- United States

- /

- Communications

- /

- NasdaqGM:CLFD

3 US Growth Companies With Up To 16% Insider Ownership

Reviewed by Simply Wall St

As the United States market navigates through a period of heightened anticipation surrounding the Federal Reserve's interest rate decisions, major indices like the Dow Jones Industrial Average are experiencing fluctuations, with stock futures pointing to a potential rebound. In such an environment, growth companies with significant insider ownership can often present compelling opportunities for investors seeking alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Hesai Group (NasdaqGS:HSAI) | 24.4% | 72.7% |

Here we highlight a subset of our preferred stocks from the screener.

Clearfield (NasdaqGM:CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clearfield, Inc. manufactures and sells a range of fiber connectivity products both in the United States and internationally, with a market cap of $458.52 million.

Operations: The company's revenue segments consist of $125.63 million from Clearfield and $43.41 million from Nestor Cables.

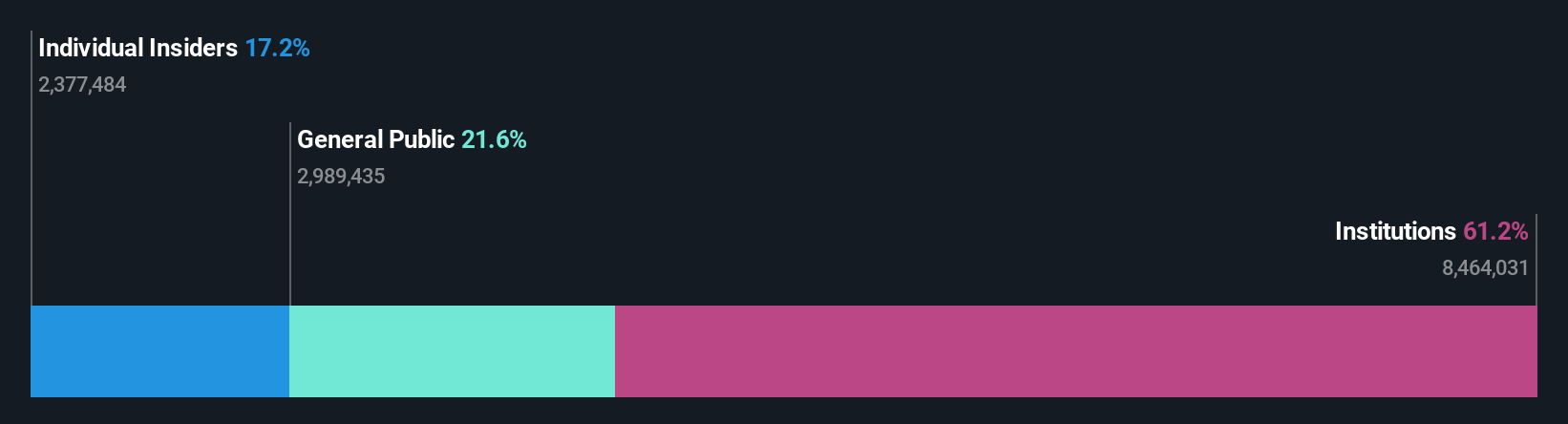

Insider Ownership: 16.9%

Clearfield, Inc. demonstrates characteristics of a growth company with high insider ownership, evidenced by substantial insider buying over the past three months and no significant insider selling. Analysts expect Clearfield's revenue to grow at 11.7% annually, surpassing the US market average of 9.1%, with earnings projected to increase significantly at 106.93% per year as it becomes profitable within three years. Despite recent financial challenges, including a net loss for the fiscal year and declining sales, Clearfield remains undervalued by approximately 61% relative to its estimated fair value according to analysts' assessments. Recent product innovations like the StreetSmart Ready Connect Terminal highlight its strategic focus on addressing market needs in fiber connectivity solutions.

- Click to explore a detailed breakdown of our findings in Clearfield's earnings growth report.

- The valuation report we've compiled suggests that Clearfield's current price could be quite moderate.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States with a market cap of $832.36 million.

Operations: The company's revenue is primarily derived from its origination segment, contributing $684.44 million, and its servicing segment, which adds $16.82 million.

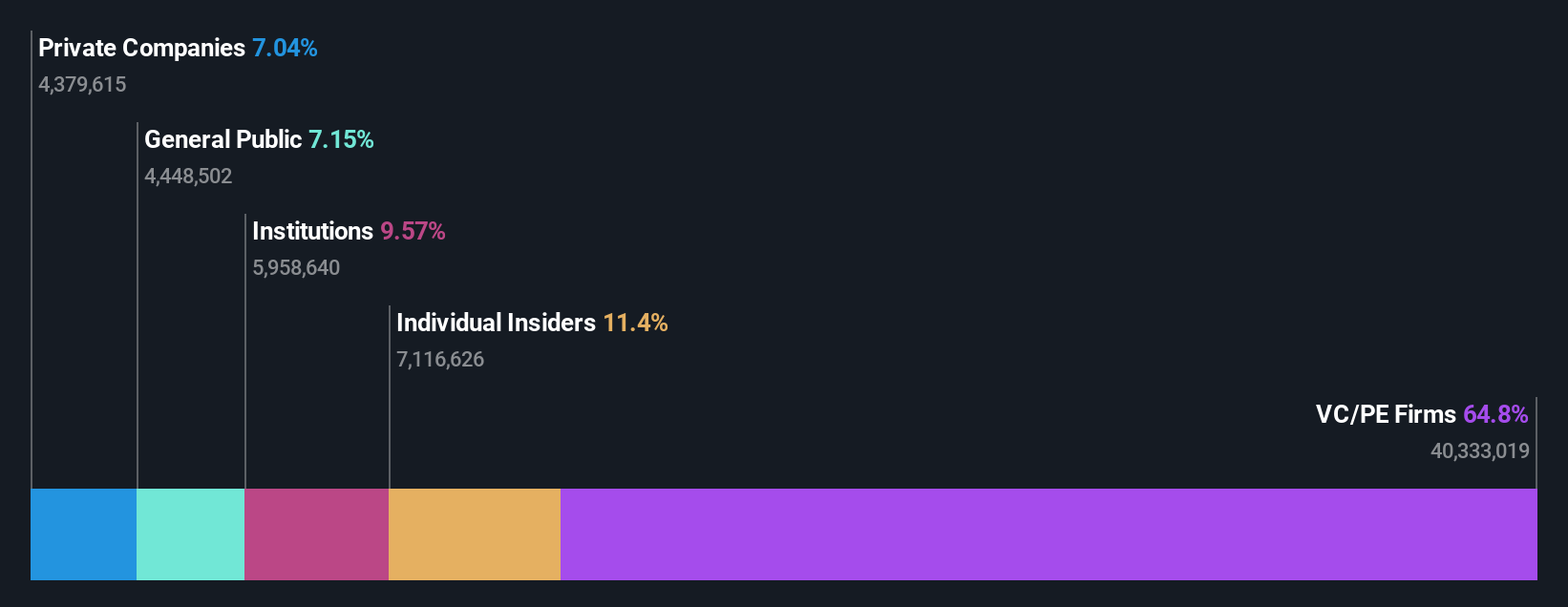

Insider Ownership: 11.4%

Guild Holdings is trading 31.9% below its estimated fair value, with analysts anticipating a 23.3% price increase. Despite recent financial setbacks, including a net loss of US$66.89 million for Q3 2024, revenue is projected to grow at an impressive 23.8% annually, outpacing the US market average of 9.1%. While insider transactions show more buying than selling recently, volumes remain modest. The company is actively pursuing acquisitions to bolster growth amidst ongoing market volatility.

- Click here to discover the nuances of Guild Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility Guild Holdings' shares may be trading at a discount.

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of $757.31 million.

Operations: The company generates revenue of $681.23 million from its Internet Information Providers segment.

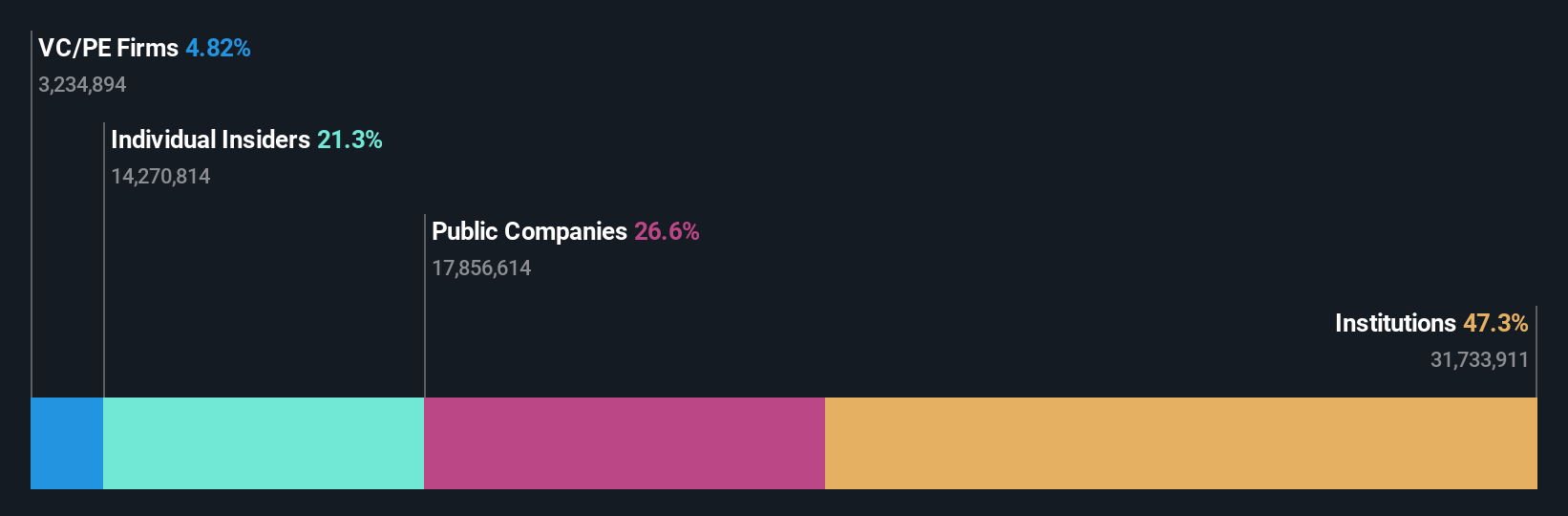

Insider Ownership: 12.2%

MediaAlpha's recent earnings report shows significant improvement, with Q3 2024 sales at US$259.13 million and a net income of US$9.48 million, reversing last year's loss. The company expects strong revenue growth in the fourth quarter, projecting between US$275 million to US$295 million. Despite past shareholder dilution and high share price volatility, MediaAlpha is trading at 73.9% below its estimated fair value, with earnings forecasted to grow significantly faster than the market average.

- Take a closer look at MediaAlpha's potential here in our earnings growth report.

- Our expertly prepared valuation report MediaAlpha implies its share price may be too high.

Make It Happen

- Click here to access our complete index of 202 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CLFD

Clearfield

Manufactures and sells various fiber connectivity products in the United States and internationally.

Reasonable growth potential with adequate balance sheet.