- United States

- /

- Personal Products

- /

- NasdaqCM:NHTC

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the new year begins, major U.S. stock indices have extended their recent slump, with the Dow Jones Industrial Average and S&P 500 both experiencing declines. Despite these broader market challenges, penny stocks—often representing smaller or newer companies—remain an area of interest for investors seeking growth opportunities. While the term "penny stock" may seem outdated, these investments can still offer significant potential when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.77 | $5.59M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.22 | $1.85B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.4M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.30 | $9.9M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.29 | $10.67M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.01 | $91.3M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.47 | $42.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.31 | $23.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.94 | $84.54M | ★★★★★☆ |

Click here to see the full list of 735 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Natural Health Trends (NasdaqCM:NHTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Natural Health Trends Corp. is a direct-selling and e-commerce company offering personal care, wellness, and lifestyle products under the NHT Global brand, with a market cap of $53.02 million.

Operations: The company's revenue is derived from its wholesale miscellaneous segment, totaling $43.05 million.

Market Cap: $53.02M

Natural Health Trends Corp. has demonstrated stable weekly volatility and improved net profit margins, currently at 1.8%, compared to last year's 0.9%. The company is debt-free, with short-term assets of US$53.8 million exceeding liabilities, indicating financial stability. Earnings have grown significantly by 89.4% over the past year, surpassing both industry averages and the company's five-year growth rate of 38.7% per year. Despite a low return on equity at 2.1%, the company maintains high-quality earnings and an experienced board with an average tenure of over nine years, though its dividend sustainability remains questionable due to coverage concerns.

- Unlock comprehensive insights into our analysis of Natural Health Trends stock in this financial health report.

- Learn about Natural Health Trends' historical performance here.

Ikena Oncology (NasdaqGM:IKNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ikena Oncology, Inc. is an oncology company focused on developing therapies targeting cancer growth, spread, and resistance in the United States, with a market cap of $79.14 million.

Operations: Currently, there are no reported revenue segments for Ikena Oncology.

Market Cap: $79.14M

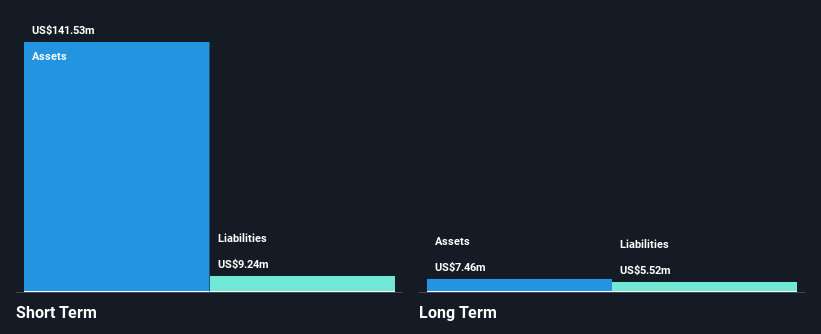

Ikena Oncology is a pre-revenue company with a market cap of US$79.14 million, indicating its position in the early stages of development. The company has no debt and possesses short-term assets totaling US$141.5 million, which comfortably cover both short-term and long-term liabilities. Despite being unprofitable with increasing losses over the past five years, Ikena has secured significant financing through a US$75 million private placement involving key investors like Deep Track Capital and Foresite Capital. Additionally, Ikena is set to merge with Inmagene Biopharmaceuticals in a reverse merger transaction expected to close by mid-2025.

- Take a closer look at Ikena Oncology's potential here in our financial health report.

- Gain insights into Ikena Oncology's future direction by reviewing our growth report.

Tuniu (NasdaqGM:TOUR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tuniu Corporation is an online leisure travel company operating in China with a market cap of $126.45 million.

Operations: The company's revenue segment consists of Travel Services, generating CN¥510.84 million.

Market Cap: $126.45M

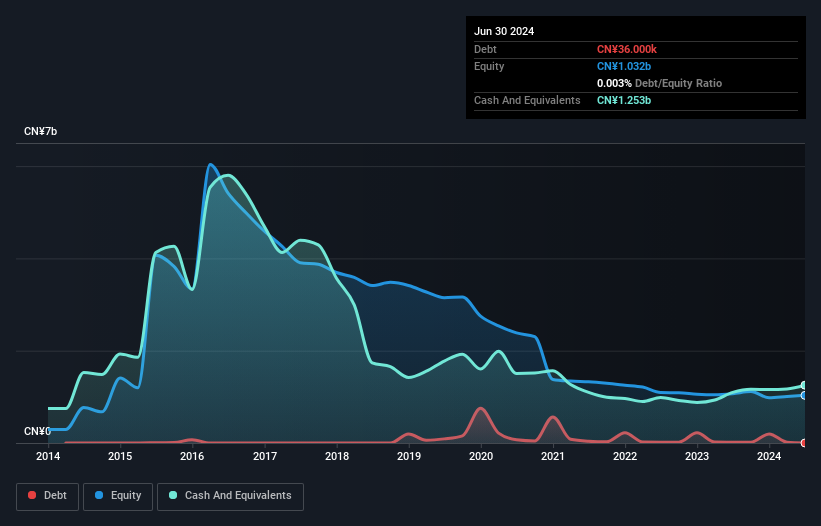

Tuniu Corporation, with a market cap of $126.45 million, operates in the online leisure travel sector in China. The company reported third-quarter revenue of CN¥186 million and net income of CN¥44.45 million, showing year-over-year growth. Despite being unprofitable overall, Tuniu has reduced its losses over the past five years and maintains more cash than debt, indicating financial stability. Recent strategic moves include a share buyback program where 6.2 million shares were repurchased for $5.6 million, reflecting management's confidence in the company's valuation and future prospects amidst ongoing challenges in profitability and industry conditions.

- Click here to discover the nuances of Tuniu with our detailed analytical financial health report.

- Explore Tuniu's analyst forecasts in our growth report.

Make It Happen

- Unlock our comprehensive list of 735 US Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Natural Health Trends, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Natural Health Trends might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NHTC

Natural Health Trends

A direct-selling and e-commerce company, provides personal care, wellness, and lifestyle products under the NHT Global brand.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives