Key Takeaways

- Draganfly is one of the most experienced drone manufacturers worldwide, boasting nearly three decades of innovation, and is now emerging as a North American leader in secure, NDAA-compliant drones.

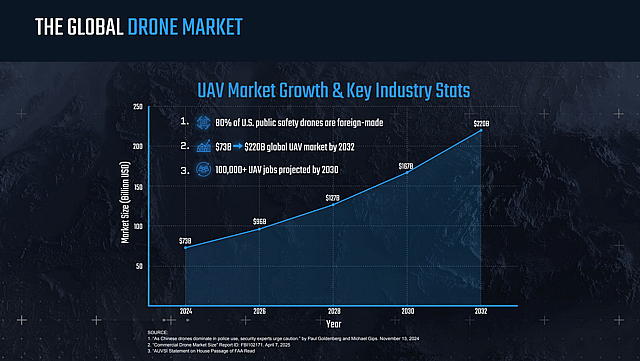

- The company is riding massive industry tailwinds as Western governments shift away from Chinese-made drones, funneling billions into trusted domestic suppliers.

- With fresh defense contracts, U.S. manufacturing expansion, and proven military-grade platforms like the Commander 3XL, Draganfly is entering its most exciting growth phase yet.

- Revenue could surge to ~C$70M by 2030, implying substantial upside from today’s market cap.

About Draganfly

Draganfly Inc. is a Canadian drone systems manufacturer with a 27-year track record at the forefront of unmanned aerial vehicles (UAVs). Founded in 1998, the company has carved out a reputation for building advanced drones for defense, public safety, agriculture, and commercial use.

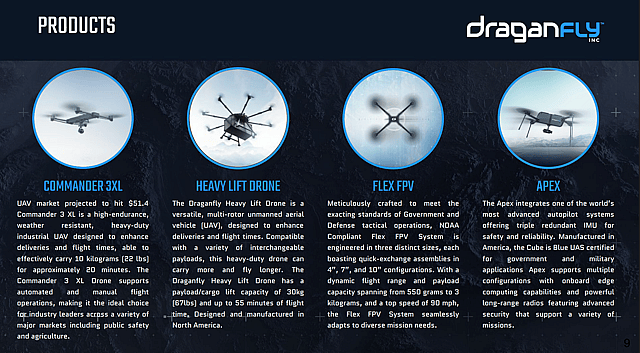

Its flagship Commander 3XL long-endurance UAV, tactical FPV drones, and payload solutions like landmine-detection and medical delivery systems position the company as one of the few domestic players capable of scaling into high-value, specialized markets.

Unlike foreign competitors, Draganfly doubles down on U.S. and Canadian production. With state-of-the-art, AS9100-certified lines in place, the company is perfectly aligned with tightening government security standards. Whilst still a micor-cap with modest revenue (C$6.6M in 2024), the company has built credibility through defense exercises, humanitarian missions, and key partnerships, Draganfly is now primed for breakout growth.

Catalysts

Defense Spending and Domestic Supply Shift

The global drone market is in flux, and Draganfly is in the driver’s seat. With nearly 80% of U.S. police drones still Chinese-made, the replacement opportunity is massive. Canada’s C$220M drone commitment for Ukraine explicitly prioritizes advanced tactical capabilities — a direct fit for Draganfly’s platforms.

Meanwhile, the U.S. Department of Defense’s “Unleashing American Drone Dominance” program is a once-in-a-generation opportunity for secure, homegrown suppliers like Draganfly to take center stage.

Military Validation of Technology

Draganfly’s Commander 3XL and Flex FPV drones stole the spotlight at the DoD’s T-REX 24-2 exercise, achieving a flawless 100% mission success rate. The results have already translated into a major Commander 3XL order (announced Q3 2025), underscoring the company’s credibility.

Participation in this exercise also placed Draganfly alongside only three other chosen providers, highlighting the uniqueness of its platform in endurance and versatility. The company’s use of Blue UAS-certified autopilot systems and modular payload designs further strengthens its positioning for defense adoption.

Scaling Production Capacity

To meet growing demand, Draganfly has expanded its U.S. manufacturing footprint, establishing AS9100-certified production lines and contract-manufacturing partnerships. This scaling effort addresses one of the company’s key bottlenecks and positions it to execute larger-volume defense and public safety contracts. The expansion provides both redundancy and faster delivery times, ensuring compliance with domestic sourcing requirements for military contracts. By leveraging new capacity, Draganfly can better capture near-term opportunities like bulk Commander 3XL orders, which would have been difficult to fulfill at prior production levels.

Strategic Partnerships

Draganfly’s partnerships expand its reach into high-profile, specialized missions. Collaborations with SafeLane Global (landmine detection), networking technology alliances for drone swarms, and advisory board appointments of influential former defense leaders all set the stage for bigger wins.

These strategic relationships don’t just validate Draganfly’s technology, they open doors to NATO-aligned projects and multinational procurement opportunities, placing the company on the map as a trusted partner in the next era of drone warfare and humanitarian support.

Assumptions

Revenue Outlook

We project Draganfly can scale from ~C$6.6M revenue in 2024 to ~C$87M by 2030, implying a ~65% CAGR. That growth is anchored in aggressive defense contract adoption with the Commander 3XL and further supported by adjacent verticals like humanitarian demining and drone-delivered medical services.

Profitability

By 2030, we project a 15% net margin (~C$13M in net income). Beyond just hardware, higher-margin services and software enhance the revenue mix, supporting above-average margins for a company evolving into an integrated defense-tech solutions provider

Valuation Multiple

We apply a 35x P/E ratio to 2030 earnings. This higher multiple reflects the possibility that the market continues to value emerging defense-tech companies like Draganfly as growth stocks rather than mature contractors. It assumes the company remains in a strong growth phase post-2030, benefiting from expanding TAM and technology-driven adoption.

Discount Rate and Shares

Using a 10% discount rate (to reflect micro-cap risk) and ~22.5M shares outstanding, we convert 2030 projections into today’s fair value.

Valuation

- 2030 revenue: ~C$87M

- Net margin: 15% = C$13M net income

- P/E multiple: 35x = C$459M market cap in 2030

- Discounted at 10% (5 years): ≈ C$285M present value

- Per share (22.5M shares): ≈ C$12.66 (~US$9.21 at 0.73 CAD/USD)

Based on these assumptions, Draganfly’s fair value could be substantially above current levels. The combination of stronger revenue growth, higher margins, and a premium multiple creates meaningful upside potential if execution goes well.

Risks

- Competition: Well-funded U.S. players like Skydio and Red Cat compete head-to-head for defense and public safety contracts. Skydio, for example, has raised more than $700M, making it larger and well capitalised.

- Government Dependence: Revenue is tied to unpredictable defense budgets and policy priorities. If U.S. or Canadian procurement timelines slip, Draganfly’s near-term growth could stall despite strong demand signals.

- Financial Risk: Draganfly is still in its growth phase and not yet profitable. Additional capital raises may be needed to fund expansion, which could bring some dilution. However, the recent $25M raise provides over a year of runway and flexibility to execute on growth plans.

- Scaling Challenges: Rapid production ramp-up may bring supply-chain or quality hurdles, but management is actively addressing these as part of its growth plan.

- Technology Risk: Drone and counter-drone technologies are advancing quickly, highlighting the need for ongoing R&D.

- Customer Concentration: Early revenue may depend heavily on one or two contracts, increasing volatility. A delay or cancellation of even a single defense order would materially impact results.

Conclusion

Draganfly is a speculative but promising defense and public safety drone play. With proven platforms, growing manufacturing capacity, and strong policy tailwinds, it has credible paths to scaling revenue several-fold over the next five years. Under the assumptions, investors could see upside well above today’s valuation if Draganfly capitalizes on its pipeline of defense opportunities and maintains growth momentum. For investors seeking exposure to the rising demand for North American-made defense drones, Draganfly offers a higher-risk, higher-reward opportunity.

How well do narratives help inform your perspective?

Disclaimer

The user Jolt_Communications holds no position in NasdaqCM:DPRO. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Sponsored Content Notice

This Narrative has been sponsored by Draganfly (the Sponsor), which has paid Simply Wall St a fee for its publication on our platform and subsequent promotion. Any relationship between Simply Wall St and Draganfly does not influence how we produce or moderate other content on this website. The Sponsor has a financial interest in the subject matter of this narrative. Simply Wall St has not independently verified any statements or projections made by the author, and does not endorse or guarantee the accuracy or completeness of the information provided.