Last Update 20 Feb 25

Fair value Decreased 0.80%Key Points

- SoundHound has developed over two decades of moat in an industry that just started getting traction.

- With shrinking electronics and communication with machines becoming more mainstream, I believe the company can capture much of this growth.

- Tech diversification is the biggest advantage for the company, as user adoption can transfer across different sectors.

- Stock dilution driven by stock-based compensation and cash raising remains the biggest performance risk.

- Even assuming a 15% annual dilution, a sector-conservative 20x valuation, and a high 8.53% cost of equity, Soundhound’s stock could be worth around $28.8 today.

Industry Catalysts

AI As a New Paradigm

- Artificial intelligence has become a cornerstone of modern technology, revolutionizing industries ranging from healthcare to automotive and creating the biggest hype since the introduction of the internet in the 1990s.

- The rise of AI has also led to the development of sophisticated natural language processing (NLP) and automatic speech recognition (ASR) systems. These technologies allow machines to accurately understand and respond to human speech, paving the way for voice assistants, smart home devices, and voice-enabled automotive systems.

- Market Research Future anticipates that the Voice AI market will grow from $17.16 billion in 2025 to $204 billion by 2034 at a compound annual growth rate of over 31% annually.

Hardware Minimization Favors Voice Tech

- Another major trend driving the adoption of voice technology is the ongoing miniaturization of hardware. As devices become smaller and more compact, traditional input methods like keyboards and touchscreens are becoming less practical. In many cases, voice commands are the only viable option for interacting with these devices. A small microphone is all that is needed to enable voice functionality, making it an ideal solution for compact and wearable devices.

- Safety concerns are another tailwind, particularly in the automotive industry, where voice technology integrated into an infotainment system enhances drivers' safety and convenience.

- Similarly, voice assistants like Amazon’s Alexa and Google Assistant have become ubiquitous in the smart home sector, allowing users to control lights, thermostats, and other devices with simple voice commands. As hardware shrinks, voice technology is poised to become the primary interface for various applications, from IoT devices to industrial equipment.

Stargate is a $500 Billion Industry Tailwind

- The AI industry received a significant boost with the announcement of the Stargate project, the Trump administration’s $500 billion AI infrastructure development initiative.

- Stargate involves major tech players like Oracle, SoftBank, and OpenAI, with an initial investment of $100 billion and plans to invest up to $400 billion over the next four years. The project aims to support the re-industrialization of the U.S., create 100,000 jobs, and enhance national security through AI advancements.

Company Catalysts

Moat Built Through Patents And Decades Of Know-How

- SoundHound started as a Stanford dorm-based project between a few aspiring academics in 2004. At that time, hardly anyone thought about voice AI. However, over more than two decades, the team accumulated diverse experience with this technology, building a moat of over 280 patents that set it apart from competitors. These patents cover a wide range, including speech recognition, natural language understanding, and voice search.

- The firm’s long history in the field has allowed it to refine its algorithms and accumulate vast amounts of data, which are critical for training AI models. With automotive partnerships, including Stellantis, Hyundai, and Mercedes-Benz, as well as partnerships with various food industry companies, SoundHound is well-positioned to maintain this moat. Thus, after a period of restructuring, the company re-accelerated its R&D expense in 2024.

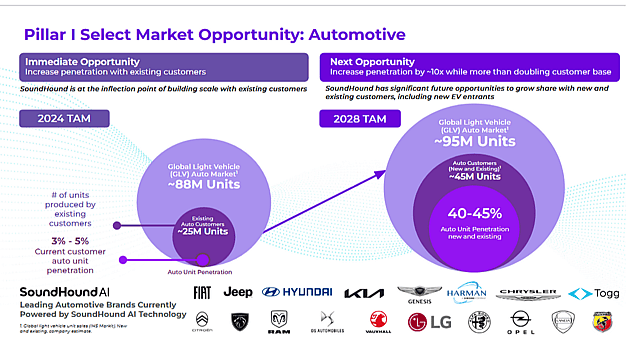

SoundHound’s Automotive market opportunity, Source: Investor Presentation

Multiple Potential Revenue Streams

SoundHound has positioned itself to capitalize on growing AI demand by adapting a three-pillar revenue strategy.

- The first pillar focuses on royalties from voice-enabled products. For example, SoundHound’s voice AI platform is used by major car manufacturers to enhance in-car experiences. The company’s technology enables drivers to control navigation, entertainment, and climate systems using natural language, reducing distractions and improving safety. A similar user case is restaurants and retail chains using this tech to power their ordering systems, reduce wait times, and improve the overall customer experience.

- The second pillar revolves around subscriptions from voice-enabled services, like smart devices and IoT. SoundHound’s voice AI is being integrated into various consumer electronics, including smart speakers, TVs, and home appliances. This allows users to interact with their devices more intuitively and hands-free, driving adoption and customer satisfaction.

- The third pillar encompasses the previous two. As they independently scale, pillar three becomes the voice commerce ecosystem, as customers have more incentive to adopt SoundHound’s technology.

RISKS (To my thesis)

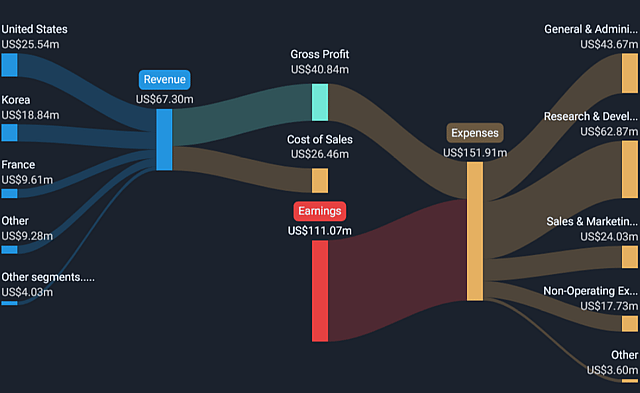

- Declining Gross Margins: SoundHound's gross margins have deteriorated significantly, with GAAP gross margins falling to 48.8% in Q3 2024, down from 72.9% the previous year. Even on a non-GAAP basis, gross margins are only 59.7%, well below the mid-70s margins typical of enterprise software companies. This margin compression is partly due to the impact of recent acquisitions, which have introduced lower-margin businesses into the mix. The company's ability to recover margins through cost synergies and operational improvements remains uncertain.

- Stock-Based Compensation (SBC): SoundHound's stock-based compensation has been a significant expense, with $9 million in SBC recorded in Q3 2024 alone. This dilutes existing shareholders and adds to the company's overall cost structure. Over time, high SBC typically leads to share dilution and increased pressure on the stock price.

- Acquisition Dependency And Cash Burn: While SoundHound has reported strong revenue growth (89% year-over-year in Q3 2024), a significant portion of this growth is attributed to acquisitions like Amelia and Synq3. Furthermore, the company is burning cash at a rapid pace, with year-to-date operating cash burn widening by 39% year-over-year to $75.7 million. If the company doesn’t reach an adjusted EBITDA positive by the end of this year, it could lead to more share issues, further feeding into dilution, which (per Simply Wall St data) reached 44% in 2024.

ASSUMPTIONS

- I’m assuming the industry grows as expected (around 30% annually) which will help the company grow at a 50% annual growth rate between FY 2026 and 2028 and 30% annual growth in FY 2029-30.

- Using that growth, I assume a $1.2 billion FY 2030 revenue from the current revenue estimate of $164 million.

- I’m assuming a gradual non-GAAP gross margin improvement to 70% by FY2030 as the company realizes cost synergies from acquisitions and scales its operations.

- I am assuming a 15% FCF margin by FY2030, in line with mature software companies, resulting in an FCF of approximately $180 million in FY2030.

- I expect stock dilution to slow but still average 15% per year until 2030, giving the terminal year share count around 554 million. I assume no stock buybacks or dividends in this period.

VALUATION

- Assuming $1.2 billion in revenue by 2030 and a valuation multiple of 20x – which is conservative for a tech company, the calculation is as follows.

- Future share price = EV Market cap / Diluted share count = (20x$1.2) / 554 = 54.2

Using a cost of equity of 8.53% (owing to Soundhound’s high Beta), we discount the future share price back to 2025, where

PV = FY2030 share price / (1.0853)5 = 43.3 / 1.504 = 28.80.

Thus, I estimate SoundHound’s intrinsic stock value today to be $28.80 per share.

Have other thoughts on SoundHound AI?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst StjepanK has a position in NasdaqGM:SOUN. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.