- United States

- /

- Airlines

- /

- NYSE:CPA

3 Dividend Stocks Offering Up To 5.6% Yield For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with major indices like the Dow, S&P 500, and Nasdaq closing at record levels, investors are keenly watching for opportunities amid expectations of potential interest rate cuts by the Federal Reserve. In such a dynamic environment, dividend stocks can offer a compelling blend of income and stability for portfolios seeking to capitalize on current market trends while managing risk.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.36% | ★★★★★☆ |

| PACCAR (PCAR) | 4.43% | ★★★★★☆ |

| OTC Markets Group (OTCM) | 4.44% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.79% | ★★★★★★ |

| Ennis (EBF) | 5.53% | ★★★★★★ |

| Employers Holdings (EIG) | 3.04% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.61% | ★★★★★☆ |

| Dillard's (DDS) | 4.58% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.55% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.37% | ★★★★★☆ |

Click here to see the full list of 122 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Orrstown Financial Services (ORRF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orrstown Financial Services, Inc. is a financial holding company for Orrstown Bank, offering commercial banking and financial advisory services to a diverse client base in the United States, with a market cap of $680.82 million.

Operations: Orrstown Financial Services, Inc. generates revenue primarily through its Community Banking segment, which reported $233.72 million.

Dividend Yield: 3.1%

Orrstown Financial Services offers a reliable dividend yield of 3.09%, though it falls short of the top tier in the US market. The company has consistently increased its dividends over the past decade, supported by a low payout ratio of 43.4%. Recent financials show strong earnings growth, with net income reaching US$19.45 million for Q2 2025, and a recent dividend increase to US$0.27 per share highlights ongoing shareholder returns amidst strategic debt redemption initiatives.

- Get an in-depth perspective on Orrstown Financial Services' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Orrstown Financial Services is trading behind its estimated value.

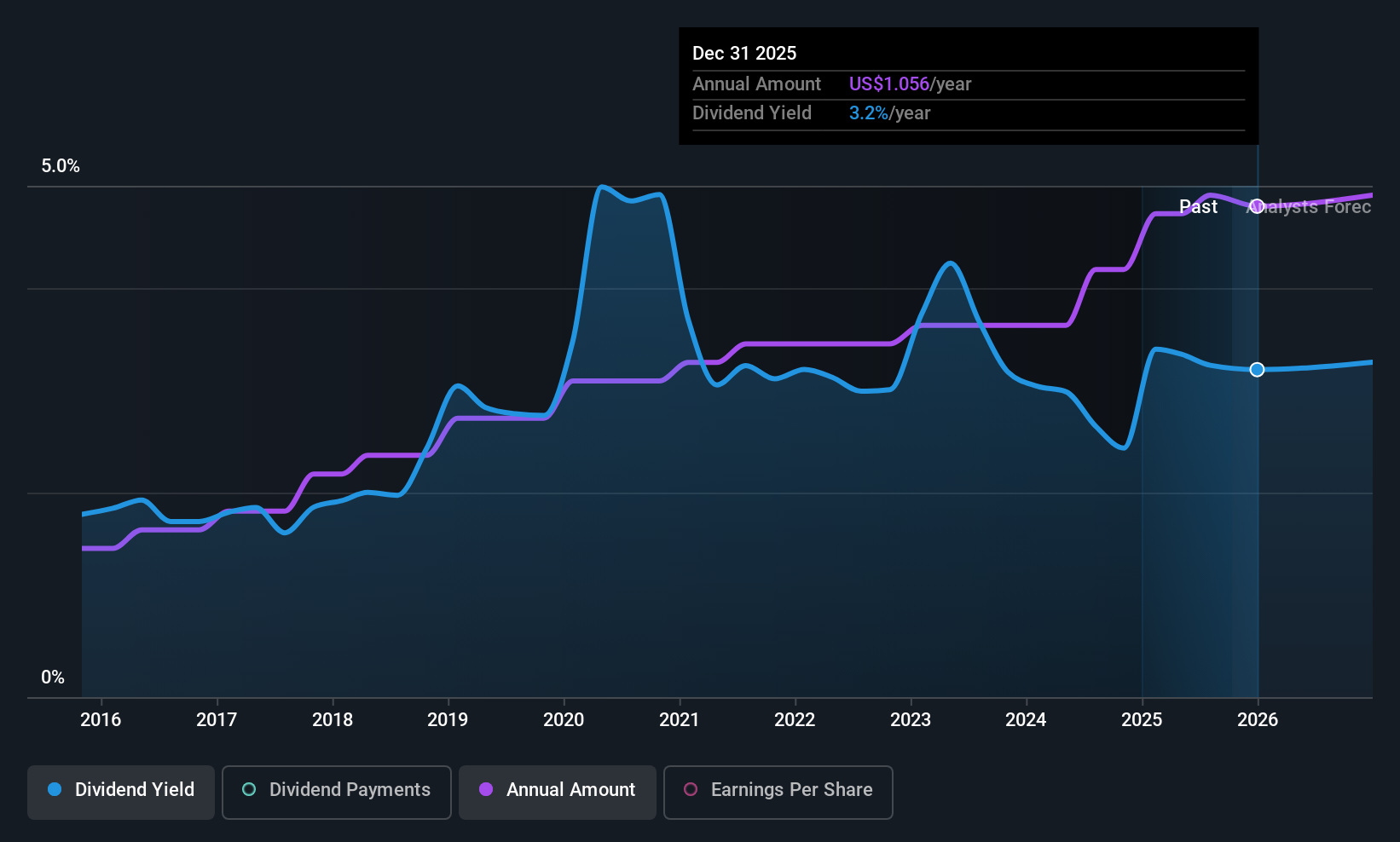

Archer-Daniels-Midland (ADM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products, with a market cap of approximately $29.88 billion.

Operations: Archer-Daniels-Midland Company's revenue comes from its key segments: Nutrition ($7.49 billion), Carbohydrate Solutions ($11.88 billion), and AG Services and Oilseeds ($65.69 billion).

Dividend Yield: 3.3%

Archer-Daniels-Midland (ADM) maintains a reliable dividend record with a recent payout of US$0.51 per share, supported by a low cash payout ratio of 23.9%, indicating strong coverage by cash flows. Despite earnings pressures and lower profit margins at 1.3%, ADM's dividends remain stable and have grown over the past decade. Recent strategic moves, including streamlining soy protein operations and a partnership with OCOchem for sustainable production, aim to enhance operational efficiency and support long-term growth prospects.

- Unlock comprehensive insights into our analysis of Archer-Daniels-Midland stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Archer-Daniels-Midland is priced higher than what may be justified by its financials.

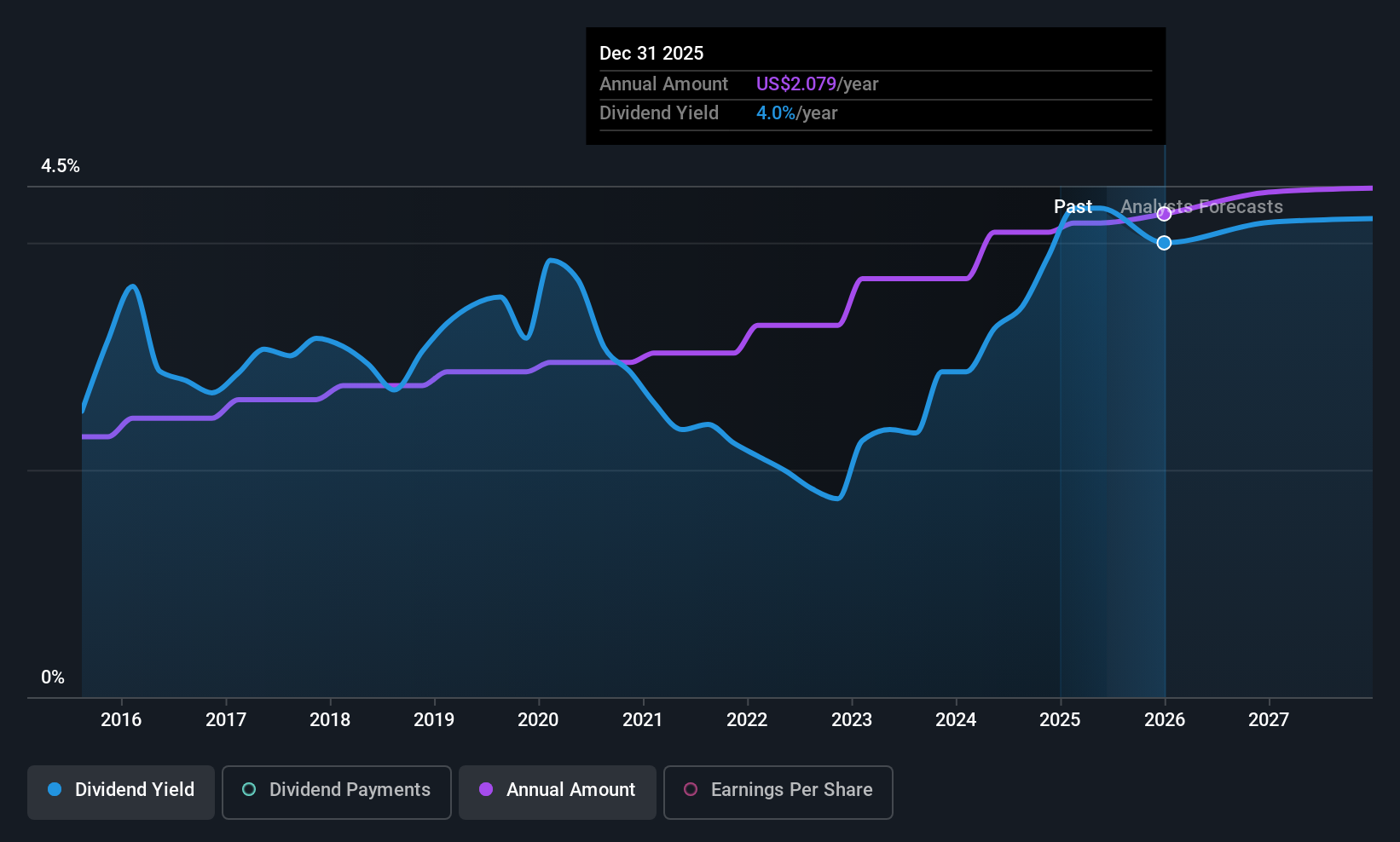

Copa Holdings (CPA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Copa Holdings, S.A. operates through its subsidiaries to offer airline passenger and cargo transport services, with a market cap of $4.71 billion.

Operations: Copa Holdings generates revenue primarily from its air transportation segment, amounting to $3.48 billion.

Dividend Yield: 5.6%

Copa Holdings' recent dividend of US$1.61 per share reflects a high yield, ranking in the top 25% of US dividend payers. However, its dividends have been volatile over the past decade and are not well covered by cash flows, with a cash payout ratio of 109%. Despite this, earnings growth and a low price-to-earnings ratio suggest potential value. Recent results show increased revenue and net income, supporting operational stability despite dividend concerns.

- Navigate through the intricacies of Copa Holdings with our comprehensive dividend report here.

- The analysis detailed in our Copa Holdings valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click this link to deep-dive into the 122 companies within our Top US Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)