- United States

- /

- IT

- /

- NYSE:KD

3 US Stocks Estimated To Be Trading At Discounts Up To 49.9%

Reviewed by Simply Wall St

As the U.S. stock market approaches record highs, driven by a rally in chipmakers and positive earnings reports, investors are increasingly attentive to opportunities that may arise amidst fluctuating geopolitical developments and economic policies. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential discounts within the market, especially when major indexes are near their peaks.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Argan (NYSE:AGX) | $142.99 | $277.77 | 48.5% |

| Celsius Holdings (NasdaqCM:CELH) | $22.43 | $44.45 | 49.5% |

| Northwest Bancshares (NasdaqGS:NWBI) | $13.23 | $26.31 | 49.7% |

| Afya (NasdaqGS:AFYA) | $15.90 | $31.50 | 49.5% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.38 | $37.85 | 48.8% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $37.70 | $75.20 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | $26.04 | $51.68 | 49.6% |

| Equifax (NYSE:EFX) | $270.23 | $530.55 | 49.1% |

| Kyndryl Holdings (NYSE:KD) | $43.45 | $86.66 | 49.9% |

| Nutanix (NasdaqGS:NTNX) | $71.59 | $141.57 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

Kyndryl Holdings (NYSE:KD)

Overview: Kyndryl Holdings, Inc. is a global technology services company specializing in IT infrastructure services with a market cap of approximately $9.27 billion.

Operations: Kyndryl Holdings generates revenue from several key segments, including $2.34 billion from Japan, $3.90 billion from the United States, $5.63 billion from Principal Markets, and $3.25 billion from Strategic Markets.

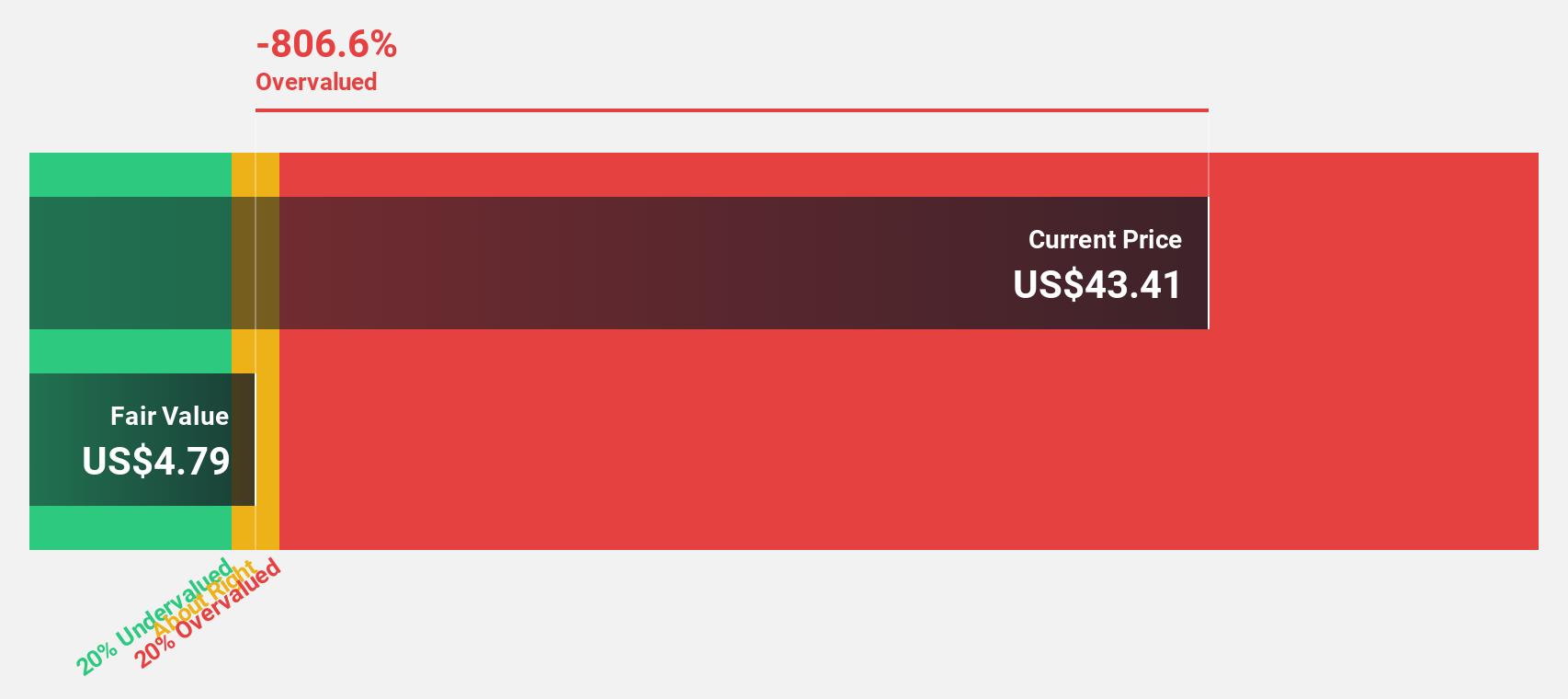

Estimated Discount To Fair Value: 49.9%

Kyndryl Holdings appears undervalued, trading at US$43.45, significantly below its estimated fair value of US$86.66. The company recently reported a net income of US$215 million for Q3 2024, marking a shift from losses in the previous year. Despite slower revenue growth forecasts compared to the market, Kyndryl's earnings are expected to grow substantially at 47.2% annually, highlighting strong potential based on cash flow analysis.

- In light of our recent growth report, it seems possible that Kyndryl Holdings' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Kyndryl Holdings.

Eli Lilly (NYSE:LLY)

Overview: Eli Lilly and Company is a global pharmaceutical firm that focuses on discovering, developing, and marketing human pharmaceuticals, with a market cap of approximately $743.82 billion.

Operations: Eli Lilly generates revenue of approximately $40.86 billion from the discovery, development, manufacturing, marketing, and sales of pharmaceutical products worldwide.

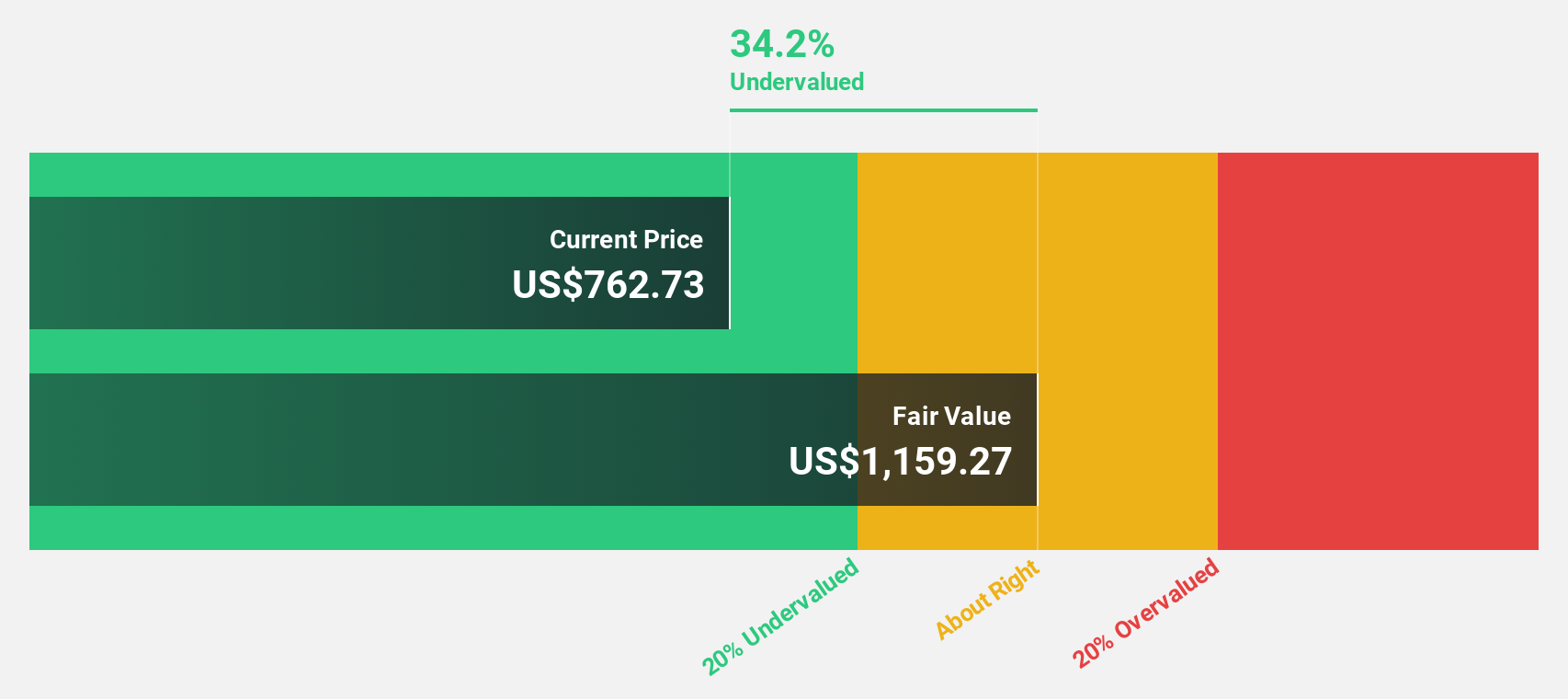

Estimated Discount To Fair Value: 40.7%

Eli Lilly is trading at US$842.18, considerably below its estimated fair value of US$1,419.84, indicating potential undervaluation based on cash flows. The company anticipates significant earnings growth of 25% annually over the next three years, outpacing the broader U.S. market's forecasted growth rate. Despite recent FDA approvals for key drugs like Omvoh and Zepbound potentially boosting revenue streams, Eli Lilly's operating cash flow does not sufficiently cover its debt obligations.

- Our earnings growth report unveils the potential for significant increases in Eli Lilly's future results.

- Navigate through the intricacies of Eli Lilly with our comprehensive financial health report here.

Spotify Technology (NYSE:SPOT)

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market cap of approximately $125.65 billion.

Operations: Spotify generates revenue through its Premium segment, which accounts for €13.82 billion, and its Ad-Supported segment, contributing €1.85 billion.

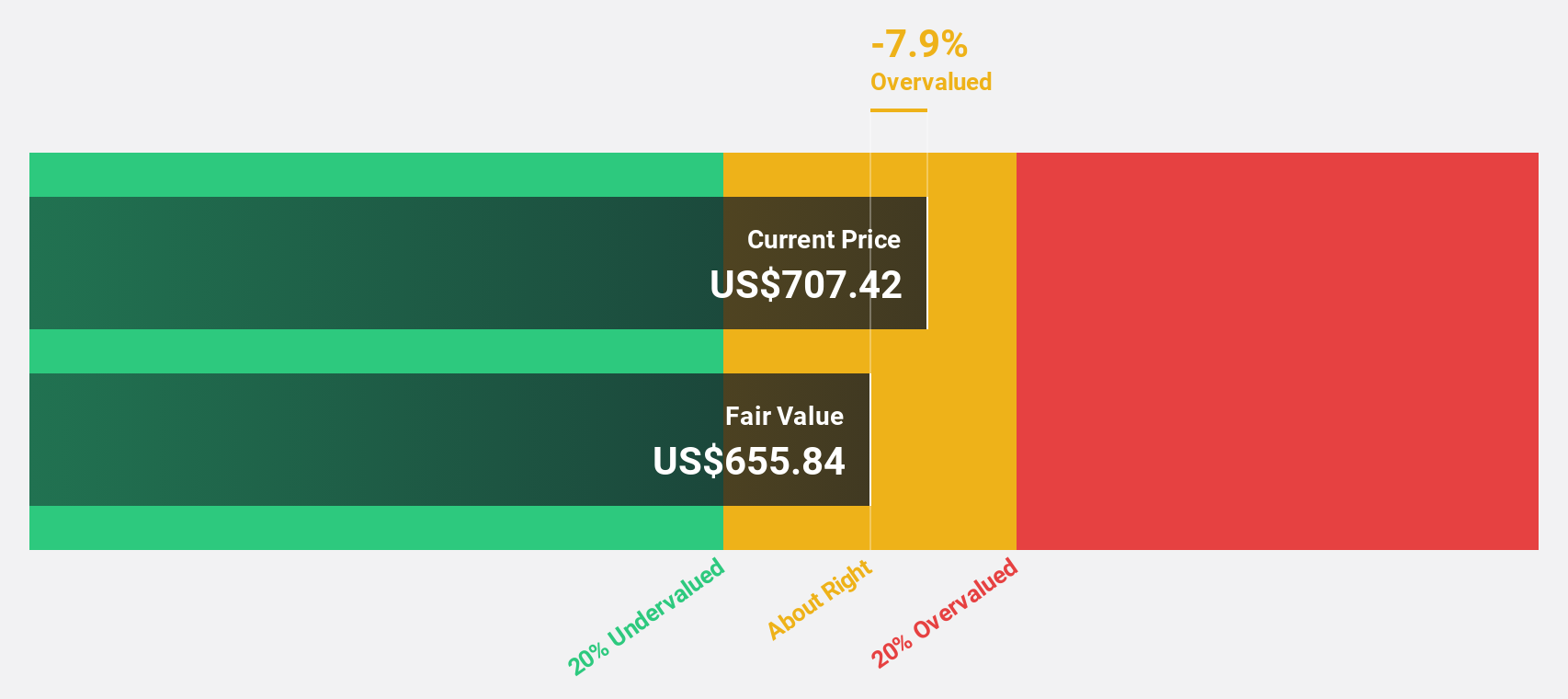

Estimated Discount To Fair Value: 22.9%

Spotify Technology is trading at US$626, below its estimated fair value of US$811.75, suggesting undervaluation based on cash flows. The company has turned profitable this year with significant earnings growth expected at 23.4% annually, surpassing the U.S. market's pace. Recent earnings reports show a strong performance with net income rising to EUR 1,138 million for 2024 from a loss last year, reflecting improved financial health and operational efficiency.

- The analysis detailed in our Spotify Technology growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Spotify Technology's balance sheet health report.

Make It Happen

- Embark on your investment journey to our 182 Undervalued US Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives