The Cheesecake Factory is a stock that I believe most people do not understand it's actual potential; or really what makes this stock so attractive for long term growth.

Here is a brief description of the company according to Benzinga:

"Cheesecake Factory Inc owns and operates restaurants in the United States and Canada under brands that include The Cheesecake Factory, North Italia, and a collection within the Fox Restaurants Concepts subsidiary. The company's international presence, in the Middle East and Mexico, is through licensing agreements with third parties. The company also has a bakery division that produces cheesecakes and other baked products for sale in its restaurants, international licensees, and third-party bakery customers. The company has four operating business segments: The Cheesecake Factory restaurants, North Italia, other FRC, and Flower Child. Majority of the company's revenue comes from The Cheesecake Factory restaurants segment."

During their recent 2Q25 earnings call/report; they also showed a lot of promise towards what the future of their company holds. So from here I will dive into what I took out of their recent earnings and then after that go over more of the financials/statistics and price targets I have come up with for the company.

2Q25:

Estimate Earnings: $1.06 Actual: $1.116 (+ 6% yoy)

Estimate Revenue: $947.31 Million Actual: $955.8 Million (+6% yoy)

Adjusted EBITDA: $100 Million (+9% yoy)

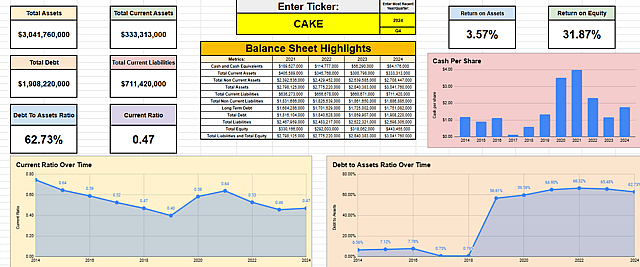

Current Available Liquidity: $515.3 Million

- $148.8 Million Cash

- $366.5 Million Revolving Credit Facility with no outstanding balances

Total Debt Outstanding: $644 Million

- $69 Million in 2026 Senior Notes (0.375%)

- $575 Million in 2030 Senior Notes (2%)

CapEx: $42 Million

Dividends Paid: $14 Million

Shares Repurchased: $0.1 Million (2,500 Shares)

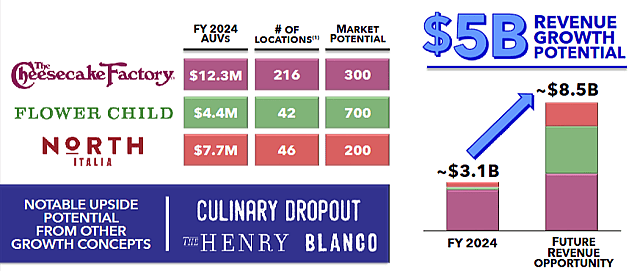

At the end of the quarter CAKE had 363 total restaurants

- Cheesecake Factory: 216

- North Italia: 46

- Flower Child: 42

- FRC: 52

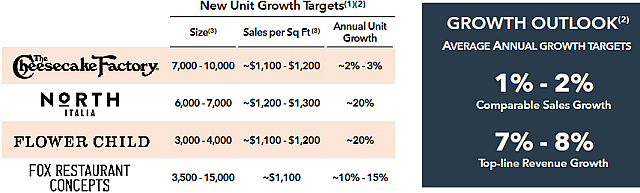

Details Per Franchise

Cheesecake Factory:

- $31 Average Check

- 21% of Revenue came from off premises sales

- Revenue: +1%

North Italia:

- Lunch Average Check: Mid $30's//Dinner: Mid $40's

- POTENTIAL For 200 Domestic Locations

- Currently 46 Restaurants in 16 States

- Target 20% Average Annual Unit Growth

- Comp Sales: -1% yoy

Flower Child:

- POTENTIAL for 700 Domestic Locations

- 42 locations in 15 States

- Targeting 20% Annual Unit Growth

- 50% of Sales came from off premises (takeout/delivery)

Fox Restaurants Concepts (FRC):

- 52 Locations in 11 States

- FY24 Revenue $300 Million

Below I will also share what their current goal is to help the company grow their pipeline of storefronts to increase revenue year in and year out.

Plan For Diversifying Portfolio:

Global Footprint: Cheesecake Factory

National Expansion: North Italia; Flower Child

Testing Growth: Culinary Dropout; Blanco; The Henry

Incubation Stage: Dough Bird; Pushing Daisies; Wild Flower; Zin Burger; The Arrogant Butcher; Olive and Ivy; Fly Bye; The Green House

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them; but they also have new concepts that are starting to spread nationally and are continually working to create even more for future growth. Especially from FRC; that is what one of the biggest benefits from that acquisition is; the fact that it is able to continue to test out new concepts and find something that sticks and then push it out nationally.

2025 Outlook

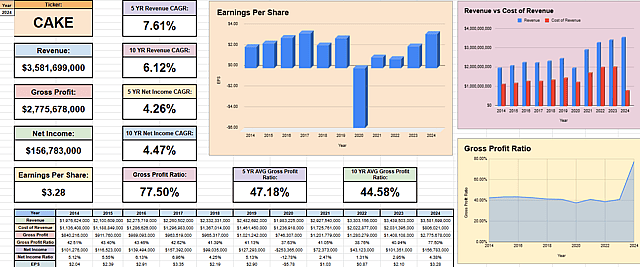

Consolidated Sales: $3.76 Billion

CCF AUV's: $12.5 Million

Net Income Margin Target: 4.9% (at stated sales level)

CapEx: $190-$200 Million

Dividend for Q3: $0.27/Share

Share Repurchase Program: Offset dilution, overtime, from employee stock-based compensation and support EPS

New Unit Growth: Up to 25 new openings

- Cheesecake Factory: 4

- North Italia: 6

- Flower Child: 6

- FRC: 9

New Unit Growth

Market Potential

Overall the potential that CAKE holds over the next 10 years makes me very eager to continue to buy into this company. As I see them as a potential growth company; they also hold in my opinion as a Value/Dividend company as well; which makes them even more attractive.

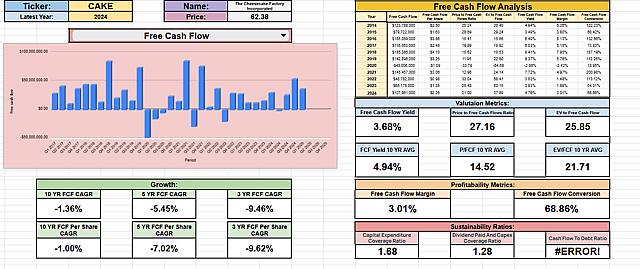

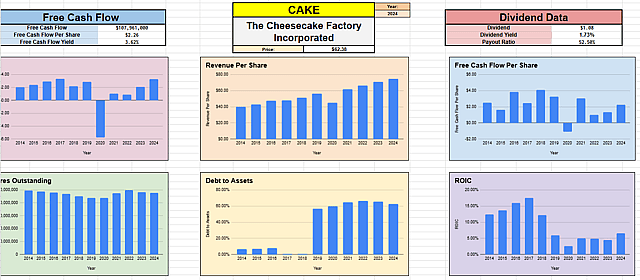

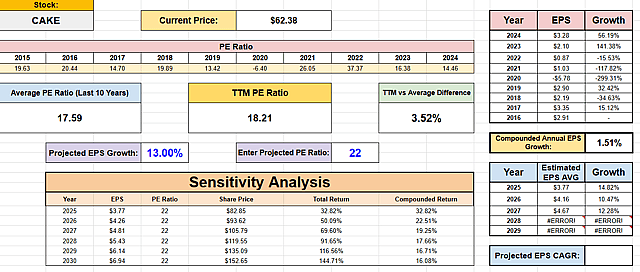

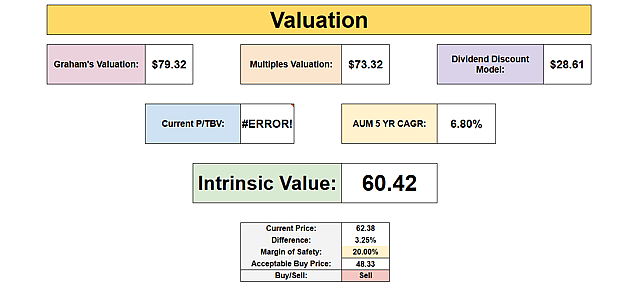

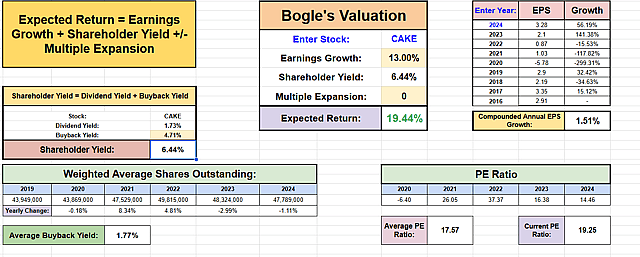

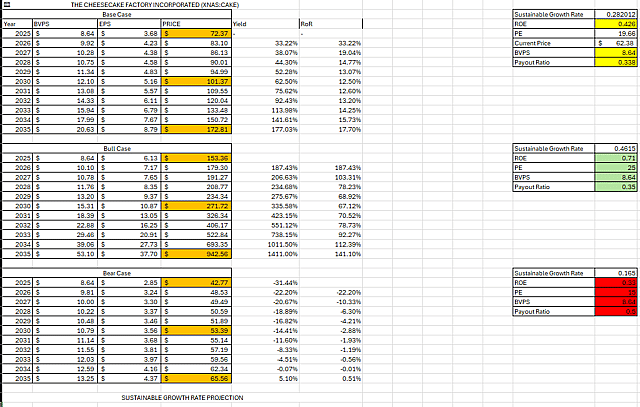

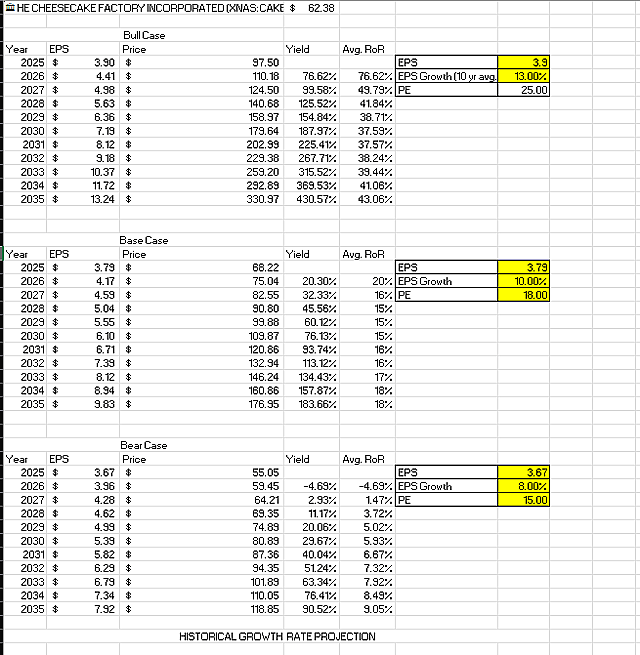

Price Targets/Financials/Statistics

Based off of the above data I have come to the following price projections

Current Value: $73.83 (18.36% Undervalued)

2026: $91.09 (46.02% Annual RoR)

2027: $100.43 (30.50% Annual RoR)

2028: $111.39 (26.19% Annual RoR)

2029: $125.82 (25.43% Annual RoR)

2030: $141.45 (25.35% Annual RoR)

2031: $148.41 (22.98% Annual RoR)

2032: $172.89 (25.31% Annual RoR)

2033: $206.38 (28.86% Annual RoR)

2034: $252.78 (33.91% Annual RoR)

2035: $317.75 (40.94% Annual RoR)

*ALSO THIS IS NOT TAKING INTO CONSIDERATION DIVIDENDS/DIVIDEND REINVESTMENTS*

Overall I feel very good about the long-term growth of this company and it is a stock that I will continue to add to my portfolio.

As of right now I am willing to pay up to $105.90 as that is the number I came up with that would equal up to the price for a 20% annual RoR over a 10 year time period.

How well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NasdaqGS:CAKE. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.