- United States

- /

- Software

- /

- NasdaqGS:CGNT

We Think Cognyte Software (NASDAQ:CGNT) Needs To Drive Business Growth Carefully

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Cognyte Software (NASDAQ:CGNT) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Cognyte Software

SWOT Analysis for Cognyte Software

- Currently debt free.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Good value based on P/S ratio compared to estimated Fair P/S ratio.

- Has less than 3 years of cash runway based on current free cash flow.

- Not expected to become profitable over the next 3 years.

When Might Cognyte Software Run Out Of Money?

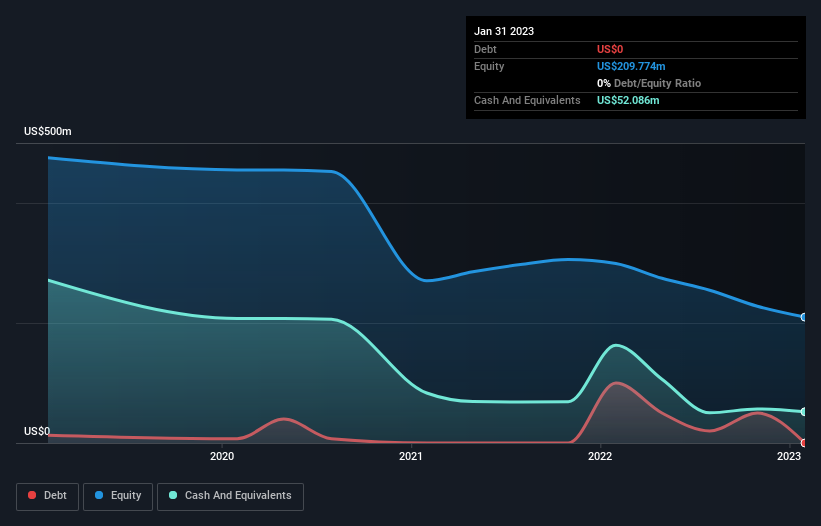

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In January 2023, Cognyte Software had US$52m in cash, and was debt-free. In the last year, its cash burn was US$49m. So it had a cash runway of approximately 13 months from January 2023. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Cognyte Software Growing?

It was quite stunning to see that Cognyte Software increased its cash burn by 221% over the last year. While that's concerning on it's own, the fact that operating revenue was actually down 34% over the same period makes us positively tremulous. Considering these two factors together makes us nervous about the direction the company seems to be heading. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Cognyte Software To Raise More Cash For Growth?

Cognyte Software revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Cognyte Software has a market capitalisation of US$334m and burnt through US$49m last year, which is 15% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Cognyte Software's Cash Burn A Worry?

On this analysis of Cognyte Software's cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. Summing up, we think the Cognyte Software's cash burn is a risk, based on the factors we mentioned in this article. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Cognyte Software (of which 2 are concerning!) you should know about.

Of course Cognyte Software may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CGNT

Cognyte Software

A software-led technology company, focuses on solutions for data processing and analytics worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026