- United States

- /

- Luxury

- /

- NYSE:ONON

Three Top Stocks Estimated To Be Trading At Discounts Of Up To 45.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the United States market experiences a surge, with the Dow Jones Industrial Average reaching record highs following Federal Reserve Chair Jerome Powell's indication of potential interest rate cuts, investors are keenly observing opportunities that might arise from these shifting economic conditions. In this context, stocks trading below their intrinsic value present compelling prospects for those looking to capitalize on market fluctuations while maintaining a focus on fundamental analysis and long-term growth potential.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $115.19 | $225.65 | 49% |

| Udemy (UDMY) | $6.78 | $13.22 | 48.7% |

| StoneCo (STNE) | $14.83 | $28.88 | 48.6% |

| Niagen Bioscience (NAGE) | $9.77 | $18.91 | 48.3% |

| Lyft (LYFT) | $15.81 | $30.93 | 48.9% |

| Fiverr International (FVRR) | $23.04 | $45.18 | 49% |

| First Commonwealth Financial (FCF) | $16.86 | $32.97 | 48.9% |

| First Busey (BUSE) | $23.19 | $45.40 | 48.9% |

| e.l.f. Beauty (ELF) | $116.31 | $224.85 | 48.3% |

| Dime Community Bancshares (DCOM) | $28.37 | $56.37 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

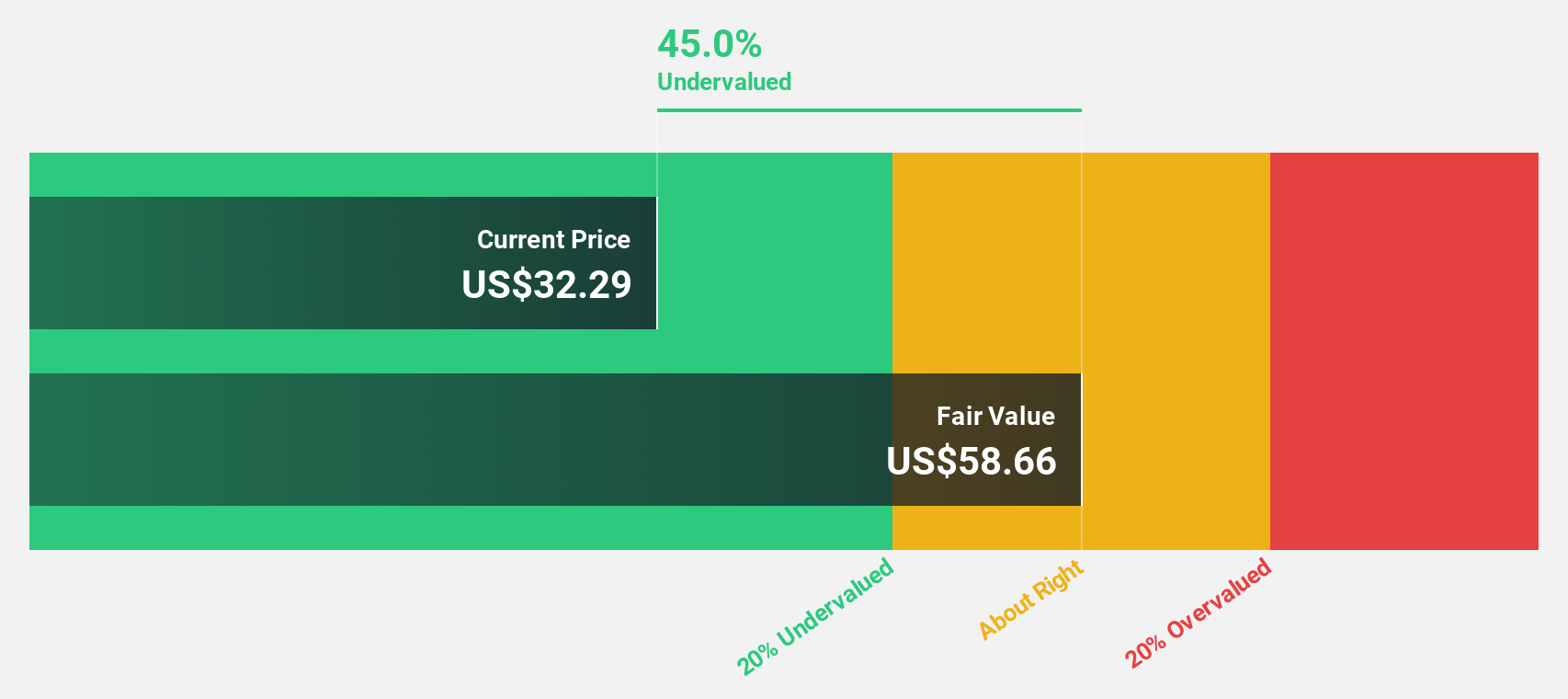

Tenable Holdings (TENB)

Overview: Tenable Holdings, Inc. offers cyber exposure management solutions across various regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of approximately $3.68 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated $949.25 million.

Estimated Discount To Fair Value: 45.7%

Tenable Holdings is trading at US$30.08, significantly below its estimated fair value of US$55.35, indicating it may be undervalued based on cash flows. Despite slower revenue growth projections compared to the broader market, earnings are anticipated to grow substantially at 65.71% annually and profitability is expected within three years. Recent executive changes with a new CFO experienced in strategic growth could bolster financial performance, while innovative product expansions like Tenable AI Exposure enhance its market position in cybersecurity solutions.

- Our expertly prepared growth report on Tenable Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Tenable Holdings here with our thorough financial health report.

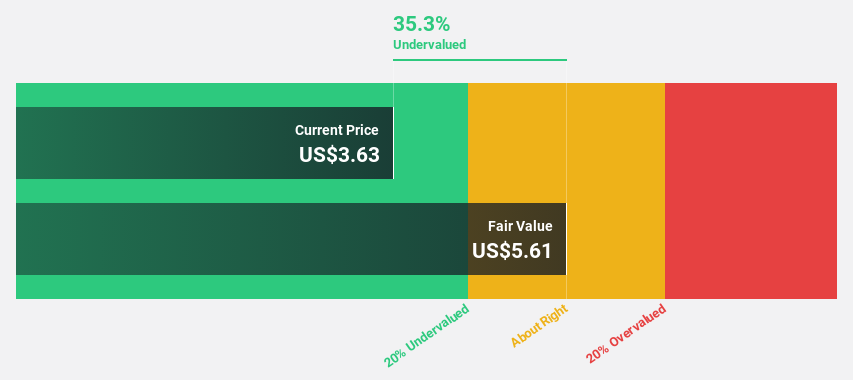

Blend Labs (BLND)

Overview: Blend Labs, Inc. offers a cloud-based software platform tailored for financial services firms in the United States, with a market cap of approximately $772.79 million.

Operations: The company's revenue primarily comes from its cloud-based Blend Platform, which generated $121.52 million, alongside a segment adjustment of $46.26 million.

Estimated Discount To Fair Value: 11.8%

Blend Labs is trading at US$3.47, slightly below its estimated fair value of US$3.93, suggesting potential undervaluation based on cash flows. Revenue growth is forecasted at 10.1% annually, outpacing the broader US market but not significantly high. Recent executive changes with a new Head of Finance could enhance strategic direction. Despite current unprofitability, earnings are expected to grow substantially by 88.45% annually over the next three years, potentially improving financial stability.

- In light of our recent growth report, it seems possible that Blend Labs' financial performance will exceed current levels.

- Take a closer look at Blend Labs' balance sheet health here in our report.

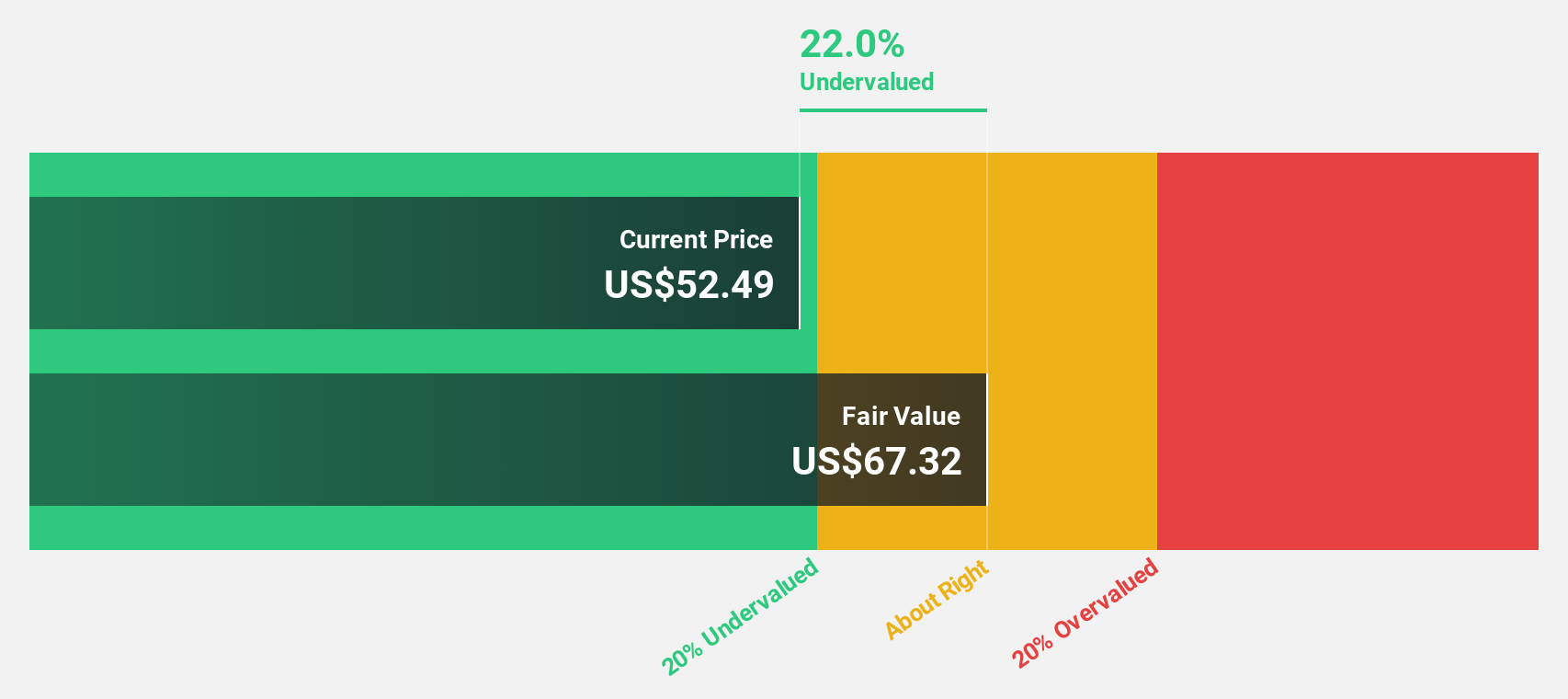

On Holding (ONON)

Overview: On Holding AG develops and distributes sports products globally, with a market cap of $14.77 billion.

Operations: The company's revenue segment includes Athletic Footwear, generating CHF 2.72 billion.

Estimated Discount To Fair Value: 17.2%

On Holding is trading at US$44.58, below its estimated fair value of US$53.85, indicating potential undervaluation based on cash flows. Recent guidance raised net sales expectations to CHF 2.91 billion for 2025, reflecting strong growth prospects despite a recent quarterly net loss of CHF 40.9 million. Forecasts suggest revenue and earnings will grow faster than the market at 17.7% and 34.7% annually, respectively, supported by strategic board additions enhancing governance and oversight capabilities.

- The analysis detailed in our On Holding growth report hints at robust future financial performance.

- Get an in-depth perspective on On Holding's balance sheet by reading our health report here.

Make It Happen

- Discover the full array of 199 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONON

On Holding

Engages in the development and distribution of sports products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives