- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

3 Stocks Estimated To Be Undervalued In August 2025

Reviewed by Simply Wall St

As of August 2025, the U.S. stock market is experiencing a downturn, with the S&P 500 declining for four consecutive days amid a persistent slump in technology stocks. Investors are closely watching Federal Reserve Chair Jerome Powell's upcoming speech for insights into potential interest rate changes, as recent inflation data has presented mixed signals. In such uncertain times, identifying undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies and position themselves advantageously when conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.76 | $225.65 | 48.7% |

| Udemy (UDMY) | $6.71 | $13.21 | 49.2% |

| StoneCo (STNE) | $14.81 | $28.93 | 48.8% |

| Royal Gold (RGLD) | $169.71 | $330.04 | 48.6% |

| Niagen Bioscience (NAGE) | $9.63 | $18.91 | 49.1% |

| Lyft (LYFT) | $15.57 | $30.86 | 49.5% |

| Fiverr International (FVRR) | $22.88 | $45.19 | 49.4% |

| First Commonwealth Financial (FCF) | $16.79 | $32.97 | 49.1% |

| First Busey (BUSE) | $23.23 | $45.40 | 48.8% |

| Dime Community Bancshares (DCOM) | $28.61 | $56.44 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

AGNC Investment (AGNC)

Overview: AGNC Investment Corp. provides private capital to the U.S. housing market and has a market cap of approximately $10.01 billion.

Operations: AGNC generates revenue primarily through its REIT - Mortgage segment, which accounts for $496 million.

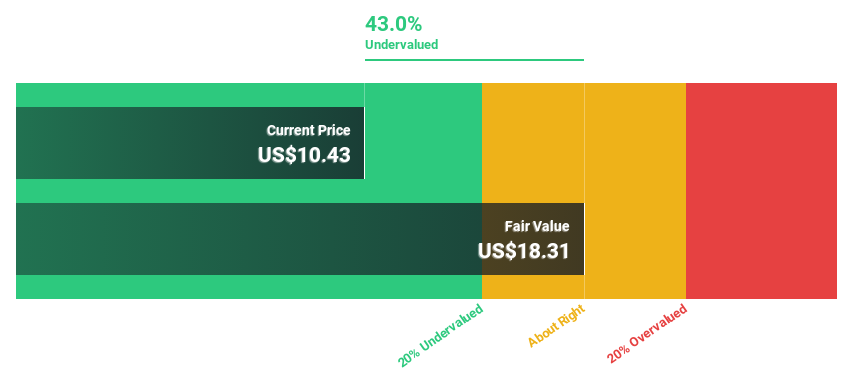

Estimated Discount To Fair Value: 43.4%

AGNC Investment is trading significantly below its estimated fair value at US$9.71 compared to a fair value of US$17.16, suggesting undervaluation based on cash flows. Despite a forecasted revenue growth of 42.2% annually, AGNC faces challenges with unsustainable dividends not covered by earnings or free cash flows and substantial shareholder dilution over the past year. Recent financial results showed a net loss of US$140 million for Q2 2025, reflecting ongoing financial pressures.

- Our expertly prepared growth report on AGNC Investment implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of AGNC Investment with our comprehensive financial health report here.

Palomar Holdings (PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company offering property and casualty insurance to individuals and businesses in the United States, with a market cap of approximately $3.24 billion.

Operations: The company generates $682.21 million from its property and casualty insurance business in the United States.

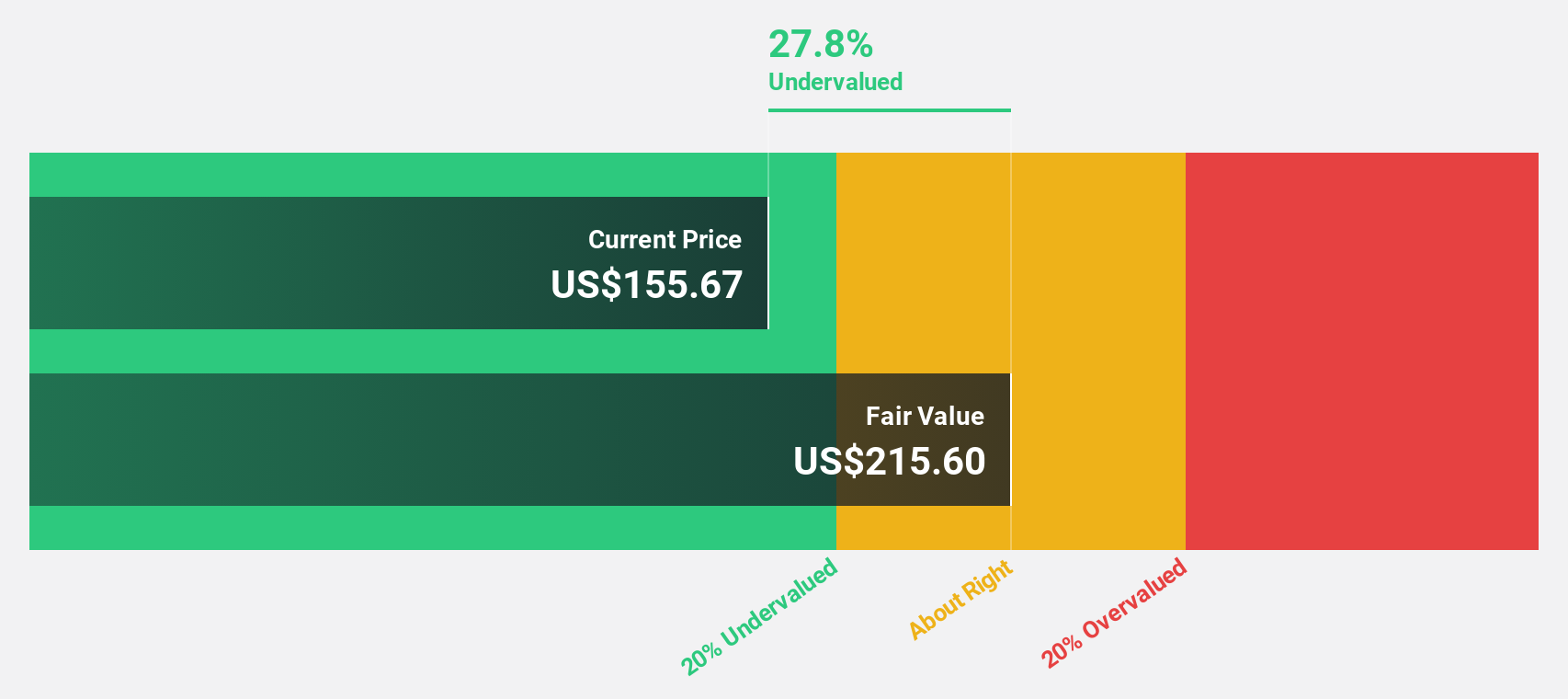

Estimated Discount To Fair Value: 39.7%

Palomar Holdings is trading at US$125.07, which is significantly below its estimated fair value of US$207.31, indicating potential undervaluation based on cash flows. The company's recent Q2 earnings report showed strong revenue growth to US$203.31 million and net income of US$46.53 million, reflecting robust financial performance. Additionally, a strategic partnership with Neptune Flood enhances its market position in flood insurance while a $150 million share repurchase program could further support shareholder value.

- The growth report we've compiled suggests that Palomar Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Palomar Holdings.

XPeng (XPEV)

Overview: XPeng Inc. designs, develops, manufactures, and markets smart electric vehicles in China with a market cap of approximately $19.75 billion.

Operations: The company generates revenue primarily from its smart electric vehicle segment, amounting to CN¥60.29 billion.

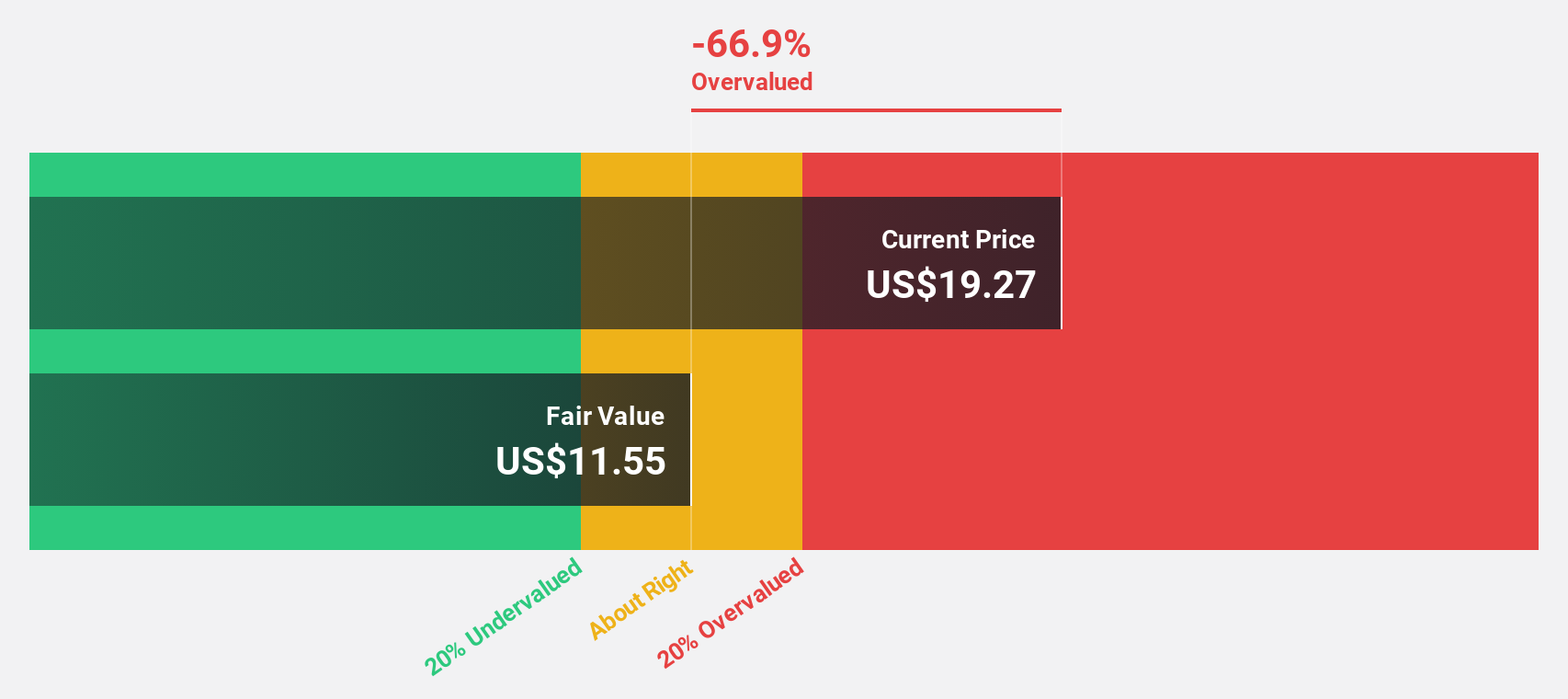

Estimated Discount To Fair Value: 23%

XPeng is trading at US$20.37, below its estimated fair value of US$26.46, suggesting potential undervaluation based on cash flows. The company reported significant revenue growth in Q2 2025 to CNY 18.27 billion, with a reduced net loss of CNY 477.75 million year-over-year. Strategic alliances with Volkswagen and robust vehicle deliveries bolster XPeng's growth trajectory, while forecasts indicate profitability within three years and revenue growth exceeding market averages at 23.3% annually.

- Our earnings growth report unveils the potential for significant increases in XPeng's future results.

- Dive into the specifics of XPeng here with our thorough financial health report.

Summing It All Up

- Click through to start exploring the rest of the 196 Undervalued US Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives