- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

3 UK Penny Stocks With Market Caps Over £100M To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weaker trade data from China, reflecting broader global economic concerns. Despite these headwinds, investors continue to seek opportunities in smaller or newer companies that may offer untapped value. Penny stocks, though an older term, remain a relevant investment area for those looking to capitalize on companies with solid financial foundations and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.875 | £545.79M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.05 | £165.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.775 | £11.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.545 | $316.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £73.12M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.852 | £699.54M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Diaceutics PLC is a diagnostic commercialization company that offers data, data analytics, and implementation services to pharma and biotech companies, with a market cap of £140.48 million.

Operations: The company's revenue is derived entirely from its Medical Labs & Research segment, totaling £34.40 million.

Market Cap: £140.48M

Diaceutics PLC, with a market cap of £140.48 million, remains a compelling prospect in the penny stock arena due to its strategic focus on precision medicine commercialization. Despite being unprofitable and experiencing increased losses over the past five years, the company reported H1 2025 sales of £14.56 million, indicating growth from the previous year. Diaceutics is debt-free and maintains sufficient cash runway for over a year based on current free cash flow levels. Recent expansion of its PMx commercialization partnership underscores its potential for incremental service revenue and strengthens its role in precision medicine solutions.

- Click here to discover the nuances of Diaceutics with our detailed analytical financial health report.

- Examine Diaceutics' earnings growth report to understand how analysts expect it to perform.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across various international markets, with a market cap of £113.86 million.

Operations: The company generates revenue from Foundry Operations amounting to £197.94 million and Machining Operations totaling £32.13 million.

Market Cap: £113.86M

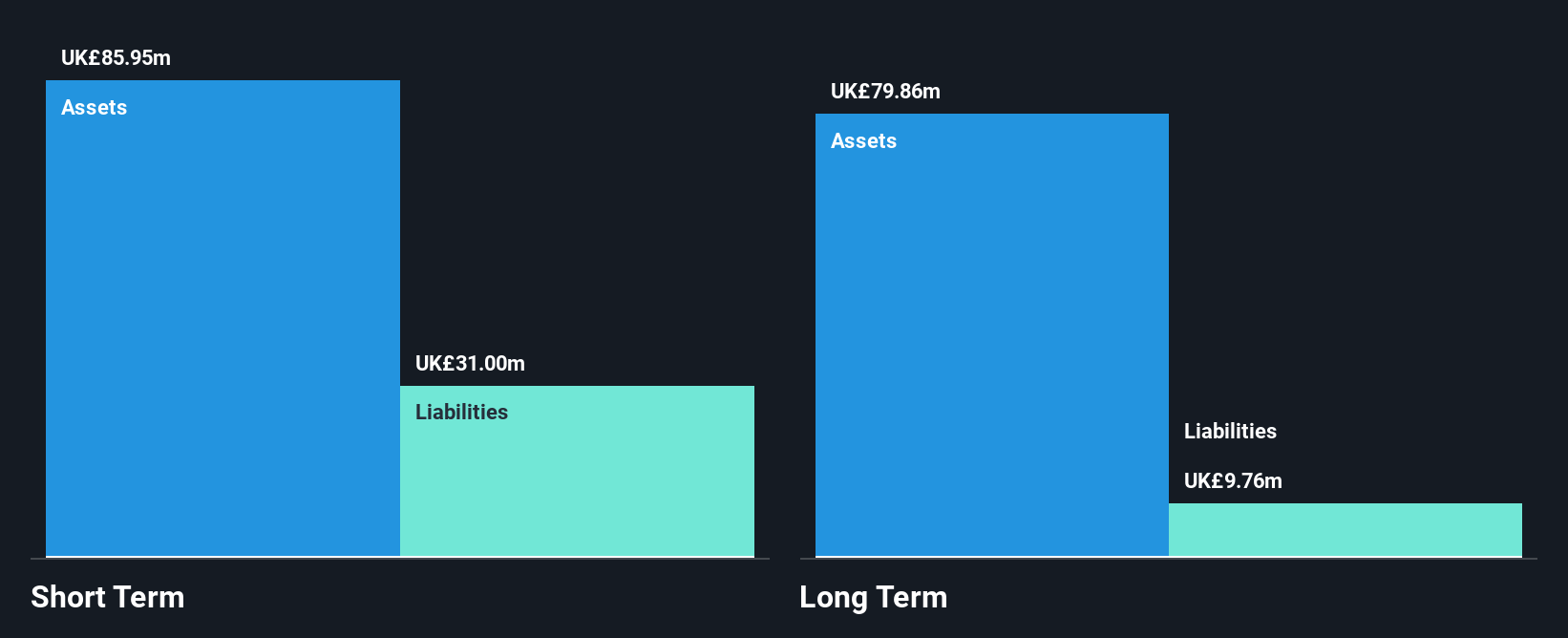

Castings P.L.C., with a market cap of £113.86 million, presents a mixed picture for penny stock investors. The company is debt-free and maintains stable short-term assets (£100.1M) that cover both short and long-term liabilities, highlighting financial prudence. However, recent negative earnings growth (-75%) and declining profit margins (2.4% from 7.5% last year) are concerning despite high-quality past earnings and no shareholder dilution over the past year. The board's seasoned experience offers stability amid these challenges, while forecasts suggest potential earnings growth of 25.59% annually, albeit with current dividends not well covered by earnings or cash flows.

- Unlock comprehensive insights into our analysis of Castings stock in this financial health report.

- Evaluate Castings' prospects by accessing our earnings growth report.

Hostelworld Group (LSE:HSW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hostelworld Group plc operates as an online travel agent specializing in the hostel market globally, with a market cap of £144.86 million.

Operations: The company generates revenue of €92.3 million from providing software and data processing services.

Market Cap: £144.86M

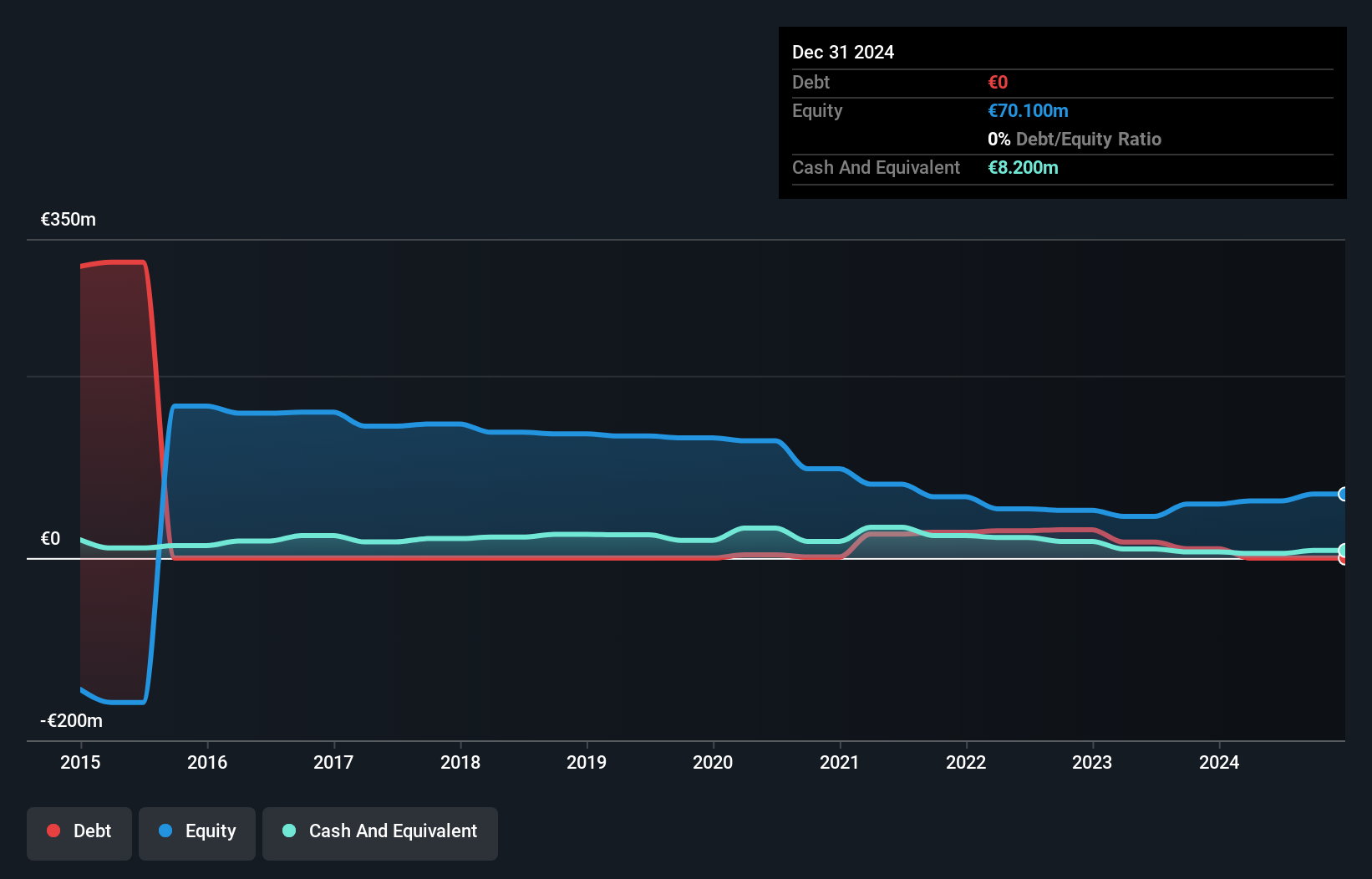

Hostelworld Group, with a market cap of £144.86 million, offers both opportunities and challenges for penny stock investors. The company is debt-free and has experienced significant earnings growth over the past five years. However, recent negative earnings growth and declining profit margins (8.3% from 16.1% last year) raise concerns despite high-quality earnings and stable weekly volatility (4%). The management team is experienced, but short-term liabilities (€20.4M) exceed short-term assets (€17.2M). Recent strategic moves include share buybacks, dividend increases, and active pursuit of acquisitions to bolster its position in the youth travel market.

- Dive into the specifics of Hostelworld Group here with our thorough balance sheet health report.

- Gain insights into Hostelworld Group's future direction by reviewing our growth report.

Where To Now?

- Click here to access our complete index of 302 UK Penny Stocks.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion