’s performance. That’s another good place to start when you’re creating your own narrative and fair value estimate.

Key Events During the Next Week

This week, there are some key employment and sentiment data releases to keep an eye out for:

Monday

- 🇨🇳 China's Caixin Manufacturing PMI is expected to remain at 50.5.

- 🇺🇸 US ISM Manufacturing PMI is expected to rise slightly from 49.3 to 49.8.

Tuesday

- 🇺🇸 US JOLTs Job Openings are expected to decrease from 8.1M to 7.8M. That would be a substantial decrease compared to recent figures.

Wednesday

- 🇺🇸 US ADP National Employment is expected to decline to 115k from 122k.

- 🇺🇸 US ISM Services PMI is forecast to decline marginally to 54.

Thursday

- 🇦🇺 Australia's Balance of Trade is expected to decline from $7bn to $3.2bn.

- 🇬🇧 The Bank of England is forecast to cut the benchmark rate from 4.75% to 4.5%.

- 🇺🇸 US Initial Jobless Claims are forecast to increase to 215k from 207k.

Friday

- 🇺🇸 US Nonfarm Payrolls is expected to show a decrease from 256k to 205k.

- 🇺🇸 US unemployment is forecast to remain steady at 4.1%.

- 🇨🇦 Canada’s unemployment rate is expected to increase slightly to 6.8%.

Fourth quarter earnings season continues with more Mag7 stocks and some prominent pharmaceutical companies and chipmakers.

The largest are listed below - or you can check the Nasdaq website for a more comprehensive list:

- Amazon

- Alphabet

- Eli Lilly

- Merck

- Pfizer, Inc.

- Disney

- AMD

- Qualcomm

- Arm Holdings

- Palantir

- Uber

- Fiserv

- Spotify

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.