- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

3 Stocks Estimated To Be Up To 49.8% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 4.1%, contributing to a 7.9% increase over the past year, with earnings anticipated to grow by 14% per annum in the coming years. In this context of upward momentum and growth expectations, identifying stocks that are estimated to be significantly below their intrinsic value can present valuable opportunities for investors seeking potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lantheus Holdings (NasdaqGM:LNTH) | $103.64 | $204.56 | 49.3% |

| Modine Manufacturing (NYSE:MOD) | $79.09 | $155.53 | 49.1% |

| Ready Capital (NYSE:RC) | $4.42 | $8.65 | 48.9% |

| Shift4 Payments (NYSE:FOUR) | $80.63 | $159.28 | 49.4% |

| Bel Fuse (NasdaqGS:BELF.A) | $66.40 | $130.61 | 49.2% |

| Veracyte (NasdaqGM:VCYT) | $32.14 | $63.15 | 49.1% |

| Elastic (NYSE:ESTC) | $82.12 | $160.34 | 48.8% |

| Reddit (NYSE:RDDT) | $112.25 | $223.76 | 49.8% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.25 | $10.40 | 49.5% |

| CNX Resources (NYSE:CNX) | $29.06 | $57.83 | 49.7% |

Let's explore several standout options from the results in the screener.

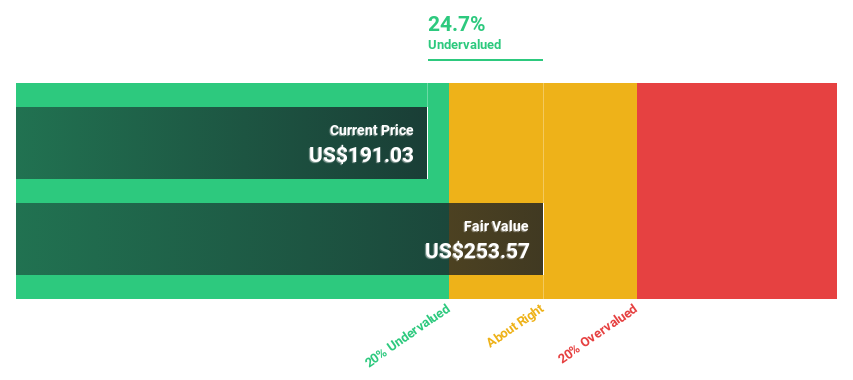

Palo Alto Networks (NasdaqGS:PANW)

Overview: Palo Alto Networks, Inc. offers cybersecurity solutions globally and has a market cap of approximately $111.44 billion.

Operations: The company generates revenue from its Security Software & Services segment, amounting to $8.57 billion.

Estimated Discount To Fair Value: 26.6%

Palo Alto Networks is trading at US$176.04, significantly below its estimated fair value of US$239.68, suggesting it might be undervalued based on cash flows. Despite a decrease in profit margins from last year, the company's earnings are forecast to grow faster than the US market at 17.7% annually. Recent strategic partnerships and product innovations enhance its cybersecurity offerings, potentially supporting future revenue growth above market expectations at 12.8% per year.

- According our earnings growth report, there's an indication that Palo Alto Networks might be ready to expand.

- Dive into the specifics of Palo Alto Networks here with our thorough financial health report.

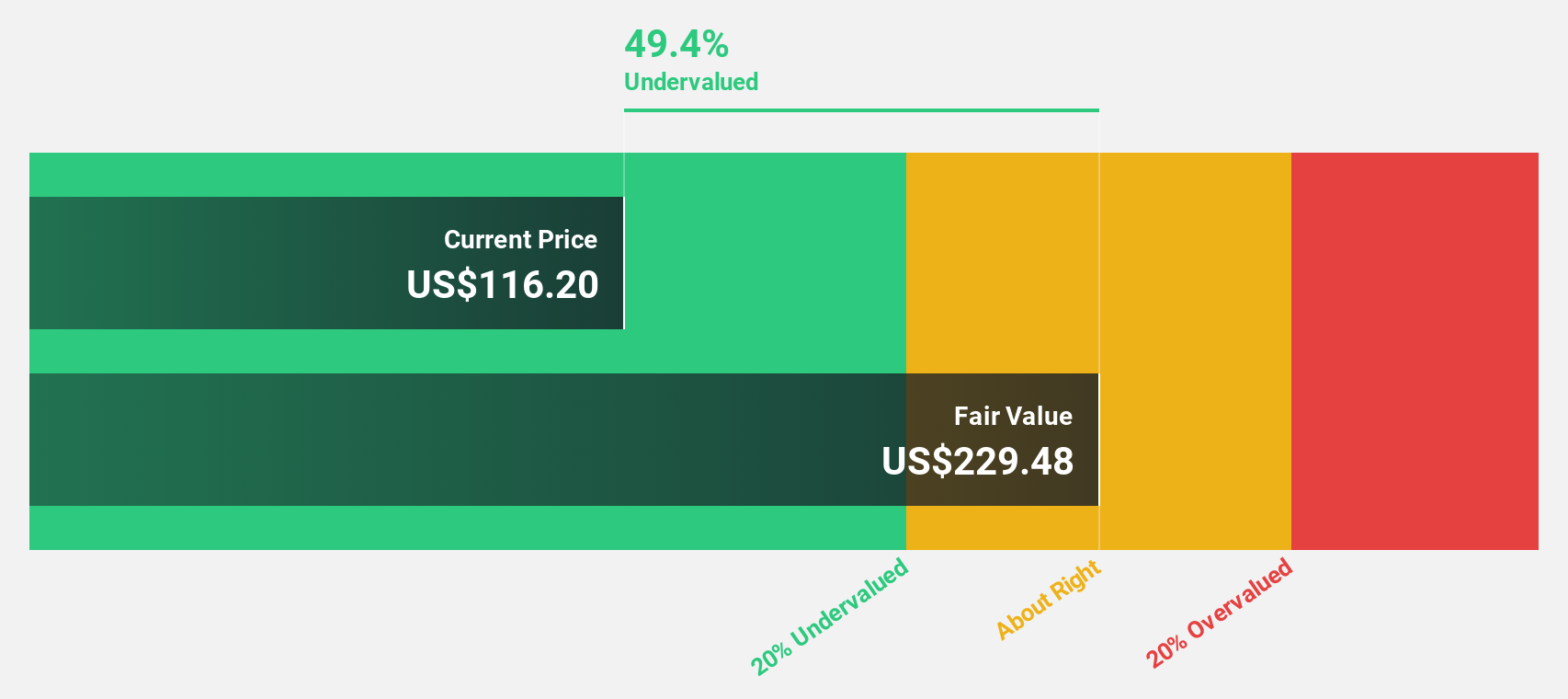

Reddit (NYSE:RDDT)

Overview: Reddit, Inc. operates a digital community both in the United States and internationally, with a market cap of $19.39 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to $1.30 billion.

Estimated Discount To Fair Value: 49.8%

Reddit is trading at US$112.25, significantly below its estimated fair value of US$223.76, indicating potential undervaluation based on cash flows. Despite recent insider selling and a volatile share price, Reddit's revenue growth is projected to outpace the market at 21.4% annually, with profitability expected within three years. Recent partnerships enhancing data insights and advertising capabilities could support this growth trajectory, although current return on equity forecasts remain modest at 15.3%.

- Our comprehensive growth report raises the possibility that Reddit is poised for substantial financial growth.

- Navigate through the intricacies of Reddit with our comprehensive financial health report here.

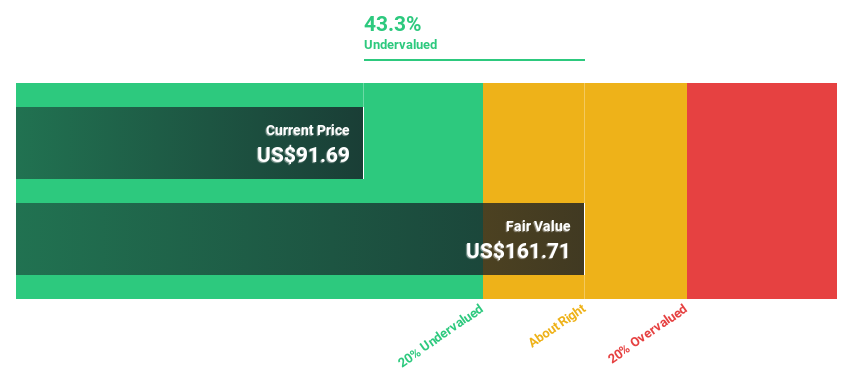

TransUnion (NYSE:TRU)

Overview: TransUnion is a global consumer credit reporting agency offering risk and information solutions, with a market cap of approximately $15.08 billion.

Operations: The company's revenue segments include U.S. Markets at $2.27 billion, International at $0.90 billion, and Consumer Interactive at $0.96 billion.

Estimated Discount To Fair Value: 36.3%

TransUnion, priced at US$82.47, trades well below its estimated fair value of US$129.38, presenting a potential opportunity based on cash flows. Despite revenue growth forecasts trailing the market, earnings are expected to grow significantly faster than the US average over the next three years. Recent earnings reports show improved profitability and strategic partnerships enhancing product offerings could bolster future performance. However, high debt levels not fully covered by operating cash flow pose a risk to consider.

- Our expertly prepared growth report on TransUnion implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of TransUnion stock in this financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 181 Undervalued US Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Reddit, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives