- United States

- /

- Specialty Stores

- /

- NasdaqGM:DXLG

3 Penny Stocks On US Exchanges With Market Caps Over $80M To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable upswing, driven by gains in major indices and a tech rally led by companies like Nvidia and Tesla, investors are exploring various avenues for growth. Penny stocks, often associated with smaller or newer companies, continue to capture interest due to their affordability and potential for significant returns. Despite being an older term, penny stocks remain relevant as they can offer unique opportunities when backed by strong financial fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $91.49M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.884275 | $6.54M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.50 | $10.2M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.65 | $2B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.285 | $11.23M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.68 | $48.23M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.22M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.908 | $82.23M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.41 | $380.13M | ★★★★☆☆ |

Click here to see the full list of 713 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Identiv (NasdaqCM:INVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Identiv, Inc. is a security technology company offering secure identification and physical security solutions globally, with a market cap of $88.85 million.

Operations: The company's revenue is primarily derived from the Americas at $75.12 million, followed by Europe and The Middle East at $17.78 million, and Asia-Pacific at $11.32 million.

Market Cap: $88.85M

Identiv, Inc., a security technology company, has faced financial challenges with declining revenues and consistent unprofitability. Despite this, the company maintains a strong cash position with sufficient runway for over three years and no debt. Recent strategic moves include appointing Kim Macaulay as SVP to drive growth initiatives and exploring acquisitions as part of its expansion strategy. Identiv's focus on innovative NFC-enabled products positions it well in the IoT space, especially for applications like healthcare and smart packaging. The company's share repurchase program reflects confidence in its long-term prospects despite current financial hurdles.

- Click to explore a detailed breakdown of our findings in Identiv's financial health report.

- Learn about Identiv's future growth trajectory here.

Destination XL Group (NasdaqGM:DXLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Destination XL Group, Inc. operates as a specialty retailer of big and tall men's clothing and shoes in the United States, with a market cap of $145 million.

Operations: The company's revenue is primarily generated from its retail segment, which accounts for $484.95 million.

Market Cap: $145M

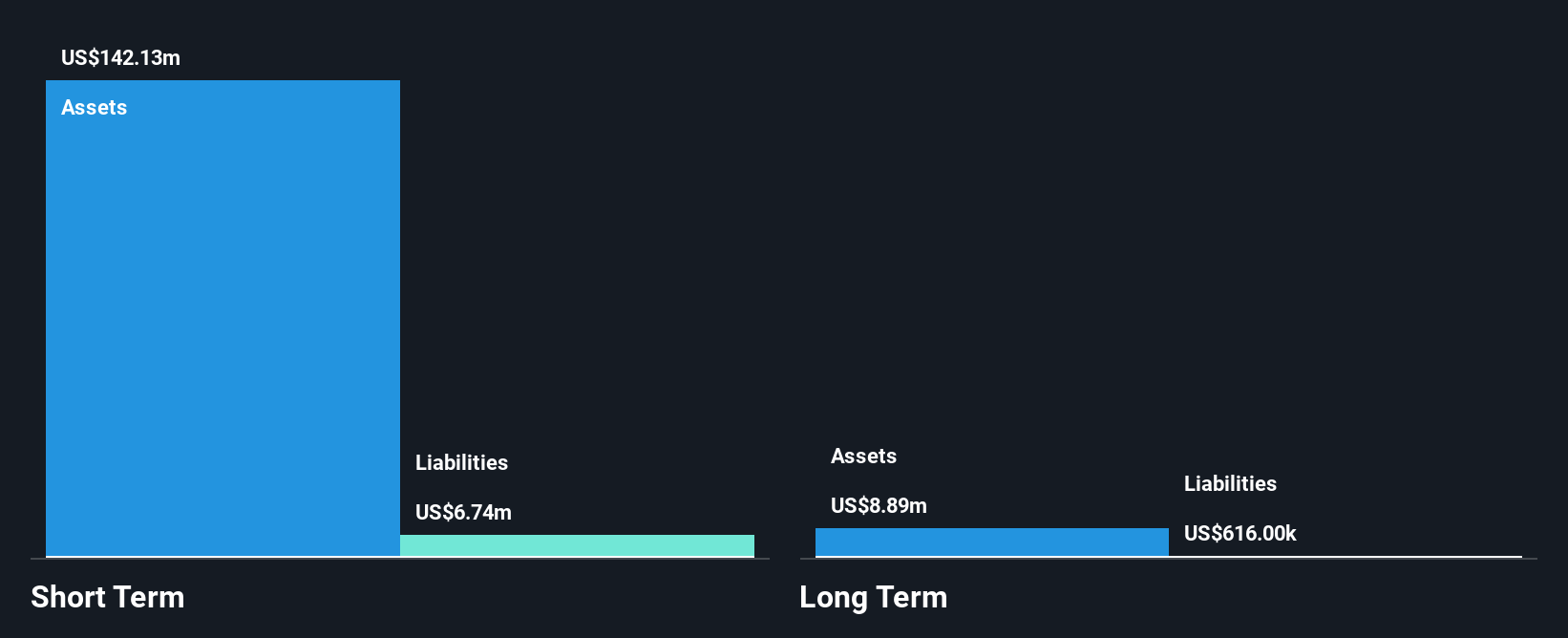

Destination XL Group, Inc. has experienced financial volatility, with recent guidance revisions reflecting decreased sales expectations for fiscal 2024 at US$467.0 to US$470.0 million. The company's profit margins have declined from 5.8% to 2%, and it reported a net loss of US$1.81 million in the third quarter compared to a net income of US$4.02 million the previous year, highlighting challenges in maintaining profitability amidst declining sales figures and comparable sales down by 7.4% during the holiday period. Despite these setbacks, DXLG remains debt-free and has completed a significant share buyback program valued at US$10.22 million, indicating management's confidence in its future potential despite short-term hurdles.

- Jump into the full analysis health report here for a deeper understanding of Destination XL Group.

- Review our growth performance report to gain insights into Destination XL Group's future.

Information Services Group (NasdaqGM:III)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Information Services Group, Inc. operates as a technology research and advisory company across the Americas, Europe, and the Asia Pacific with a market cap of $158.99 million.

Operations: The company's revenue is primarily derived from its Fact-Based Sourcing Advisory Services, amounting to $255.99 million.

Market Cap: $158.99M

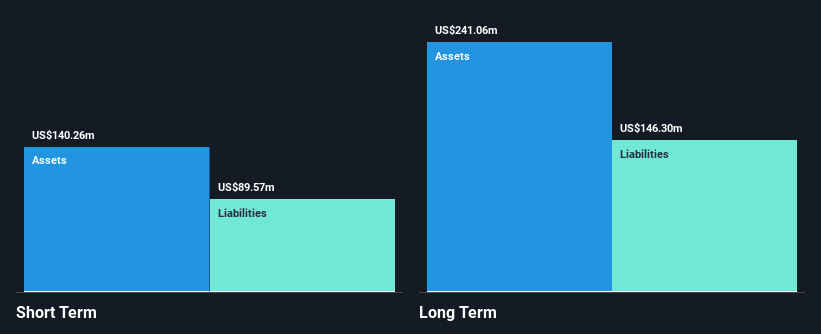

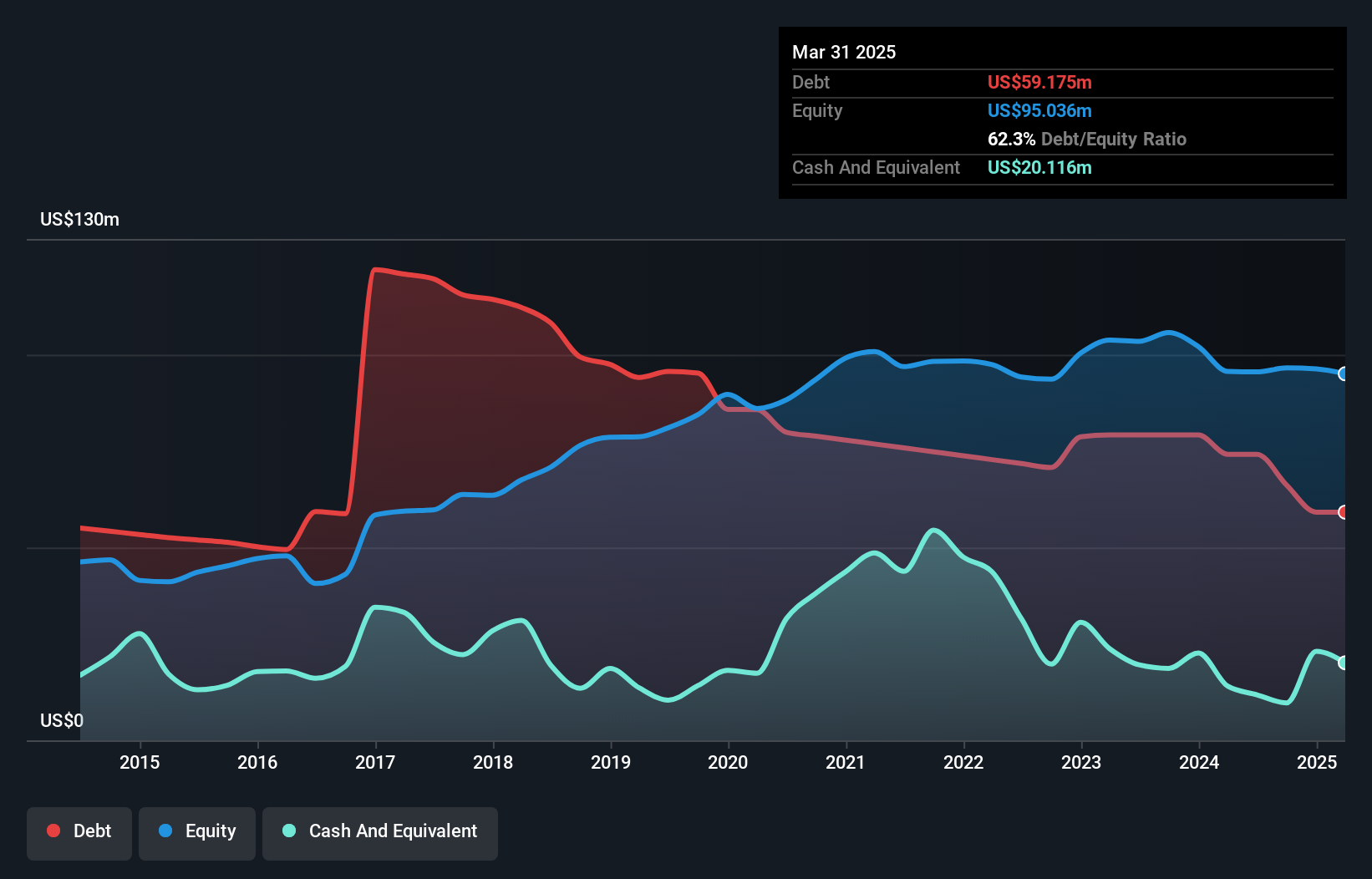

Information Services Group, Inc. faces challenges with a high net debt to equity ratio of 58.5% and interest payments not well covered by EBIT, indicating financial strain. Despite these issues, the company maintains a strong short-term financial position with assets exceeding liabilities and has reduced its debt over time. Recent earnings showed decreased sales from US$71.77 million to US$61.28 million year-over-year for Q3 2024, resulting in lower net income of US$1.15 million compared to US$3.2 million previously. The firm continues shareholder returns through dividends and share buybacks while launching new research initiatives in global capability centers.

- Dive into the specifics of Information Services Group here with our thorough balance sheet health report.

- Evaluate Information Services Group's prospects by accessing our earnings growth report.

Make It Happen

- Navigate through the entire inventory of 713 US Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:DXLG

Destination XL Group

Operates as a specialty retailer of big and tall men’s clothing and footwear in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives