- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:DIBS

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As January 2025 unfolds, the U.S. stock market is experiencing a rebound from a recent selloff, with investors closely watching earnings reports and Federal Reserve decisions. In this context, penny stocks continue to intrigue investors due to their potential for growth and value, despite being smaller or newer companies. These stocks can offer unique opportunities when backed by robust financials, making them an interesting area for those seeking under-the-radar investment options with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.69 | $11.4M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8985 | $6.25M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.65M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.283 | $10.58M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.73 | $84.93M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.57 | $42M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.11 | $52.57M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.29 | $23.06M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.90 | $79.98M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Wrap Technologies (NasdaqCM:WRAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wrap Technologies, Inc. is a public safety technology and services company that develops policing solutions for law enforcement and security personnel globally, with a market cap of $93.14 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling $4.23 million.

Market Cap: $93.14M

Wrap Technologies, with a market cap of US$93.14 million, faces challenges typical for penny stocks. Despite having meaningful revenue of US$4.23 million from its Aerospace & Defense segment, the company is unprofitable and has seen earnings decline by 16.1% annually over the past five years. It has less than a year of cash runway based on current free cash flow trends and lacks experienced management and board teams. However, recent strategic moves such as relocating its manufacturing facility to Virginia aim to enhance operational capabilities and expand partnerships in public safety innovation, potentially boosting future prospects despite current financial hurdles.

- Take a closer look at Wrap Technologies' potential here in our financial health report.

- Evaluate Wrap Technologies' historical performance by accessing our past performance report.

1stdibs.Com (NasdaqGM:DIBS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 1stdibs.Com, Inc. operates an online marketplace for luxury design products worldwide and has a market cap of approximately $131.45 million.

Operations: The company generates revenue of $86.41 million from its online retail segment.

Market Cap: $131.45M

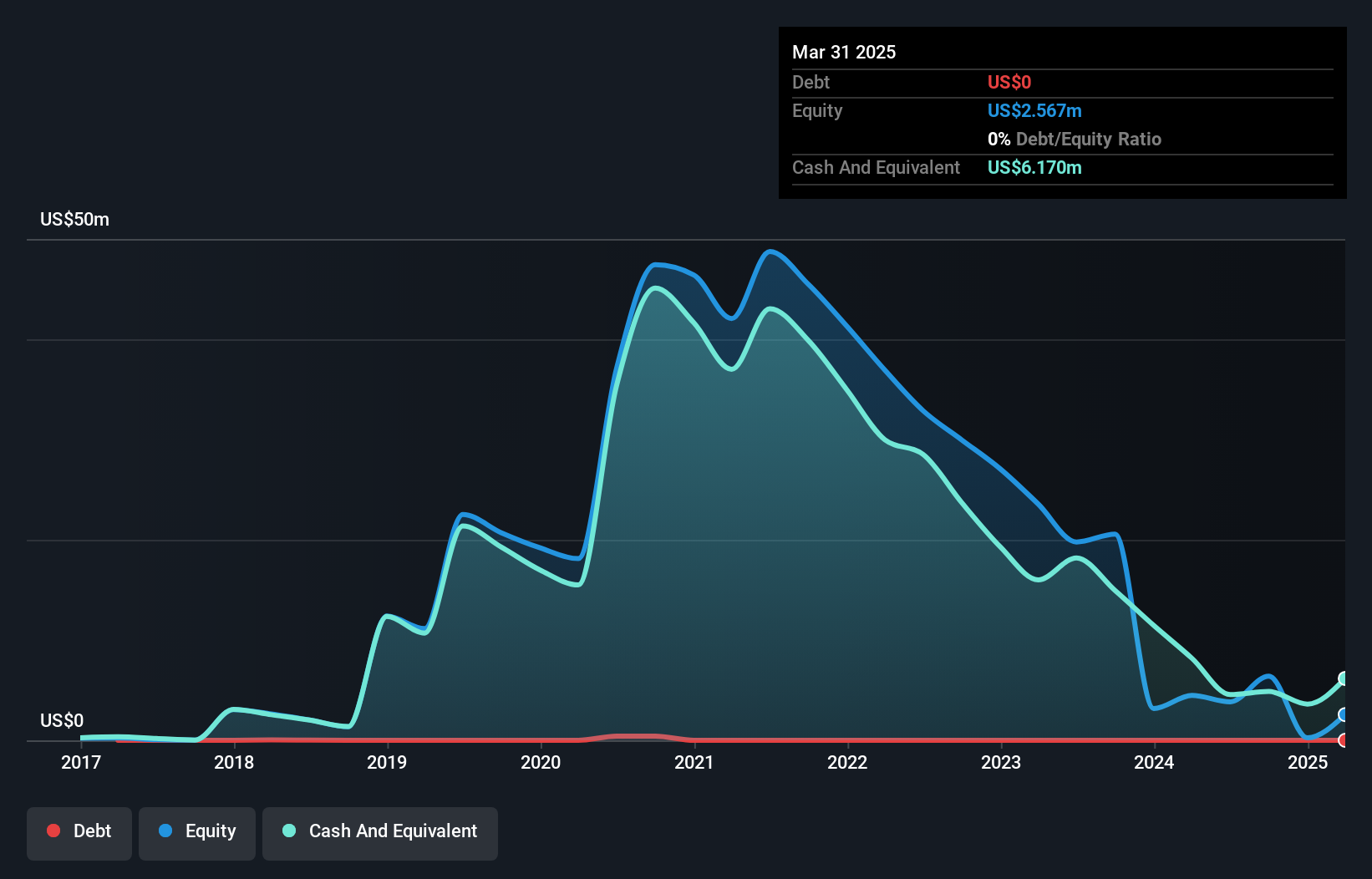

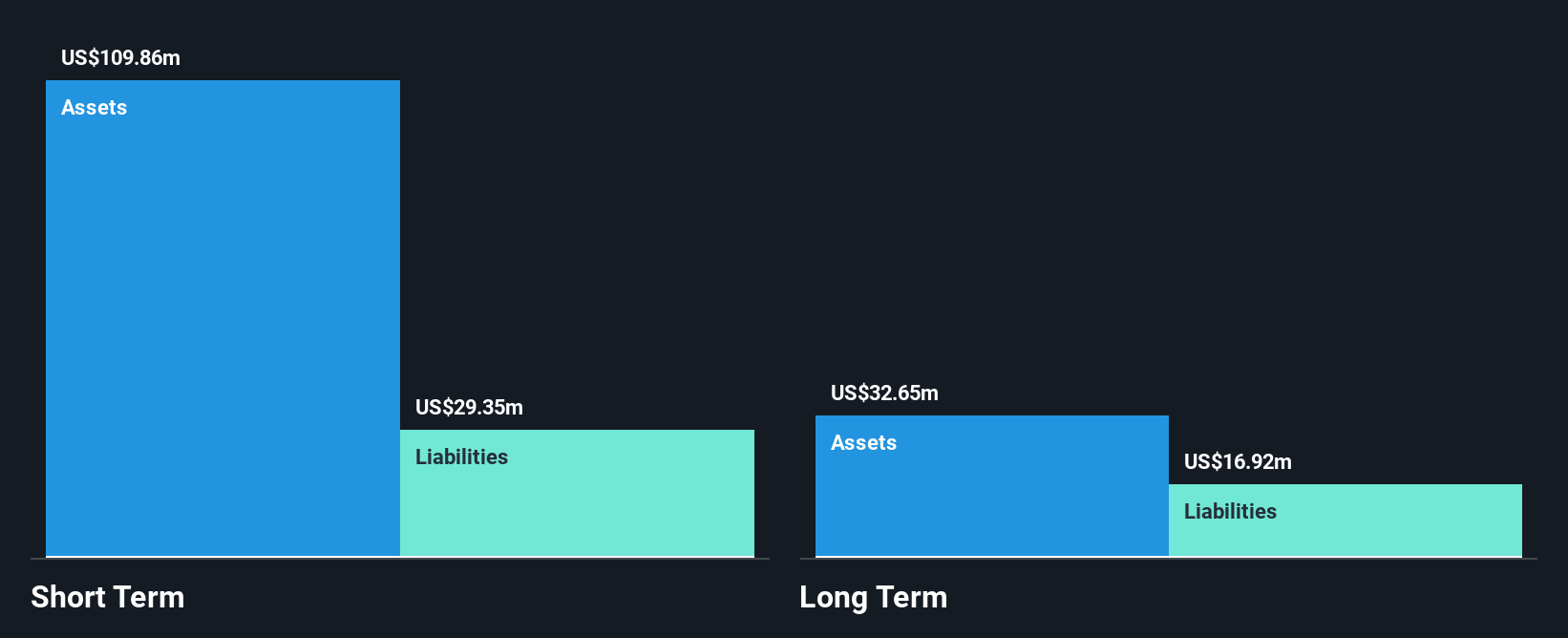

1stdibs.Com, Inc., with a market cap of US$131.45 million, operates in the online luxury design marketplace and remains unprofitable despite generating US$86.41 million in revenue. The company has improved its financial position by reducing net losses over the past five years at a rate of 13.9% annually and maintains a strong cash runway exceeding three years without debt obligations. Recent earnings showed slight sales growth to US$21.19 million for Q3 2024 but an increased net loss of US$5.68 million compared to last year, alongside share repurchases totaling US$0.92 million as part of its buyback program.

- Navigate through the intricacies of 1stdibs.Com with our comprehensive balance sheet health report here.

- Gain insights into 1stdibs.Com's outlook and expected performance with our report on the company's earnings estimates.

Range Impact (OTCPK:RNGE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Range Impact, Inc., along with its subsidiaries, operates in the United States providing health and wellness products, with a market capitalization of $18.38 million.

Operations: The company generates revenue primarily from its Range Reclaim segment, contributing $10.77 million, and the Range Security segment, which adds $1.12 million.

Market Cap: $18.38M

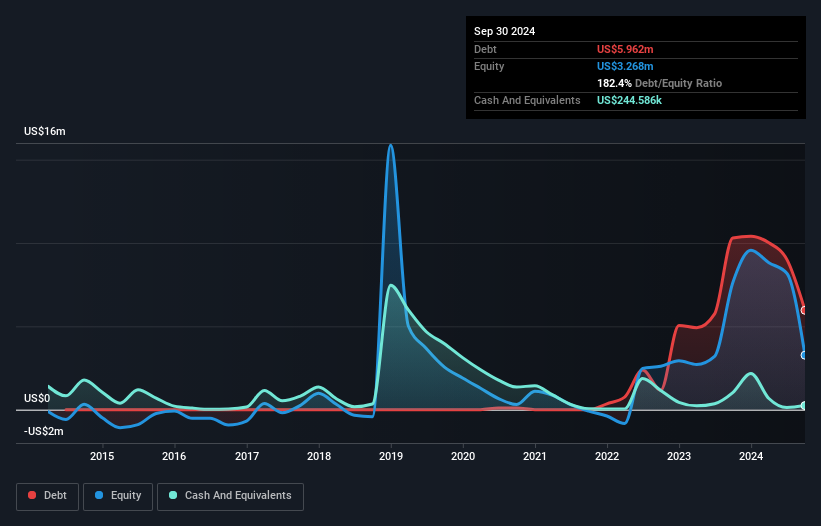

Range Impact, Inc., with a market cap of US$18.38 million, operates in the health and wellness sector, generating revenue primarily from its Range Reclaim segment at US$10.77 million. Despite recent challenges, including declining sales to US$2.17 million for Q3 2024 and a net loss of US$4.92 million, the company has managed to secure additional funding through private placements totaling approximately US$0.5 million in January 2025. Its debt levels have increased significantly over five years with a high net debt to equity ratio of 174.9%, though short-term assets cover both short- and long-term liabilities effectively.

- Click to explore a detailed breakdown of our findings in Range Impact's financial health report.

- Assess Range Impact's previous results with our detailed historical performance reports.

Taking Advantage

- Click through to start exploring the rest of the 706 US Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DIBS

1stdibs.Com

Operates an online marketplace for luxury design products worldwide.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)