- United Kingdom

- /

- Energy Services

- /

- LSE:HTG

Hunting And 2 Other UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, which has impacted companies closely tied to its economy. In such a climate, investors often seek opportunities that balance affordability with growth potential. Penny stocks, though an older term, continue to offer intriguing possibilities by focusing on smaller or newer companies that combine strong financials with the chance for significant upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.70 | £526.2M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.13 | £172.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.70 | £10.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.878 | £324.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.40 | £122.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.15 | £183.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.74 | £10.19M | ✅ 3 ⚠️ 4 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.795 | £282.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.50 | £76.17M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, along with its subsidiaries, manufactures components, technology systems, and precision parts globally and has a market cap of £522.77 million.

Operations: The company's revenue is primarily generated from North America at $384.7 million, followed by Asia Pacific at $316.6 million, Hunting Titan at $212.9 million, Subsea Technologies at $127.4 million, and the Europe, Middle East and Africa region (EMEA) contributing $80.4 million.

Market Cap: £522.77M

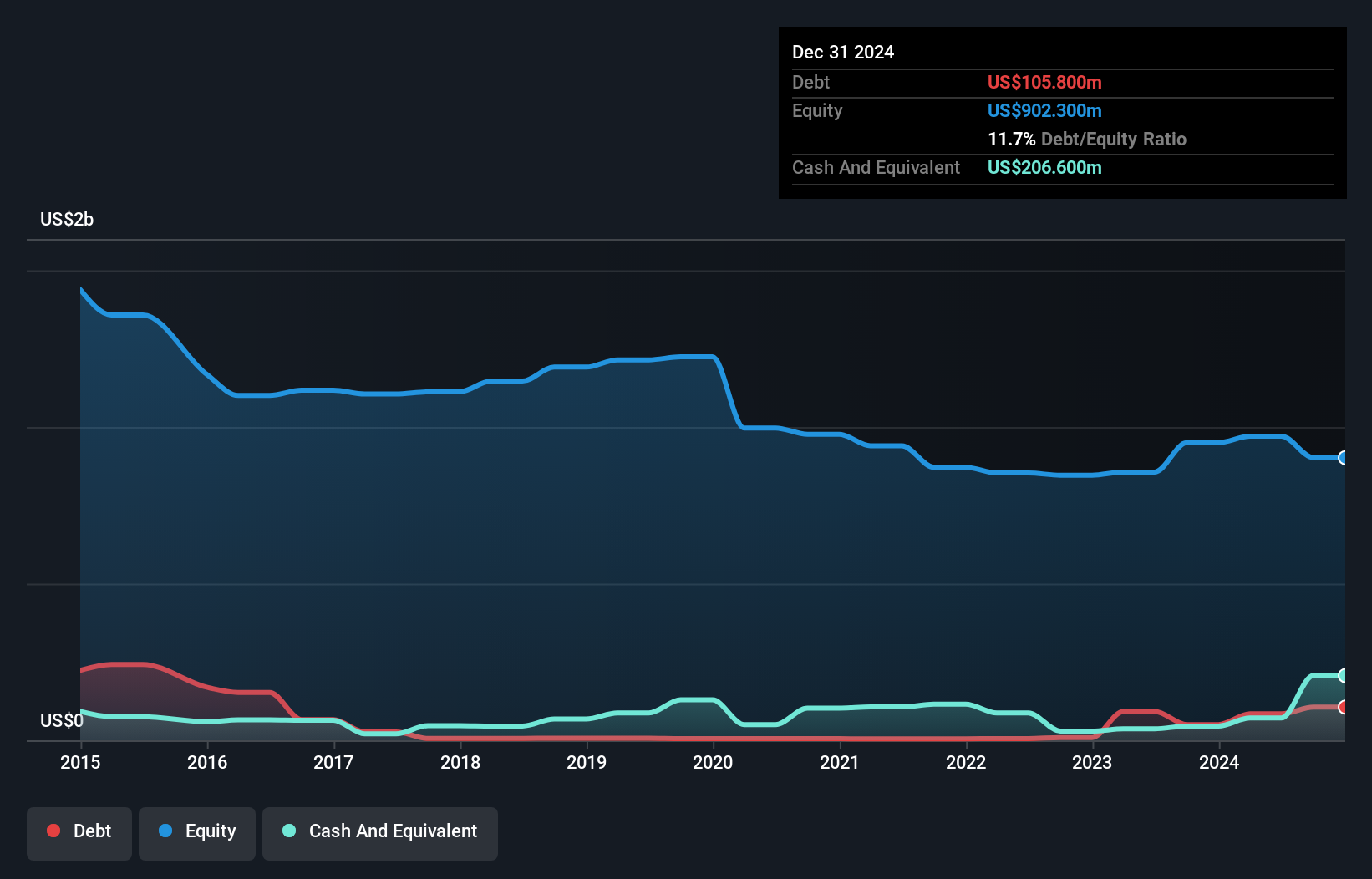

Hunting PLC, despite being unprofitable, showcases potential through its robust cash position exceeding total debt and a substantial cash runway of over three years supported by positive free cash flow. Recent earnings indicate sales growth to US$528.6 million for H1 2025, although net income declined to US$20.2 million from the previous year. The company secured a significant $31 million contract for subsea technologies in the Black Sea, boosting its order book to approximately $125 million. Additionally, Hunting is exploring M&A opportunities and has announced an interim dividend increase to 6.2 cents per share reflecting financial flexibility amidst ongoing strategic expansion efforts in subsea operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Hunting.

- Assess Hunting's future earnings estimates with our detailed growth reports.

Saga (LSE:SAGA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Saga plc, along with its subsidiaries, offers package and cruise holidays, general insurance, and personal finance products and services in the United Kingdom with a market cap of £351.25 million.

Operations: Saga generates revenue through its package and cruise holidays, general insurance, and personal finance products and services within the United Kingdom.

Market Cap: £351.25M

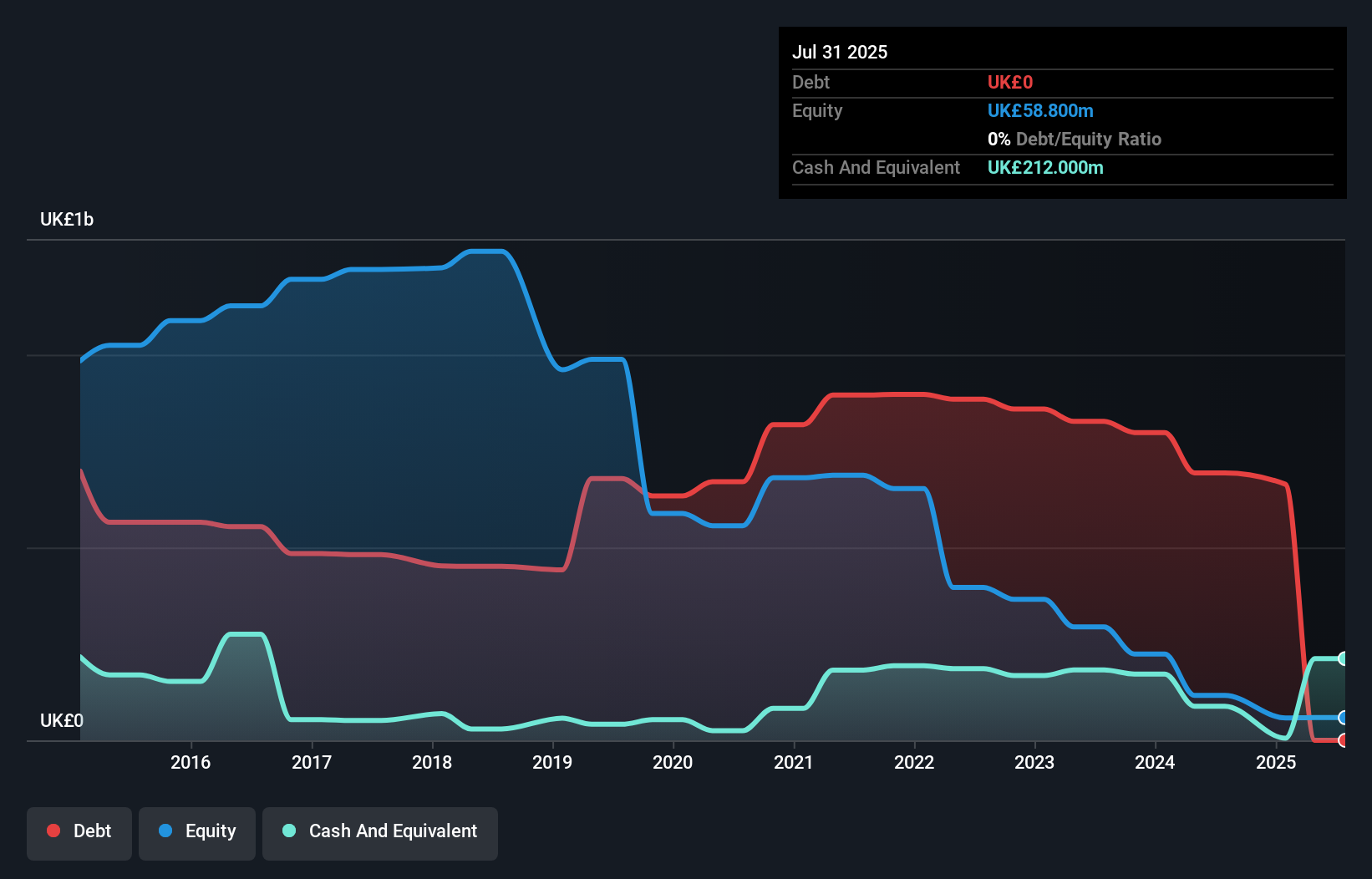

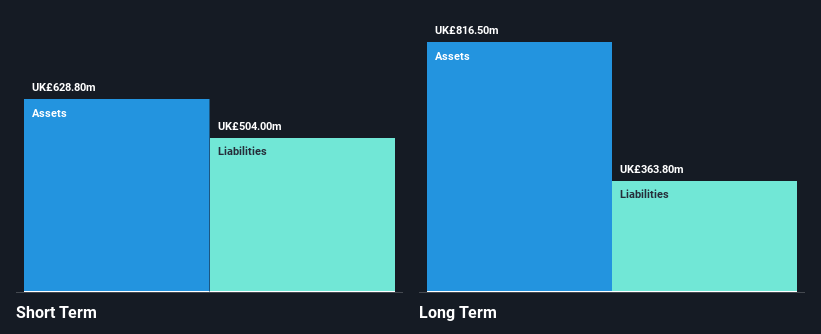

Saga plc, while unprofitable, has significantly reduced its net loss to £3.4 million for H1 2025 from £106.1 million a year ago, reflecting improved financial performance. The company is debt-free and maintains a strong cash runway exceeding three years due to positive free cash flow growth. Saga's strategic partnership with NatWest Boxed aims to enhance its financial services offerings for the over-50 market, starting with an innovative instant access savings product set to launch later this year. Despite challenges in covering long-term liabilities with current assets, Saga continues to trade at good value relative to peers and industry standards.

- Take a closer look at Saga's potential here in our financial health report.

- Learn about Saga's future growth trajectory here.

S4 Capital (LSE:SFOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: S4 Capital plc, along with its subsidiaries, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £137.89 million.

Operations: The company generates revenue from Technology Services amounting to £69.6 million, with a segment adjustment of £716.5 million.

Market Cap: £137.89M

S4 Capital plc faces challenges as it remains unprofitable, with a net loss of £22.3 million for H1 2025 and declining sales from the previous year. Despite this, the company maintains a satisfactory net debt to equity ratio of 28.3% and has sufficient cash runway for over three years due to positive free cash flow. Recent strategic moves include a partnership with VAST Data to enhance media services and the launch of Dev2 by Monks Technology Services, aimed at accelerating application development cycles using AI. However, macroeconomic uncertainties have impacted revenue forecasts negatively for 2025.

- Click to explore a detailed breakdown of our findings in S4 Capital's financial health report.

- Examine S4 Capital's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 298 companies by clicking here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HTG

Hunting

Manufactures components, technology systems, and precision parts worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives