- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Top Growth Stocks With High Insider Stakes In April 2025

Reviewed by Simply Wall St

The United States market has shown robust performance recently, rising 6.8% over the past week and 5.9% in the last year, with all sectors experiencing gains and earnings projected to grow by 14% annually. In this promising environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

We'll examine a selection from our screener results.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $51.97 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

Operations: The company's revenue primarily stems from its Software & Programming segment, which generated $4.79 billion.

Insider Ownership: 37.7%

Earnings Growth Forecast: 48.9% p.a.

Atlassian, with significant insider ownership, is trading at 37.3% below its estimated fair value. Although recent earnings showed a net loss of US$38.21 million for the quarter, revenue increased to US$1.29 billion from the previous year. The company's forecasted annual profit growth is robust, expected to surpass market averages over the next three years. Recent board changes include Karen Dykstra's appointment as director, potentially enhancing governance and strategic oversight.

- Click here and access our complete growth analysis report to understand the dynamics of Atlassian.

- Insights from our recent valuation report point to the potential undervaluation of Atlassian shares in the market.

Tesla (NasdaqGS:TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

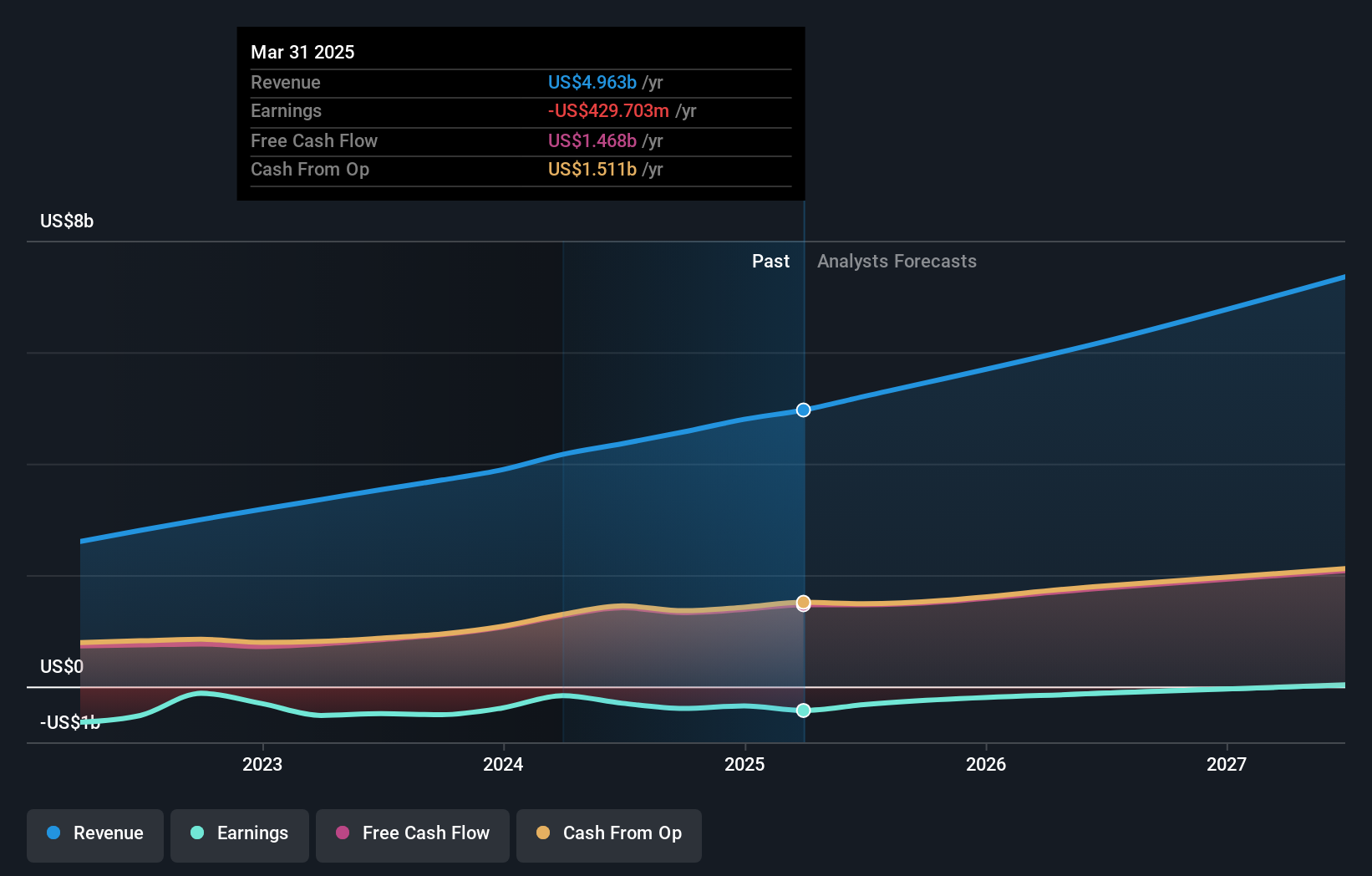

Overview: Tesla, Inc. is involved in designing, developing, manufacturing, leasing, and selling electric vehicles as well as energy generation and storage systems globally with a market cap of approximately $811.56 billion.

Operations: The company's revenue primarily comes from its automotive segment, which generated $87.60 billion, and its energy generation and storage segment, contributing $10.09 billion.

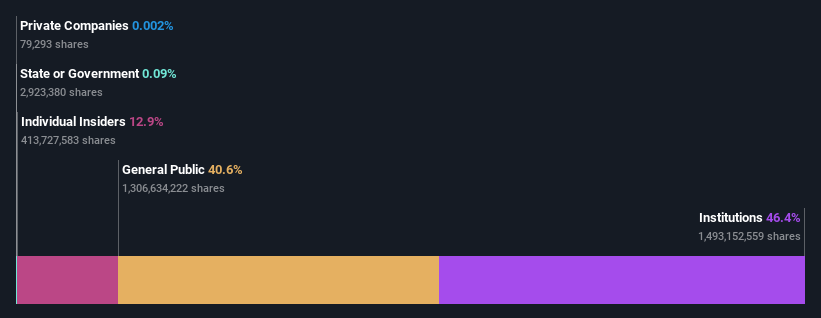

Insider Ownership: 12.9%

Earnings Growth Forecast: 22.9% p.a.

Tesla's insider ownership is underscored by substantial buying activity over the past three months, despite recent volatility in its share price. The company's earnings are projected to grow significantly at 22.9% annually, outpacing the broader US market. However, profit margins have decreased from last year, and revenue growth is expected to be slower than some high-growth benchmarks but still above market averages. Recent vehicle delivery results indicate robust operational performance amidst ongoing legal disputes with Matthews International Corporation over Dry Battery Electrode technology rights.

- Unlock comprehensive insights into our analysis of Tesla stock in this growth report.

- Our comprehensive valuation report raises the possibility that Tesla is priced higher than what may be justified by its financials.

Workday (NasdaqGS:WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally and has a market cap of approximately $60.33 billion.

Operations: The company generates revenue from its cloud applications segment, amounting to $8.45 billion.

Insider Ownership: 19.6%

Earnings Growth Forecast: 27.6% p.a.

Workday's high insider ownership aligns with its strong growth prospects, as the company anticipates earnings to grow significantly at 27.6% annually, surpassing US market averages. Recent strategic partnerships and product innovations, such as the collaboration with Incorta and AI-powered contract management solutions, enhance Workday's data accessibility and operational efficiency. Despite a decline in profit margins from last year, Workday is trading below its estimated fair value and remains poised for continued revenue growth above market rates.

- Take a closer look at Workday's potential here in our earnings growth report.

- Our valuation report here indicates Workday may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 198 Fast Growing US Companies With High Insider Ownership.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 20 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Tesla, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives