- United States

- /

- Electrical

- /

- NYSE:BE

3 Stocks That Might Be Undervalued By Up To 31.8% According To Estimates

Reviewed by Simply Wall St

As the U.S. stock market experiences a strong rebound, with major indexes like the Dow Jones and S&P 500 poised for their best week since June, investors are keenly eyeing opportunities amid this positive momentum. In such an environment, identifying undervalued stocks can be particularly rewarding as these equities may offer potential value in a market that continues to show resilience and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.26 | $17.92 | 48.3% |

| Warrior Met Coal (HCC) | $78.72 | $154.96 | 49.2% |

| Super Group (SGHC) (SGHC) | $10.93 | $21.73 | 49.7% |

| Sotera Health (SHC) | $17.44 | $33.62 | 48.1% |

| Perfect (PERF) | $1.73 | $3.45 | 49.9% |

| Freshworks (FRSH) | $12.01 | $23.95 | 49.8% |

| Flutter Entertainment (FLUT) | $199.92 | $392.76 | 49.1% |

| Elastic (ESTC) | $69.94 | $135.64 | 48.4% |

| Circle Internet Group (CRCL) | $72.64 | $140.25 | 48.2% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.98 | $37.29 | 49.1% |

We'll examine a selection from our screener results.

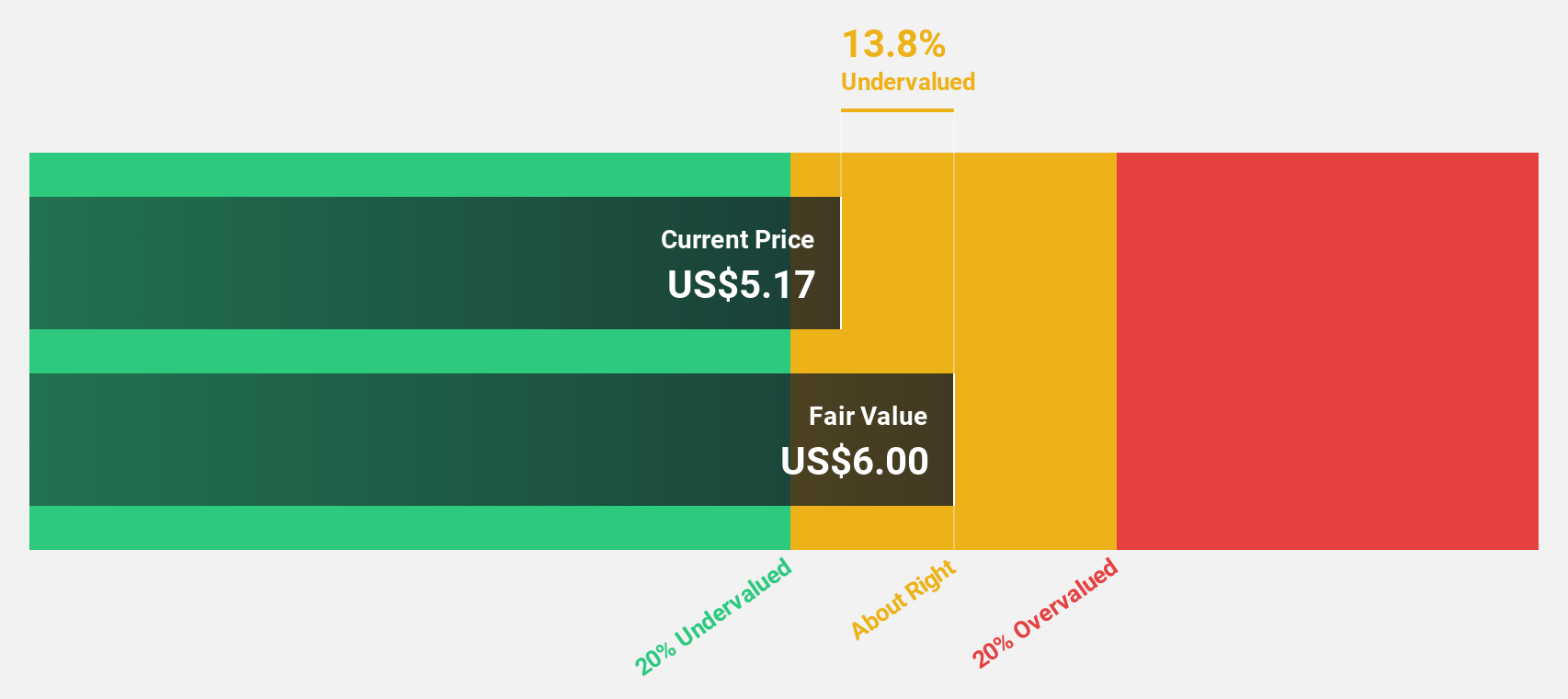

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering services in countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam with a market cap of approximately $21.74 billion.

Operations: Grab Holdings Limited generates revenue through its superapp services offered in Southeast Asia, encompassing diverse markets including Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Estimated Discount To Fair Value: 29.0%

Grab Holdings is trading at US$5.32, below its fair value estimate of US$7.49, indicating potential undervaluation based on cash flows. Recent earnings reports show profitability with net income of US$96 million for the first nine months of 2025, a turnaround from a loss last year. The company's strategic partnerships in autonomous vehicle technology could enhance future cash flows, while revenue and earnings growth forecasts exceed market averages, suggesting potential for improved valuation metrics over time.

- Insights from our recent growth report point to a promising forecast for Grab Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Grab Holdings' balance sheet health report.

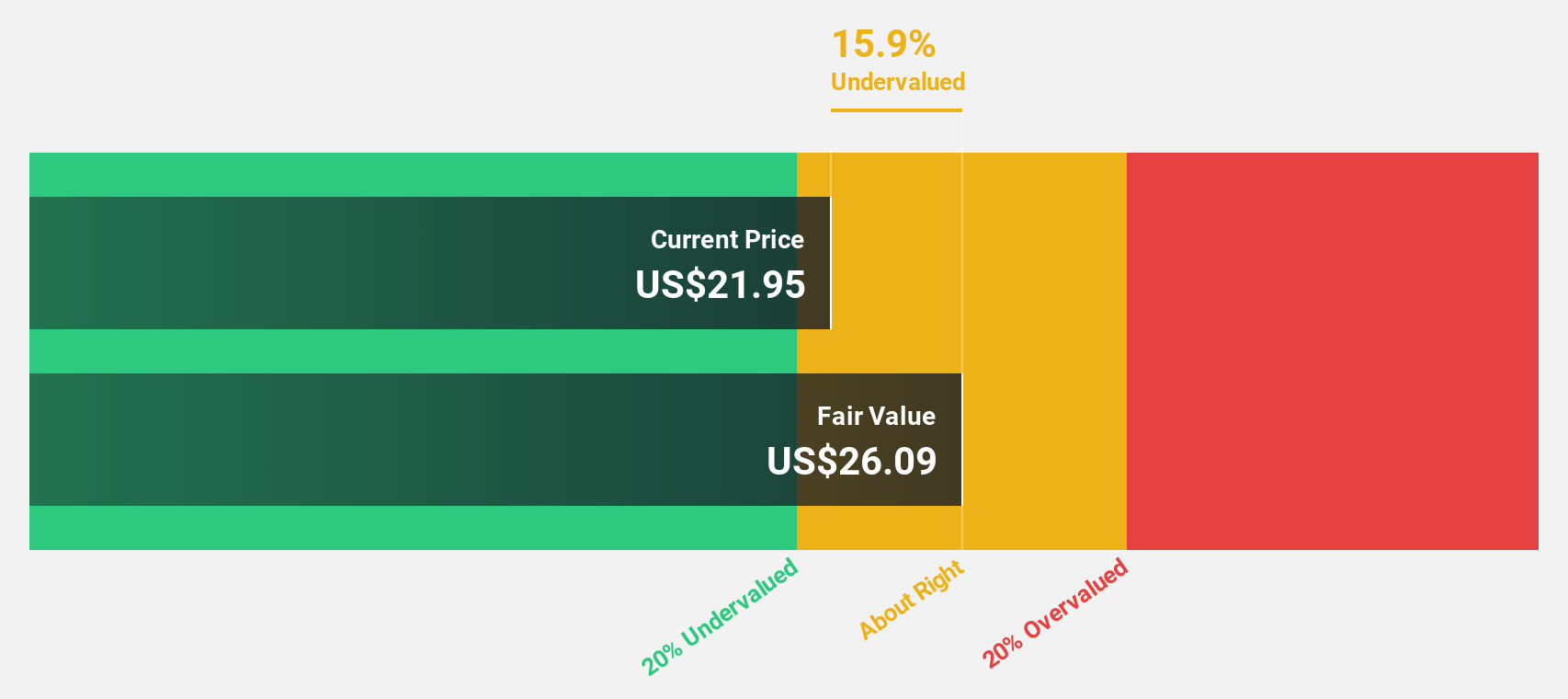

Bloom Energy (BE)

Overview: Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally, with a market cap of $23.92 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, amounting to $1.82 billion.

Estimated Discount To Fair Value: 31.8%

Bloom Energy is trading at US$101.14, below its fair value estimate of US$148.35, highlighting potential undervaluation based on cash flows. The company recently became profitable and forecasts robust revenue growth of 32.3% annually, outpacing the market average. A strategic $5 billion partnership with Brookfield aims to expand AI infrastructure using Bloom's fuel cell technology, potentially boosting future cash flows despite current net losses and volatile share price movements.

- Upon reviewing our latest growth report, Bloom Energy's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Bloom Energy with our comprehensive financial health report here.

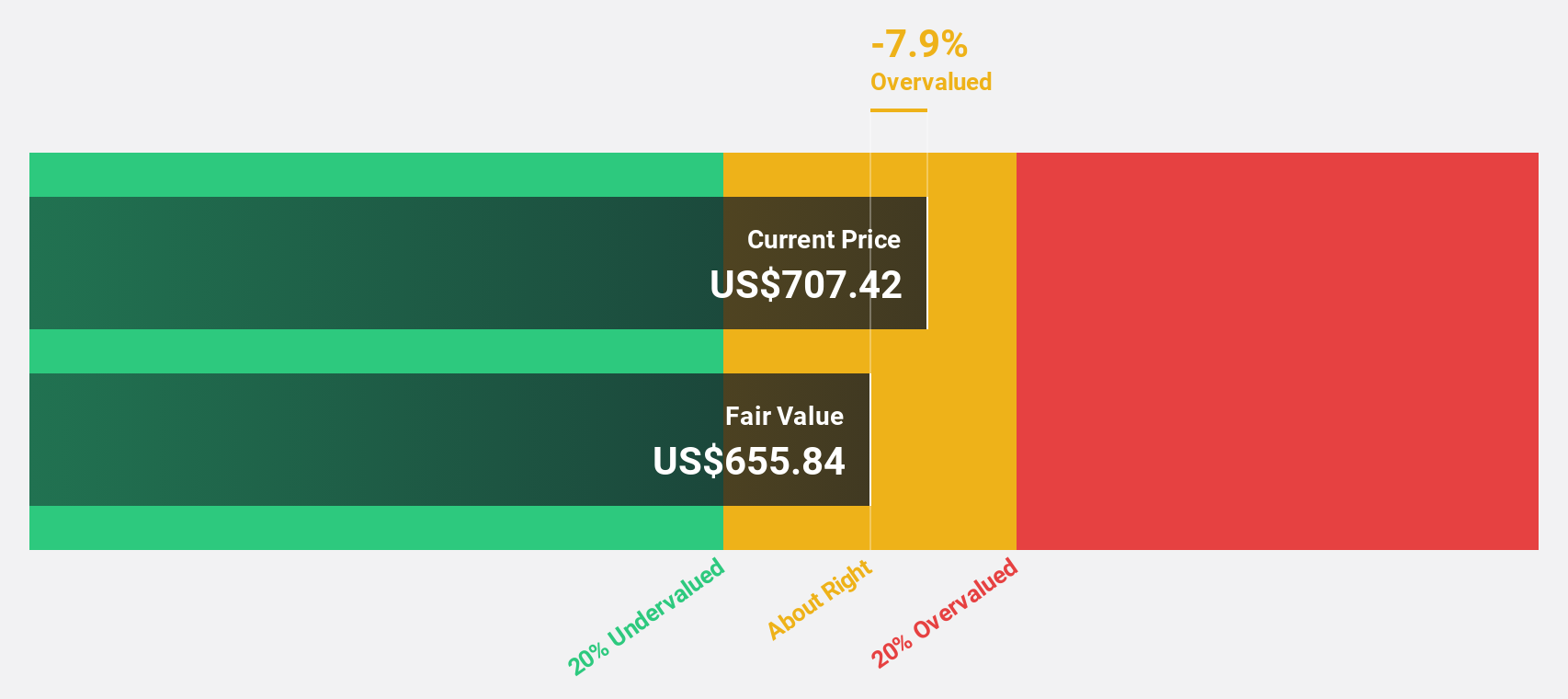

Spotify Technology (SPOT)

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $122.14 billion.

Operations: The company's revenue is primarily derived from its Premium segment, which generated €15.04 billion, and its Ad-Supported segment, contributing €1.86 billion.

Estimated Discount To Fair Value: 12.8%

Spotify Technology is trading at US$592.69, below its estimated fair value of US$679.77, suggesting potential undervaluation based on cash flows. The company reported significant earnings growth with net income rising to EUR 899 million in the recent quarter. Despite facing a class action lawsuit over streaming fraud, Spotify's strategic alliances and AI initiatives aim to enhance artist-fan connections and bolster future revenue streams. Leadership changes may further influence strategic direction and cash flow management.

- Our expertly prepared growth report on Spotify Technology implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Spotify Technology.

Where To Now?

- Click this link to deep-dive into the 212 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BE

Bloom Energy

Designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)