- United States

- /

- Banks

- /

- NasdaqGS:FCBC

Uncovering 3 Undiscovered Gems in United States Stocks

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has risen by 25% over the past year with earnings forecast to grow by 15% annually. In this dynamic environment, identifying stocks that may be undervalued or overlooked can offer unique opportunities for investors seeking growth potential in a thriving market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

FS Bancorp (NasdaqCM:FSBW)

Simply Wall St Value Rating: ★★★★★★

Overview: FS Bancorp, Inc. is a bank holding company for 1st Security Bank of Washington, offering banking and financial services to local families, businesses, and industry niches with a market cap of approximately $313.93 million.

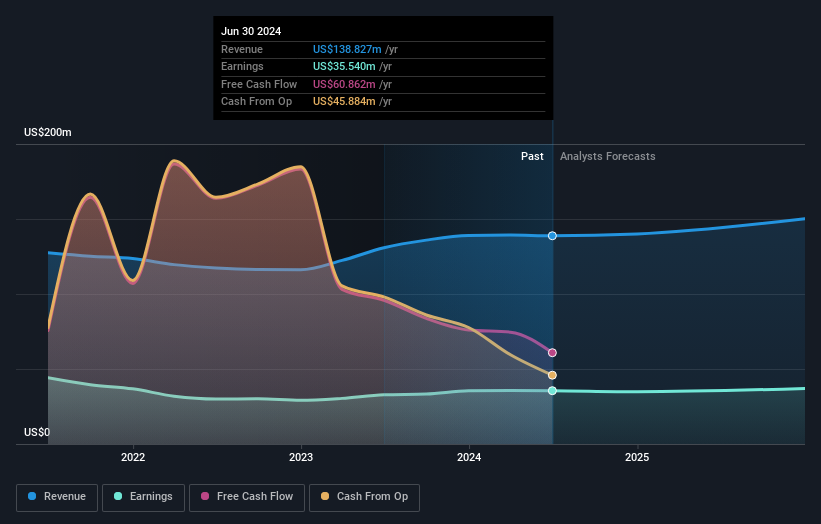

Operations: FS Bancorp generates revenue primarily through its Commercial and Consumer Banking segment, which contributes $117.94 million, while Home Lending adds $21.52 million.

FS Bancorp, with total assets of US$3.0 billion and equity of US$288.9 million, appears to be a robust player in its sector. The company has total deposits of US$2.4 billion against loans amounting to US$2.5 billion, indicating a strong lending position supported by primarily low-risk funding sources—91% from customer deposits. A sufficient allowance for bad loans at 290% and non-performing loans at just 0.4% underscore its prudent risk management practices. Additionally, FS Bancorp's earnings growth over the past year outpaced the industry average by 10%, reflecting high-quality past earnings and trading well below estimated fair value by 60%.

- Navigate through the intricacies of FS Bancorp with our comprehensive health report here.

Examine FS Bancorp's past performance report to understand how it has performed in the past.

First Community Bankshares (NasdaqGS:FCBC)

Simply Wall St Value Rating: ★★★★★★

Overview: First Community Bankshares, Inc. is a financial holding company for First Community Bank, offering a range of banking products and services, with a market capitalization of $734.02 million.

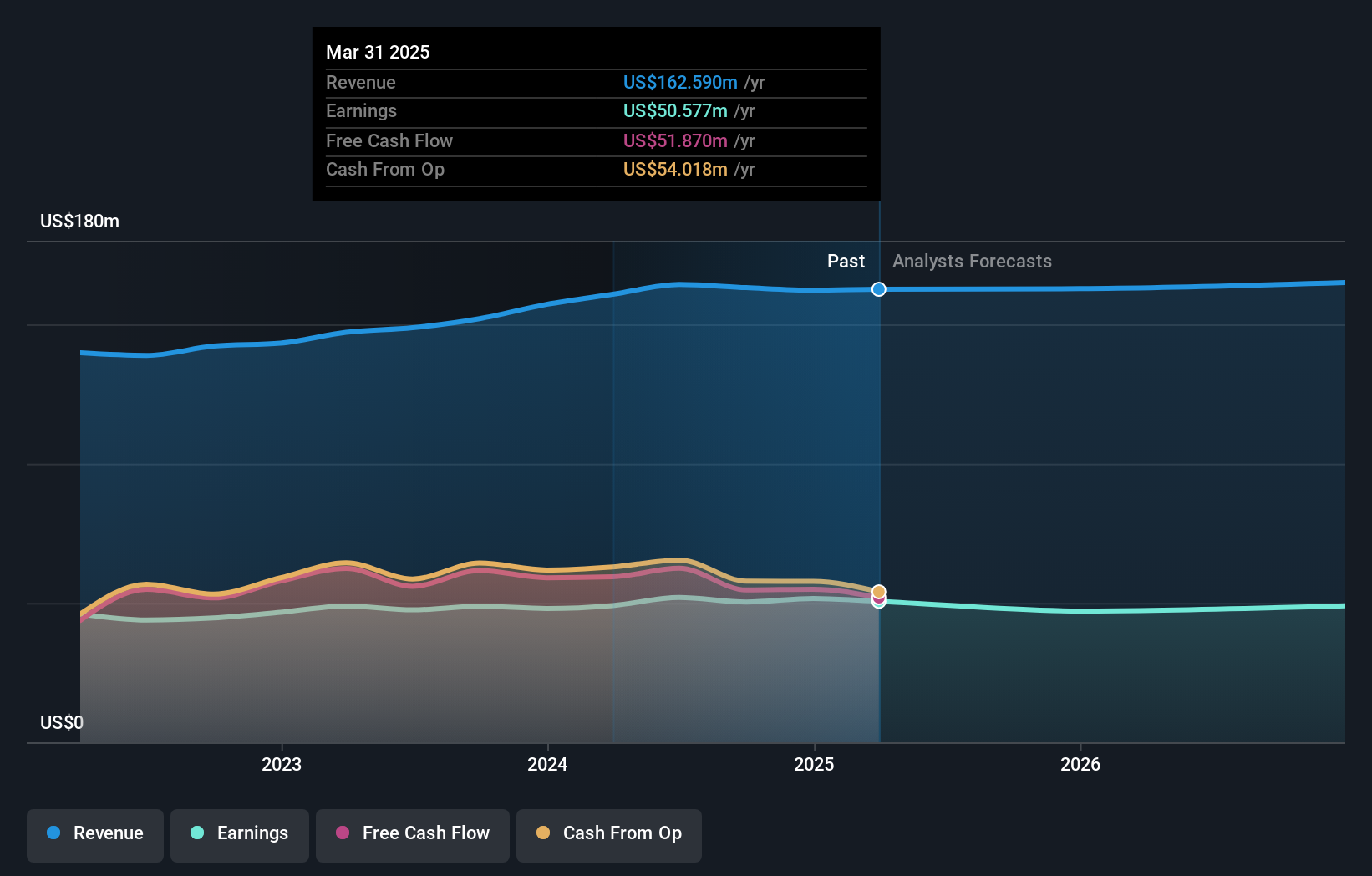

Operations: The primary revenue stream for First Community Bankshares comes from its community banking segment, generating $163.17 million. The company's market capitalization stands at $734.02 million.

Boasting total assets of US$3.2 billion and equity of US$520.7 million, First Community Bankshares presents a robust financial foundation with deposits at US$2.7 billion and loans totaling US$2.4 billion. The bank's net interest margin stands at 4.4%, while its allowance for bad loans is sufficient at 0.8% of total loans, indicating prudent risk management practices. Despite a forecasted earnings decline averaging 2.5% annually over the next three years, recent earnings growth outpaced the industry average by reaching 3.1%. Additionally, the company repurchased shares worth US$14.94 million since September 2023, reflecting confidence in its value proposition.

ReposiTrak (NYSE:TRAK)

Simply Wall St Value Rating: ★★★★★★

Overview: ReposiTrak, Inc. is a software-as-a-service provider that designs, develops, and markets proprietary software products in North America with a market capitalization of $385.67 million.

Operations: ReposiTrak generates revenue primarily from its software and programming segment, which amounts to $20.83 million.

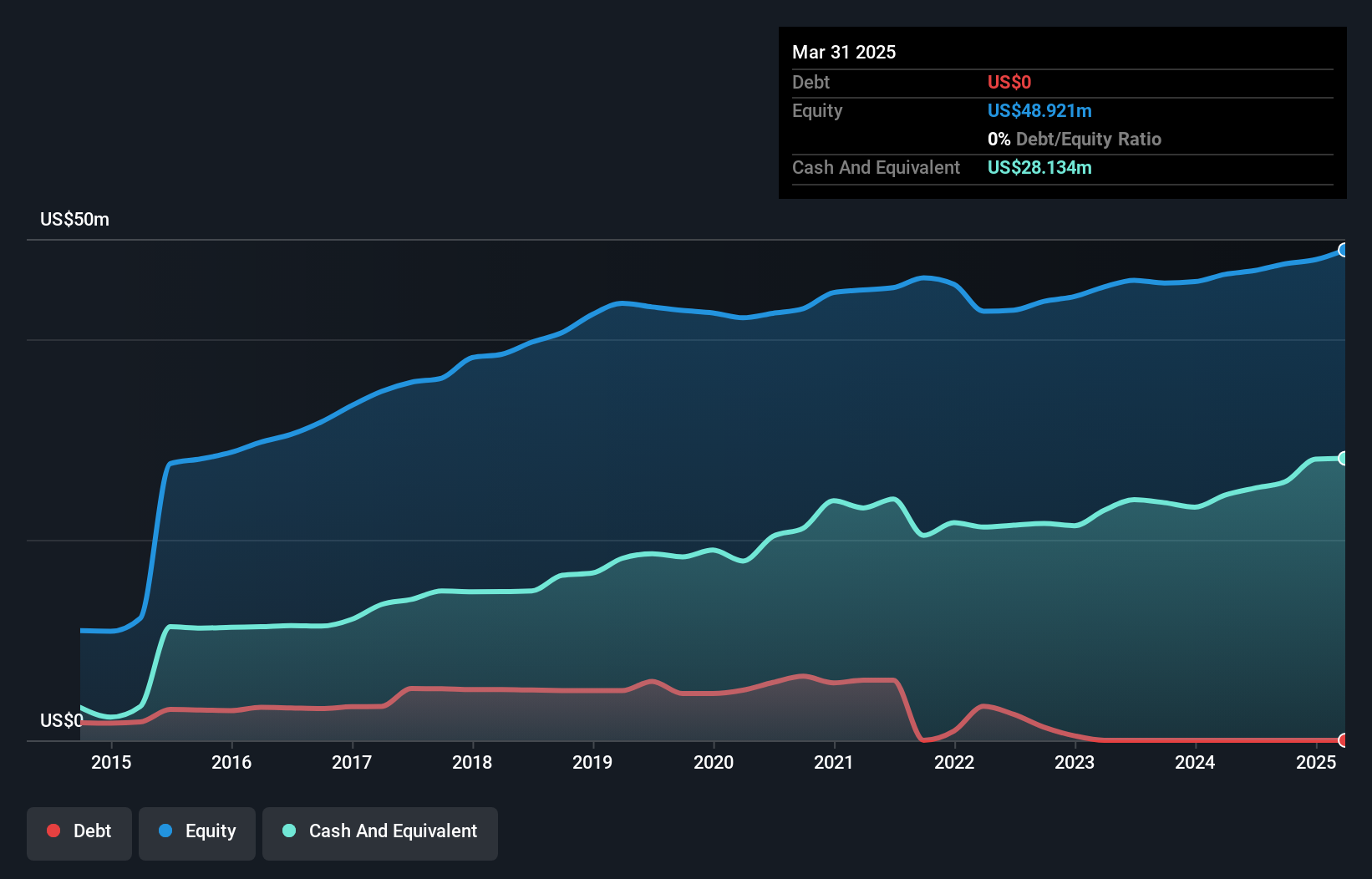

ReposiTrak, a nimble player in the software-as-a-service sector, is gaining traction due to increasing traceability mandates from retail giants like Walmart and Kroger. The company boasts zero debt now compared to a 10.9% debt-to-equity ratio five years ago and has achieved an impressive 26.1% annual earnings growth over the past five years. While its recent partnership with Upshop aims to enhance supply chain visibility, ReposiTrak faces challenges such as complex supplier onboarding and competitive pressures necessitating innovation. Despite these hurdles, analysts foresee a robust 14.3% revenue growth annually for three years with improved profit margins projected at 28.5%.

Make It Happen

- Unlock our comprehensive list of 249 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCBC

First Community Bankshares

Operates as the financial holding company for First Community Bank that provides various banking products and services.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives