- United Kingdom

- /

- Consumer Finance

- /

- LSE:FCH

Spotlight On UK Penny Stocks For April 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and global economic uncertainties. Despite these broader market pressures, investors often look to penny stocks for their potential to offer both affordability and growth. While the term "penny stocks" might seem outdated, it remains relevant as these smaller or newer companies can present unique opportunities when they demonstrate strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.647 | £54.63M | ✅ 4 ⚠️ 4 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.74 | £282.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.21 | £160.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.595 | £407.32M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.835 | £369.68M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.624 | £1.01B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.966 | £154.06M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.822 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 386 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Fonix (AIM:FNX)

Simply Wall St Financial Health Rating: ★★★★★★

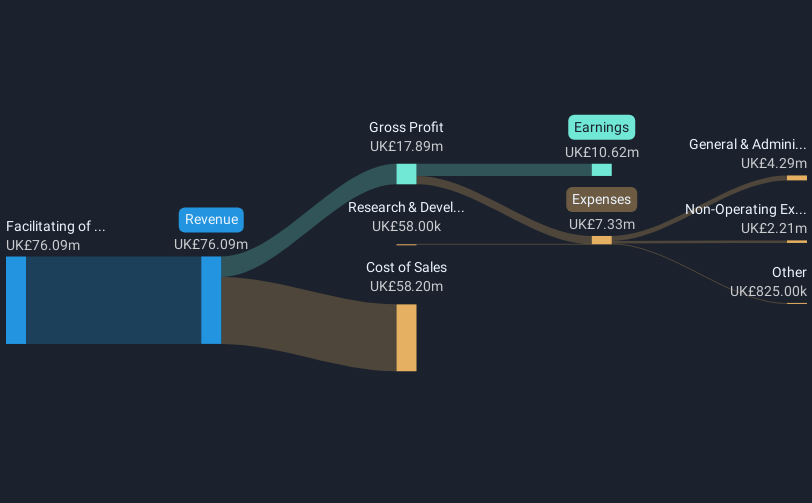

Overview: Fonix Plc operates in the United Kingdom, offering mobile payments and messaging services, as well as managed services for sectors such as media, charity, gaming, and e-mobility, with a market cap of £198.15 million.

Operations: The company generates £75.18 million in revenue from its mobile payments and messaging facilitation segment.

Market Cap: £198.15M

Fonix Plc, with a market cap of £198.15 million, offers promising attributes for investors interested in penny stocks. The company has demonstrated consistent earnings growth of 14.8% annually over the past five years and maintains high-quality earnings. With no debt and strong short-term asset coverage, Fonix's financial stability is noteworthy. Although its recent earnings growth (14.1%) lags behind industry averages, its net profit margins have improved to 14.6%. Despite a dividend yield of 4.15% not being fully covered by free cash flow, Fonix continues to increase dividends as part of its progressive policy, reflecting management's confidence in future performance.

- Dive into the specifics of Fonix here with our thorough balance sheet health report.

- Understand Fonix's earnings outlook by examining our growth report.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

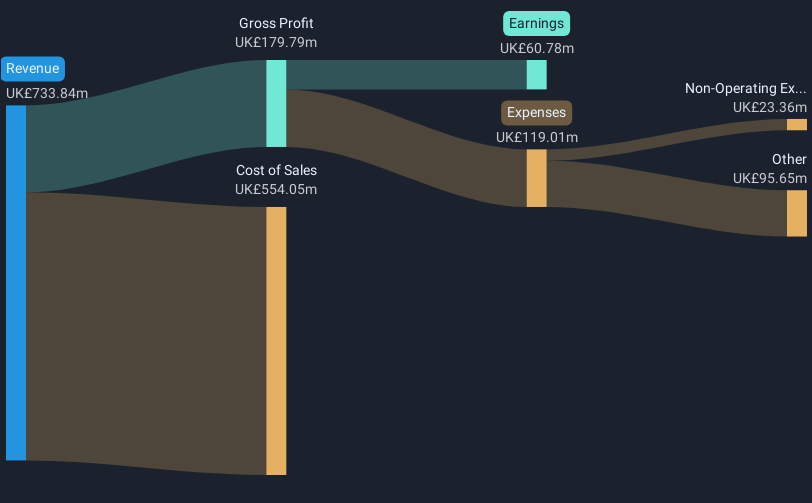

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £248.64 million.

Operations: No specific revenue segments are reported for Next 15 Group.

Market Cap: £248.64M

Next 15 Group plc, with a market cap of £248.64 million, presents a mixed picture for penny stock investors. The company has experienced significant earnings growth of 46% annually over the past five years, supported by high-quality earnings and strong interest coverage at 8.2 times EBIT. Its return on equity is high at 22.6%, indicating efficient use of capital. However, recent challenges include a decline in net profit margins from 7.2% to 5.4% and negative earnings growth over the past year (-25.4%). Additionally, its share price remains highly volatile and short-term liabilities exceed short-term assets by £21.8 million.

- Navigate through the intricacies of Next 15 Group with our comprehensive balance sheet health report here.

- Assess Next 15 Group's future earnings estimates with our detailed growth reports.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

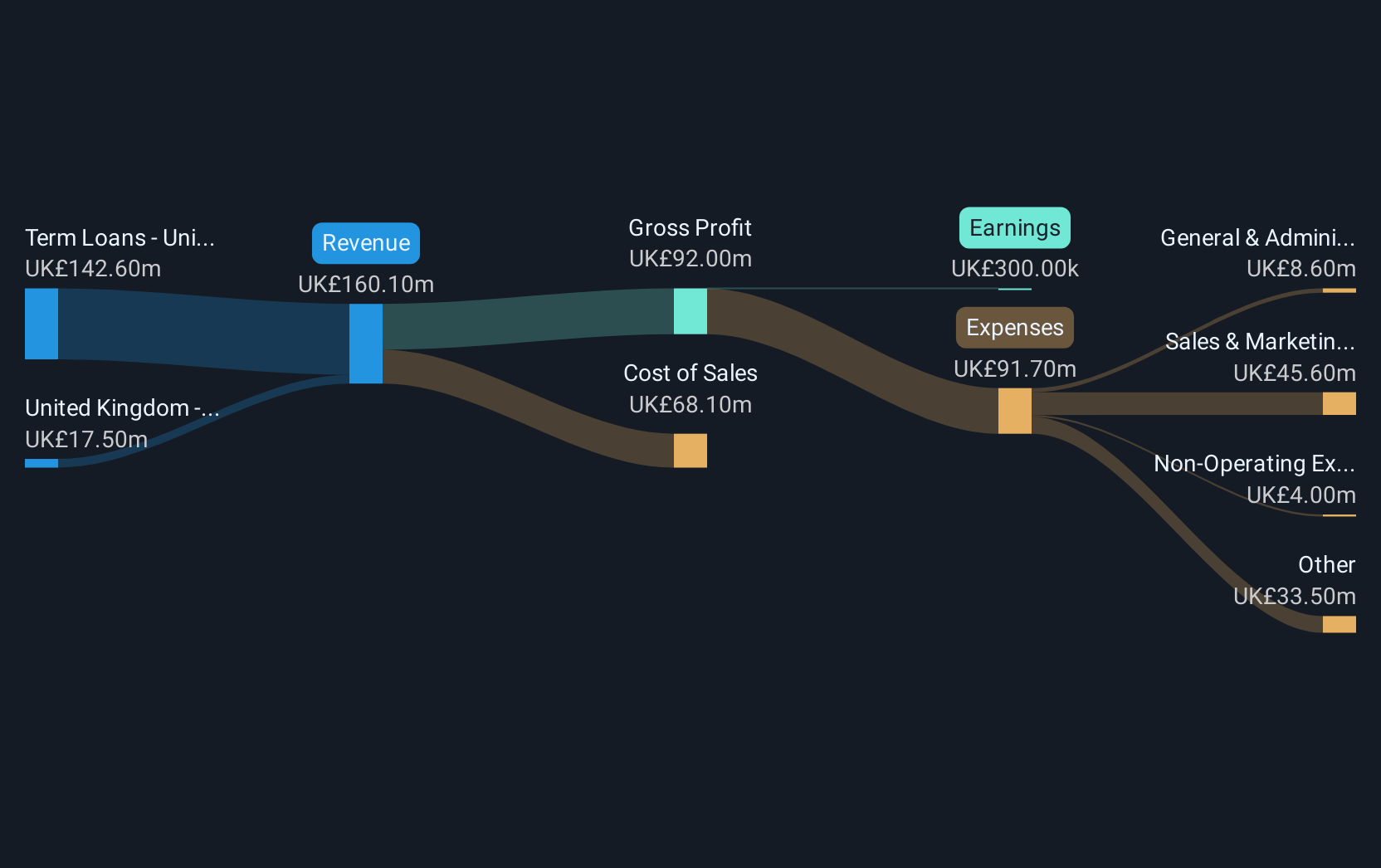

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market cap of £339.85 million.

Operations: The company's revenue is derived from its FlexiPay service in the United Kingdom, generating £17.5 million, and Term Loans in the same region, contributing £142.6 million.

Market Cap: £339.85M

Funding Circle Holdings plc, with a market cap of £339.85 million, offers a complex profile for penny stock investors. The company has transitioned to profitability over the past year, reporting net income of £8.6 million after a previous loss and achieving revenue growth to £160.1 million from £130.1 million year-on-year. Its debt-to-equity ratio has significantly improved over five years, and short-term assets exceed both short- and long-term liabilities by substantial margins (£307.4M vs £135.1M and £6.4M respectively). However, high weekly volatility persists alongside low return on equity at 0.1%. A recent share buyback program up to £25 million may impact future liquidity or capital allocation strategies.

- Click to explore a detailed breakdown of our findings in Funding Circle Holdings' financial health report.

- Gain insights into Funding Circle Holdings' outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Click through to start exploring the rest of the 383 UK Penny Stocks now.

- Ready For A Different Approach? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FCH

Funding Circle Holdings

Provides online lending platforms in the United Kingdom and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives